Once the ultimate badge of startup glory, the ‘unicorn’ club – privately held companies worth over $1 billion – isn’t growing as fast as it used to. The heady days of 2021 and 2022, when venture capital money flowed freely and valuations soared, have given way to a more restrained reality.

By 2025, investors have grown more cautious, funding rounds more selective, and valuations more grounded. Yet, amid the slowdown, artificial intelligence remains the standout exception – a magnet for capital and talent that is spilling over into sectors from healthcare to finance and enterprise software.

As of October 2025, 117 privately held companies have reached valuations of US$1 billion or more, earning unicorn status, and 96 of those are still private, whereas a handful of businesses either went public or were acquired. This prompted the team at BestBrokers to analyse the latest data from CBInsights, TechCrunch and PitchBook to uncover which industries are producing the biggest number of new unicorns, which regions are leading the way, and which private companies are generating the most investor attention in today’s volatile market.

Interestingly, the unicorn landscape is becoming more concentrated in 2025, with a rising share of value held by ‘ultra-unicorns’ worth $5 billion or more. Furthermore, there are now more startups valued at over $100 billion than ever before – these high-growth companies are sometimes referred to as ‘hectocorns’ (from Greek ‘hecto-’ meaning ‘one hundred’ and ‘corn’, referring to the mythological creatures known as unicorns). The companies achieving unicorn status this year, however, are less valuable; what stands out instead is the very limited range of industries they operate in.

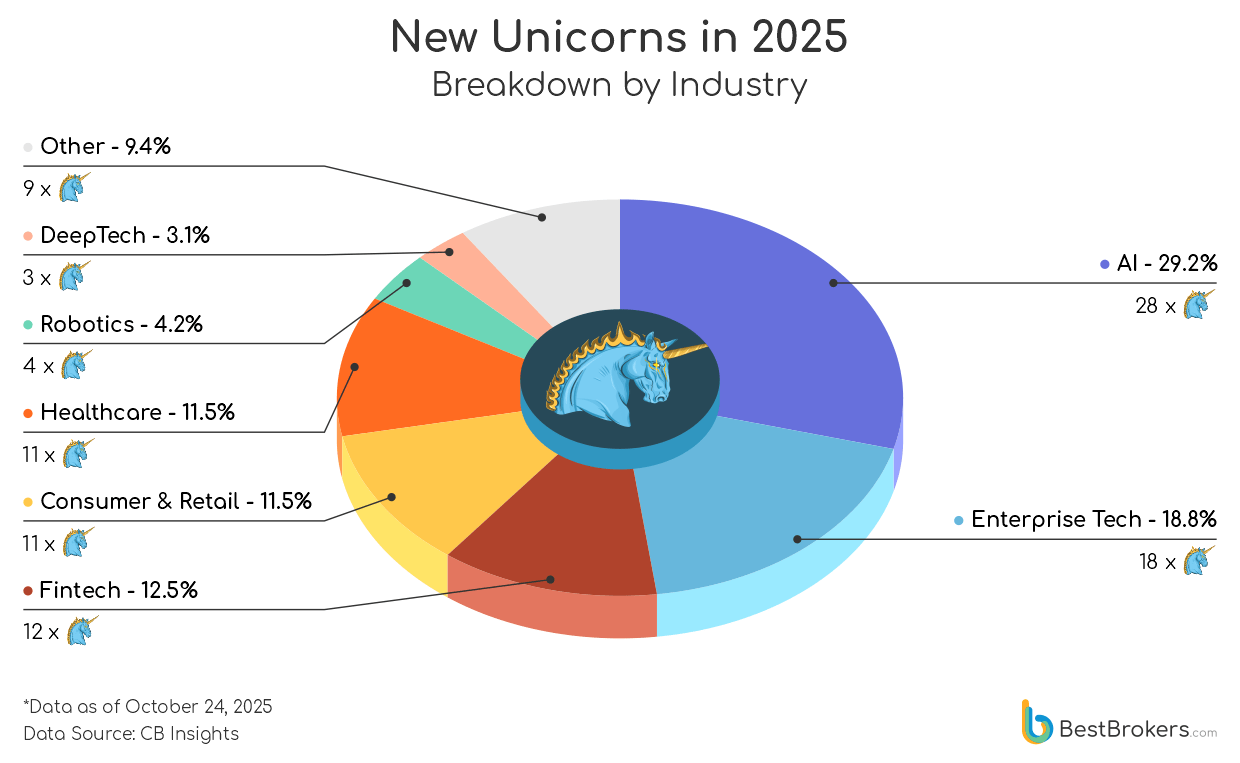

Artificial intelligence is now embedded in almost every technology sector in some form, with many enterprise and software startups leveraging AI models or offering AI-powered platforms. Of the 96 private companies that reached and maintained unicorn status this year, 28 are AI companies, representing 29.2% of the total. In comparison, 46.6% of startups that achieved a valuation of $1 billion or more in 2024 were AI businesses.

Another 18.8% of the private businesses, or 18 companies, reaching a $1 billion valuation this year, are within the Enterprise Tech sector. Among them is Berlin-based workflow automation platform n8n, which achieved a $2.5 billion valuation in a $180-million Series C funding round in early October. The startup, along with several others within this industry, also heavily implements AI into its products. Another 12 new unicorn startups this year are Fintech companies, 11 work within the Healthcare & Life Sciences industry (including pharmaceuticals and biotechnologies), and there are 11 in the broad Consumer & Retail category. There are 4 startups in the Robotics field, and 3 can be categorised as Deep Tech.

Beverly Hills-based superintelligence human-enhancement technology company Labs Companies, Inc., (formerly LavLabs) or simply Labs, emerged as the most valuable private startup that reached unicorn status this year. In September, it completed a Series Seed II financing of $35 million, reaching $12.5 billion in post-money valuation. Labs works as a holding company for several specialised labs which focus on fields, including artificial superintelligence, wearable tech and immersive realities, cryptographic finance, and human-enhancement technologies. Its most notable project is the Yuhmmy App, which is said to allow people to share food, drinks, sweets, snacks and recreational flavours through live audiovisual Tasterooms.

Founded by former OpenAI CTO Mira Murati, the US-based AI company Thinking Machines Lab has reached an impressive $12 billion valuation despite only launching in February 2025. This makes it the second-most valuable ‘newly born’ unicorn startup of 2025. The company develops advanced multimodal AI systems designed to enhance human-AI collaboration, addressing challenges of model consistency and scalability. It attracted substantial investor interest, including a $2 billion seed funding round led by Andreessen Horowitz in July 2025.

Founded by Canadian-born billionaire entrepreneur Daniel Nadler in 2022, OpenEvidence has seen its valuation grow to an impressive $3.5 billion following a $210 million Series B funding round co-led by Google Ventures and Kleiner Perkins. The healthcare startup, known as the ‘ChatGPT for doctors’, has become the fastest-growing medical search engine for clinicians over the past year, currently supporting more than half a million clinical conversations every day. It is believed the platform is now used by around 40% of U.S. clinicians, with the app adding 90,000 new members every month.

Pittsburgh-based healthcare AI company Abridge has established itself as a transformative force in medical technology, raising $300 million in a Series E funding round that boosted its valuation to $5.3 billion. Abridge automates the creation of clinical notes and records from medical conversations, streamlining documentation for healthcare professionals.

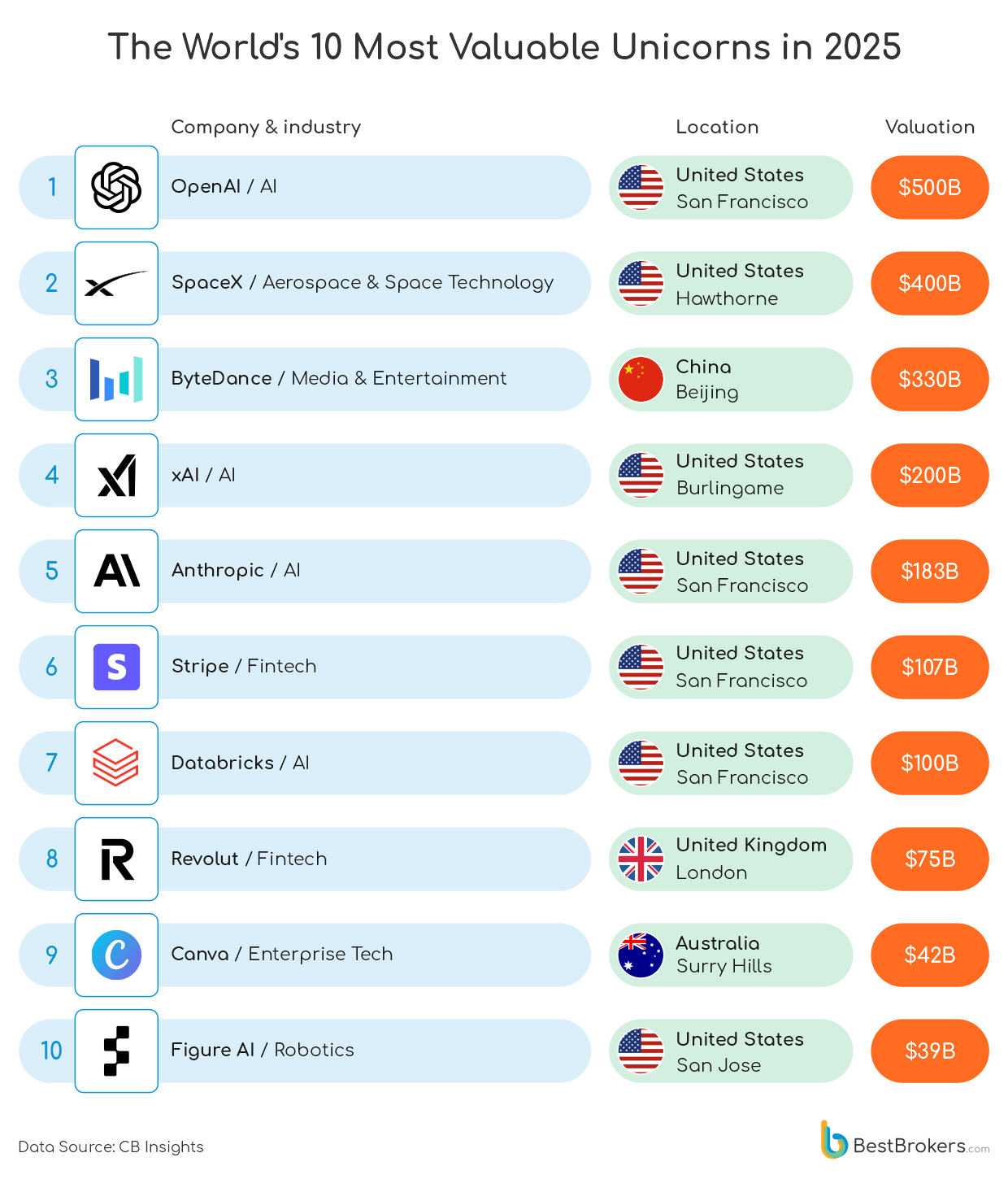

The largest privately held unicorn companies in the world in 2025

OpenAI has become the world’s most valuable private company, surpassing both Elon Musk’s SpaceX and TikTok’s parent company, ByteDance, with a $500 billion valuation, more than $200 billion since its last round. Investors cite the company’s rapid revenue growth, expanding enterprise contracts, and anticipated restructuring toward a for-profit model as key factors behind the higher valuation. With its nonprofit arm set to retain over $100 billion in equity, OpenAI is also positioned to become one of the wealthiest philanthropic organisations globally.

SpaceX, formerly the most valuable private company in the world, is now ranked second after being surpassed by OpenAI, with a current valuation of $400 billion. Headquartered in Hawthorne, California, the company’s immense value stems primarily from the continued expansion of its Starlink satellite network, including recent acquisitions of wireless spectrum licences from EchoStar to support direct-to-cell 5G services. SpaceX also continues to post record launch activity and strengthen its revenue outlook for 2025, with Starbase, Texas, serving as a central hub for its growing operations.

ByteDance remains a global leader in digital media and entertainment, with a valuation of over $330 billion following a recent employee share buyback programme. In the U.S., TikTok operates under a majority-stake divestiture to American investors, including Oracle and News Corp, while ByteDance retains roughly 50% of the profits through licensing its recommendation algorithm. This arrangement allows TikTok to remain accessible in the U.S., though ongoing regulatory scrutiny and congressional oversight continue to monitor ByteDance’s involvement to address national security concerns.

Which countries are home to the most Unicorns in 2025?

Of the 96 private companies achieving a valuation of at least $1 billion or more so far in 2025, 60 are based in the United States. There are currently 734 unicorn startups in the country, which is nearly half of the 1,323 unicorn companies currently in the world. The U.S. has long been the prime destination for successful companies, thanks to its well-established venture capital ecosystem, robust legal protections for investors and entrepreneurs, a large consumer market, and a culture that actively encourages innovation and risk-taking.

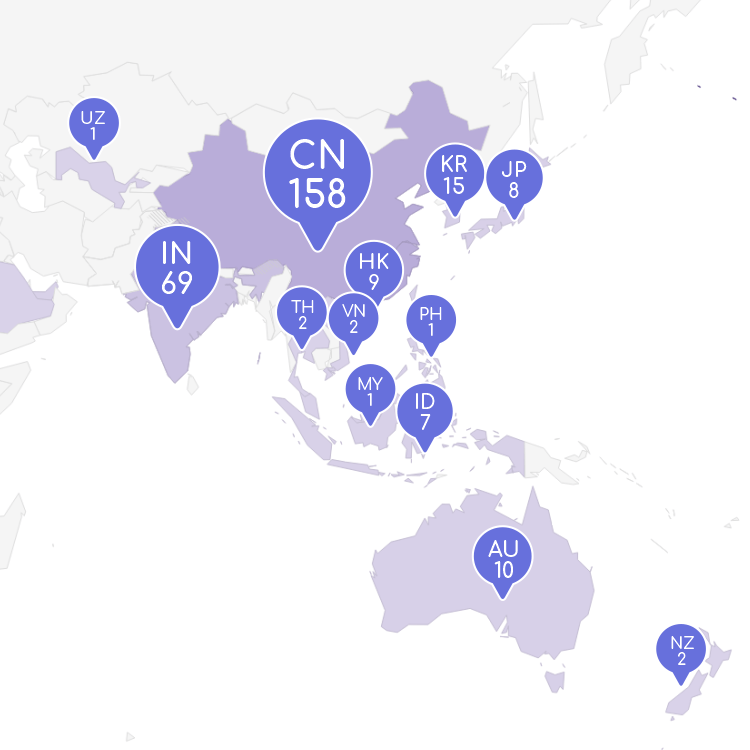

Although the U.S. is often viewed as the land of opportunity, it is far from the only region where successful, high-growth companies can thrive. Asia and the Middle East are home to 325 unicorn startups, with China and India leading the way with 158 and 69 private companies valued at over a billion U.S dollars, respectively. This growth is supported by well-developed domestic markets, rapidly expanding middle classes, and abundant tech talent, all of which create fertile ground for entrepreneurship and innovation.

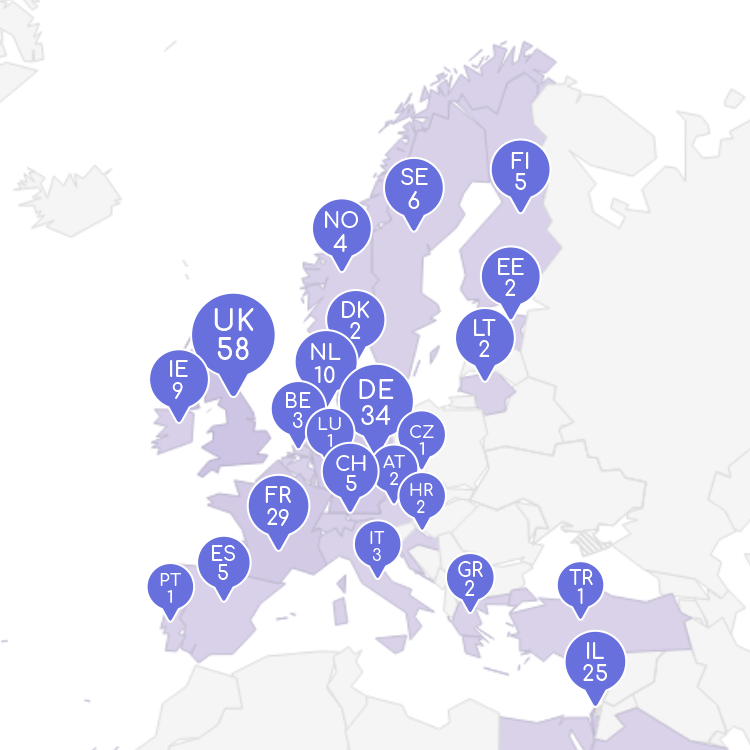

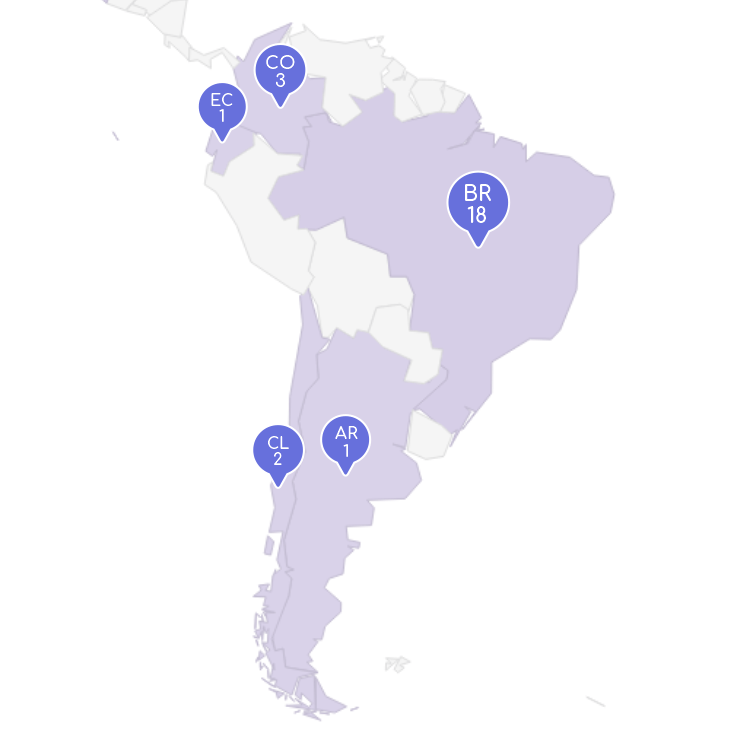

In Europe, the United Kingdom leads with 58 unicorn startups, followed by Germany with 34 and France with 29. Other regions that have shown strong potential for private ventures include Israel, with 25 unicorns, Canada, with 21, and Brazil, with 18.

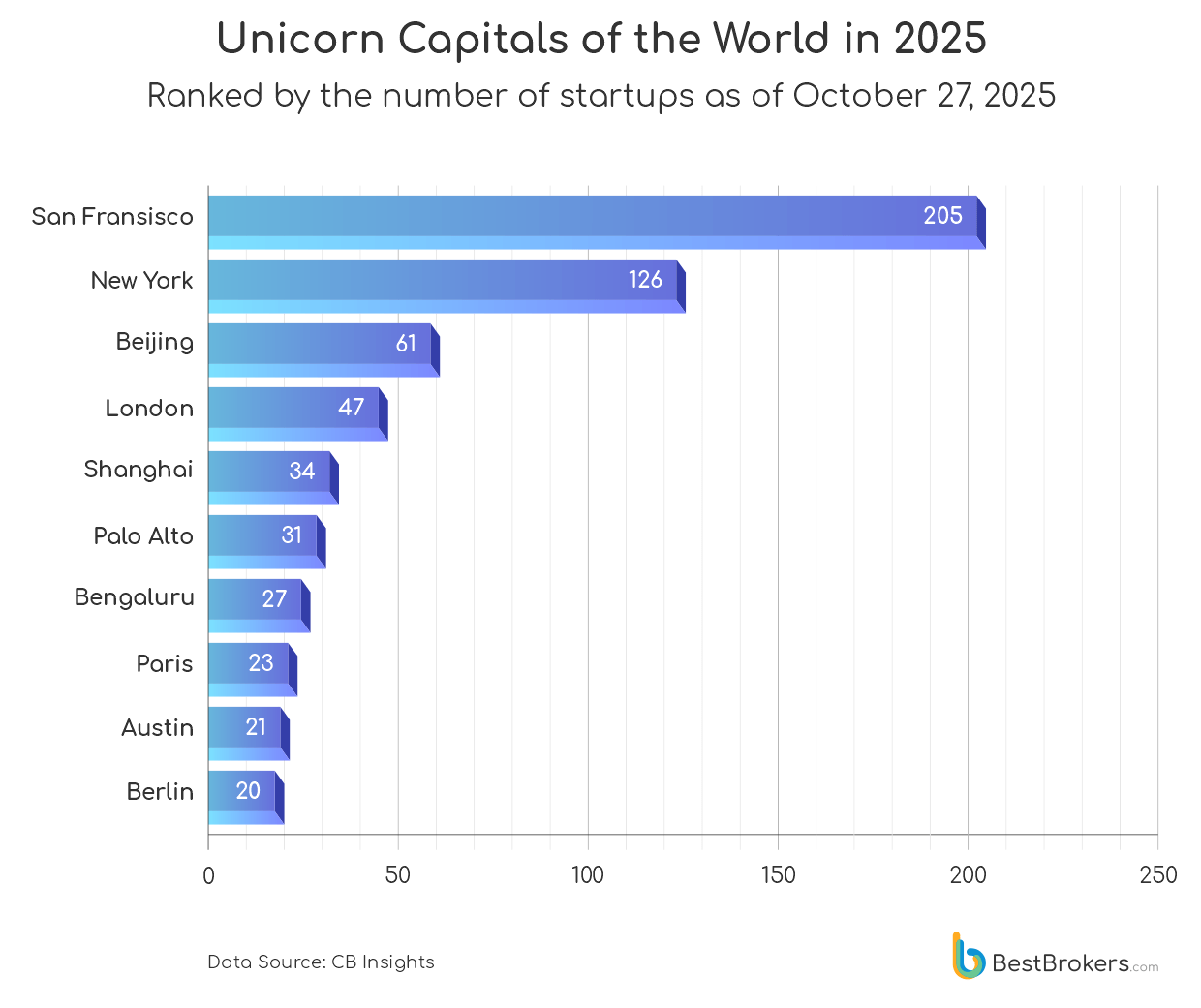

Silicon Valley, New York, and Beijing – The Unicorn Capitals in 2025

Location is crucial to a startup’s success, and Silicon Valley has long been a hotspot for private companies, thanks to its dense networks of talent, investors, and experienced entrepreneurs. Setting up a business there makes it easier to attract top talent, secure funding, and access mentorship, while the region’s culture of innovation and risk-taking helps startups scale rapidly, significantly boosting their chances of success. This is why there are 205 unicorns in San Francisco alone, the most of any city in the world, and over 300 across the wider Silicon Valley. San Francisco is home to some of the world’s most valuable startups, including Databricks ($100 billion), Anthropic ($183 billion), and the world’s most valuable private company, OpenAI, which reached a valuation of $500 billion in October 2025.

Still, Silicon Valley is not the only region fostering unicorn companies. New York has emerged as a major hub thanks to its diverse talent pool, vast market, strong industry clusters in fintech and media, and excellent infrastructure, all of which create an ideal environment for high-value startups. The city is currently home to 126 unicorns, with the most valuable being Ramp, a fintech firm specialising in corporate spend management and expense automation, valued at $22.5 billion, and NFT marketplace OpenSea, which has a valuation of $13.3 billion.

Similarly, Beijing is often regarded as the Silicon Valley of China, serving as the country’s leading tech hub. With world-class universities, strong government backing, and a dense concentration of AI, fintech, and e-commerce firms, the city has become a powerhouse for unicorn creation, which explains its position as the third-largest hub for unicorns globally. Currently, it is home to 61 privately held companies, with ByteDance, TikTok’s parent company, the largest one by far, with a valuation of $330 billion.

Why Do Companies Stay Private?

Not many companies manage to reach a valuation of $1 billion or more. Those that do will sometimes go public through an IPO or acquisition, but many company founders find staying private an enticing option for many reasons. On average, companies remain unicorns for eight years, according to a 2023 analysis by Ilya Strebulaev and the Venture Capital Initiative at Stanford.

It is a common misconception that companies’ founders prefer private to public companies so they can keep their finances private. While this is a valid reason that hardly needs an explanation, there are many other factors in play. Those who choose to remain private can exercise greater control over their business; they have more autonomy and answer to fewer shareholders. Of course, there are also fewer requirements for reporting whereas public companies in the United States, for instance, are subject to the rules of the Securities and Exchange Commission (SEC).

Until a couple of decades ago, IPOs or initial public offerings were the best way to raise capital. However, now many businesses are turning to venture capital funds and the private market. This allows them to choose their investors rather than sell shares to the public, which inevitably means having to meet shareholders’ high expectations.

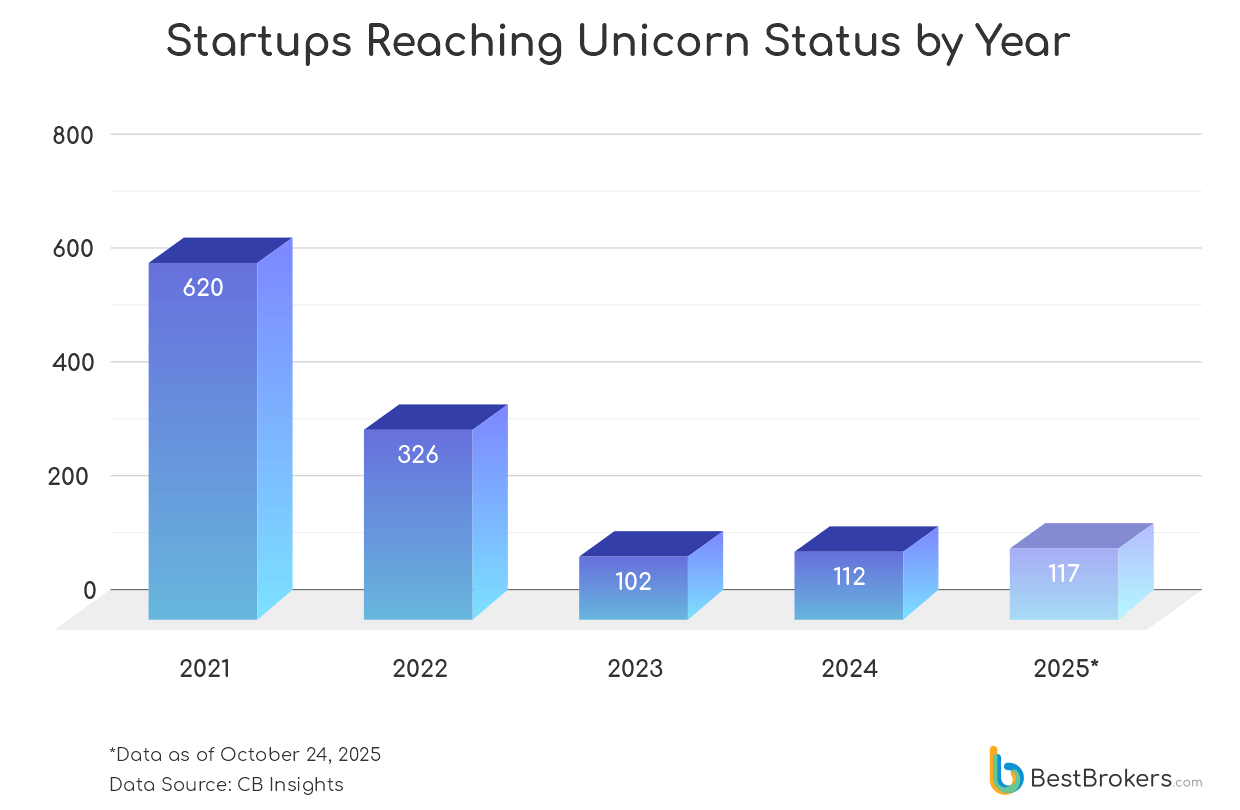

The Number of Companies to Reach Unicorn Status Throughout the Years

The creation of unicorn companies has slowed markedly since its peak in 2021, when roughly 620 firms reached the $1 billion mark, followed by 326 in 2022. Activity eased further, with 102 new unicorns in 2023 and 112 in 2024. In 2025, 117 companies have achieved unicorn status and 96 have remained on the unicorn list, with strong prospects of surpassing last year’s total, indicating the market may be regaining momentum.

These figures represent only the newly minted unicorns each year, rather than the total worldwide, but they illustrate how the private company landscape is maturing, with investors becoming more selective and valuations stabilising.

Methodology

To visually represent the current state of unicorns, the team at BestBrokers analysed raw company data from the business analytics platform CB Insights. Additional data for VC funding rounds and company valuations was collected from TechCrunch, Crunchbase, and Pitchbook. We looked at figures as of July 2025, and grouped the unicorns in the database by country, industry, and valuation. Note that the statistics are updated on a regular basis, and changes might occur.

Companies that reached Unicorn status in 2025 – Raw Data

| Company | Valuation (billions of US$) | Date Joined | Country | City | Sector | Select Investors |

|---|---|---|---|---|---|---|

| Labs | $12.50 | 4/18/2025 | United States | Beverly Hills | AI | JET Venture Capital, Sivad VC |

| Thinking Machines Lab | $12.00 | 6/20/2025 | United States | San Francisco | AI | Andreessen Horowitz, Accel |

| Polymarket | $9.00 | 10/7/2025 | United States | New York | Financial Services | 1789 Capital, Founders Fund |

| Reflection AI | $8.00 | 10/9/2025 | United States | New York | AI | |

| Abridge | $5.30 | 2/23/2025 | United States | Pittsburgh | AI | Institutional Venture Partners, Spark Capital, Lightspeed Venture Partners |

| Quince | $4.50 | 7/29/2025 | United States | San Francisco | Consumer & Retail | 8VC, Notable Capital |

| Base Power | $4.00 | 10/8/2025 | United States | Austin | Energy | Addition, 137 Ventures |

| OpenEvidence | $3.50 | 2/19/2025 | United States | Cambridge | AI | Sequoia Capital |

| Decart | $3.21 | 8/7/2025 | United States | San Francisco | AI | Sequoia Capital, Zeev Ventures |

| Nscale | $3.20 | 2025 | United Kingdom | London | AI | |

| Filevine | $3.00 | 9/23/2025 | United States | Salt Lake City | Enterprise Tech | Accel, Album VC, Signal Peak Ventures |

| n8n | $2.50 | 10/20/2025 | Germany | Berlin | Enterprise Tech | NVentures (NVIDIA), Redpoint, Visionaries Club, Sequoia, and Felicis Ventures |

| Peregrine.io | $2.50 | 3/4/2025 | United States | San Francisco | AI | Sequoia Capital, Fifth Down Capital |

| Baseten | $2.15 | 9/25/2025 | United States | San Francisco | AI | Bond, Greylock Partners, Institutional Venture Partners |

| FieldAI | $2.00 | 8/20/2025 | United States | Mission Viejo | AI | Bezos Expeditions, Prysm Capital, Khosla Ventures |

| Framer | $2.00 | 8/27/2025 | Netherlands | Amsterdam | Enterprise Tech | Atomico, Accel, Foundation Capital |

| Invisible Technologies | $2.00 | 2025 | United States | San Francisco | AI | |

| Kalshi | $2.00 | 6/25/2025 | United States | New York | Financial Services | Sequoia Capital |

| Supabase | $2.00 | 4/22/2025 | United States | San Francisco | Enterprise Tech | Accel, Coatue, Craft Ventures |

| The Bot Company | $2.00 | 3/22/2025 | United States | New York | Robotics | |

| OLIPOP | $1.85 | 2/12/2025 | United States | Oakland | Consumer & Retail | Rocana Venture Partners |

| Distyl AI | $1.80 | 9/22/2025 | United States | San Francisco | AI | Khosla Ventures |

| Lovable | $1.80 | 7/17/2025 | Sweden | Stockholm | AI | Accel, Hummingbird Ventures |

| Neko Health | $1.80 | 1/23/2025 | Sweden | Stockholm | Healthcare & Life Sciences | Lightspeed Venture Partners, General Catalyst |

| Strive Health | $1.80 | 2025 | United States | Denver | Healthcare & Life Sciences | |

| Modular AI | $1.60 | 9/24/2025 | United States | Palo Alto | AI | US Innovative Technology Fund, General Catalyst, Google Ventures |

| Pathos | $1.60 | 5/1/2025 | United States | Chicago | Healthcare & Life Sciences | New Enterprise Associates |

| Anaconda | $1.50 | 7/31/2025 | United States | Austin | AI | General Catalyst, Silicon Valley Bank, Morningside Venture Partners |

| Chapter | $1.50 | 4/16/2025 | United States | New York | Healthcare & Life Sciences | Coatue |

| Fal | $1.50 | 7/31/2025 | United States | San Francisco | AI | Andreessen Horowitz, Notable Capital, Meritech Capital Partners |

| Plata | $1.50 | 3/12/2025 | Mexico | Mexico City | Financial Services | Coatue |

| SpreeAI | $1.50 | 5/6/2025 | United States | Incline Village | Consumer & Retail | |

| Tide | $1.50 | 9/21/2025 | United Kingdom | London | Financial Services | TPG |

| XING Mobility | $1.50 | 3/30/2025 | Taiwan | Transportation | 6MV | |

| You.com | $1.50 | 9/3/2025 | United States | Palo Alto | AI | Day One Ventures, Salesforce Ventures, Radical Ventures |

| Ninja | $1.50 | 7/21/2025 | Saudi Arabia | Dhahran | Consumer & Retail | Bunat Ventures |

| Pump.fun | $1.50 | 3/30/2025 | Ireland | Limerick | Fintech | 6MV |

| Lead Bank | $1.47 | 2025 | United States | Kansas City | Financial Services | |

| Tailscale | $1.45 | 4/8/2025 | Canada | Toronto | Enterprise Tech | Accel |

| Aragen | $1.40 | 1/13/2025 | India | Hyderabad | Healthcare & Life Sciences | |

| Fox Ess | $1.40 | 1/13/2025 | China | Wenzhou | Energy | Sparkedge Capital, Guotai Ruichengde Asset Management |

| Kapital | $1.40 | 2025 | Mexico | Mexico City | Financial Services | |

| Posthog | $1.40 | 9/29/2025 | United States | San Francisco | Enterprise Tech | Peak XV Partners, Stripe, Y Combinator |

| Zhiyuan Robot | $1.40 | 5/30/2025 | China | Pudong | Robotics | Tencent Venture Capital, BlueRun Ventures |

| Xpanceo | $1.35 | 7/8/2025 | United Arab Emirates | Dubai | DeepTech | Opportunity Venture |

| Netradyne | $1.34 | 1/16/2025 | United States | San Diego | Transport & Logistics | Point72 Ventures, SVB, Qualcomm Ventures |

| Tekever | $1.33 | 5/6/2025 | Portugal | Lisbon | Defence Tech | Ventura Capital, Iberis Capital |

| Lila Sciences | $1.30 | 10/14/2025 | United States | Cambridge | AI | |

| Nothing | $1.30 | 9/15/2025 | United Kingdom | London | Consumer & Retail | Tiger Global Management, C Ventures, EQT Ventures |

| Ultragreen.ai | $1.30 | 2025 | Singapore | Singapore | Healthcare & Life Sciences | 65 Equity Partners, Vitruvian Partners |

| Unitree Robotics | $1.30 | 6/20/2025 | China | Hangzhou | Robotics | |

| Gecko Robotics | $1.25 | 6/12/2025 | United States | Pittsburgh | Robotics | Founders Fund, Drive Capital, US Innovative Technology Fund |

| Linear | $1.25 | 6/10/2025 | United States | San Francisco | Enterprise Tech | Accel |

| LangChain | $1.25 | 7/10/2025 | United States | San Francisco | Enterprise Tech | Institutional Venture Partners, Sequoia Capital |

| Teamworks | $1.24 | 6/18/2025 | United States | Durham | Enterprise Tech | |

| Firmus Technologies | $1.20 | 2025 | Australia | Saint Leonards | AI | |

| Hightouch | $1.20 | 2/18/2025 | United States | San Francisco | Enterprise Tech | Sapphire Ventures, Bain Capital Ventures, Amplify Partners |

| Nerdio | $1.20 | 3/18/2025 | United States | Chicago | Enterprise Tech | General Atlantic, Lead Edge Capital, MK Capital |

| Raise Financial Services | $1.20 | 10/6/2025 | India | Maharashtra | Fintech | |

| Seekr | $1.20 | 6/18/2025 | United States | Vienna | AI | AMD Ventures |

| Tala Health | $1.20 | 7/15/2025 | United States | San Francisco | Healthcare & Life Sciences | Sofreh Capital |

| Tines | $1.13 | 2/11/2025 | Ireland | Dublin | Enterprise Tech | Accel, Addition, Index Ventures |

| Coralogix | $1.12 | 6/17/2025 | Israel | Ramat Gan | Enterprise Tech | NewView Capital, Brighton Park Capital, Aleph |

| Dream Security | $1.10 | 2/17/2025 | Israel | Tel Aviv | Enterprise Tech | Bain Capital Ventures, Aleph |

| Modal | $1.10 | 10/1/2025 | United States | New York | AI | Lux Capital, Redpoint Ventures, Amplify Partners |

| Redotpay | $1.10 | 9/1/2025 | Hong Kong | Hong Kong | Fintech | |

| Substack | $1.10 | 7/17/2025 | United States | San Francisco | Enterprise Tech | Bond, Andreessen Horowitz, J17 Capital |

| Rebellions | $1.08 | 7/28/2025 | South Korea | Seoul | Industrials | WAED Ventures, Kakao Ventures, Samsung Ventures |

| Juniper Square | $1.02 | 5/9/2025 | United States | San Francisco | Financial Services | Ribbit Capital, Redpoint Ventures, CSC Upshot Ventures |

| Airalo | $1.00 | 7/10/2025 | Singapore | Singapore | Consumer & Retail | CVC Capital Partners, Peak XV Partners |

| Ambience | $1.00 | 7/28/2025 | United States | San Francisco | AI | Andreessen Horowitz, Kleiner Perkins |

| Apex | $1.00 | 9/12/2025 | United States | Culver City | Industrials | Interlagos, 8VC, Point72 Ventures |

| Assured | $1.00 | 3/5/2025 | United States | Palo Alto | Fintech | ICONIQ Capital, Kleiner Perkins, Costanoa Ventures |

| Awardco | $1.00 | 5/20/2025 | United States | Lindon | Enterprise Tech | |

| BuildOps | $1.00 | 3/21/2025 | United States | Santa Monica | Enterprise Tech | Meritech Capital Partners, Fika Ventures, 1984 Ventures |

| Endless | $1.00 | 2/26/2025 | New Zealand | Auckland | Recycling | Foresight Ventures |

| Enveda | $1.00 | 9/4/2025 | United States | Boulder | Healthcare & Life Sciences | FPV Ventures, Kinnevik |

| Eve | $1.00 | 9/30/2025 | United States | San Mateo | Consumer & Retail | Spark Capital, Lightspeed Venture Partners, Andreessen Horowitz |

| Halter | $1.00 | 6/23/2025 | New Zealand | Auckland | Healthcare & Life Sciences | Bessemer Venture Partners, Blackbird Ventures |

| IQM Quantum Computers | $1.00 | 2025 | Finland | Espoo | DeepTech | |

| JSW One Platforms | $1.00 | 5/13/2025 | India | Mumbai | Consumer & Retail | |

| Just Salad | $1.00 | 2/24/2025 | United States | New York | Consumer & Retail | D1 Capital Partners |

| Meter | $1.00 | 6/12/2025 | United States | San Francisco | Enterprise Tech | General Catalyst |

| MUBI | $1.00 | 5/31/2025 | United Kingdom | London | Consumer & Retail | Sequoia Capital, C4 Ventures |

| Nourish | $1.00 | 4/23/2025 | United States | Austin | Healthcare & Life Sciences | Index Ventures |

| Owner | $1.00 | 5/13/2025 | United States | Palo Alto | Consumer & Retail | |

| Parloa | $1.00 | 05/06/2025 | Germany | Berlin | AI | Altimeter Capital |

| Periodic Labs | $1.00 | 8/8/2025 | United States | Menlo Park | AI | Andreessen Horowitz |

| Quantum Systems | $1.00 | 5/6/2025 | Germany | Gilching | Defence Tech | Notion Capital, Bayern Kapital |

| QuEra Computing | $1.00 | 2/11/2025 | United States | Boston | DeepTech | QVT, Day One Ventures, Sabanci Ventures |

| Randpanda | $1.00 | 04/03/2025 | United States | San Francisco | AI | Google Ventures, Lightspeed Ventures |

| Reka AI | $1.00 | 7/22/2025 | United States | Sunnyvale | AI | Radical Ventures |

| Thyme Care | $1.00 | 9/25/2025 | United States | Nashville | Healthcare & Life Sciences | Concord Health Partners, Foresite Capital, Andreessen Horowitz |

| Zama | $1.00 | 6/25/2025 | France | Paris | AI | Mulitcoin Capital |

| Zerohash | $1.00 | 7/14/2025 | United States | Chicago | Financial Services | Liberty City Ventures, PEAK6, Point72 Ventures |

| Zyphra | $1.00 | 6/9/2025 | United States | Palo Alto | AI | Bison Ventures, Future Ventures, Intel Capital |