There are tons of cryptocurrency information on the internet, enough to overwhelm professional cryptocurrency dealers let alone newcomers. However, if you’re looking for a detailed guide on how to trade cryptocurrencies, you’re at the right place. To lift the burden of information overload, we focus on the most important aspects of cryptocurrency trading. We made this guide simple yet well-detailed.

What is cryptocurrency?

A cryptocurrency is a form of virtual or digital currency secured by cryptography. Several cryptocurrencies are on a decentralized network established using the blockchain technology. Blockchain is a distributed ledger maintained by distant connections of different computers. A special trait of cryptocurrencies is the fact they are not issued by or under the control of any central authority. This makes it impossible for governments to manipulate or meddle with them.

In this guide, you’ll learn everything you need to start your cryptocurrency trading journey. Whether you’re looking to start or broaden your knowledge in the cryptocurrency sphere, this guide will enable you to buy and sell cryptocurrencies the right way. So let’s dive in.

In simpler terms, cryptocurrency is virtual money that you can’t see, touch, or feel. We use money for purchases or when paying for different services. Cryptocurrencies retain these attributes and more.

Cryptocurrency deals are borderless. It means that you can send this form of electronic money anywhere in the world so long as both parties dealing in the sale have a cryptocurrency wallet. We will come to what a cryptocurrency wallet is in the latter part of this guide.

Cryptocurrency gives you the fiscal power to enjoy your own money and manage yourself without interference from third parties like governments or central authorities. Nothing has access to your finances except you alone.

Blockchains, which are organisational technologies for preserving the integrity of transactional data, are an essential element of numerous cryptocurrencies.

Cryptocurrencies are digital money established on a network connected across distant computers. The decentralised nature of these means that there’s less control from centralised authorities or the government.

The word “cryptocurrency” is derived from the process of encryption which is used to protect the network.

Cryptocurrencies can be used to make secure payments online, and transactions are represented by ledger entries, denominated in terms of tokens. The word “Crypto” defines the various cryptographic techniques and encryption algorithms used to safeguard entries such as public-private key pairs, elliptical curve encryption, and hashing functions.

Examples of Cryptocurrency

The first cryptocurrency to use the blockchain technology was Bitcoin, which is still the most precious and most popular coin. Now, there exist over a thousand cryptocurrencies with different functions and uses.

See the common ones in the table below:

| Cryptocurrency | Symbol | Launch Date | Market Cap (Oct. 14, 2021) |

|---|---|---|---|

| Bitcoin | BTC | 2009 | Over $1 trillion |

| Ethereum | ETH | 2014 | Over $400 billion |

| Binance Coin | BNB | 2017 | Over $70 billion |

| Cardano | ADA | 2017 | Over $70 billion |

| Tether USD | USDT | 2015 | Over $68 billion |

| Ripple | XRP | 2013 | Over $53 billion |

| Dogecoin | DOGE | 2012 | Over $31 billion |

Cryptocurrency designation: money or security?

As much as cryptocurrencies are seen as money, the U.S. Internal Revenue Service (IRS) classified it as fiscal security or asset. This means that if you profit from investing or trading in cryptocurrencies, the government will tax you for it. The United States Department of Treasury in a proposal announced that taxpayers are to report transactions of $10k and above to the Internal Revenue Service. How an investor is taxed depends on the duration they hold their assets.

Origin of Bitcoin

What is known today as Bitcoin was created in 2008 by an individual or group of individuals known by the pseudonym “Satoshi Nakamoto.” However, the currency came into use in 2009 when its implementation was released as open-source software. Since then, Bitcoins are created through a process known as mining.

There is about 18.8 million Bitcoins circulating the market with a market capitalization of approximately $1.088 trillion as of October 14, 2021; however, this figure changes frequently according to market conditions. There are only about 21 million Bitcoins in existence, so there’s a limit to how much Bitcoin can be mined. This prevents manipulation.

Bitcoin is just one of the numerous cryptocurrencies in the world, but it is, by far, the leading one. After the launch of Bitcoin in 2009, other coins came to be such as Litecoin, Cardano, EOS, IOTX, DENT, Ethereum. All these other coins are known as Altcoin. The total value of all coins was estimated to be over $1.8 trillion in Aug. 2021 with Bitcoin dominating the market at approximately 46.5%.

Bitcoin is the first cryptocurrency created by an individual or group of individuals hiding under the pseudonym “Satoshi Nakamoto.” Any coin that is not Bitcoin is regarded as “Altcoin” which means Alternative Coin.

Common cryptocurrency term

Every field has some kind of language or slang that the stakeholders in the field use in their discussions. To be able to understand cryptocurrency discussions and analysis, you need to learn the meaning of these terms below:

ATH & ATL

“ATH” stands for All-Time High. When a particular asset reaches a new high price or record price that has not been reached before, then we can say that that asset has made a new ATH. Knowing the ATH of digital currencies can prove valuable as this would allow you to avoid buying too high or buying near it. The opposite of this is “ATL” which means “All Time Low”. When an asset reaches the lowest price in its history then we say that asset is trading at its ATL.

Bear/Bearish

If you have a bearish bias towards an asset, you believe that the price of that asset will decline. When your sentiment is bearish, you take a short position in the market with the hope of making some profits when the price falls. A person with a bearish sentiment in the market is called a bear.

Blockchain

Blockchain is a digital register that is made up of series of blocks. Each block in a blockchain contains verified trades. It was designed to be decentralized and immutable – meaning that no one can delete or distort a transaction once it is registered in the blocks. Blockchain came to be in 2008 after the release of Bitcoin’s whitepaper.

Distributed Ledger

A distributed ledger is a register containing information that has been distributed or shared across different devices. An example of this is the Blockchain which was developed to track all the transactions of Bitcoin.

P2P

This is a shortened form of peer-to-peer, which is a type of service where two people transact directly without a third party or intermediary. In this case, a buyer and a seller deal directly through the P2P service.

Escrow

An escrow is a middleman or third party that holds money on behalf of another party. This usually happens when two parties who do not trust each other want to execute a transaction, so they give the funds to an escrow who now releases it when all obligations have been fulfilled by the other party.

Fiat Currencies

Fiat currencies are physical currencies that are issued by the government. Thus, they are usually centralized and minted. Examples of these are the United States dollar, the Japanese yen, and the British pound.

Exchanges

Exchanges are platforms where you can buy and sell cryptocurrencies. They are the marketplace for buyers and sellers to interact with one another to trade their different assets. Crypto exchanges are the fastest way to buy and sell cryptocurrencies.

FOMO

“FOMO” means the “fear of missing out.” This is a situation whereby investors and traders start buying an asset because they have seen or heard (social media hypes or rumours) that the price of an asset will increase. This is almost similar to panic buying because you do not want to miss out on the news or whatever forces are driving the price of that asset up.

However, trading in this way can hurt your portfolio as most of the time you may be buying into a manipulated market.Fork

A fork is the alteration of digital assets protocols or rules. This happens when the developers update the asset rules. A fork can happen in two ways: a soft fork and a hard fork. A hard fork is the changes made to an asset’s protocol that disallow the old protocol from working in the new one – that is, a permanent change from an old ecosystem to a new one. On the other hand, a soft fork is backwards-compatible because old nodes will recognize the new blocks as valid.

FUD

“FUD” stands for “Fear, Uncertainty, and Doubt.” This usually happens when market participants start spreading inaccurate and misleading information about a particular asset for the sole purpose of causing the price to dip, and then making profits by buying at a lower price.

HODL

“HODL” is not a misspelt word. It was coined by traders meaning to “Hold On for Dear Life.” A trader who’s hodling will usually not sell his holdings during volatile market periods but, instead, will hold on to it in hopes that the price will reverse or move further in their favour.

Initial Coin Offering

Initial Coin Offering or an ICO is a situation whereby a coin is being listed on an exchange so that the public can buy and sell it at will. It is a means to raise capital, just like when a company offers shares to the public when they decide to go public.

KYC

Know Your Customers or KYC is a method used by exchanges to verify the identity of their clients. This was enforced by regulatory bodies.

Long/Long Position

When you take a long position or you go long in a market, it means that you expect prices to rise in value. If you are long on Ethereum, for example, it means you bought the crypto with the hope that it appreciates.

Short/Shorting

When you short an asset, it means you expect or anticipate a drop in the price of that asset. Shorting can either be by directly selling the asset or buying a put option. Selling/Shorting an asset is a risky method of trading considering the volatile nature of the market.

Market Cap

Market cap means market capitalization which refers to the total market value of an asset. For example, the market cap of Bitcoin is the product of the total number of outstanding Bitcoins in circulation and the current market price.

POS

Proof of Stake or “POS” is a method of verifying transactions. Cryptocurrencies that use this method to verify transactions often distribute all their tokens in advance, and the miners are selected based on their contributions, (the amount they have staked). Stakeholders usually receive rewards in the form of transactions fees.

POW

Proof of Work or “POW” for short is a way to show that a digital asset’s transaction has been confirmed. Bitcoin and many other cryptos use Proof of Work. While miners do most of the work in this kind of system, they are rewarded with a fraction of the assets under verification.

Noob

If you’re new to trading or cryptocurrency, you will be referred to as a noob. It is a short way of saying “newbie.” Noobs have to learn how the market works before they get involved in this volatile market.

Moon/Mooning

The word “moon” or “mooning” means that an asset has risen rapidly in value. For example, you could say that Dogecoin is going to the moon when its price rises sharply.

Mining Incentive

Mining incentives are given to miners who confirm transactions and mine those transactions into blocks. For instance, people who partake in mining Bitcoin have to buy special hardware and pay for huge electricity costs, it only makes sense they receive some form of token for this tedious work – see it as their wage for working.

Rekt

When you lose a substantial amount of money because of holding an asset, you are said to have rekt – a slang for wrecked.

ROI

ROI means Return on Investment. It simply tells you how much you have realized from your investment in a cryptocurrency. This can either be positive or negative.

Pump and Dump

Pump and dump is a form of market manipulation where traders or investors come together to influence the price of an asset so that they will sell it when the price is high. They do this by creating a false activity in the market which ignorant investors buy into, causing the price to pump. After pumping the price, they will dump (sell it) and make profits while leaving ignorant traders with the bag (worthless coins). You have to pay attention not to get caught in a pump-and-dump scheme.

Token

The unit of any digital asset or currency is usually called a token. For example, Bitcoin, ADA, BNB, etc. It is worth taking note that some tokens are created to fulfil a specific purpose.

Whale

A whale is a trader who trades or controls a large volume of cryptocurrencies. Whales have been known to inflate or manipulate the price of digital currencies. It is usually given a metaphorical description as making waves in the ocean.

White Paper

White papers are documents that contain comprehensive information about a digital asset together with its underlying technology or ecosystem. This document helps traders or investors to understand how that particular asset works and its uses.

Some benefits and shortcomings of cryptocurrencies

As with most things in life, cryptocurrencies come with a lot of benefits, as well as some demerits. Below are some of these benefits and threats.

Benefits – Cryptocurrencies make it easier for two parties to transfer funds quickly without the need to involve a third party like a credit card company or a bank. These funds are protected by the use of keys (public and private) and other mechanisms like proof of stake and proof of work.

A cryptocurrency user normally has a wallet (used for storing cryptocurrencies). This wallet has a public key and a private key (known only by the owner of the wallet) used to approve and authorise transactions. The fee charged when transferring funds is smaller than what a regular bank will charge its customers.

Shortcomings – Because cryptocurrencies are semi-anonymous, they have become the route through which illegal transactions, such as tax evasion and money laundering. Although cryptocurrencies are valued for their privacy and protection against the repressive government and whistle blowers. Their level of anonymity varies from coin to coin.

For example, Bitcoin is a terrible choice for illegal activities because the design of Bitcoin’s ecosystem has assisted the authorities in arresting and punish offenders. But coins like Monero, Dash, or Zcash are almost impossible to trace.

| Benefits | Shortcomings |

|---|---|

| Easy to transfer funds directly between two parties | Facilitates illegal transactions |

| Transactions are secure | Money can be lost forever if the wallet bearer dies unexpectedly |

| Transaction fees are relatively small |

What is a cryptocurrency wallet, and what are the types?

Since cryptocurrencies are not physically owned, they must therefore have some storage mechanism. To store your crypto, you must have a wallet. A cryptocurrency wallet works like a regular bank account but with a few differences.

A cryptocurrency wallet holds your private keys and also keeps your crypto accessible and safe. With a wallet, you will be able to send and receive crypto and even use it to pay for goods or services. You use your private keys to gain access to your wallet.

Wallets exist in different forms — from mobile wallets which you can use to shop online (just like a credit card) to hardware wallets that you can physically keep, like a ledger.

How do crypto wallets work?

Crypto wallets are quite different from your physical wallet because, instead of storing money, crypto wallets store private and public keys. The public keys are like your bank account number, while the private keys are like the PIN you use to access the money in your account.

When you send some coins to someone’s wallet address, you’re transferring the ownership of your coins to the recipient. So, for the recipient to spend the newly transferred coins, his private keys must match the public address where the coins are sent.

Thus, ownership of the private keys gives one a total control over the funds associated with the corresponding public address. For this reason, it is vital to make sure you keep your private keys safe so that ONLY YOU know what they are. If another person gets hold of your private keys, they can steal your coins by sending them to another wallet address that they control.

You should also back up your private keys so as to prevent accidental loss because you’d lose your funds if you cannot recover your lost private keys. There have been cases of investors losing millions of dollars as a result of losing their private keys.

Types of Crypto Wallets

There are many types of crypto wallets. Each type operates differently, with its own advantages and disadvantages. Below are some of the main ones you can choose from:

Desktop wallets – Desktops wallets are desktop applications that can be downloaded and installed. You can only access it from the PC on which it is installed. It is more secure than the online wallet, but a virus or PC hack will put your assets at risk.

Mobile wallets – Mobile wallets are mobile apps, which can only be accessed from the smartphone where they are installed. They are more secure than an online wallet because the data aren’t stored on the cloud (but rather in the mobile device). However, they are less secure than desktop wallets because of the threat of breaking your phone.

Hardware wallets – A hardware wallet is a physical device where you can keep your secret keys. You can link it with your computer through its USB port. It’s far more secure than the other classes of wallets above. However, they aren’t free; you have to buy them. It’s the safest option if you want to keep your cryptos offline as well as accessible.

Paper wallets – A paper wallet is a secure wallet option but can be stressful to use. In using a paper wallet, your private keys are written on a piece of paper. But the problem of using this comes from the material itself, that is, the paper. If anything happens to it or it gets damaged or burnt, your assets are gone.

Note that wallets are coin specific. So before choosing the wallet you need, make certain that it can store the asset you need it to store. If your wallet can only receive Bitcoin and you send another coin into it, you will not be able to receive it. If you send a coin to a wallet that does not support it, your coin will be gone for good.

| Wallet | How to access it | How secure |

|---|---|---|

| Online wallet | Web browsers | Least secure |

| Desktop wallet | The PC | Quite secure |

| Mobile wallet | The mobile device | Better than an online wallet |

| Hardware wallet | The hardware device | Very secure |

| Paper wallet | The paper | Very secure |

Cryptocurrency trading vs. investing: which is better?

As you start your journey in cryptocurrency, you have to be certain of your goals — whether you want some short-term gains or you want to hold your assets for a long time.

Cryptocurrency trading means speculating on the short-term price movements of crypto coins either by directly buying and selling the coins on a crypto exchange or by trading the CFDs (Contracts for Difference) via a CFD broker.

CFDs enable you to speculate on the short-term price movements in the cryptocurrency market without having to own the underlying asset. You can long or short the market as you like and can make use of leverage – that is, you do not need to have the full face value of the asset before you can trade it. You only need to have the required fraction of the face value known as margin to trade the asset but you don’t own the underlying asset. However, you should know that leverage can amplify both your profit and loss; so, depending on whether the market moves in favour or against your position, it can be a blessing or a curse.

Investing in cryptocurrency, on the other hand, implies holding your crypto assets for a long time — many years or even for life (HODL). It’s more like the buy-and-hold method when investing in stocks. A Crypto investor buys a coin they believe would grow in the future and hold it for many years or forever, only selling piece by piece when they need money.

Both trading and investing have their benefits. It all depends on your goals and risk appetite. If you have a high tolerance to risk, you might decide to trade, but if you are a more conservative person, you may decide to buy and hold.

| Trading | Investing |

|---|---|

| Short term | Long term (HODL) |

| For those with a high risk tolerance | For conservatives |

| Directly with the coins or indirectly via CFDs | Directly with the coins |

| Can use leverage to increase potential profits | Not available |

Crypto market versus the stock market

Now, let’s compare the cryptocurrency market to the stock market.

How is the crypto market similar to the stock market?

While the cryptocurrency market and the stock market are very different in many ways, there are a few things they have in common. First, both are considered security markets by tax authorities, and profits made from trading or investing in them are taxable based on the duration of the trades.

Second, investing and trading strategies are more or less the same for both markets. Cryptocurrency traders can choose to scalp, day-trade, or swing-trade, while crypto investors can buy and hold their assets as they would normally do in the stock market – for the long term.

Third, the tools used in trading the crypto market are the same as the ones used in the stock markets. Both markets are represented with charts for market analysis, and technical indicators (we will come to this later in this guide) can be used to analyse them.

Fourth, although the cryptocurrency market is nascent and still developing (unlike the stock market that has been there for centuries), it also has many derivative products, such as futures and options. Moreover, just as the stock market is valued in fiat currencies, the crypto market also has its value pegged against fiat currencies.

| Crypto Market | Stock Market | |

|---|---|---|

| Taxable security | ||

| Short-term trading and long-term investing | ||

| Technical analysis tools used | ||

| Derivative products |

The difference between the cryptocurrency market and the stock market

Despite the supposed similarities in the two markets, they are very different. Succeeding in one doesn’t mean you can trade the other. Here are the key areas where they differ.

Market securities or assets – In the stock market, you buy shares of publicly listed companies but in the crypto market, you buy or invest in the coin or the technology and idea behind it and never the company behind it.

Regulations – The stock market being around a long time means that regulators have had time to study it and had understood its nature; therefore, there have been some set of rules and guidelines on how the market is conducted. The cryptocurrency market, on the other hand, is just a decade old and regulators are still finding it difficult to understand how this novel market works. For now, no definitive rules are guiding the cryptocurrency market and this is one of the reasons the market is still volatile and without control.

Market maturity – Age is very important in the financial market. The stock market has been active for many centuries, while the cryptocurrency market is still in its first decade. Trading volume and market value in the stock market are far larger than that of the crypto market. The young age of cryptocurrency is one of the contributing factors to its wide volatility.

| Crypto Market | Stock Market | |

|---|---|---|

| Volatility | Very high | Normal |

| Assets | Crypto coins, tokens, and technology | Shares of companies |

| Regulations | Poor | Adequate |

| Maturity | A decade | Many centuries |

Various cryptocurrency markets

There are two categories to trade in the cryptocurrency market: the spot market and the derivatives market.

Crypto spot market

In the cryptocurrency spot market, coins or tokens are bought or sold for immediate delivery. When you trade in the spot market, you will own the assets. This means that you can profit only when the value of the underlying asset in your portfolio rises.

For example, if you buy 1BTC (equivalent to $55,980 at the time of writing this), you will need to pay the face value, in this case, $55,980. You will have 1BTC in your wallet: if the price rises, you profit, but if it does otherwise, you incur losses.

The spot market is made up of two types of traders: Makers and Takers.

A maker is the initiator of a trade. As a maker, you put up a particular asset for sale on an exchange. For example, if a trader wants to sell a coin, they will open a trade specifying the price they want to sell it at. The takers are on the end of the market, they fulfil the maker’s order.

But makers are not just sellers, and takers are not just buyers: there are makers on both sides of the market as well as takers. A maker is someone that places a limit order, can be a sell or a buy order, which is added to the order book and creates liquidity. A taker, on the other hand, is someone that places a market order to buy or sell at the best available price. Makers create liquidity, while takers consume liquidity, which is how the names came about.

Crypto derivatives market

Cryptocurrency derivatives are financial contracts that track the value of an underlying asset. They can also derive their value from other derivatives.

Derivatives consist of contracts of multiple parties with the contracts getting their price from already existing assets like Bitcoin, Ada, Dent, and others.

There are many forms of derivatives in the crypto market. Some of them include leveraged tokens, futures contracts, options contracts, CFD (Contract for Difference), and token swaps. However, Crypto derivatives are only for experienced traders and the risks involved are far larger than that of the spot market.

| Crypto spot market | Crypto derivatives market |

|---|---|

| You own the asset | May not own the asset in most situations |

| Traded at face value | Traded on margin |

| Leverage unlikely | Leverage is available |

The bid-ask spread

The bid-ask spread, or spread for short, is the difference between the highest bid price (buy order) from the lowest ask price (sell order) for any market. This difference shows you the lowest price a seller wants to sell and the highest price a buyer wants to buy. To put it more specifically, it is the difference between the prices of the lowest-lying sell limit order and the highest-lying buy limit order.

The size of the spread is used to measure how liquid the market is. The smaller the spread, the higher the liquidity in the market. It is also used to measure the supply and demand of a security where supply is represented by the sell-side and demand by the buy-side.

Common chart types

A chart is a graphical representation of data — in this case, price — over time. There are so many types of charts you can use to analyse the cryptocurrency market, but the most popular ones are the Japanese Candlestick, the bar chart, and the line chart. Others include the point and figure chart, Renko chart, etc. But we will focus on the most popular three.

Candlestick chart

The Japanese candlestick chart graphically represents the price movements in a trading session as a candlestick, with upper and lower wicks and a body depending on the price action for that period. Each candlestick represents a price at a specific timeframe. For instance, a 10-minutes candlestick chart will show candles that represent 10-minute trading sessions each, while a 1-hour chart will show the price action of a 1-hour trading session per candlestick.

A Japanese candlestick has four data points: the opening price, lowest price, highest price, and closing price. The opening price is the first data that is recorded for a given trading session (timeframe), while the closing price is the last price point before the chart starts to print a new candle.

One interesting thing about the candlestick chart is that it can be colour-coded to show how the trading session closed (bullishly or bearishly), and you can customize it to the colours you like. However, the most common colours traders use are green or white for bullish candlesticks and red or black for bearish candlesticks. The wick or shadow shows how far the price traded from the open or close price to the high and low of the trading session.

Bar chart

A bar chart is the graphical representation of price using price bars. Each bar shows the price action for a particular timeframe. A bar chart consists of a vertical line that shows the lowest and highest price for a given period plus side marks that indicate the open and close prices. Just like the Japanese candlestick, a 10-minutes bar chart shows the price action for every ten minutes. It also consists of four data points representing the open, high, low, and close.

Line chart

A line chart represents a security’s price by using a single, continuous line. Most often, the closing prices of the trading sessions are used to plot the line chart but any other price point — open, high, or low — can be used. The line chart helps in reducing confusion that results from looking at the open, high, and low prices. It is best used to look at the general movement of the market (trend).

Comparing the three common chart patterns

| Candlestick Chart | Bar Chart | Line Chart | |

|---|---|---|---|

| Shows individual trading sessions | Yes | Yes | No (it’s a continuous line) |

| Colour-coded | Yes | Yes | no |

| Price points shown | 4 (open, low, high, and close) | 4 (open, low, high, and close) | 1 (mostly close but can be any of the 4 price points) |

Why trade cryptocurrencies?

Despite the negative publicity the cryptocurrency market has had since its emergence, many people still trade it. What attracts people to the cryptocurrency market? Well, here are some reasons you may want to try out the market:

Easy to open an account – It’s easy to start trading crypto compared to stocks. For example, you do not have to bring numerous documents to open an account. Some exchanges will only require your email to sign in.

Wide varieties of assets to trade – The cryptocurrency market has developed a lot, despite its relatively young age. Most product offerings that are found in the stock market can now be traded in the cryptocurrency market. Some of these products include leveraged tokens, options, futures, CFDs (Contract for Difference), and swaps. Any kind of derivatives you are looking to trade is available in the cryptocurrency market.

Market volatility – The volatility in the cryptocurrency market can be seen as a positive thing for traders. Let’s ignore the negatives for now; the cryptocurrency market can produce quick gains. An increase in volatility means more trading opportunities for you.

There’s some degree of privacy and anonymity – If you love privacy, then the cryptocurrency market will be your best bet. Unlike stock trading that involves opening an account with your documents, some crypto exchanges do not store your data or have access to your crypto. However, there are some centralized exchanges where you will be required to drop some details about yourself.

Cryptocurrency trading techniques

There are two primary methods to analyse and trade the financial markets. These methods have existed for a very long time and have also been integrated into the cryptocurrency market. They are Fundamental Analysis (FA) and Technical Analysis (TA). You can use each of these techniques independently but most traders use them together.

Understanding fundamental analysis (or FA)

Fundamental analysis is the technique of using financial and economic factors that directly affect a security to forecast its future value. FA helps you to ascertain whether an asset is overvalued or undervalued at the current market price. If you can figure this out, then you can decide whether to invest in it or not or how long you would like to hold the asset if you already own it.

Using FA for cryptocurrency trading involves looking at two significant factors — the on-chain and off-chain metrics. On-chain metrics include wallet addresses (both active and inactive), network fees, network hash rate, and transactions, and token issuance rate.

These on-chain metrics may seem too much of a burden to find. But thanks to websites like Bitinfocharts.com, you can easily find this information, and it is simple and easy to analyse.

On the other hand, off-chain metrics are just about exchange listings, community engagement, and government regulations, the technology, and the mission of the crypto asset.

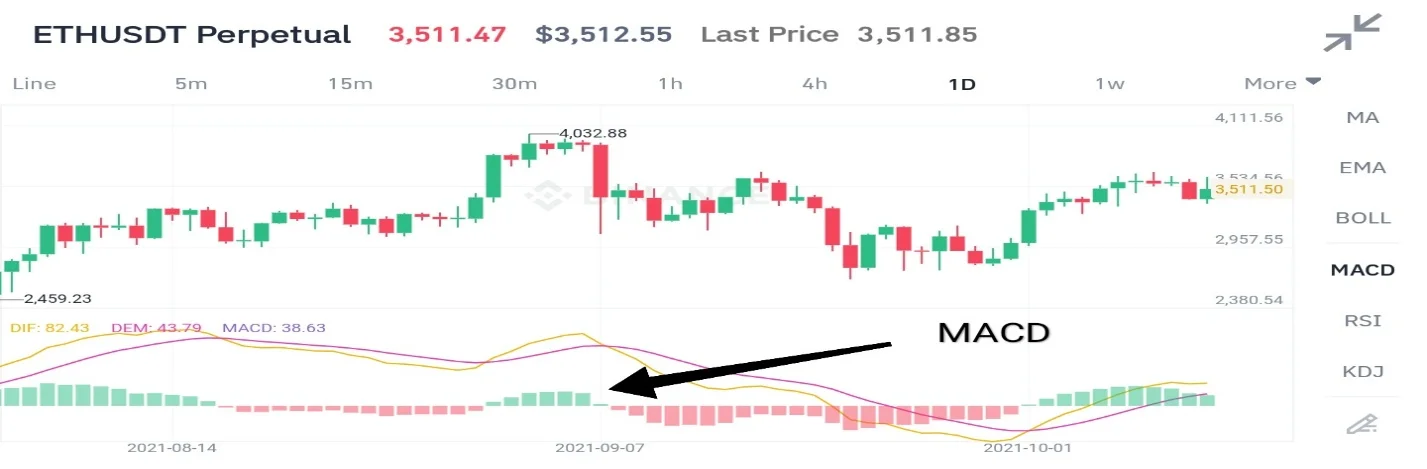

Understanding technical analysis (or TA)

Technical analysis is a trading technique whereby traders use charting software and trading indicators to study historical price action and patterns so as to predict the possible price movements in the future. Some of the indicators used include moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), etc. Other tools used include candlestick patterns, chart patterns, support and resistance, trend lines, and Fibonacci levels.

You can use technical analysis to trade on any timeframe and employ any style, from scalping to long-term trading. The key thing traders look out for is the condition of the market: is it trending or range-bound?

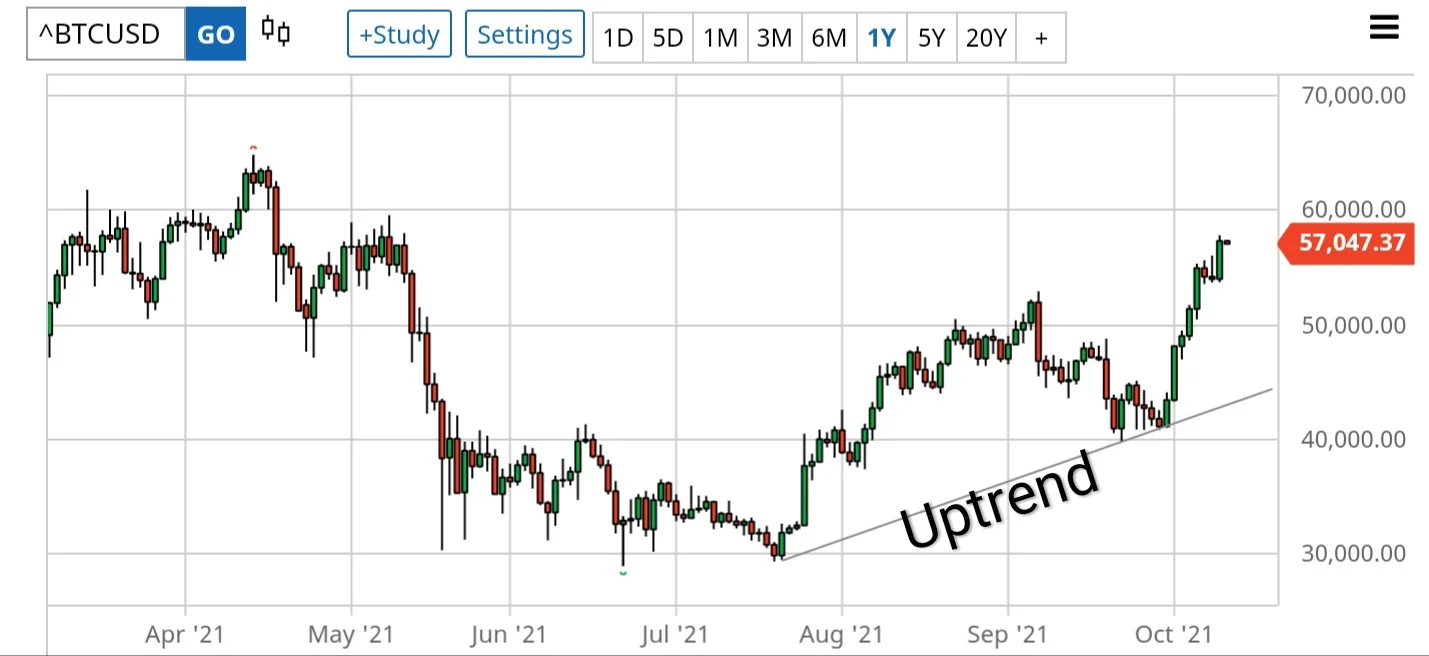

A trending market

A trending market has an overall upward or downward tendency. You can spot the trend from the nature of the price action, but many traders use moving averages and trend lines to delineate it.

Generally, market trends are divided into two types: a bull market and a bear market. A bull market is a market that is in an uptrend (the general market direction is upwards), while a bear market is one in a downtrend (prices are declining).

Another thing to note is that market does not move in a straight line. It is normal for the market to show a temporary decline during an uptrend and also rally for a brief period during a downtrend. However, the timeframe you look at also matters because you can have an uptrend in an hourly timeframe while that same asset might be in a downtrend in the daily timeframe. Trends on the higher timeframe are of more importance to those of the lower time frame.

Range-bound market

A market is described as range-bound if it is moving sideways. That is, there seems not to be a clear market direction; the market is neither in an uptrend nor in a downtrend. This type of market can also be called a trendless, horizontal, or ranging market.

The market just swings up and down within a range. The upper border of the range acts as a resistance zone as the price finds it difficult to convincingly climb above it. Likewise, the lower border of the range acts as a support area with the price failing to break below it.

Common technical analysis tools and indicators

Technical indicators are mathematical calculations based on market data. This data can be on-chain data, volume, price, volatility, and open interest amongst others. Technical indicators may be described as leading or lagging the price.

While most technical indicators are based on price data, some are based on volume, and they are referred to as volume indicators. Examples include on-balance volume, open interest, accumulation and distribution, etc.

Price-based indicators can be grouped into trend indicators (moving averages and ADX) and oscillators (CCI, RSI, and Stochastic, etc.), and momentum indicators, such as the MACD.

Trend lines

Trend lines are a popular tool used by traders and chartists. They are diagonal lines that are drawn on the charts to connect price points. However, some traders do draw them on other technical indicators.

The primary purpose of a trend line is to determine the trend in the market and to make sense of the market structure. It can also be used to identify dynamic support and resistance levels. Trend lines can be applied to any timeframe. However, trend lines on higher timeframes are more reliable than lower timeframes. Also, a trend line is considered valid only if the price touches it at least twice; anything less and it is considered not reliable.

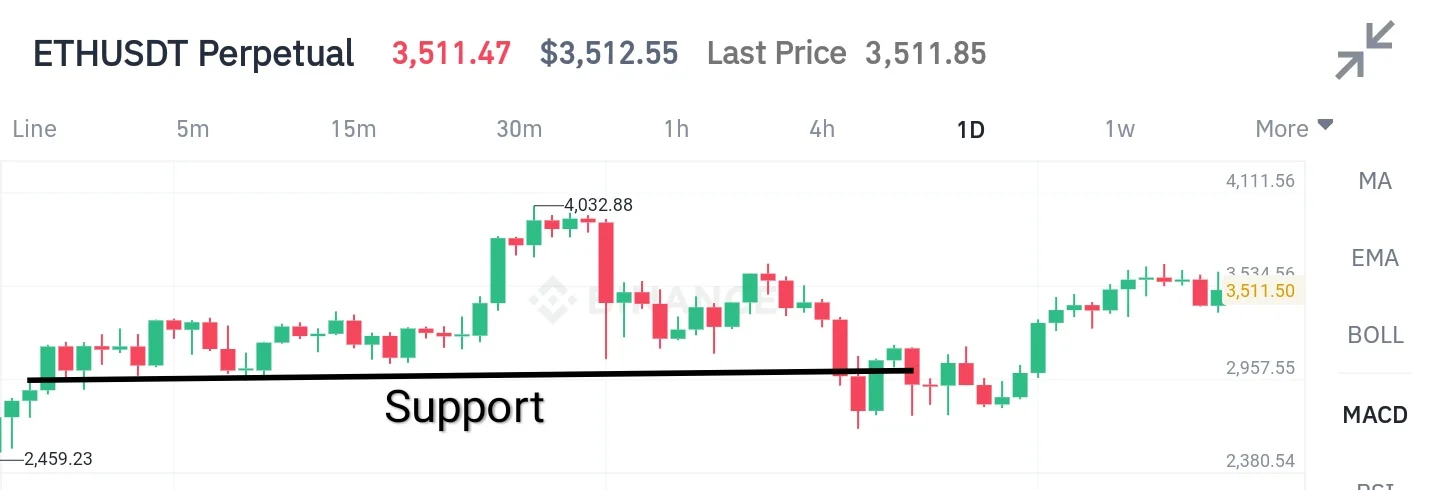

Support and resistance levels

Support and resistance are very important concepts in technical analysis. The support level acts as the floor from where the price bounces upward. That is, it is an area of increased demand where bidders (buyers) get in and push prices up.

A resistance level, on the other hand, is the price ceiling. It is an area where there is a large amount of supply, which causes the price to decline due to increased selling pressure.

To put it short, support is a level of increased demand while resistance is a level of increased supply. However, there are other factors that contribute. From the chart above, notice that when the price broke above the resistance level that level started acting as a support level.

Apart from drawing the trend lines and horizontal lines for support and resistance, traders also use technical indicators in their analysis. Let’s take a look at the most commonly used indicators.

Moving averages

Moving averages are technical indicators used to smooth price actions. It is also used to identify market trends. The moving average is a lagging indicator because it relies on historical prices.

There are different types of moving averages; the two most popular ones are the SMA (Simple Moving Average) or EMA (Exponential Moving Average). While both of these smoothen prices, they differ in the way they are calculated.

The SMA is calculated using previous price data from n’ periods and then creating an average from it. As an example, the 100-day SMA takes the mean price of the last 100 days and then represents it as a line on the graph.

The EMA on the other hand puts more weight on the recent price data than on the older ones. As a result of this, it reacts faster to price action than the SMA.

Moving averages are a great tool to use in your trading, but as with most indicators, they should never be used alone because of their lagging behaviour. Pairing it with another indicator will give you a higher probability of success in your trades.

Oscillators

Oscillators are technical indicators that oscillate about a central line or within the upper and lower limits of the indicator box. Oscillators are used to identify when a particular asset is overbought or oversold. Technically speaking, when the indicator enters the upper extreme band, the asset can be said to be in the overbought region, and if it is in the lower extreme band, the asset may be said to be oversold.

Examples of oscillator indicators include the Relative Strength Index, the Williams %R, Stochastic, CCI, Momentum, and the MACD.

FA vs. TA – which is better for trading?

Whether or not to use fundamental analysis or technical analysis will depend on your trading preferences. If you are the kind of trader that would normally enter and exit trades rapidly within a day, then using technical analysis will be your go-to approach, but that does not mean that you can’t trade based on news events. On the other hand, if you prefer to research and make trading decisions based on core information about an asset, then fundamental analysis is a good choice.

| Fundamental Analysis | Technical Analysis |

|---|---|

| Considers economic and other factors to estimate the present and future worth of the asset | Uses previous price action to forecast future price movements |

| Suitable for ascertaining the long-term outlook of the asset | Mostly focused on short-term and medium-term price movements |

| Requires deliberate research into the factors that can affect the asset | Focuses on the market data (mostly price and volume) |

| It’s used for gauging the long-term direction of the market | It’s used for timing entry and exits |

Using the two approaches may be more helpful than relying on one. As a cryptocurrency trader, you can never have enough tools in your trading arsenal. Integrating both FA and TA into your trades will give you a higher chance of spotting trading opportunities in the crypto market. This is because the two complement each other.

Let’s take a look at a practical scenario. You can use FA to determine the overall direction of the market over the long term. But there is not much help in deciding when to invest using this information. This is where TA comes in; you can use TA to time your entry and also use it to know when to exit.

Additionally, when you want to invest in an asset using TA, you can use FA to determine if the direction you are taking is in line with the market’s long-term outlook. Now, you see how important it is to use both techniques rather than using only one of them.

Types of trading orders

To buy or sell crypto, you have to make some form of a request to the market. This request is known as order. For immediate buying and selling, you might trade at a market order but sometimes you may want to trade at a particular price level. Below are some of the common types of orders in trading.

- What is a market order? – A market order is an order to buy or sell a security at the best available market price. Market orders will be executed at the current market price regardless of whether it is spiked up or down. While this type of order can get you in at a worse price, your order is executed immediately.

-

What is a limit order? – This is a buy or sell order to be executed at a specified price level or a better one. A limit buy order must be placed below the current market price for it to be valid, and the order is executed at the specified level or below it. Likewise, a limit sell order is placed above the current market price, and the order is executed at the specified price level or above it.

For example, you can place a limit buy order if you expect the price to decline after a rally before continuing the rally. Let’s say BTC is trading at around $56k, you may decide to place a limit buy order at $54k if you think it’s a support level. When the market declines to $54k or lower, your order will be filled but never higher than your limit order. A major drawback to this is that market may not come down to hit your order or it might take a longer time to execute.

Limit orders are a great way of taking advantage of buying at a lower price than what the market is offering. But you must understand how it works before using it properly.

-

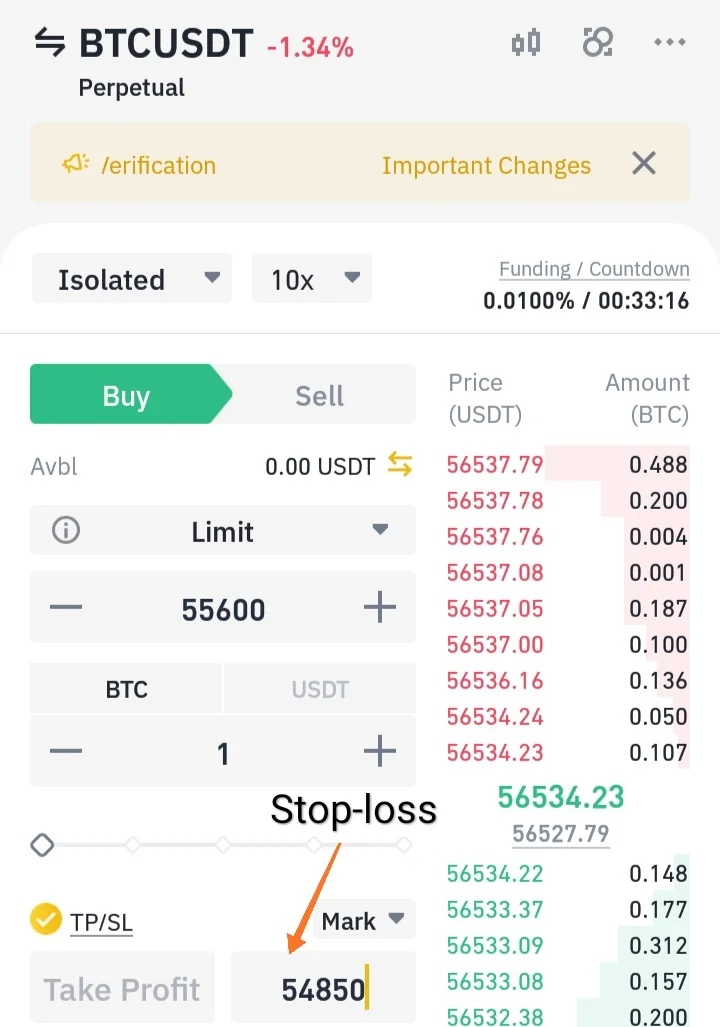

What is a stop-loss order? – A stop-loss order is an order to exit from a position if the market moves against your position up to a certain level. The idea behind a stop-loss order is to limit losses. As a trader, you must have an invalidation point – a point where you accept that your prediction is wrong. When your stop-loss order is triggered and executed, your trades are closed and you incur a small loss that you already planned to take.

See the example below. An order to buy 1 Bitcoin at $55,600 was placed and below the limit price, you can see another price as $54,850. That is a stop-loss order telling the market that after executing the limit order, if prices go below our entry point, it should close the trade at $54,850. Using a stop-loss order allows you to avoid a catastrophic loss or a complete liquidation of your trading account.

Note that a stop-loss order is not fool-proof. In certain conditions where the price gaps below your stop-loss order, it will not be triggered. Nonetheless, it’s always better to set it, but you should always monitor your trades and also keep your position size small to reduce losses.

Knowing when to buy and sell

Knowing when to buy or sell is not an easy skill to acquire. But the key thing is to have your entry and exit criteria. For example, you might decide to buy when the market is oversold and sell when the market is overbought based on a 14-period RSI indicator.

But it is not enough to have a trading strategy with entry and exit rules. You should also have a trading plan.

Why do you need a trading plan?

Having a trading plan will go a long way to ensure you do the right thing at all times in line with your goal. Without a trading plan, you will be buying and selling without knowing what you hope to achieve. A trading plan is like having a map; it is your guide in your cryptocurrency trading journey.

Your trading plan helps to keep your emotions in check. As you may know, one of the greatest challenges traders face is how to deal with their emotions. This is even more serious when the price starts going against your position or when you start having multiple streaks of losses. Keeping to your trading plan will enable you to avoid irrational trading decisions.

A trading plan also forces you to have money management and risk management strategies. These are essential for succeeding in trading, as they help you to preserve your account long enough to start making profits.

Different styles of trading

Crypto traders adopt different styles of trading — scalping, day trading, swing trading, and position trading. The right style for you depends on your personality, risk tolerance, and how busy your schedule is. For example, you might be someone who works 9 to 5 and have no luxury of time to monitor the market.

Now, let’s take a look at those trading styles:

Scalping

Scalping is an intraday trading strategy whereby a trader profits from small price changes over a very short time — from seconds to some minutes. This strategy involves constant monitoring of charts on the lowest timeframes, quick timing, and precise entry and exit.

Trades can run from a few to hundreds per day when scalping. In fact, most scalping strategies these days are implemented with trading algorithms.

Day trading

A day trading strategy involves going in and out of a position within a day — day traders normally close their position before the end of the trading day. It involves holding positions between some minutes and a few hours, and a few trades can be made before the end of the day.

If you have got a busy schedule, day trading might not be for you because it requires monitoring the markets all day.

Due to the volatility of the cryptocurrency markets, day trading might not be a suitable style for beginners. A day trader must have strong discipline and the ability to keep emotions out of their trades.

Since it involves having multiple trades open, an electronic trading system might be adopted to help filter misjudgements that come with human emotions. If you are a risk-averse trader, you should consider using a more conservative approach to trading.

Swing trading

Swing trading is an approach that involves holding a position from a few days to a few weeks. The aim is to capture the individual price swings on the daily timeframe, so the trades are mostly done on that timeframe, though a swing trader can step down to the 4-hour timeframe to get a better entry.

Swing trading is a more conservative approach since trades are held for a few days to few weeks, and the trader does not need to constantly monitor the market. It also allows the trader to catch larger market moves compared to day trading and scalping.

Position trading (HODL)

Position trading is a long-term trading strategy. It is also known as a trend-following strategy. It involves spotting trends and trading in the direction of those trends. Typically, trades are held for months and sometimes for years until a trend reversal is spotted. Swing and position trading are more suitable to beginners than the day trading strategy.

| Scalping | Day Trading | Swing Trading | Position Trading | |

|---|---|---|---|---|

| Trade duration | Some seconds to a few minutes | Some minutes to a few hours | Days to weeks | Months to years |

| What traders are called | Scalpers | Day traders | Swing traders | Position traders |

| Timeframe | Tick chart, 1-minute, and 5-minute timeframes | 5-minute to hourly timeframe | Daily timeframe and sometimes, 4-hourly timeframe | Weekly timeframe and daily timeframe |

| Time requirement | Time-consuming | Time-consuming | Less time consuming | Least time consuming |

| Approach | Part-time or full-time | Full-time | Part-time | Part-time |

Margin trading (trading with leverage)

Margin trading is a situation where a broker or an exchange allows you to carry a position with only a fraction of its total worth. This means that you’re trading with leverage as you automatically borrowed from the broker or exchange to complement your capital. This has rewards as well as consequences.

When using leverage in trading, your wins and losses are amplified. Many exchanges offer different degrees of leverage like 10:1, 50:1, 100:1, etc. Beginner traders should understand how leverage works before opting to use it in their trading.

Risk management

The cryptocurrency market is riskier han any other market due to its nature. Cryptos have been known to make double-digit percentage moves within a day, thus, proper risk management must be adopted to preserve capital. How and when you should buy assets should be considered. Also, the amount of capital to be dedicated to an asset must be pre-set before executing any trade.

Managing your portfolio

Portfolio management is very important in crypto trading. This will involve how well you allocate capital across all the assets that you hold.

Before creating a portfolio of cryptocurrency investments, you should plan what you expect from a particular asset over the short term and long term.

Managing your portfolio properly will ensure you get consistent returns from your investment by adding high-performing assets and removing underperforming ones.

How to pick the best cryptocurrency exchange

There are many exchanges out there for you to trade your cryptocurrencies on. While some are good, there are also bad eggs among them. Below are some things to look out for before choosing a cryptocurrency exchange.

Security – Security should be a top priority for any exchange. Some cryptocurrency exchanges have been victims of hacks where tokens worth hundreds of millions of dollars were stolen. Ensure the exchange uses the best technology to secure their website and protect customers’ data.

Transaction fees – You need to understand the fee structure of an exchange before choosing it as this can have an impact on the kind of trading system you use. If you’re a scalper or a day trader, for example, you will pay more fees because of your frequent and numerous positions.

Your profit margin will depend on the fees. If fees are low, the profit will be large, but if fees happen to be high, you may not even make profits at all.

Payment and withdrawal methods – The ease of depositing and withdrawing funds should be considered before choosing an exchange. An exchange with multiple payment option (credit cards, cryptocurrencies, PayPal, etc.) makes it easier for users to do transactions with ease.

User experience – An exchange user interface should be easy to navigate especially for newbies. Things like placing buy and sell orders should be easily done.

Recommended platforms for your first trades

If you are a beginner looking for an exchange with ease of navigating, then Coinbase is your best choice. Coinbase offers basic buying and selling of cryptocurrencies. It also offers a high level of transparency and security.

However, if you want a professional trading experience with more advanced tools and assets to trade, then Binance is the ideal exchange. Binance offers a low trading fee and over 500 tradable cryptocurrencies as well as different order types.

Steps to start trading cryptos

If you have made up your mind to start trading cryptocurrency, these are the steps you may follow:

- Raise the capital: You should only commit money you can afford to lose to trading. Do not invest urgent money (rent, light and water bills, or emergency funds) since anything can happen and you can lose everything. You can start with small capital to test the waters and get yourself familiar with the market before committing large funds.

- Create a trading plan: Trading without a plan is like sailing without a compass. Create a trading plan with all your trading criteria and risk management. It will help you to avoid overtrading and manage your risk accordingly.

- Register with a reliable exchange: Now that you have everything set, you will need to open an account with an exchange and fund it to get started with your first trade.

- Buy your first crypto: It’s now time to place your first trade. Select your preferred cryptocurrency and start trading.

Conclusion

Trading cryptocurrencies can be rewarding when done properly. Research and continuous learning are necessary for a successful trading career.

Additionally, having other sources of income will help lift the burden of relying totally on trading because the beginning can be tough. We hope that this guide has been of great help.