Two years after their approval, spot Bitcoin Exchange Traded Funds (ETFs) have become a defining feature of the cryptocurrency market. In early 2026, these funds collectively hold more than 1.3 million BTC, making ETFs some of the largest institutional holders of Bitcoin globally.

Yet beneath the headline growth, ETF inflows have become increasingly uneven and volatile. While total holdings expanded significantly through 2025, early 2026 has seen choppy dynamics with periods of net outflows amid institutional repositioning. Using quarterly on-chain data and official AUM (Assets Under Management) figures, our team at BestBrokers analysed how Bitcoin ETF ownership has evolved since 2024, highlighting the shifting flow dynamics and the structural implications for institutional crypto exposure.

BlackRock: Leading the BTC ETF Market

BlackRock, the world’s biggest and most reputable hedge fund and asset manager, has steadily increased its Bitcoin holdings through its iShares Bitcoin Trust (IBIT), one of 11 SEC-approved spot Bitcoin ETFs. IBIT provides institutional and retail investors with a fully regulated vehicle to gain exposure to Bitcoin without directly holding the cryptocurrency, allowing BlackRock to build its Bitcoin position over time strategically.

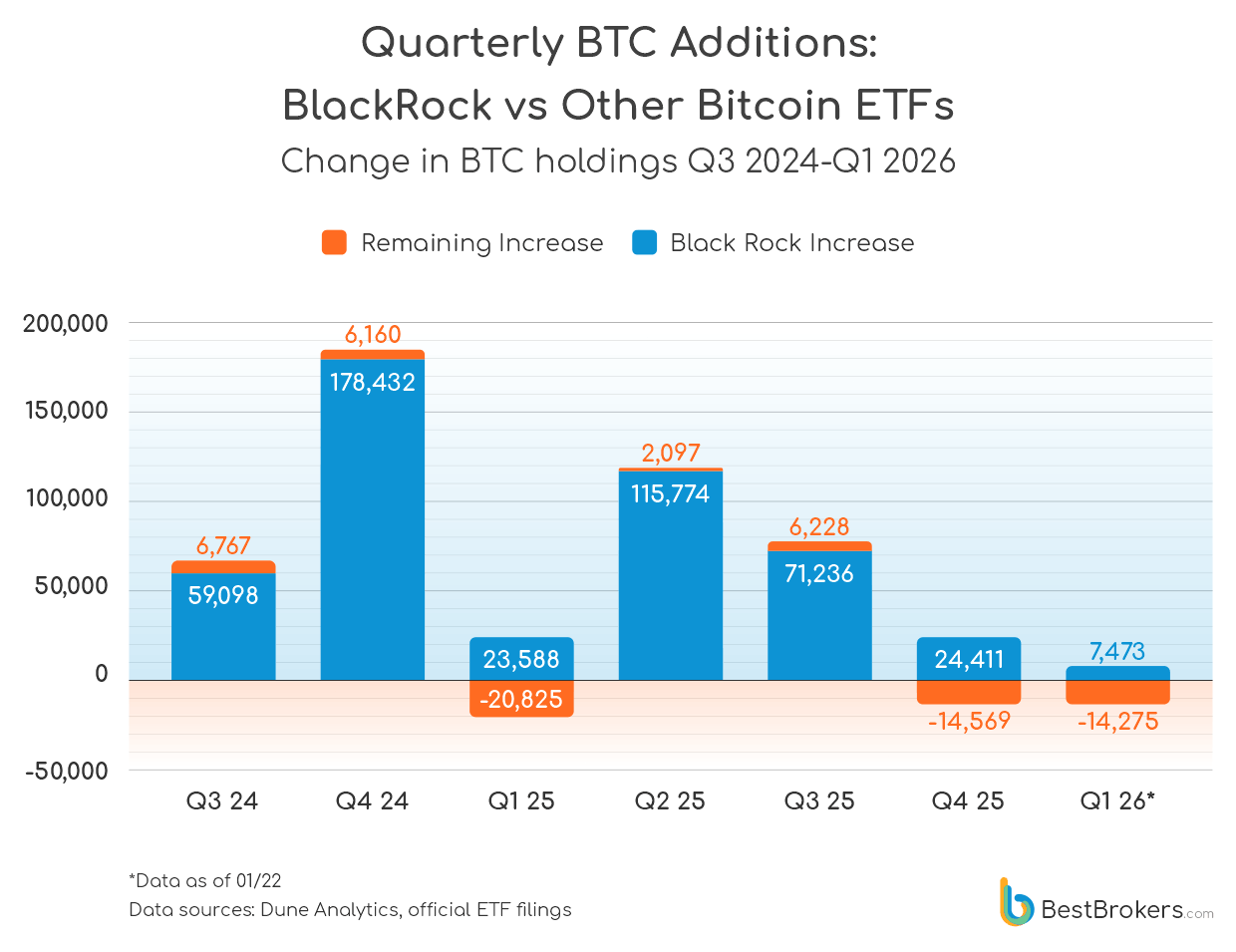

Since launch, BlackRock’s Bitcoin holdings have risen from 303,935 BTC in Q2 2024 to 783,947 BTC by January 2026, representing an increase of approximately 258% relative to its initial post-approval level. This sustained accumulation has cemented IBIT’s position as the dominant force within the Bitcoin ETF market.

‘BlackRock’s steady accumulation of Bitcoin demonstrates how the market increasingly views the cryptocurrency as a hedge against inflation, tariffs, and broader economic turbulence. Beyond that, the firm’s consistent inflows suggest a growing belief among institutional players that digital assets are set to become a core part of the financial landscape.’

– Alan Goldberg, Analyst at BestBrokers

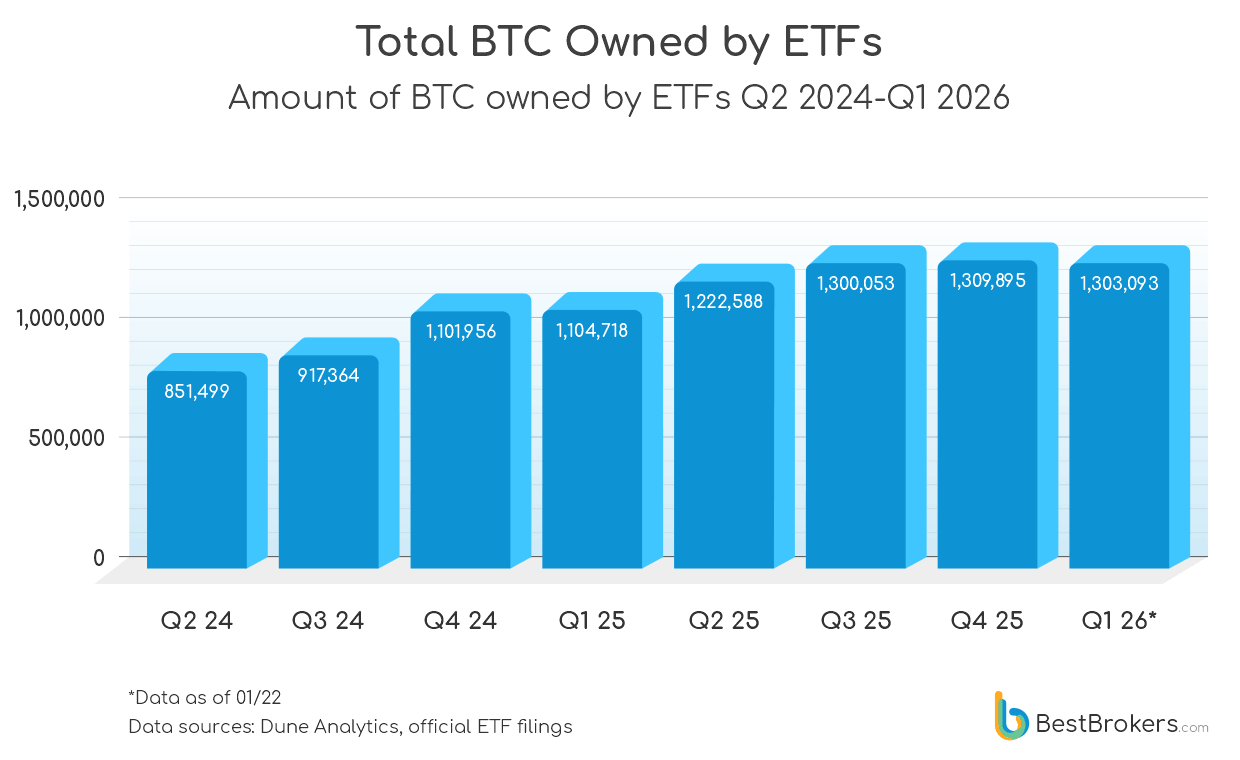

Total BTC Owned by ETFs

Since Q2 2024, total Bitcoin holdings across all U.S.-approved spot ETFs have risen from 851,499 BTC to over 1.3 million BTC. Holdings peaked at 1,309,895 BTC in December 2025 before easing slightly to 1,303,093 BTC in January 2026, marking the first broader contraction since the SEC approval.

Early 2026 was marked by pronounced volatility in Bitcoin ETF flows. The year opened with strong institutional demand, including multiple days of inflows approaching $700 million, led primarily by BlackRock’s iShares Bitcoin Trust (IBIT). This momentum was followed by sharp reversals as profit-taking and portfolio rebalancing triggered heavy redemptions across the ETF complex. The week ending 23 January saw $1.33 billion in net outflows across U.S. spot Bitcoin ETFs, the second-largest weekly redemption on record, including a single-day market-wide withdrawal of approximately $709 million. Despite the turbulence, BlackRock’s IBIT absorbed a disproportionate share of remaining inflows, reinforcing its position as the primary institutional gateway even during periods of heavy redemptions.

ETF accumulation remains highly concentrated. By January 2026, ETFs held ~6.7% of circulating Bitcoin (1.3M of all 19.5M BTC in circulation), surpassing the cryptocurrency’s founder Satoshi Nakamoto’s estimated 1.1M BTC. In Q4 2024, ETFs added 184,592 BTC, with BlackRock alone accounting for 178,432 BTC (96%). The pattern persisted: in Q3 2025, BlackRock added 71,236 BTC, while all other ETFs combined acquired just 6,228 BTC, underscoring the uneven distribution of institutional Bitcoin holdings.

BlackRock’s Bitcoin Trust ETF is accumulating Bitcoin at an unprecedented rate

BlackRock’s iShares Bitcoin Trust (IBIT) has absorbed a disproportionate share of ETF inflows since launch. Holdings rose from 303,935 BTC in Q2 2024 to 783,947 BTC by January 2026, representing a 258% increase from the initial post-approval level.

In contrast, other ETFs have experienced more modest growth or intermittent outflows. By early 2026, IBIT accounted for over 60% of all Bitcoin held in spot ETFs, demonstrating the concentration of institutional demand within a small number of funds.

‘Even when ETF inflows weaken or turn negative, BlackRock continues to accumulate. That consistency has transformed IBIT into the backbone of institutional Bitcoin demand.’

– Alan Goldberg, Analyst at BestBrokers

Ethereum ETFs: BlackRock Extends Its Dominance Beyond Bitcoin

The concentration visible in Bitcoin ETFs is increasingly mirrored within the Ethereum market. As of January 2026, spot Ethereum ETFs collectively hold more than 6.1 million ETH, with exposure heavily concentrated among a handful of issuers.

Total Ethereum Owned by ETFs

Amount of ETH owned by ETFs as of January 2026

Once again, BlackRock leads decisively, holding approximately 3.54 million ETH, followed by Grayscale, Grayscale Mini, and Fidelity, each with holdings between 730,000 and 890,000 ETH.

BlackRock alone now controls nearly 58% of all Ethereum held by ETFs, reinforcing its position as the dominant institutional gateway not only to Bitcoin, but to digital assets more broadly. As with BTC, ETF-based Ethereum ownership is becoming increasingly centralised, with capital flows gravitating toward the largest fund.

Raw Data

| Quarter | Company | Ticker | BTC AUM | USD AUM |

|---|---|---|---|---|

| 2024-04 | BlackRock | IBIT | 303,935.34 | $21,684,965,905.48 |

| 2024-04 | Grayscale | GBTC | 274,465.04 | $19,582,339,446.96 |

| 2024-04 | Fidelity | FBTC | 158,915.31 | $11,338,178,463.19 |

| 2024-04 | 21Shares | ARKB | 45,316.37 | $3,233,200,776.05 |

| 2024-04 | Bitwise | BITB | 37,524.28 | $2,677,256,219.45 |

| 2024-04 | VanEck | HODL | 9,927.02 | $708,266,339.45 |

| 2024-04 | Valkyrie | BRRR | 8,278.95 | $590,680,542.69 |

| 2024-04 | Invesco | BTCO | 6,945.00 | $495,507,003.17 |

| 2024-04 | Franklin Templeton | EZBC | 4,901.00 | $349,672,950.48 |

| 2024-04 | WisdomTree | BTCW | 1,290.47 | $92,071,903.00 |

| 2024-04 | Grayscale Mini | BTC | 0.00 | $0.00 |

| 2024-07 | BlackRock | IBIT | 363,033.39 | $22,759,794,041.34 |

| 2024-07 | Grayscale | GBTC | 219,943.71 | $13,789,016,526.79 |

| 2024-07 | Fidelity | FBTC | 171,666.02 | $10,762,324,666.48 |

| 2024-07 | 21Shares | ARKB | 50,684.48 | $3,177,581,617.45 |

| 2024-07 | Bitwise | BITB | 39,582.22 | $2,481,543,473.37 |

| 2024-07 | Grayscale Mini | BTC | 33,752.36 | $2,116,050,042.87 |

| 2024-07 | VanEck | HODL | 11,991.62 | $751,795,200.68 |

| 2024-07 | Valkyrie | BRRR | 8,889.75 | $557,328,490.74 |

| 2024-07 | Invesco | BTCO | 8,141.97 | $510,447,878.94 |

| 2024-07 | Franklin Templeton | EZBC | 5,972.84 | $374,457,859.72 |

| 2024-07 | WisdomTree | BTCW | 3,705.49 | $232,309,554.87 |

| 2024-10 | BlackRock | IBIT | 541,465.51 | $34,313,703,475.71 |

| 2024-10 | Grayscale | GBTC | 203,713.41 | $12,909,708,177.65 |

| 2024-10 | Fidelity | FBTC | 191,384.54 | $12,128,403,663.28 |

| 2024-10 | 21Shares | ARKB | 46,726.94 | $2,961,175,300.31 |

| 2024-10 | Bitwise | BITB | 40,196.57 | $2,547,333,395.97 |

| 2024-10 | Grayscale Mini | BTC | 37,512.91 | $2,377,264,838.72 |

| 2024-10 | VanEck | HODL | 13,716.83 | $869,261,558.10 |

| 2024-10 | Valkyrie | BRRR | 8,770.05 | $555,775,009.54 |

| 2024-10 | Invesco | BTCO | 7,792.76 | $493,842,106.74 |

| 2024-10 | Franklin Templeton | EZBC | 6,813.51 | $431,785,324.15 |

| 2024-10 | WisdomTree | BTCW | 3,862.49 | $244,773,308.93 |

| 2025-01 | BlackRock | IBIT | 565,053.45 | $52,828,010,903.17 |

| 2025-01 | Grayscale | GBTC | 191,859.47 | $17,937,336,954.79 |

| 2025-01 | Fidelity | FBTC | 189,423.53 | $17,709,596,325.63 |

| 2025-01 | 21Shares | ARKB | 47,780.46 | $4,467,093,791.28 |

| 2025-01 | Grayscale Mini | BTC | 40,095.03 | $3,748,566,847.06 |

| 2025-01 | Bitwise | BITB | 38,243.22 | $3,575,437,693.12 |

| 2025-01 | VanEck | HODL | 14,275.40 | $1,334,636,662.49 |

| 2025-01 | Valkyrie | BRRR | 5,899.38 | $551,545,443.75 |

| 2025-01 | Invesco | BTCO | 5,291.65 | $494,727,267.90 |

| 2025-01 | Franklin Templeton | EZBC | 4,956.35 | $463,379,067.76 |

| 2025-01 | WisdomTree | BTCW | 1,840.03 | $172,028,424.06 |

| 2025-04 | BlackRock | IBIT | 680,827.19 | $56,236,053,826.72 |

| 2025-04 | Fidelity | FBTC | 195,058.38 | $16,111,744,367.23 |

| 2025-04 | Grayscale | GBTC | 183,515.95 | $15,158,344,372.31 |

| 2025-04 | 21Shares | ARKB | 46,817.61 | $3,867,115,944.54 |

| 2025-04 | Grayscale Mini | BTC | 43,525.36 | $3,595,177,048.24 |

| 2025-04 | Bitwise | BITB | 39,512.73 | $3,263,735,704.88 |

| 2025-04 | VanEck | HODL | 15,661.22 | $1,293,610,915.74 |

| 2025-04 | Valkyrie | BRRR | 5,778.74 | $477,321,474.22 |

| 2025-04 | Invesco | BTCO | 5,188.56 | $428,573,006.24 |

| 2025-04 | Franklin Templeton | EZBC | 5,155.37 | $425,831,187.91 |

| 2025-04 | WisdomTree | BTCW | 1,547.32 | $127,808,281.79 |

| 2025-07 | BlackRock | IBIT | 752,063.18 | $80,629,783,497.78 |

| 2025-07 | Fidelity | FBTC | 204,591.49 | $21,934,550,034.56 |

| 2025-07 | Grayscale | GBTC | 174,981.53 | $18,760,023,967.93 |

| 2025-07 | Grayscale Mini | BTC | 47,236.24 | $5,064,266,082.18 |

| 2025-07 | 21Shares | ARKB | 43,601.35 | $4,674,564,132.60 |

| 2025-07 | Bitwise | BITB | 40,465.76 | $4,338,393,095.07 |

| 2025-07 | VanEck | HODL | 17,853.09 | $1,914,055,586.77 |

| 2025-07 | Invesco | BTCO | 6,107.54 | $654,798,383.80 |

| 2025-07 | Franklin Templeton | EZBC | 5,789.96 | $620,750,471.37 |

| 2025-07 | Valkyrie | BRRR | 5,768.58 | $618,457,998.51 |

| 2025-07 | WisdomTree | BTCW | 1,594.00 | $170,895,422.79 |

| 2025-12 | BlackRock | IBIT | 776,474.65 | $66,653,360,430.65 |

| 2025-12 | Fidelity | FBTC | 200,832.78 | $17,239,686,667.98 |

| 2025-12 | Grayscale | GBTC | 167,600.21 | $14,386,969,626.61 |

| 2025-12 | 21Shares | ARKB | 39,976.27 | $3,431,602,993.07 |

| 2025-12 | Bitwise | BITB | 40,043.96 | $3,437,413,570.36 |

| 2025-12 | Grayscale Mini | BTC | 48,534.62 | $4,166,260,315.42 |

| 2025-12 | VanEck | HODL | 17,061.19 | $1,464,549,610.79 |

| 2025-12 | Invesco | BTCO | 6,269.45 | $538,175,857.45 |

| 2025-12 | Franklin Templeton | EZBC | 5,757.56 | $494,234,707.96 |

| 2025-12 | Valkyrie | BRRR | 5,767.8 | $495,113,719.80 |

| 2025-12 | WisdomTree | BTCW | 1,577 | $135,371,257.00 |

| 2026-1 | BlackRock | IBIT | 783,947.20 | $69,500,043,309.59 |

| 2026-1 | Fidelity | FBTC | 197,699.66 | $17,526,862,692.15 |

| 2026-1 | Grayscale | GBTC | 161,170.27 | $14,288,386,699.03 |

| 2026-1 | 21Shares | ARKB | 36,933.00 | $3,274,257,628.01 |

| 2026-1 | Bitwise | BITB | 38,977.48 | $3,455,508,927.26 |

| 2026-1 | Grayscale Mini | BTC | 48,492.88 | $4,299,087,056.13 |

| 2026-1 | VanEck | HODL | 15,795.56 | $1,400,339,339.31 |

| 2026-1 | Invesco | BTCO | 6,426.12 | $569,701,146.09 |

| 2026-1 | Franklin Templeton | EZBC | 5,959.04 | $528,292,642.77 |

| 2026-1 | Valkyrie | BRRR | 6,041.7 | $535,620,781.17 |

| 2026-1 | WisdomTree | BTCW | 1,650 | $146,279,075.25 |

Methodology

This report reviews the total amount of Bitcoins held on-chain by all SEC-approved Bitcoin ETFs, starting from Q2 2024, the quarter following SEC’s approval of spot Bitcoin ETFs. The analysis uses quarterly data on each fund’s holdings to track accumulation trends, compare market shares, and identify which funds are contributing most to the overall growth of Bitcoin held in ETFs. Figures were sourced from Dune Analytics and official ETF filings as of January 20, 2026.