Artificial intelligence continues to dominate the venture capital landscape, with investors worldwide pouring significant resources into AI startups, infrastructure, and foundational technologies. To get a clearer picture of the current VC environment, the team at BestBrokers analysed venture capital activity in artificial intelligence and machine learning startups using data from PitchBook, CB Insights, and LIQUiDITY.

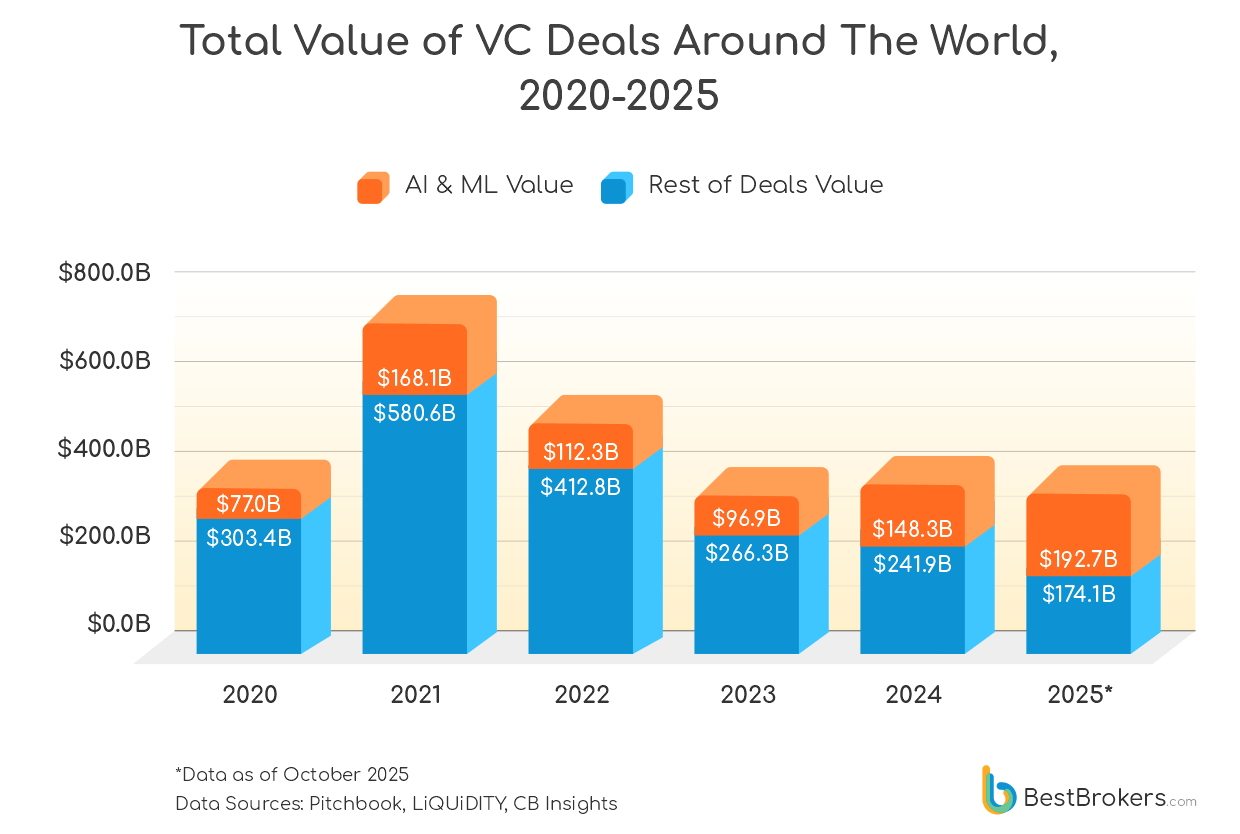

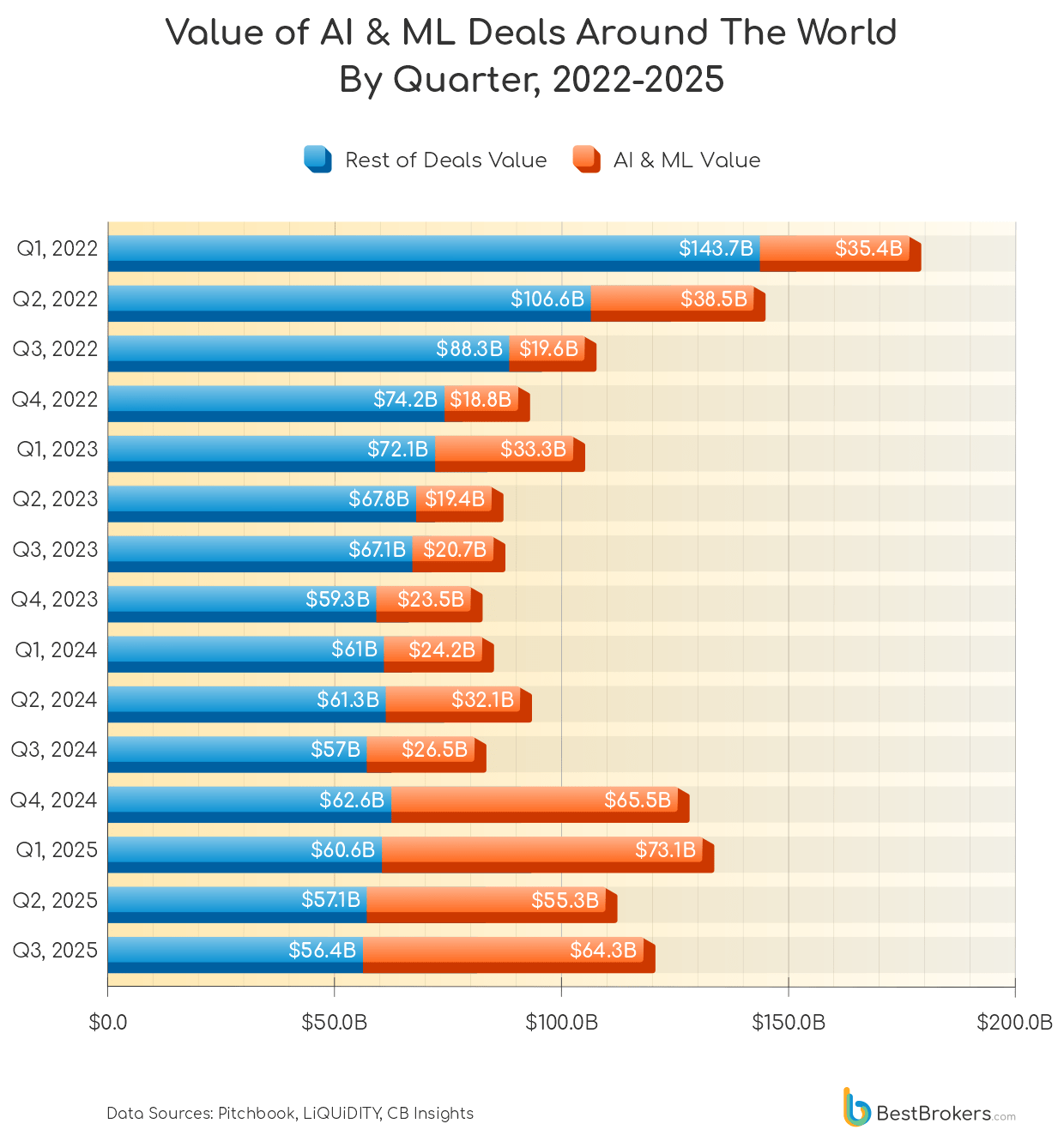

We found that since the start of 2025, AI startups have raised $192.7 billion, representing 52.5% of total venture capital investment for the year, which amounts to $366.8 billion. During the third quarter of 2025, 2,427 investment deals in AI companies were completed, continuing this year’s trend of a decline in the overall number of deals, following 2,987 deals in Q1 and 2,655 in Q2. Venture capital investment, however, has increased across all industries, with startups securing $120.7 billion in funding rounds this quarter, compared to Q2’s $112.4 billion in total. Of this, $64.3 billion went to AI startups, nearly $10 billion more than in the previous quarter, when AI startups raised $55.3 billion.

Key takeaways:

- Venture capital investment in AI reached $64.3 billion this quarter, accounting for more than 53.3% of the total $120.7 billion invested by VC firms.

- Venture investment continues to decline, with only 9,358 confirmed VC deals this quarter, the lowest number since Q2 2020, when just 9,168 deals were recorded.

- Year-on-year quarterly AI funding has jumped 142.6% since Q3 of 2024, when AI funding amounted to $26.5 billion.

- AI investments in 2025 have reached $192.7 billion so far, more than any previous full year in history, even surpassing the $168.1 billion raised during the AI boom of 2021.

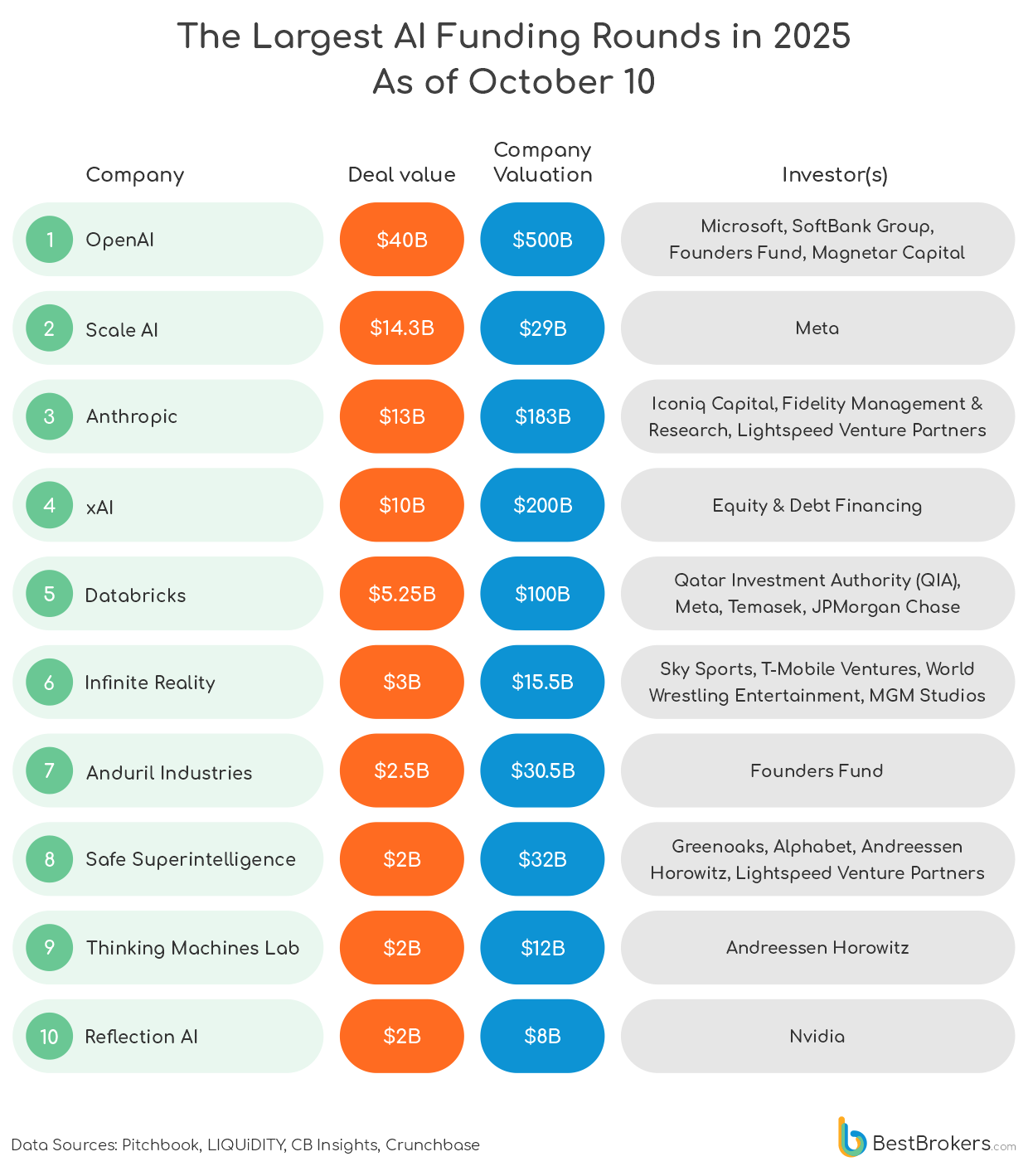

- Anthropic’s $13 billion Series F funding round was the largest venture capital deal of the quarter.

Following a period of aggressive investment throughout 2021–2022, venture capital firms have shifted into a more selective phase, focusing on startups with proven enterprise applications or those developing critical AI and cloud infrastructure. This trend is reflected in a drop in deal volume but a surge in deal value, with investors concentrating on established AI leaders. Major funding rounds in 2025, such as OpenAI’s record-breaking $40 billion raise led by SoftBank and ICONIQ Capital’s $13 billion round in Anthropic, demonstrate that investors clearly prefer backing proven and reputable AI companies.

Interestingly, many of the most heavily funded startups, including Thinking Machines Lab and Safe Superintelligence, were founded by former OpenAI staff – another clear indication of AI expertise clustering in elite startups. While this concentration is driving rapid technological advances in the firms with the resources to support it, it is also intensifying competitive pressure on newer entrants.

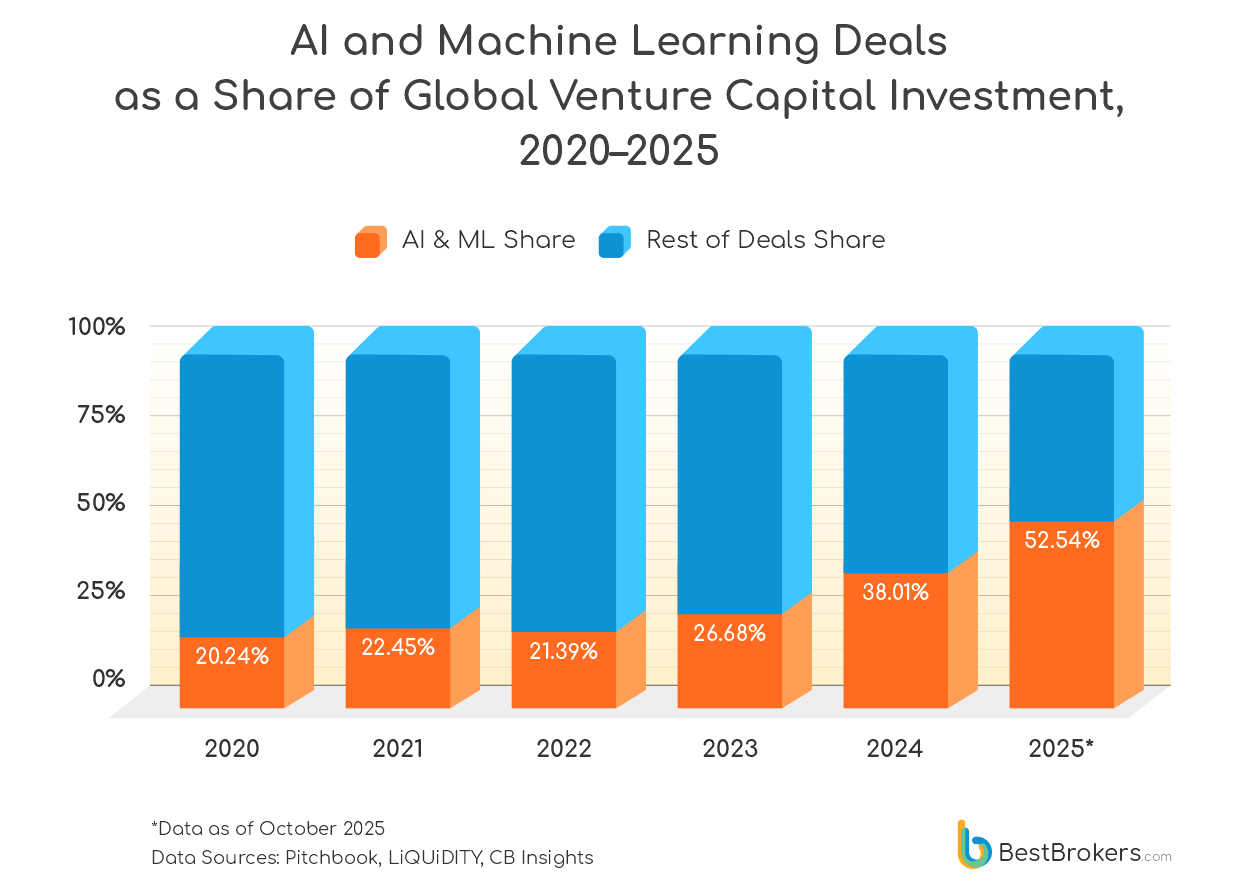

Data shows that despite a broader slowdown in deal numbers, the share of AI and machine learning investments continues to grow rapidly. In 2023, AI funding accounted for 26.7% of global venture capital deal value, up from 21.4% in 2022. By 2024, this had risen to 38%, and in 2025, it already stands at an unprecedented 52.5%, even though the year is not yet complete. With AI funding already exceeding all other venture investments combined, 2025 is on track to become the first year in history in which more than half of global VC capital flows into artificial intelligence startups.

Venture Capital in 2025: Investing More But in Fewer Startups

Venture capital funding for AI and machine learning startups has increased significantly since 2022, while VC funding for other industries has declined. Quarterly data for the years 2022-2025 shows that AI deal value has become increasingly dominant, rising from $35.4 billion in Q1 2022 to $64.3 billion in Q3 2025, while VC funding for the rest of the startup ecosystem has steadily declined.

The first major acceleration occurred in Q4 2024, when AI funding soared to $65.5 billion, nearly triple the quarterly average from the previous year. This surge was driven primarily by massive $10 billion investment rounds for Databricks and OpenAI, alongside several other significant deals, including Series F rounds exceeding $1 billion for Scale AI and Safe Superintelligence.

The upward momentum for AI funding continued well into 2025. AI startups attracted $73.1 billion in Q1, followed by $55.3 billion in Q2, and $64.3 billion in Q3, maintaining a quarterly average well above any previous year. By comparison, non-AI sectors collectively raised less than $60 billion per quarter throughout 2025, further widening the gap between AI and the broader venture landscape. Overall, AI and ML deal value has nearly doubled since early 2023 and quadrupled since mid-2022, demonstrating that investor focus has shifted toward artificial intelligence.

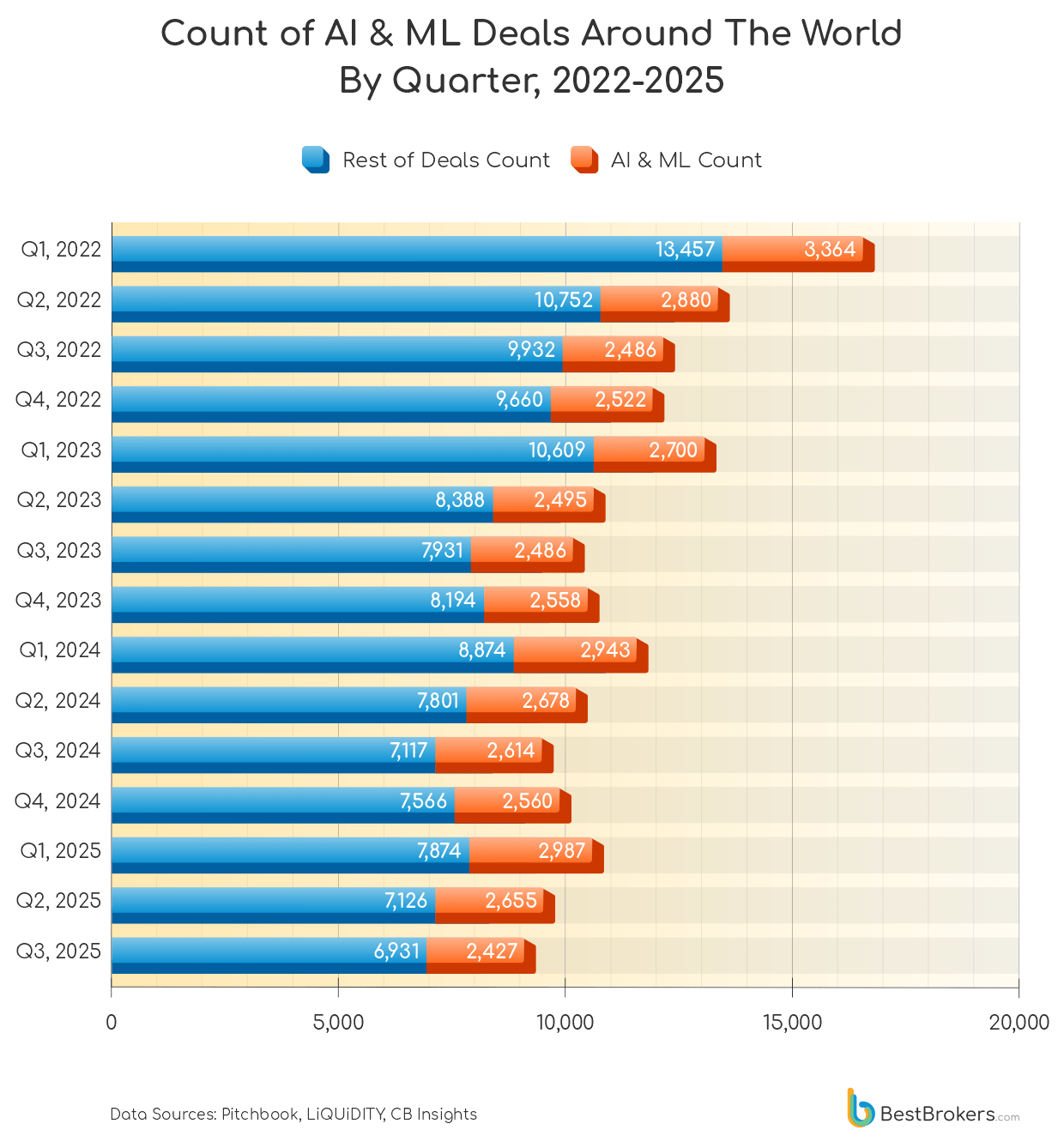

While the value of AI investments has surged since 2022, the number of deals has followed a downward trend, reflecting investors’ growing preference for fewer, larger bets. Overall global venture activity has been on a steady decline since early 2022, from 16,821 deals in Q1 2022 to just 9,358 in Q3 2025, marking a 44% drop in total deal count in a little over three years.

AI and ML-related deal count, however, has proven to be more resilient. After peaking at 3,364 deals in Q1 2022, the quarterly volume has hovered consistently between 2,400 and 3,000 through 2025, even as broader VC activity contracted. In Q1 2025, AI deals reached 2,987, their highest level since 2022, signalling sustained investor enthusiasm amid a slower funding environment.

By Q3 2025, AI deals represented roughly 26% of all global venture transactions, compared to around 20% in early 2022, underscoring how artificial intelligence continues to command a growing share of venture attention. The data highlights a clear structural shift – while total startup activity declines, AI remains the only segment maintaining both high deal flow and record-breaking valuations.

The Biggest VC Deals So Far in 2025

In the first quarter of 2025, SoftBank set a new record by investing $40 billion in OpenAI, marking the largest ever investment in a private company. Just a few months later, another milestone was achieved when Thinking Machines Lab secured the largest-ever seed-stage funding round of $2 billion. Led by Andreessen Horowitz and Greenoaks, this round valued Thinking Machines Lab at $10 billion, despite the company not yet having launched a product. By comparison, seed funding rounds rarely exceed $10 million, with the previous record held by Safe Superintelligence in 2024, which raised $1 billion.

In September 2025, Anthropic, the San Francisco-based developer of the AI chatbot Claude, secured the largest funding round of any AI company in Q3, raising $13 billion. The round was led by Iconiq Capital and also included Fidelity Management & Research and Lightspeed Venture Partners. The investment tripled Anthropic’s valuation from $61.5 billion to $183 billion, making it the second most valuable private AI company in the world, behind OpenAI, which was valued at $300 billion at the time of the deal and has since reached $500 billion.

The second largest funding round of 2025 was Meta’s $14.3 billion investment in Scale AI, which also gave CEO Mark Zuckerberg a 49% stake. In June, Elon Musk’s xAI raised $10 billion in debt and equity, a round that pushed its estimated valuation to $200 billion. Earlier, xAI acquired Musk’s social media platform X (formerly Twitter) for $33 billion in an all-stock deal, integrating its user base with xAI’s AI capabilities. Combined with strategic deals such as the $300 million integration of xAI’s chatbot Grok on Telegram, xAI has emerged as one of the most formidable competitors to OpenAI and ChatGPT.

Earlier this year, leading AI researcher Yoshua Bengio warned that advanced models are showing increasingly unpredictable and deceptive behaviour, prompting renewed calls for stronger oversight and regulation. The surge in funding for firms like Safe Superintelligence underscores the industry’s growing focus not only on technological advancement but also on the responsible and aligned development of AI to address emerging risks.

The Venture Capital Firms behind the AI Investment Boom

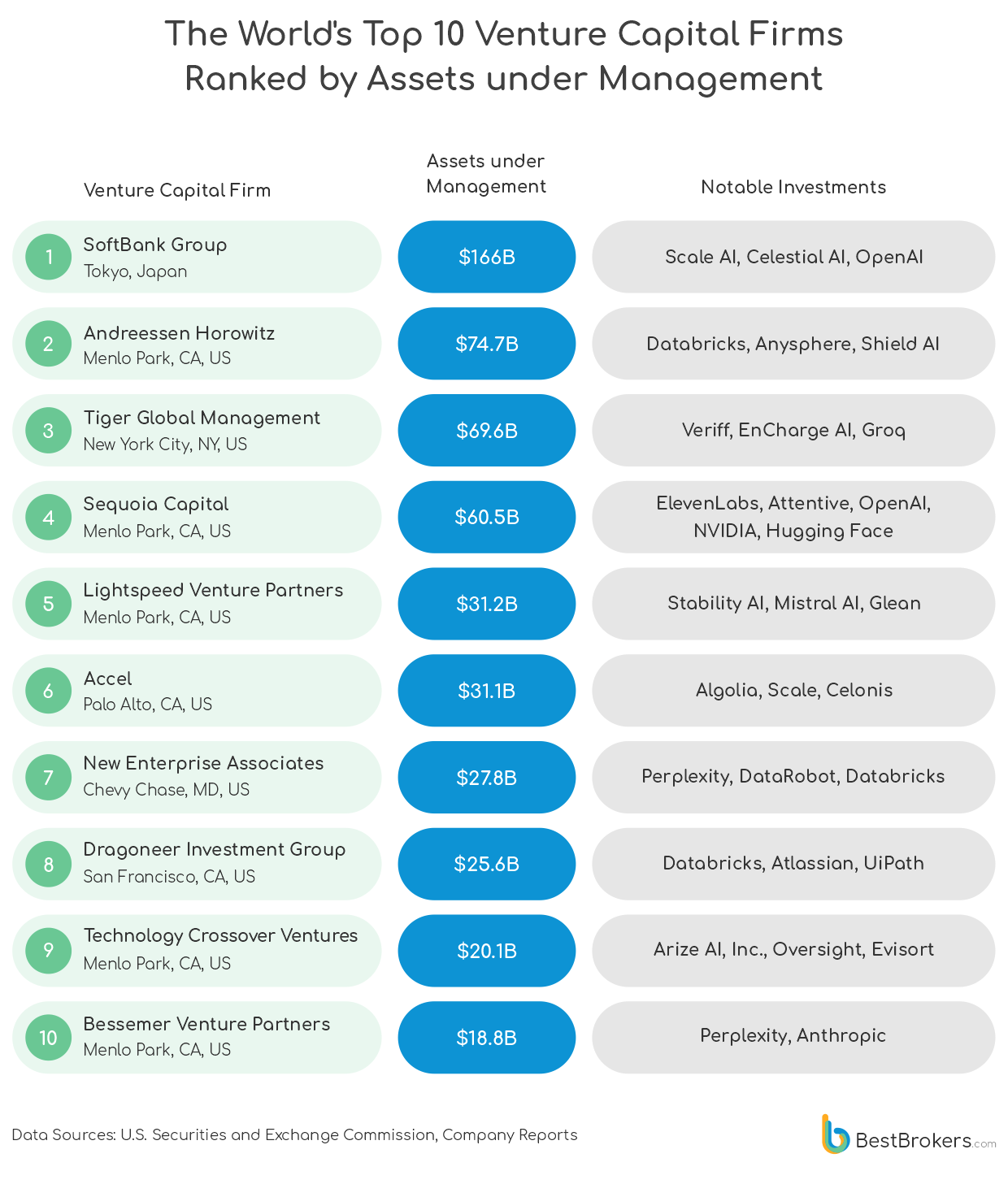

SoftBank Group Corp has been investing heavily in AI in recent years, primarily through its tech and AI investment vehicles, Vision Fund 1 and Vision Fund 2. The company’s combined assets under management (AUM) across all funds total approximately $166 billion, making SoftBank Group the largest single tech-focused investment entity. It recently signed a $40 billion deal with OpenAI in the largest private tech investment in history.

In January 2025, SoftBank Group CEO Masayoshi Son announced a $100 billion investment in U.S. AI infrastructure, part of an initiative known as the Stargate Project. The project was unveiled at a White House press conference, attended by President Donald Trump, OpenAI CEO Sam Altman, Oracle’s Larry Ellison, and Masayoshi Son. Stargate aims to deploy up to $500 billion over the next four years to build AI infrastructure, including data centres across the U.S., to create over 100,000 jobs and secure American leadership in AI. The venture is a collaboration between SoftBank, OpenAI, Oracle, and investment firm MGX, with SoftBank holding a 40% stake and Masayoshi Son as chairman.

Andreessen Horowitz, also known as a16z, is an American VC firm founded in 2009. As of 2025, it manages $74.7 billion in assets and is a major investor in the tech sector. In April 2025, Andreessen Horowitz co-funded Anysphere, the maker of Cursor, in a $900 million Series C round alongside Thrive Capital and Accel. A16z has also invested in medical AI, including a $300 million deal with Abridge, a clinical conversations AI startup, and an $8.2 million funding round for Scribenote, an AI-powered veterinary scribe platform.

Tiger Global Management, formerly known as Tiger Technology, is a U.S.-based VC firm established in 2001. It currently manages $69.6 billion in assets, ranking as the third-largest venture firm globally by AUM. In 2021, Tiger Global co-led a $300 million fundraising round with D1 Capital for U.S. AI startup Groq, pushing its valuation past $1 billion and granting the company unicorn status. More recently, Tiger Global invested $100 million in EnCharge AI, an emerging AI chip developer.

Sequoia Capital has maintained a strong focus on technology investments since its founding in 1972. Its AI investment portfolio spans consumer tech, entertainment, industrial, health, and defence sectors. As of 2025, Sequoia manages $60.5 billion in assets, with 2,809 total investments and 867 active portfolio companies. In late 2024, the firm co-invested $6 billion in Elon Musk’s xAI during its Series C round. The deal was made in collaboration with a16z, BlackRock, Fidelity Management & Research Company, Kingdom Holding, and Lightspeed, among others.

Lightspeed Venture Partners specialises in growth, seed, and early-stage tech investments. As of the latest data, the firm manages $31.2 billion in assets globally. Earlier this year, it led a $3.5 billion Series E funding round for Anthropic, valuing the company at $61.5 billion. Alongside Sapphire Ventures and WestBridge Capital, Lightspeed also invested over $102 million in Yellow AI a U.S.-based customer service automation startup. The funding spanned three rounds and pushed Yellow AI’s valuation to over $500 million.

Global VC Investment by Region: Trends and Insights

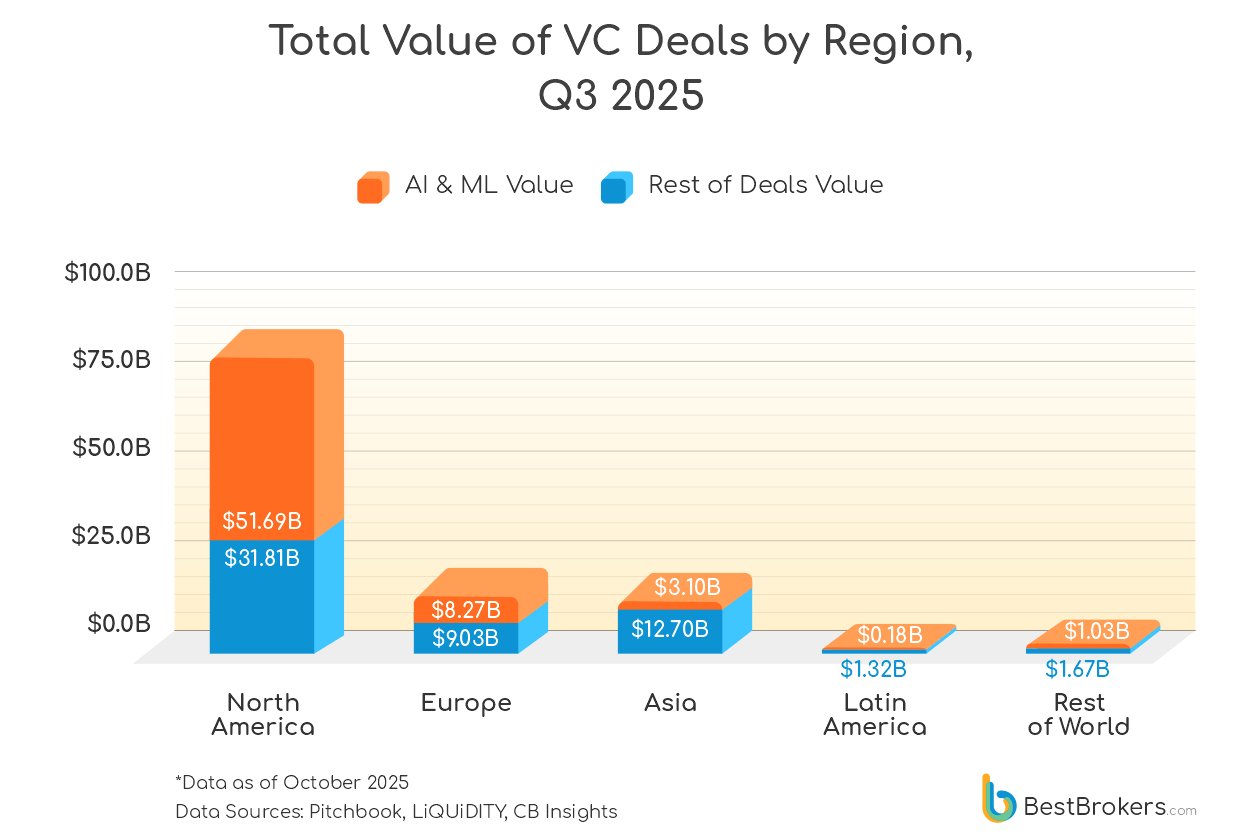

North America continues to lead global VC activity, with investment values almost doubling from $45.2 billion in 2024 to $83.5 billion in the third quarter of 2025. A key driver of this surge is investor confidence in the companies building the infrastructure that supports the current AI boom, where capital-intensive hardware startups can offer long-term strategic value. U.S. inference AI startup Groq recently raised $750 million to scale its GroqCloud and LPU deployments, expand its inference infrastructure, and strengthen its position at the heart of the American AI ecosystem.

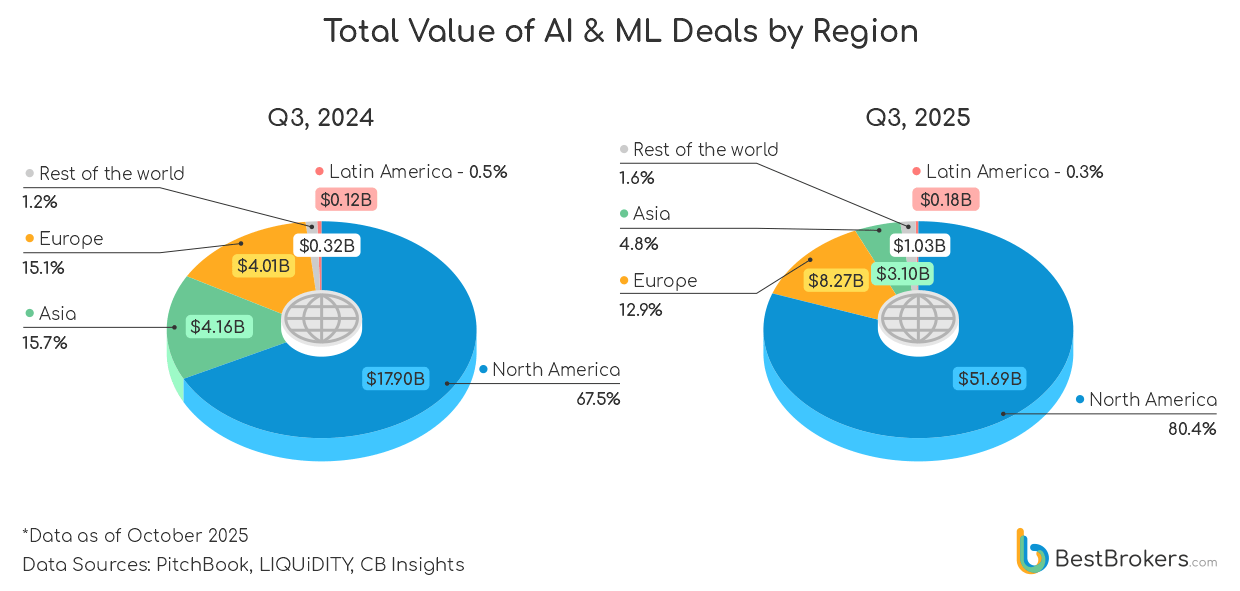

By contrast, Europe saw only a modest 16.9% increase, suggesting that while appetite for innovation remains strong, investors are being more selective as domestic markets settle. Meanwhile, Asia was the only region to record a decline, with startups across the region raising 24.4% less than the previous year, primarily due to regulatory tightening and slower-than-expected exits. Latin America (+66.7%) and the Rest of the World (+58.8%) demonstrated robust rebounds from smaller bases, signalling that emerging markets are increasingly attracting attention for early-stage innovation, particularly as local AI ecosystems begin to mature.

Focusing solely on AI investment, global momentum has become even more pronounced. Of the $83.5 billion invested in North American startups this quarter, $51.7 billion has gone to AI businesses. This represents a 188.8% surge in AI-focused venture capital flows compared with last year, when AI startups across North America, primarily in the U.S., raised a total of $17.9 billion. Q3 2025’s dramatic increase has been driven largely by blockbuster megadeals, including Anthropic’s $13 billion Series F and xAI’s $5.3 billion funding round, which alone significantly reshaped the quarterly totals.

European AI startups also delivered a strong performance, raising $8.27 billion in Q3 2025, more than double Q3 2024’s $4.01 billion. Driving this surge were standout deals such as Mistral AI’s €1.7 billion Series C, backed by ASML, and London-based Nscale’s $1.1 billion funding round, highlighting the region’s growing strength in foundation models and AI-cloud infrastructure.

Across other markets, growth varied. Latin America’s AI investment rose from $120 million in Q3 2024 to $180 million last quarter, driven by early-stage ventures in fintech, logistics, and automation. Asia was the only major region to contract, falling from $4.16 billion to $3.10 billion, as shifting macroeconomic priorities limited breakout generative AI startups and late-stage funding. While still a hub for applied AI in manufacturing and robotics, Asia lacked the high-profile Q3 megadeals that propelled North America and Europe.

Methodology

To prepare this report, the team at BestBrokers used the most recent available data on global VC firm activity from Pitchbook and from business analytics platform CB Insights and various VC investors’ websites. We also looked at additional information from a handful of other sources, such as LIQUiDITY and DealRoom.

We collected revenue and asset data for the U.S.-based VC firms from the U.S. Securities and Exchange Commission (SEC) database. Investment Advisor information is publicly available on the IAPD website, where we checked the ADV forms firms filed. For international VC firms, we analysed their most recent press releases and annual financial reports.