In early July 2025, the UK’s All-Party Parliamentary Group on Fair Banking released its report ‘No Half Measures – A Blueprint to Beat APP Fraud’, calling for sweeping reforms to a system struggling to keep pace with fraudsters. From romance scams to AI-generated voice impersonations, criminals are using increasingly sophisticated tactics to drain their victims’ bank accounts. While APP fraud (where people are tricked into sending money to fraudsters under false pretences) remains one of the most damaging and visible forms, with nearly £460 million lost in 2024 alone, it is just one part of a broader landscape of banking fraud now affecting thousands of victims across the country.

Once a symbol of security, the UK’s banking system now finds itself under siege. Some police forces report millions in fraud losses, others show strikingly high victim rates relative to population. From pensioners misled by fake officials to young adults tricked through phishing links and spoofed messages, no age group is spared. To understand the true scale of the crisis, the team at BestBrokers analysed police-recorded data on banking fraud across England, Wales, Scotland, and Northern Ireland for the period between 14 July 2024 and July 2025, examining reported cases, total financial losses, losses per 1,000 residents, and victim demographics by age and gender.

We discovered that UK police forces recorded 21,392 cases of banking fraud in this time period, with reported losses reaching £417.4 million, an average of £19,512 per incident. Strikingly, a substantial share of that total, £345 million, is attributed to 1,417 cases listed under an ‘Unknown’ police jurisdiction, likely reflecting high-value national-level investigations or reports with incomplete information. When excluding this category, the nationwide loss equates to roughly £1,094 for every 1,000 residents, a figure that illustrates the scale and persistence of financial crime affecting everyday bank account holders.

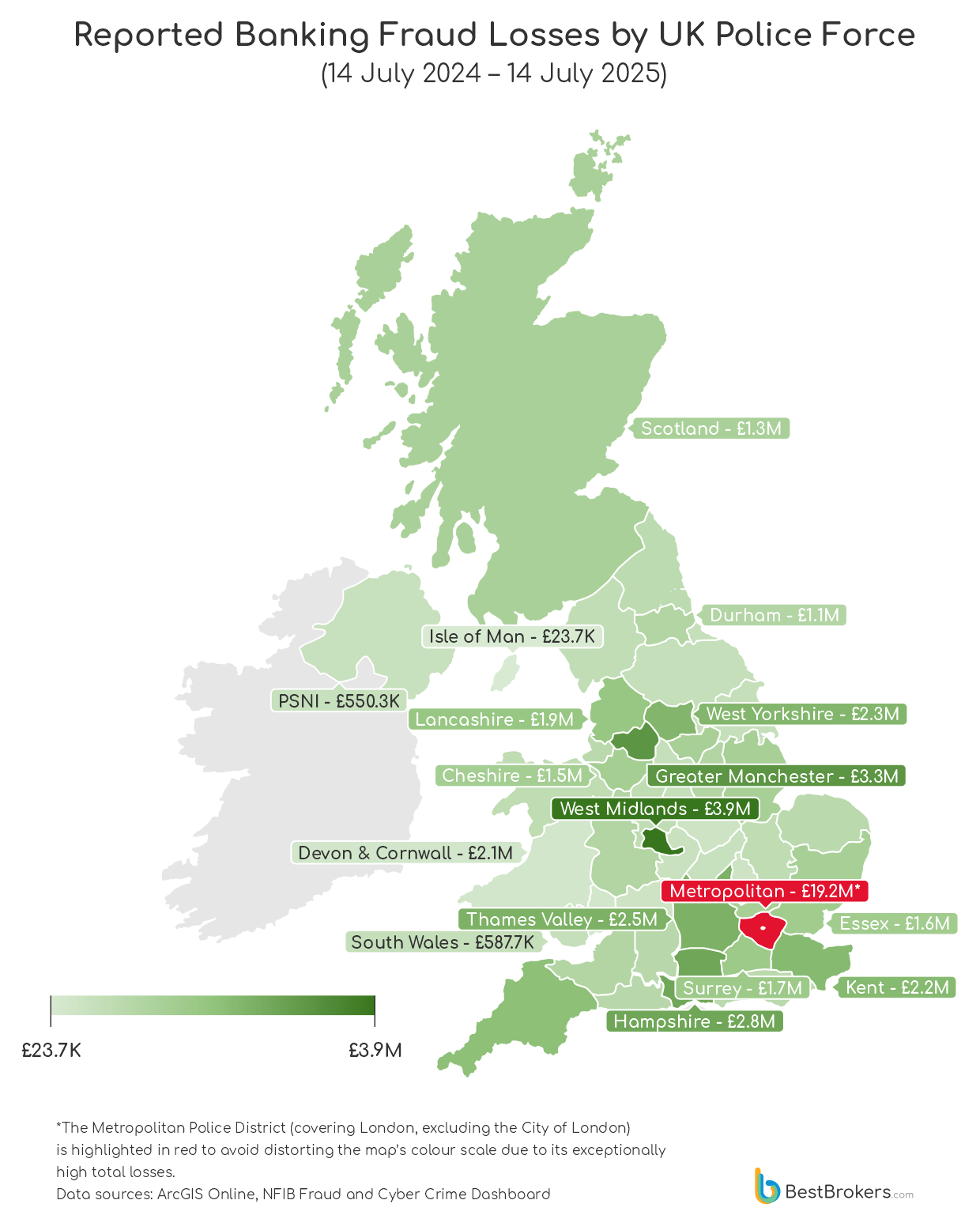

The Metropolitan Police in London leads the nation with losses from banking fraud soaring to £19.2 million across 3,206 cases, far outpacing other major urban areas like the West Midlands and Greater Manchester, which reported millions in losses spread over hundreds or thousands of incidents.

Yet, some smaller police forces tell a different story: Guernsey and Jersey, Crown Dependencies with just seven cases each, faced losses of £652,000 and £202,000 respectively, showing how a few costly frauds can dramatically impact smaller populations. The City of London, despite only six cases, saw losses exceeding £110,000, underscoring targeted scams on wealthy individuals and businesses. Meanwhile, rural areas like Durham, Wiltshire, and Suffolk recorded losses nearing or surpassing £1 million, proving fraud isn’t just a big-city problem. At the same time, Leicestershire and Dyfed-Powys police forces faced hundreds of cases but with far smaller financial impacts, highlighting the considerable variation in both the volume of cases and their financial consequences.

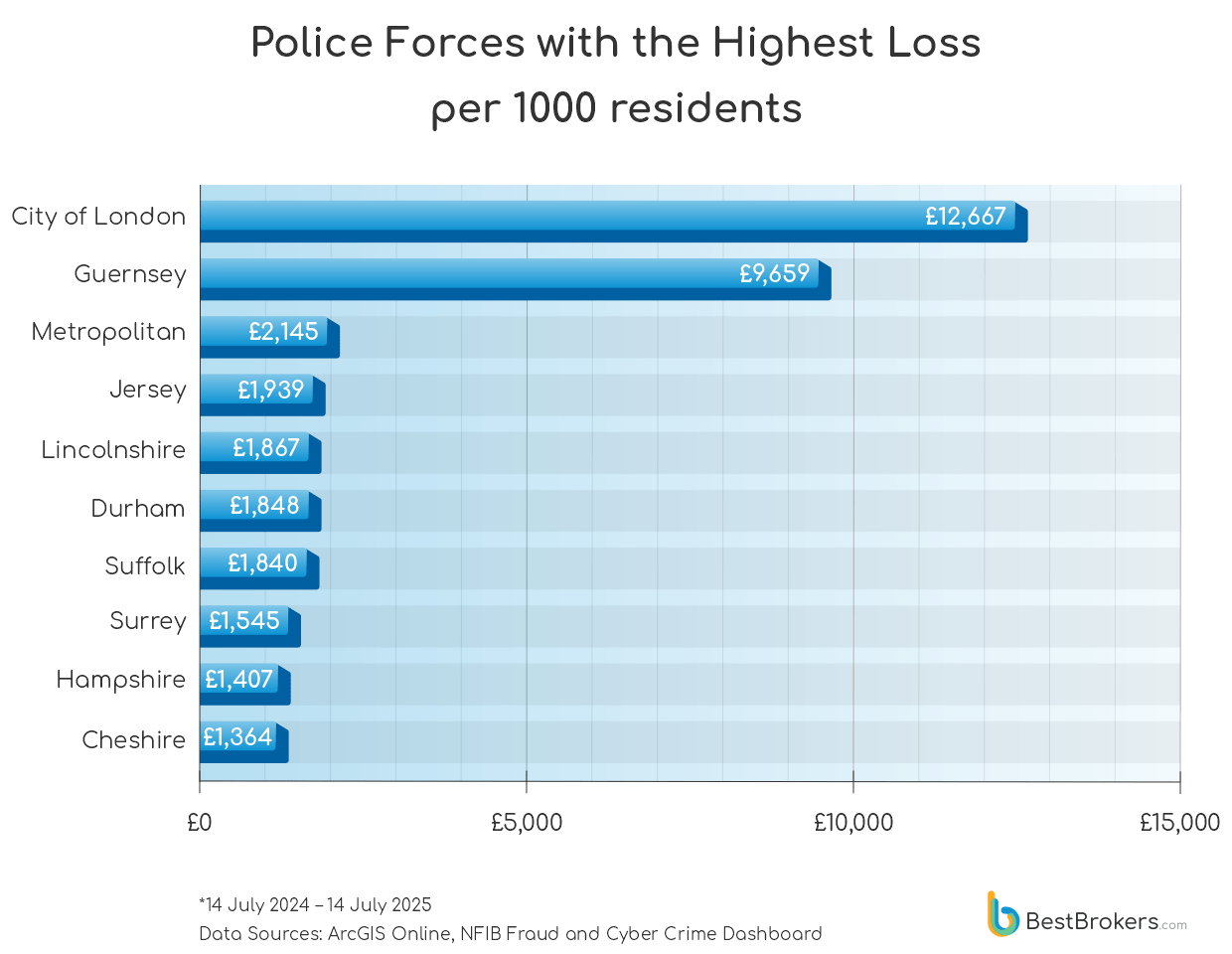

Some of the UK’s smallest territories suffer the biggest blows. In the City of London, a square mile packed with banks but home to few, just six fraud cases translate into a staggering £12,667 lost per 1,000 residents. Guernsey isn’t far behind: seven reports, £652,000 lost, and a per capita toll nearing £10,000. These are not places with rampant fraud; they are places where fraud, when it strikes, strikes hard.

Zoom out to the rest of the country, and the patterns shift. Over the past year, Greater London under the Metropolitan Police has had more than 3,200 cases and over £19 million in losses, the highest total, pushing its per capita figure to £2,145, nearly double the national average. Yet some of the quietest corners see disproportionate harm: Lincolnshire, Durham, and Suffolk all suffer losses above £1,800 per 1,000 residents, outpacing urban centres like Manchester or Birmingham. Wealth also seems to play a role – Surrey and Wiltshire, among the UK’s more affluent counties, see elevated losses per head. Meanwhile, Northern Ireland and Scotland report some of the lowest per capita impacts, hinting at different patterns of fraud or simply better luck.

Card & Online Bank Account Fraud Remain the Most Common Ways to Drain A Bank Account

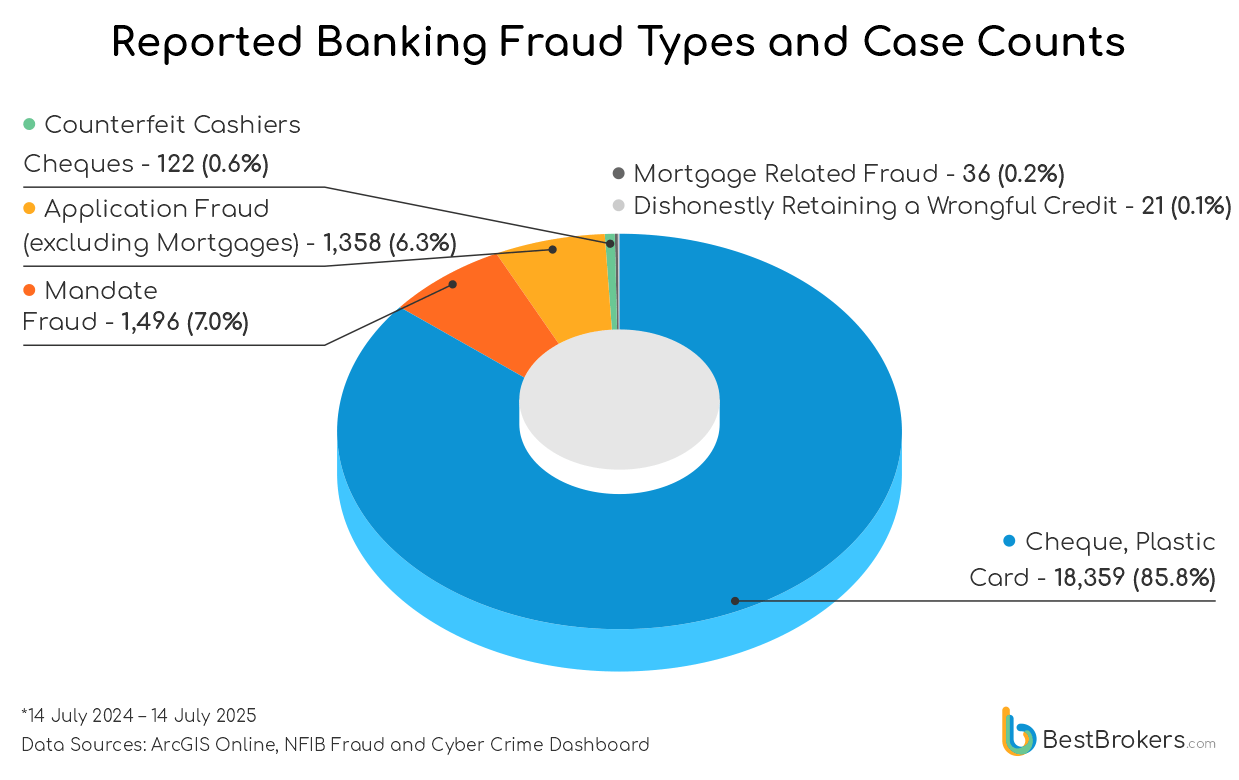

The vast majority of cases (over 18,000) relate to everyday threats such as cheque fraud, plastic card misuse, and online bank account breaches, giving a glimpse at how vulnerable routine financial transactions remain. Meanwhile, mandate fraud, where criminals manipulate payment instructions to divert funds, accounts for nearly 1,500 incidents, often involving more targeted and financially damaging schemes. Application fraud, excluding mortgages, also features prominently, with fraudsters exploiting stolen or false identities to gain access to loans and credit, leaving long-lasting impacts on victims’ financial health.

Less frequent, but still concerning, are cases of counterfeit cashier’s cheques, mortgage-related fraud, and the dishonest retention of wrongful credits, each representing sophisticated tactics that exploit different vulnerabilities in the financial system. Together, these figures paint a picture of a multifaceted fraud landscape, where criminals adapt their methods to exploit both everyday banking activities and more specialised financial processes.

Millennials & Gen Xers Most Common Victims of Banking Fraud

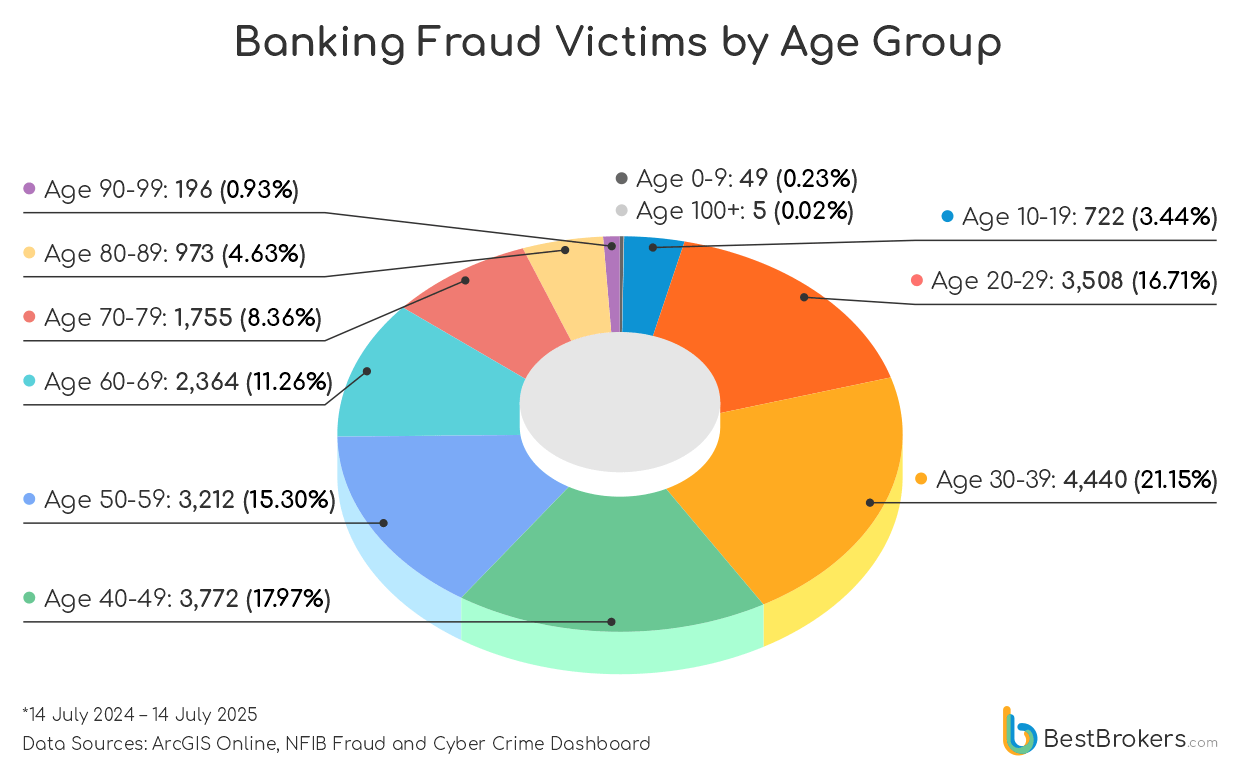

Banking fraud victims in the UK are mostly adults aged 30 to 69, with the highest concentration of cases reported by those between the ages of 30 and 39, when financial responsibility peaks. Younger people under 20 are rarely targeted due to limited financial access. Although fraud becomes less frequent for those after 60, senior citizens aged 70 and over still face significant risk, especially from cheque, card, and online banking fraud, showing their ongoing vulnerability, despite lower tech use.

Mandate and application fraud mainly hit middle-aged adults, exploiting those with complex finances and credit histories. Less common frauds like counterfeit cheques and mortgage fraud occur mostly in the 40-69 age range, aligning with involvement in high-value products. The data shows fraud affects not just younger, tech-savvy victims but also older adults less aware of scams, emphasising the need for tailored protections. Overall, financially active adults (especially middle-aged) carry the greatest fraud burden.

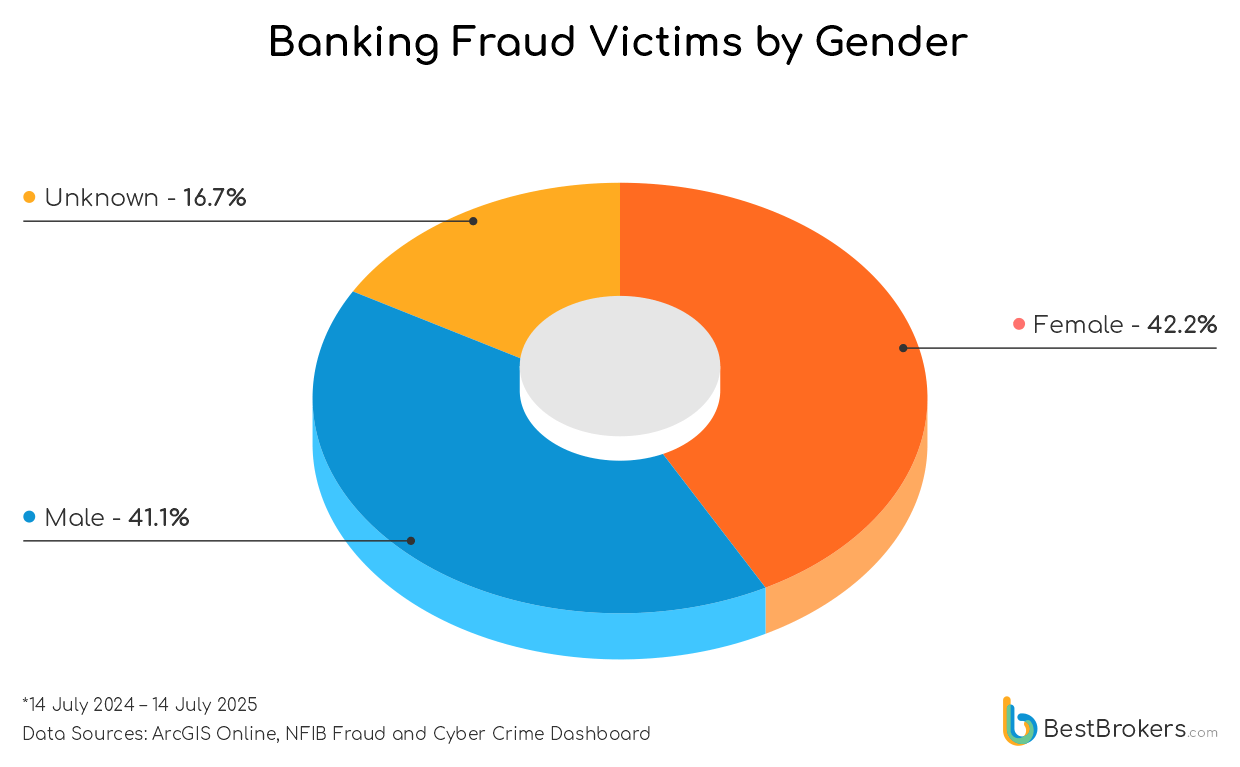

Women More Likely to Fall Victim to Banking Fraud Than Men in the UK

The gender distribution among banking fraud victims is relatively balanced overall, with only a little over a 1% difference between male and female victims. Men typically make up between 40% and 45% of reported cases, while women account for roughly 38% to 47%. An additional 17% fall under an unknown category, likely due to incomplete or missing data during the reporting process.However, several police forces show a clear gender imbalance. For instance, Guernsey stands out with men making up 57% compared to 43% women, while Jersey reports a stronger female presence at 57% against 43% male victims of banking fraud. Other areas like Derbyshire (47% male to 41% female) and Humberside (48% male to 42% female) also show a noticeable male majority, whereas Cheshire (47% female to 40% male) and Norfolk (53% female to 38% male) have a female majority.

Additionally, some police forces like South Yorkshire and West Midlands record large shares of cases with ‘unknown’ gender, over 30%, which complicates clear conclusions on gender distribution. When it comes to support requests, police forces such as the City of London and Lincolnshire report high rates of support sought, аbove 80%, while Dyfed-Powys and Dorset fall below 30%. These differences suggest that gender imbalances, combined with regional variations in support uptake, call for tailored, gender-sensitive approaches to victim support and crime reporting.

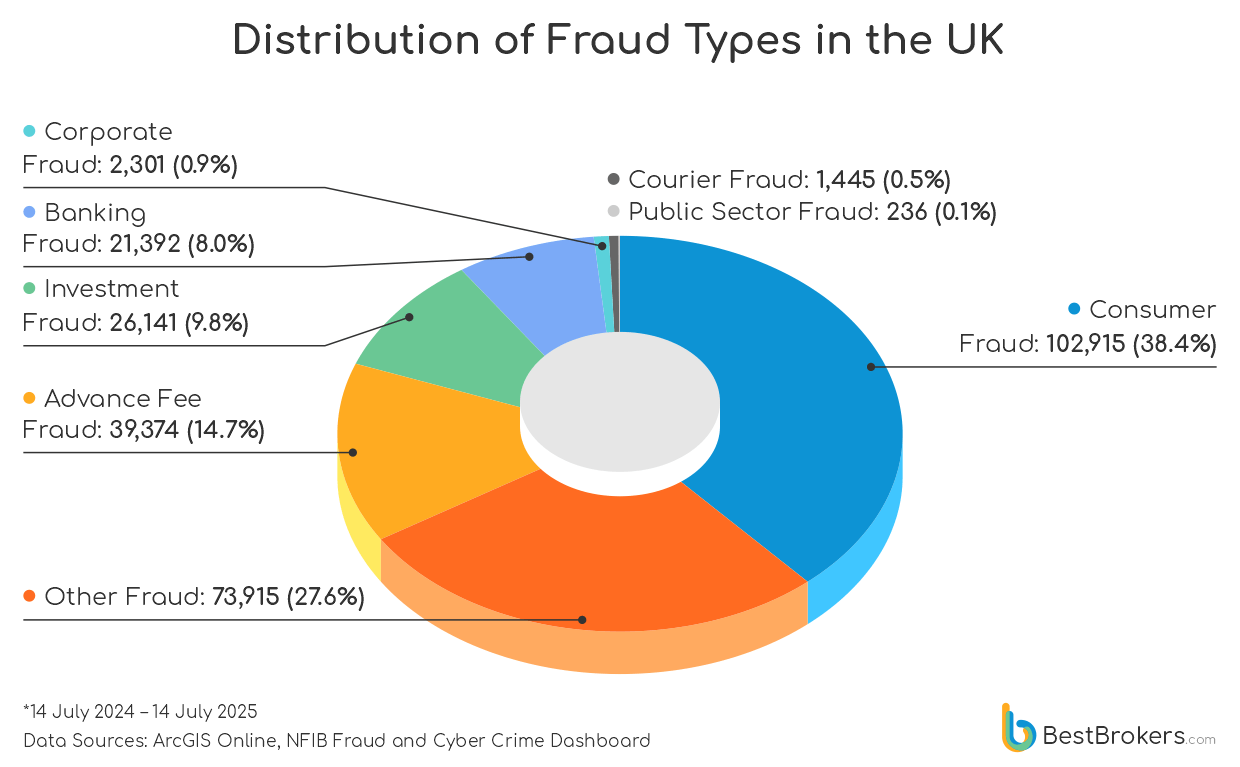

Banking Fraud Less Common Than Investment Fraud

Banking fraud, while not the most frequently reported type of fraud in the UK, commands a disproportionate share of financial losses, making it one of the costliest fraud categories in the UK. With 21,392 reported cases, banking fraud accounts for just under a fifth of the total fraud reports, far fewer than consumer fraud’s staggering 102,915 incidents or other frauds totaling 73,915 cases. However, the reported losses linked to banking fraud reach approximately £417 million, more than four times the losses from advance fee fraud (£90.6 million) and corporate fraud (£6.8 million), despite those scams having higher or comparable case numbers.

Investment fraud leads in financial impact, with losses surpassing £706 million, but its 26,141 reports are only slightly higher than banking fraud. Consumer fraud tops the frequency charts and generates the highest reported losses outside investment fraud, at over £505 million. This contrast reveals that while banking fraud may occur less often than some other types, its financial damage is severe, underlining its critical importance for law enforcement and financial institutions alike.

Methodology

For this report, we used data from the NFIB Fraud and Cyber Crime Dashboard via ArcGIS Online, covering fraud incidents reported in the UK between July 14, 2024, and July 14, 2025. We analysed banking fraud and its subtypes in detail, while for other fraud categories, such as advance fee fraud, consumer fraud, corporate fraud, and investment fraud, we collected total case numbers and reported losses. The data includes fraud targeting only individuals and not organisations (businesses or public institutions). Victim age and gender data were incorporated to identify demographic patterns, and population figures were used to calculate per capita fraud rates for fair regional comparisons. This approach provided a comprehensive view of fraud trends across the UK during the study period.