Wealth inequality has long been a pressing issue and one of the defining socio-economic challenges of our time. In recent years, the gap between rich and poor has widened significantly, with the richest 10% and 1% of people holding an increasingly larger share of national wealth across many countries around the world.

Recent analysis suggests that the world’s top 1% of earners now possess more wealth than the vast majority of the global population combined. To explore how the distribution of wealth held by the richest 10% and richest 1% has shifted in the 21st century, the team at BestBrokers gathered data from the open source World Inequality Database. Covering a span of 24 years and 217 countries, the dataset measures the portion of national wealth, encompassing both financial and non-financial assets, controlled by the wealthiest people in society.

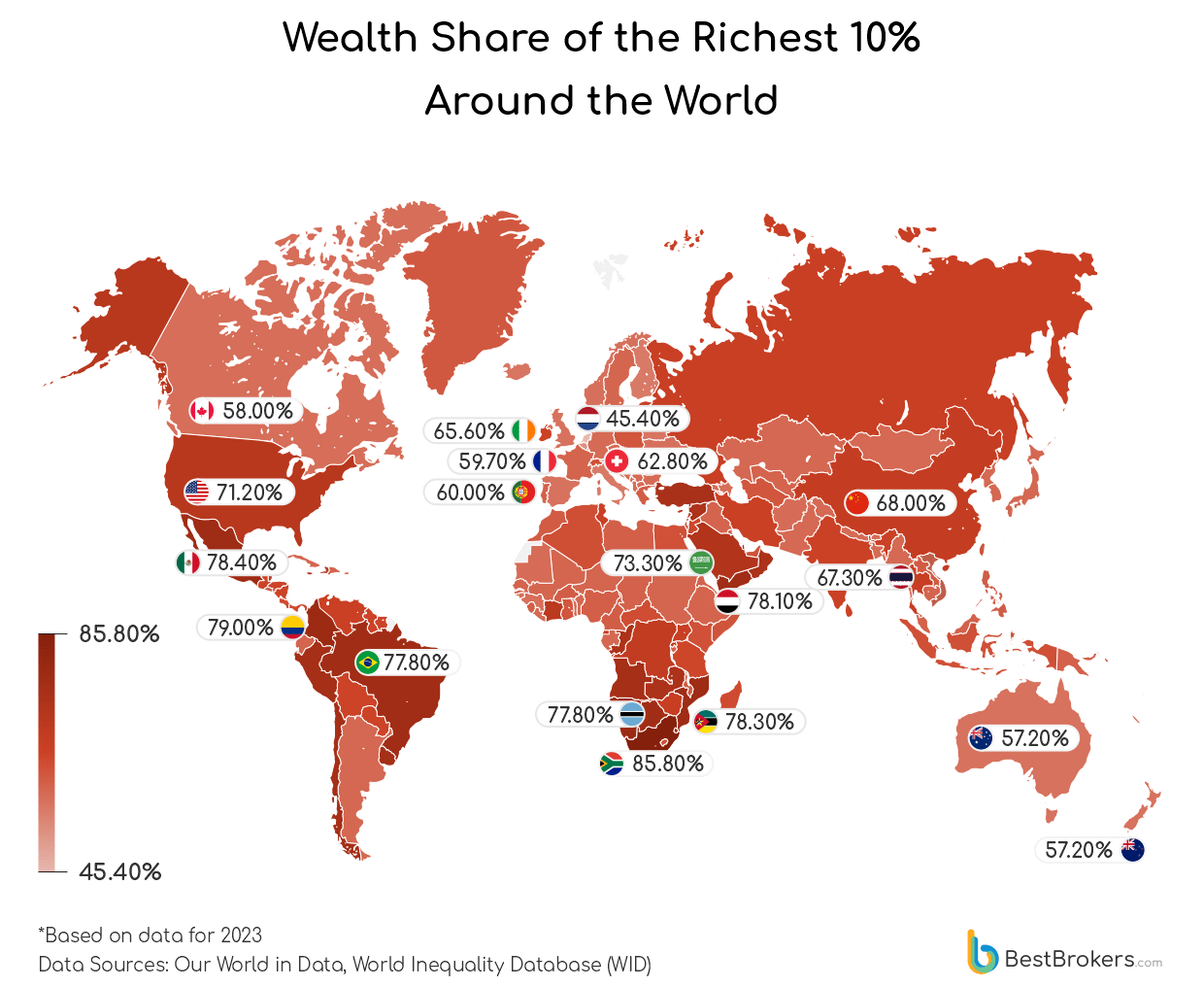

We found that China has experienced the most dramatic increase in wealth concentration among its richest 10%, whose share of the country’s total wealth jumped from 48.3% in 2000 to 68% in 2023, an increase of nearly 20 percentage points. Meanwhile, South Africa currently has the widest gap between rich and poor, with the richest 10% holding approximately 85.8% of the nation’s total wealth.

Key takeaways:

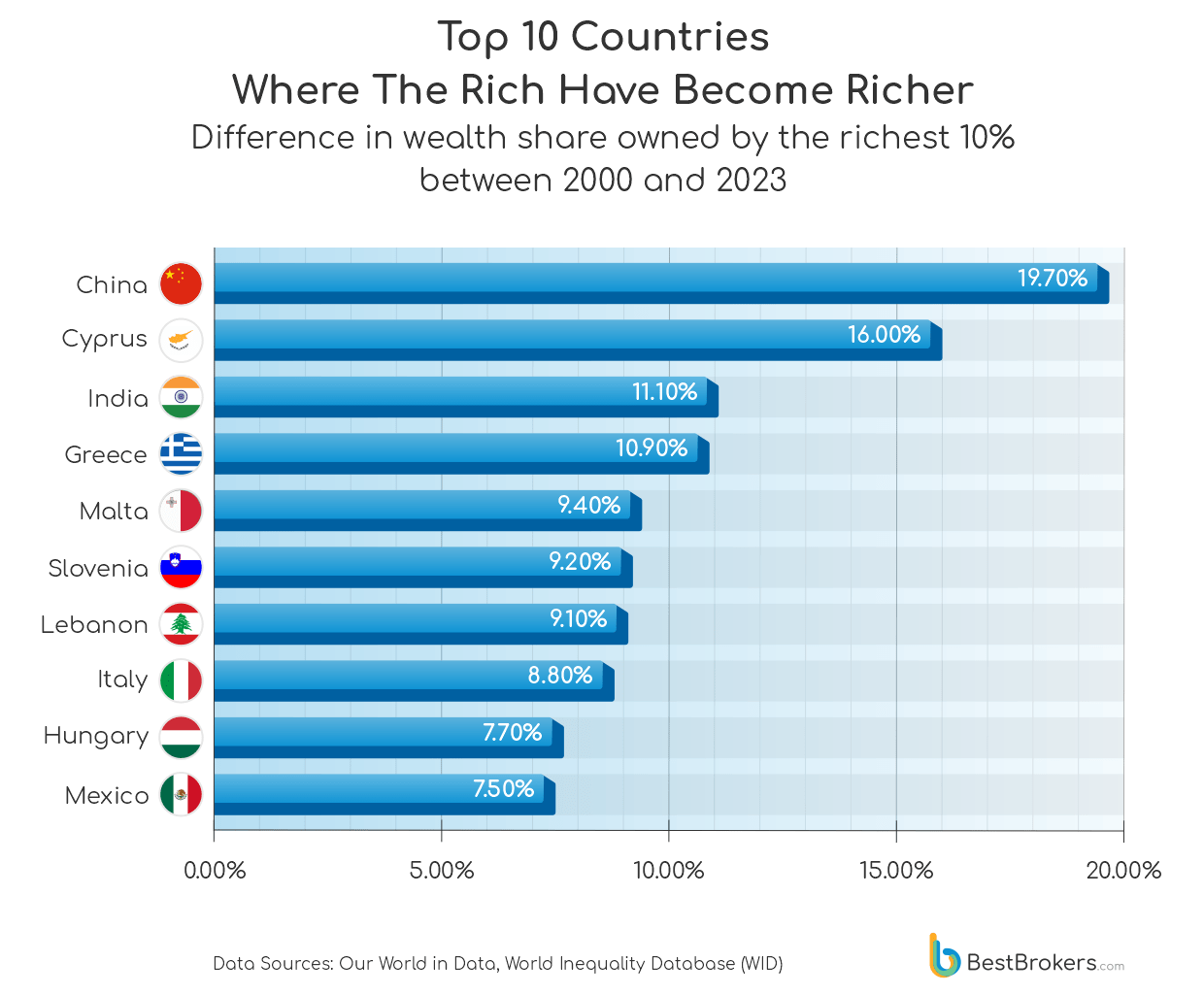

- China and India are the Asian countries where the richest 10% increased their share of national wealth the most. In China, the share of national wealth held by the richest 10% rose by 19.7 percentage points to 68%, while in India it grew by 11.1 percentage points to 65.90%.

- Among European countries, the richest 10% in Cyprus have increased their share of national wealth the most, with a rise of 16 percentage points between 2000 and 2023. Greece follows with an increase of 10.9 percentage points.

- South Africa’s richest 10% increased their share of national wealth by just 2.1 percentage points in 24 years but still hold the world’s highest share at 85.8%.

- Compared to other advanced economies like the Netherlands and Denmark, where the top 10% hold around half of the national wealth, inequality in the United States is significantly greater, with 71.20% of the nation’s wealth spread between the richest members of society.

The Most Unequal Countries in Terms of Wealth Distribution

South Africa, a country of 63.21 million, stands out as the country with the highest concentration of national wealth among the top 10% earners. In 2023, just 6.3 million people in the country controlled 86% of the nation’s wealth, with the other 56.9 million sharing the remaining 14.2%. Despite decades of democratic reforms and initiatives aimed at uplifting impoverished communities, entrenched corporate structures and systemic exclusion continue to shape the country’s economic landscape.

Neighbouring nations Eswatini and Namibia also rank among the world’s most unequal economies, as both countries still grapple with the consequences of colonial land dispossession and labour exploitation. Agriculture remains a key livelihood for rural communities; the sector’s limited modernisation has done little to narrow the wealth gap. In Namibia, around 70% of commercial farmland remains in the hands of a small elite, despite long-standing land reform debates. In Eswatini, most land is held in trust by the King, leaving citizens few formal property rights. Still, inequality in both countries has not worsened: the share of national wealth held by the richest 10% increased by just 1 percentage point in Eswatini (79.30% to 80.30%) and fell slightly in Namibia, from 80.6% to 79.8%.

In Latin America, Mexico continues to struggle with stark inequality, despite modest improvements in labour poverty which dropped to 33.9% at the beginning of 2025, a 1.9% decrease from the previous year. According to INEGI’s National Employment Survey, over 44 million people still earn less per month than the cost of a basic food basket sufficient for all family members. The richest 10% in Mexico held 70.9% of national wealth in 2000, while now it is 78.4%. While not officially designated as a tax haven, Mexico functions like one: there is no wealth or inheritance tax, capital gains tax is minimal, and the tax-to-GDP ratio is very low, all of which facilitate wealth accumulation with minimum redistribution.

The United States has also experienced a rise in wealth inequality. The share of national wealth held by the richest 10% increased from 67.9% in 2000 to 71.2% in 2023. Legislative changes, such as Trump’s ‘Big, Beautiful Bill’, introduced over $3 trillion in tax cuts, disproportionately benefiting the wealthiest Americans and large corporations. In a nation of 347 million, where 11.1% of the population lives below the poverty line, these policies have likely exacerbated the divide. The United States now ranks closer to Latin American nations in terms of wealth concentration, performing worse compared to other advanced economies such as the United Kingdom, where the richest 10% of the population owns 57.1% of the wealth, Canada (58.0%) and Australia (57.2%). America’s 71.2% share is comparable to Colombia (79%), Mexico (78.4%), and Brazil (77.8%).

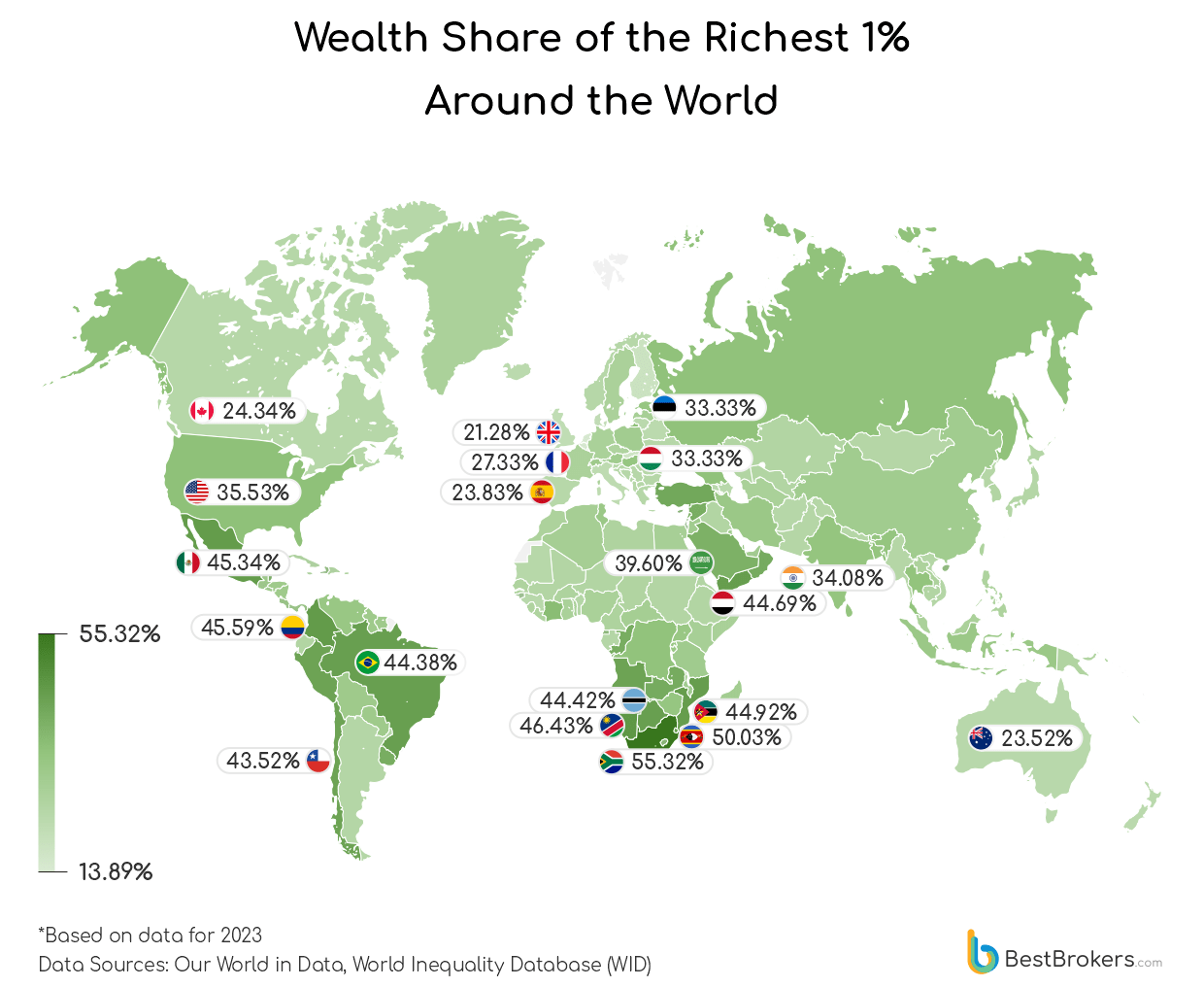

Nations with the Highest Wealth Concentration Among the Top 1%

South Africa and Eswatini are the only countries in the world where the wealthiest 1% hold more than half of the nation’s total wealth. In Cyprus, the share of wealth of the ultra-rich surged from 12.8% to 33.3% between 2000 and 2023, the sharpest rise not only in Europe but globally. Slovenia, which had the lowest inequality at the start of the century (the richest 1% owned 12.1%), also saw a significant rise in wealth concentration, with the ultra-rich owning 23.1% of the wealth by 2023. In Asia, China and India have experienced similarly steep climbs. Based on the latest data, the richest 1% control 30.4% of national wealth, up from 9.9% in 2000. In India, the figure has jumped from 10.5% to 34.1%.

Meanwhile, several African nations, including Malawi, Burkina Faso, Comoros and Cape Verde, once had far higher levels of wealth inequality, with the top 1% holding a much larger share of national resources. Recently, however, these countries have improved their equality, with the wealth share of the richest 1% now ranging between 23% and 28%.

Countries Where the Wealth Gap Has Increased the Most

China and India have seen the largest increases in the share of national wealth held by the richest 10% since 2000, rising by 19.7 and 11.1 percentage points, respectively. Following rapid market-driven growth, wealth in China has become heavily concentrated among tech and property magnates. The real estate boom in the early 2000s was a key driver of wealth accumulation, particularly in cities such as Beijing and Shanghai. India, the world’s second-largest developing economy, has experienced a similar trend, with significant growth in tech, finance, and real estate since liberalisation in the economy was initiated in 1991 and had a huge impact in the 2000s. Meanwhile, around 90% of India’s workforce remains in informal, low-paid jobs, according to the ILO’s India Employment Report.

Cyprus saw one of the sharpest rises in wealth concentration in Europe, with the share of national wealth held by the top 10% of earners growing by 16 percentage points, from 50.7% in 2000 to 66.7% in 2023. Between 2007 and 2020, the country’s ‘Golden Passport’ scheme attracted wealthy foreign investors and drove up property prices. Unlike other tourism-driven island nations where inequality fell, such as Barbados (down 6.7 points) and the Maldives (down 18.5), Cyprus saw wealth increasingly concentrated in finance, property, and offshore sectors. The country’s 2012–13 banking crisis and subsequent €10 billion bailout also contributed to wage stagnation and underemployment. Neighbouring Greece recorded a similar trend, with the richest 10% of the population increasing their share of the combined national wealth by 10.9 points. Despite a deeper economic crisis, wealth in Greece became more unevenly distributed, favouring the richest.

Countries Making the Most Progress in Reducing the Wealth Gap

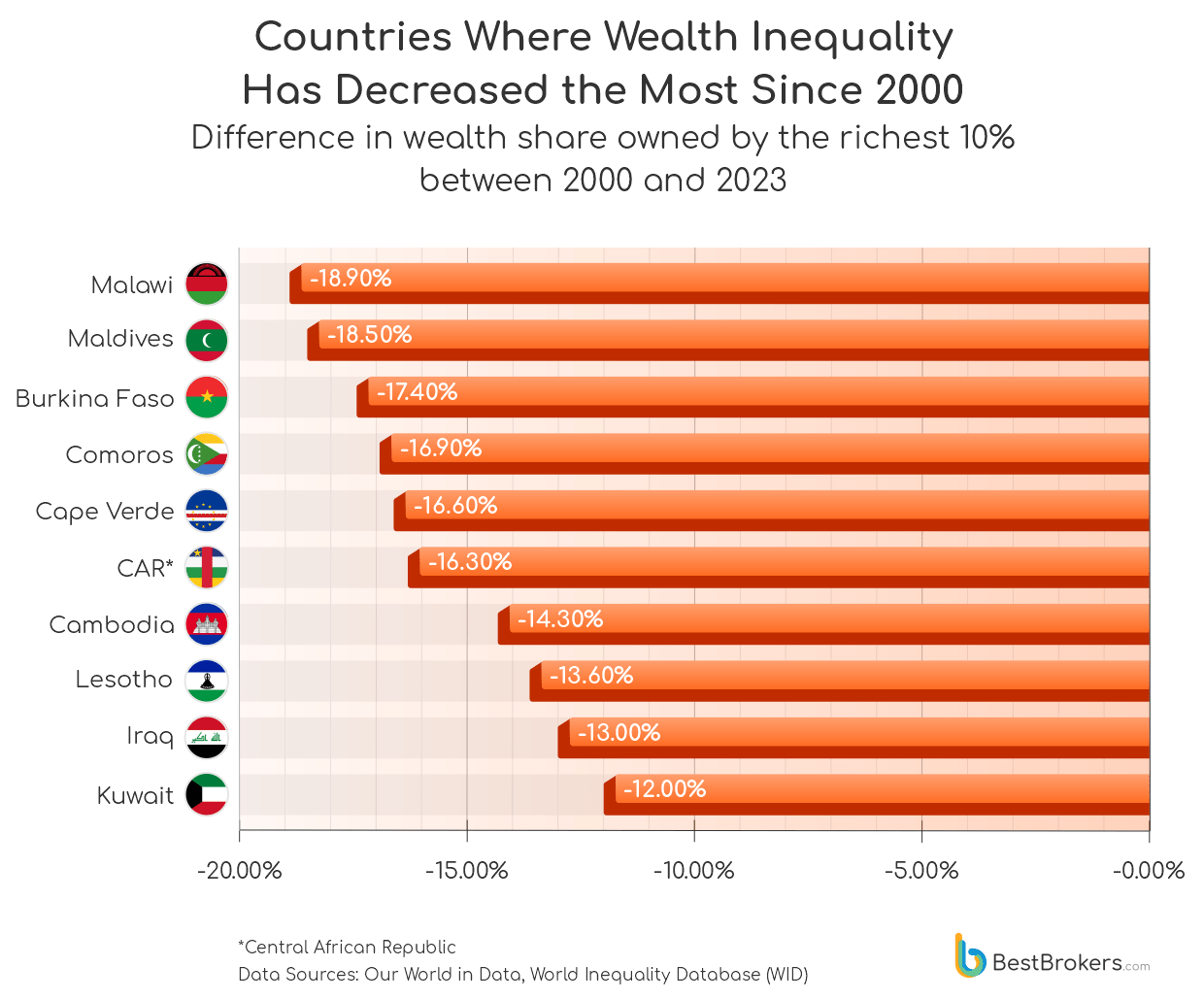

Most of the countries with significant reductions in wealth inequality are African nations. Malawi (-18.9 percentage points), Burkina Faso (-17.4), Comoros (-16.9), Central African Republic (-16.3), and Lesotho (-13.6) have seen the largest decreases in the share of national wealth held by the richest 10%. This is particularly striking given that all of these countries have faced recurring instability and persistent economic hardship. Agriculture remains the main source of livelihood, and despite only moderate productivity gains, stable remittance flows, NGO-led development projects, and mobile money have helped improve household-level economic security across these regions.

The Maldives and Kuwait, two of the more affluent countries in the top 10, have made notable strides in reducing the percentage of wealth owned by the richest 10%, by 18.5 and 12 percentage points, respectively. In the Maldives, policy shifts such as the UNDP-Government’s ‘Reimagining Tourism’ initiative have focused on supporting small and medium enterprises and promoting community-based tourism, loosening the long-standing grip of elite resort owners. Kuwait, despite its oil-fueled economy, stands apart from neighbours like Saudi Arabia, where the richest 10% still hold 73.3% of the wealth, by channelling substantial resources into public housing, free education, and universal healthcare. These investments have helped build a broad economic safety net and narrowed the gap between the richest and the rest.

Methodology

To compile this report, the team at BestBrokers collected the latest figures from the World Inequality Database and Our World in Data. We analysed the share of national wealth held by the richest 1% and 10% across 217 countries from 2000 to 2023, calculating how much these percentages have shifted over that period.