Memecoins are a curious phenomenon in the cryptocurrency world – digital tokens born out of internet culture and viral hype. At first glance, investing in something with no inherent value seems illogical. Yet, these tokens have repeatedly attracted millions of dollars, driven entirely by collective excitement and the willingness of communities to pool resources.

Cryptocurrency launchpad Pump.fun, built on Solana, supercharged the memecoin boom by letting anyone create and trade tokens instantly. This near-frictionless system triggered a surge of hyper-fast launches, with some coins briefly hitting multi-million-dollar valuations. Quickly, the platform became the busiest hub for ‘pumping’ memecoins, becoming a symbol of the 2025 memecoin boom, particularly on crypto Twitter, Telegram, and Discord.

To dive deeply into memecoin pump-and-dump behaviours, the team at BestBrokers set out to track these wallets and tokens, noting liquidity spikes, hype cycles, and patterns that mirrored the wider market. We also analysed additional market data from cryptocurrency analytics platform CoinMarketCap to assess broader trends and valuation dynamics. Fresh data suggests memecoins on Pump.fun may now be following the path of NFTs: the speculative frenzy is cooling as liquidity thins and traders grow more cautious.

Key findings from the report:

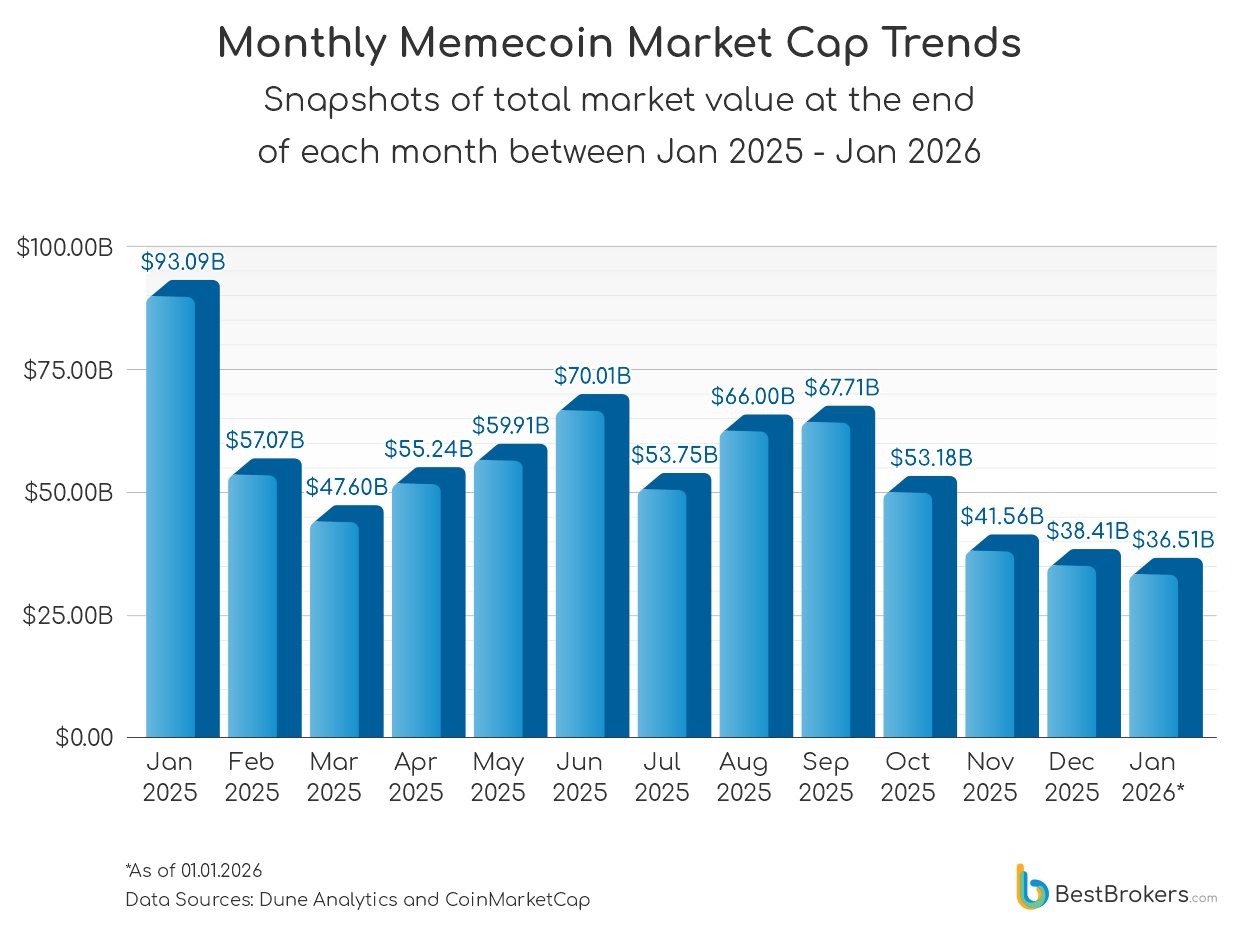

- Global memecoin market capitalisation fell 61% in the past year, from $93.09 billion in January 2025 to just $36.51 billion by January 2026, according to CoinMarketCap data.

- New token launches on Pump.fun fell sharply from a peak of 70,000 per day in January 2025 to a yearly low of under 10,000 per day in July and August. By the end of 2025 and the start of 2026, daily token launches had stabilised around 20,000 per day.

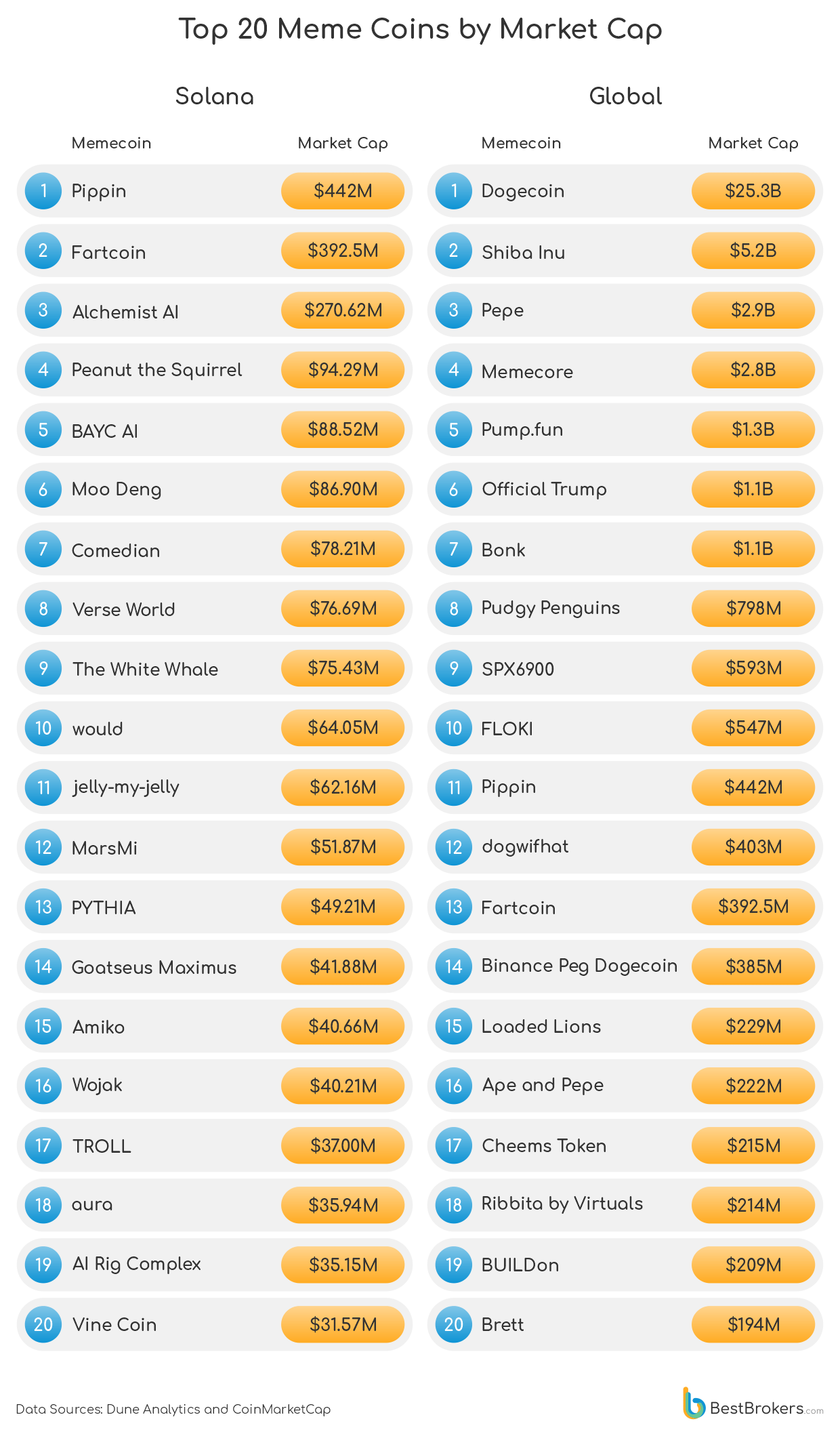

- Solana memecoins are still rising fast despite a cooling market, with standout tokens like Pippin ($442M), Fartcoin ($392.5M), and Alchemist AI ($270.62M) having reached impressive valuations in 2025.

How Solana’s Memecoins Stack Up Against Global Counterparts

Despite boasting several breakout tokens that have gone on to trade widely beyond their launch platform, Pump.fun’s ecosystem still sits some distance behind the long-established, decentralised exchanges. Standout Solana projects, such as Pippin with a market cap of roughly $442 million, and Fartcoin, just under $392.5 million, have achieved remarkable valuations, considering that the vast majority of tokens on the platform are less than two years old as of January 2025.

While several Solana-based memecoins now rank among the 20 largest memecoins on the market right now, their capitalisations remain a fraction of giants like Dogecoin ($25.3B), Shiba Inu ($5.2B), Pepe ($2.9B) and MemeCore ($2.8B). These larger assets typically benefit from deeper liquidity, longer trading histories, and stronger infrastructure, with many being Ethereum-based or using their own chain, such as Dogecoin, built on Litecoin, itself a fork of Bitcoin.

What this contrast really highlights is that Solana tokens are particularly effective at generating early momentum, even if that initial hype hasn’t yet translated into sustained market presence. On Pump.fun, tokens can surge to multi-million-dollar valuations within days, as seen with Peanut The Squirrel, Moo Deng, and BAYC AI, but these assets are still too new to have built the liquidity or long-term holder bases of more established memecoins.

Loss of Momentum

Daily Pump.fun Platform Users Over the Past Year

Tracking new and recurring users on pump.fun from January 2025 to January 2026

Pump.fun’s user activity over the past 12 months shows a pronounced rise-and-cool cycle that mirrors the wider memecoin hype pattern. Daily new-user numbers peaked in late January 2025, when the platform recorded 183,189 sign-ups in a single day. Much of this surge was fuelled by Solana’s strong resurgence in late 2024 and early 2025, which brought a wave of retail traders back into fast, low-cost on-chain speculation. During this period, Pump.fun became one of the most popular places to launch and trade new tokens. A run of viral memecoin successes, alongside heavy promotion from creators and influencers, added to the momentum, drawing in large numbers of newcomers hoping to capture the kinds of rapid gains seen by early traders.

What goes up must come down, and the platform’s early-2025 growth appears to have hit a wall. The flood of daily registrations gradually slowed as Pump.fun became saturated with thousands of nearly identical, short-lived tokens. By August, daily new-wallet sign-ups had dropped to around 45,000 per day, and by early December 2025, they had fallen further to roughly 30,000 a day. On 1 January 2026, only 33,275 new users joined the platform, an 82% drop from the previous year’s peak. Traders who once churned out dozens of tokens daily are now pacing themselves, waiting for the next big opportunity or moving on entirely.

Recurring users – those actively trading or creating tokens on Pump.fun – followed a similar trajectory. Daily active recurring users peaked at over 250,000 in January 2025, before dropping to a year-low of 20,000-30,000 in July and August. They stabilised somewhat between October and December, fluctuating between 45,000 and 75,000, with 66,000 recurring users recorded on 1 January 2026. This decline suggests that, while memecoins continued to attract occasional attention, most newcomers did not stick around, leaving the platform increasingly reliant on a smaller, core group of repeat participants.

Fewer Users Means Fewer Tokens Being Generated

Daily Token Generation on Pump.fun Over The Past Year

Tracking daily memecoin launches on Pump.fun from January 2025 to January 2026

During the last year, Pump.fun experienced one of the most dramatic boom-and-bust cycles in recent crypto history. Token launches exploded in early 2025, with daily creations peaking around 72,000 new tokens per day in late January. This frenzy coincided with the rise of several now-prominent Solana memecoins, including Fartcoin, Pippin, and Alchemist AI. By March, daily token creation had dropped sharply, fluctuating between 20,000 and 30,000 per day. Only a small number of early-year standouts continued to grow, showing that a few outliers managed to gain traction, despite the oversaturated environment.

This trend continued into the second half of 2025, dropping to a year-low of 15,000-18,000 in September and October. Despite the general decline, December saw a modest rebound: daily token counts frequently exceeded 20,000, compared with 13,000-21,000 in late September and October, suggesting that some traders remained eager to experiment with new tokens.

Part of this dynamic, however, seems to be shaped by automated activity rather than purely human behaviour. Recent research from ForkLog and The Cryptonomist indicates that most high-volume wallets are automated, with bots inflating liquidity, executing ultra-fast ‘snipes’ at launch, and cycling trades to manufacture the illusion of demand. In some cases, bots dominate 60-80% of trading for a single token, effectively shaping price action before real users can participate. Another study by Bitget points out the unusually short median hold times for Solana memecoins, consistent with bot-driven trading patterns.

This heavy bot presence means that much of Pump.fun’s market activity isn’t organic. Price spikes can be misleading, token distribution becomes skewed, and retail traders face higher risks of being frontrun or dumped on by automated wallets. While token generation remains high, a notable portion of activity is engineered rather than reflective of genuine user demand.

Market Caps Collapse as Liquidity Dries Up

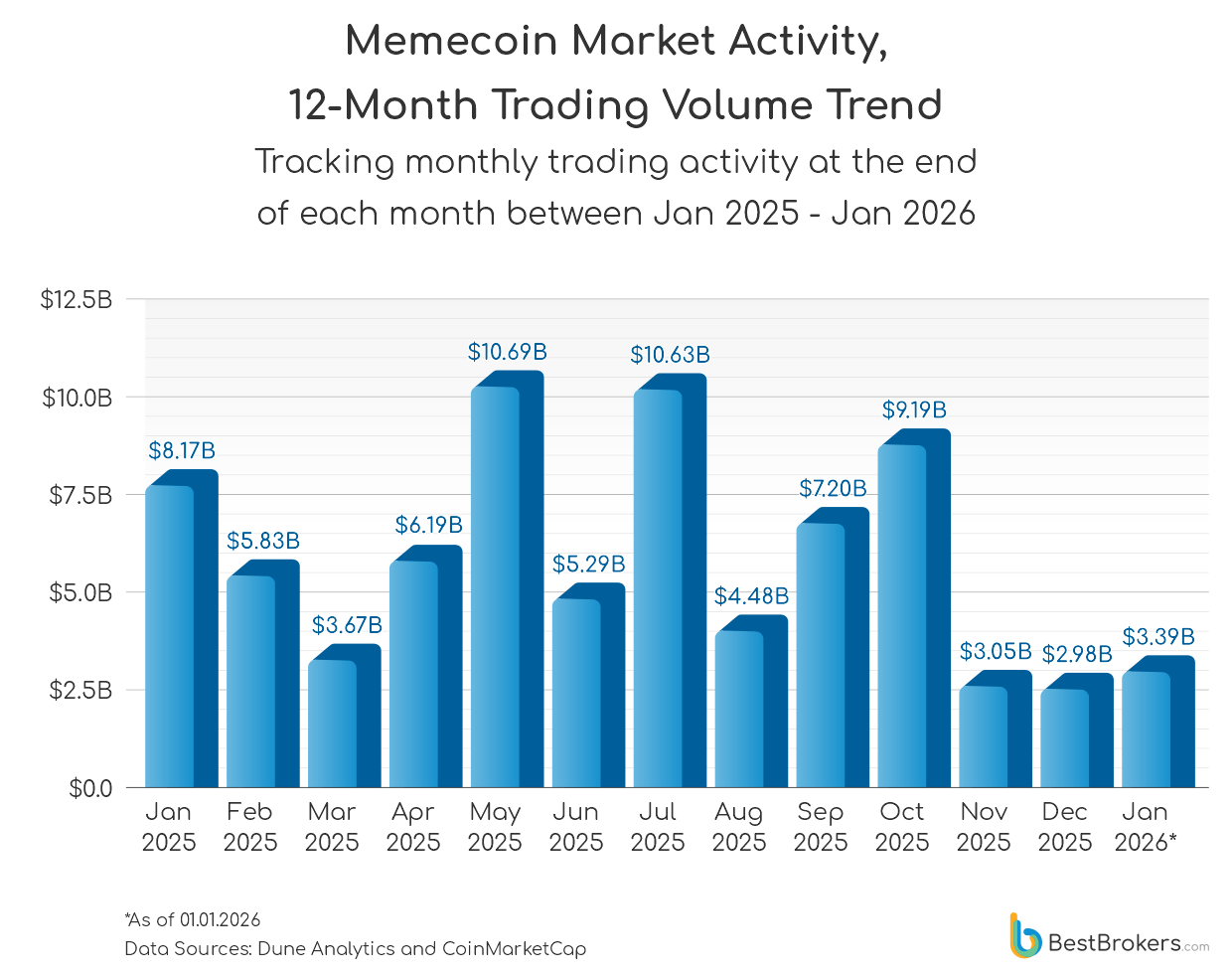

If user activity and token creation illustrate the inner workings of the Pump.fun ecosystem, broader market metrics reveal just how much speculative demand has evaporated across the memecoin sector. Total monthly trading volume declined from around $8.17 billion in January 2025 to a low of $2.98 billion in December, with a modest uptick to $3.39 billion by 1 January 2026.

Market capitalisation paints an even starker picture: memecoins collectively shed roughly two‑thirds of their aggregate value, falling from a high of $93.09 billion to around $36.51 billion over the same period. This sustained contraction reflects more than random price fluctuations: waning speculative fervour, oversupply from millions of new tokens, and a rotation of liquidity toward assets perceived to have more durable fundamentals or utility have all played a major part in the downward trajectory of memecoin market capitalisation over the past year.

Despite intermittent rebounds, such as the volume spikes seen in May and July, these proved insufficient to reverse the broader downtrend, illustrating that memecoin valuations remain highly sensitive to shifts in investor sentiment and liquidity conditions rather than sustained structural demand.

Beyond the Hype: The State of the Memecoin Market As We Enter 2026

Pump.fun’s declining token quality, shrinking user growth, and the early-stage nature of its top coins exemplify the broader post-hype contraction of the memecoin market: the speculative fervour that once propelled countless meme-inspired tokens is gradually fading. In this context, Pump.fun acts as both a barometer and a microcosm of the wider memecoin cycle, a market highly sensitive to hype and sentiment, where early winners are increasingly outnumbered by failed experiments. Much like NFTs before them, memecoins now appear to be entering a phase defined by consolidation and a shift towards assets capable of sustaining long-term interest.

Methodology

This report analyses the performance and market dynamics of memecoins over the past 12 months, focusing on user growth, daily token generation, trading volume, and market capitalisation. Daily and monthly data were used to track trends in new-user adoption, token issuance, and liquidity across top memecoins, providing insight into speculative activity and market health. Figures were sourced from Dune Analytics, CoinMarketCap, and CoinGecko, using data between January 2025 and January 2026. The analysis highlights correlations between user activity, token generation, and market metrics to identify the post-hype contraction phase of the memecoin market.