Every year, state governments across America quietly give away billions of dollars, not in cash, but in foregone tax revenue. Through a complex web of corporate subsidies, industry-specific exemptions, and targeted development incentives, states compete to attract investment and jobs. These tax breaks are pitched as engines of growth, but the true cost is often buried in opaque budgets and rarely subjected to rigorous public scrutiny.

Recent federal legislation, such as the proposed 2025 Tax Reconciliation Bill, has prompted states to further boost incentives, contributing to significant state-level tax revenue losses. To highlight the statewide impact of tax legislation across the U.S., the team at BestBrokers analyzed tax break data from all 50 states, ranking them by total revenue lost to tax breaks between 2019 and 2023. Our primary data source was the Good Jobs First Tax Break Tracker, with the most recent figures available from the year 2023.

We found that in 2023, New York was the city with the biggest net tax break revenue losses, forfeiting $4.3 billion in revenue to tax incentives, while Rio Rancho, New Mexico, saw the sharpest year-over-year increase in losses, rising from $678,000 in 2022 to $5.3 million in 2023, a 680.25% jump in just one year. At the state level, Nebraska recorded the most dramatic surge, with tax revenue losses soaring by 2,603.4% over the same period.

Key takeaways:

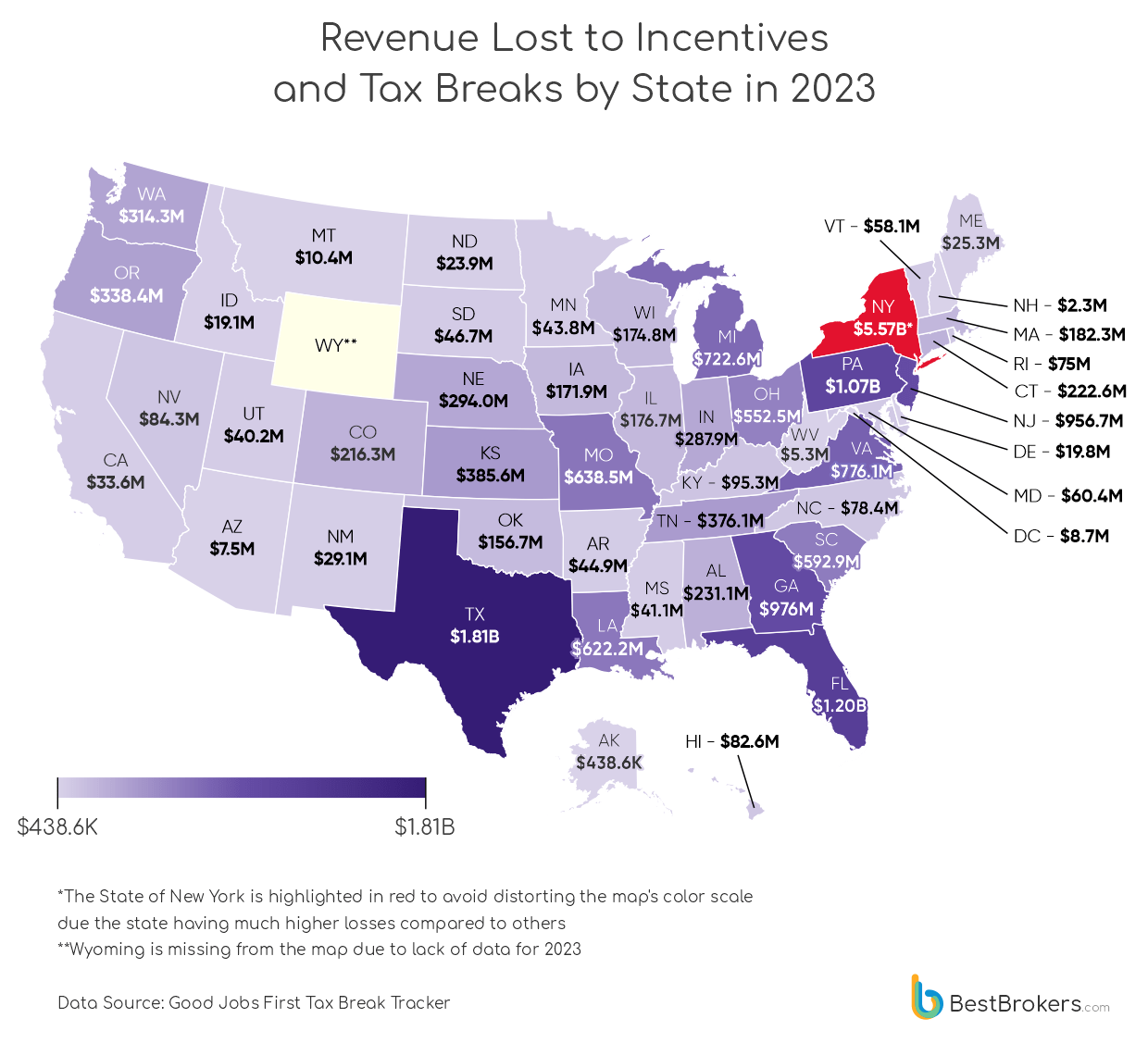

- New York State reported the highest tax break-related revenue losses in 2023, totaling $5.6 billion, accounting for 28% of the national total. New York City alone was responsible for the lion’s share, with $4.3 billion in lost tax revenue.

- Nebraska saw the sharpest jump in tax revenue losses between 2022 and 2023, increasing from $10.9 million to $294 million in just one year.

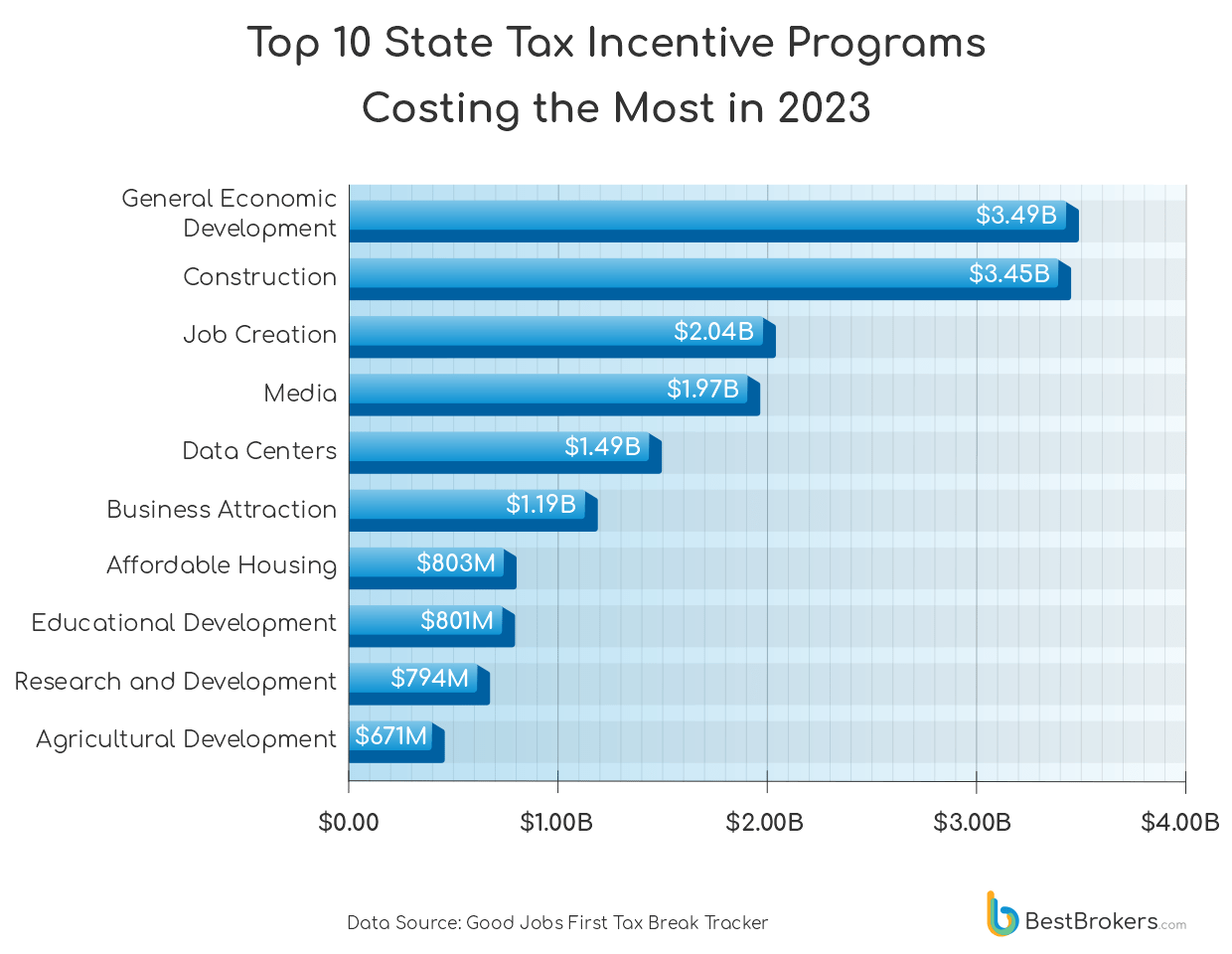

- In 2023, economic development programs accounted for the largest share of state tax revenue losses, costing the U.S $3.49 billion in forgone revenue.

Tax incentives and exemptions are powerful tools U.S. states use to attract businesses, support key industries, and stimulate local economies. However, these programs come at a steep cost, billions of dollars in lost tax revenue each year. In 2023 alone, states across the country forfeited nearly $20 billion due to various tax breaks, with losses concentrated unevenly among states and cities. This trend has been intensified by recent federal policy changes, particularly the passage of the “One Big Beautiful Bill Act” (OBBBА), which raised the cap on State and Local Tax (SALT) deductions from $10,000 to $40,000. This expansion is projected to reduce federal tax revenue by up to $5 trillion from 2025 to 2034, encouraging states to expand their tax break programs as federal limits become less restrictive.

In 2023, tax breaks in the state of New York totaled nearly $5.6 billion, accounting for 28% of all state-level tax incentive losses across the U.S., far outpacing other large state economies like Texas and Florida. New York’s massive revenue losses stem from programs such as property tax exemptions (notably the 421‑a developer incentive), generous film and TV production subsidies, and sizable corporate incentive packages aimed at attracting R&D and manufacturing investment.

As the economy of Texas now surpasses the state of New York in overall size (as of Q3 2024), the state ranks second in tax revenue losses with $1.81 billion, largely due to Chapter 313 of the Texas Tax Code. This program supports billions in property tax abatements for large-scale projects across the energy, manufacturing, and logistics sectors.

Interestingly, California, the largest state economy in the U.S., reported relatively low tax break losses in 2023, totaling just $33.6 million for the entire year. This is because California places firm limits on the scope and cost of its tax incentive programs. Home to major global tech hubs like Silicon Valley and San Francisco, the state has historically relied on its market size, talent pool, and infrastructure to attract investment, rather than offering appealing tax breaks.

In sharp contrast to the billions of dollars in lost revenue seen in states like New York and Texas, West Virginia, New Hampshire, and Alaska recorded insignificant losses from tax incentives in 2023, with a combined total of around $8 million, just below 0.09% of the national total.

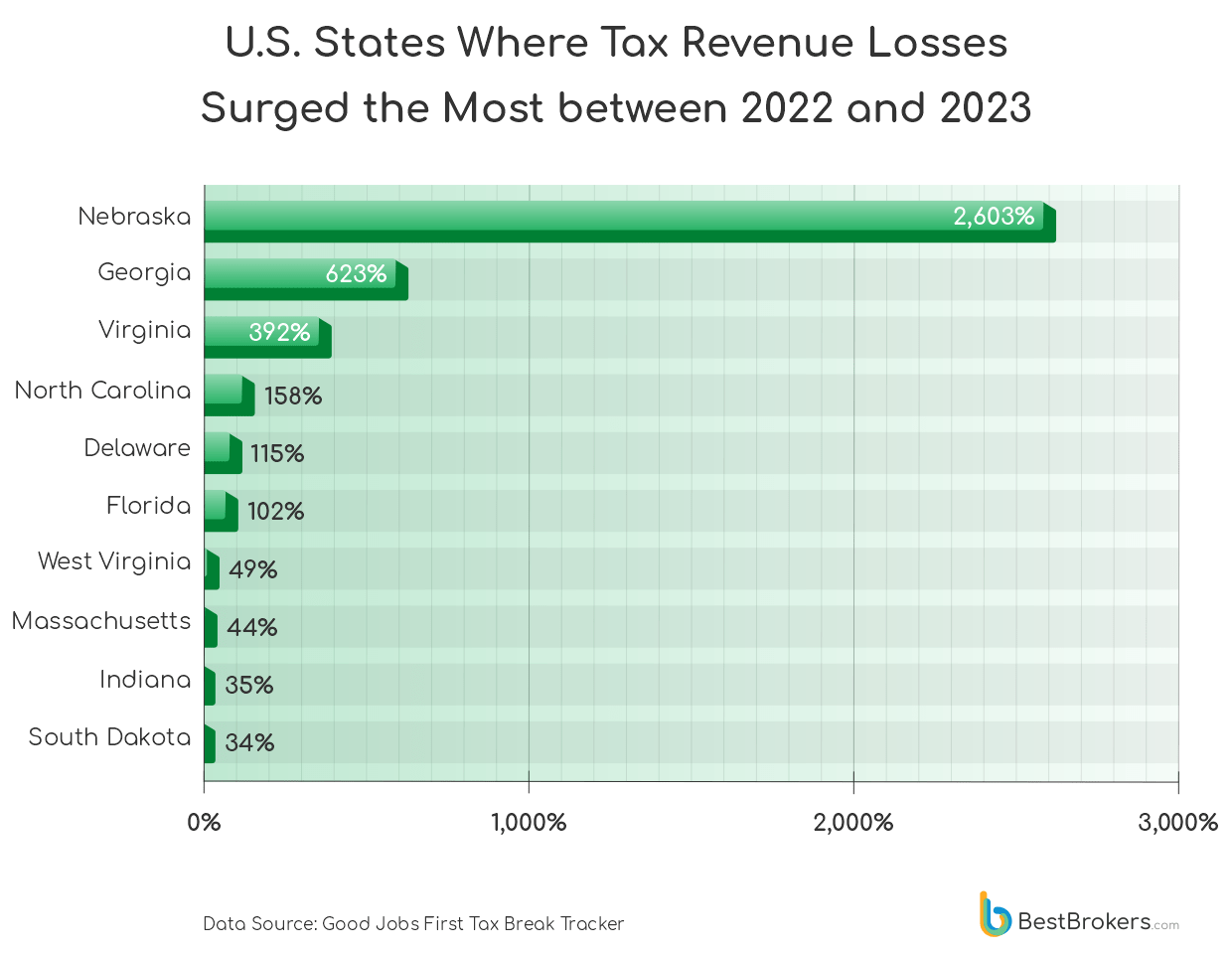

U.S. States with the Most Dramatic Tax Revenue Loss Spikes: Nebraska Surges 2,603%

Nebraska saw the largest year-over-year increase in tax revenue losses among all U.S. states. In 2022, the state failed to collect just $10.8 million due to tax incentives; by 2023, that amount had skyrocketed to $293.9 million, a staggering 2,603% increase in just one year. The main driver of these losses is the Nebraska Advantage Act and its successor, the ImagiNE Nebraska Act, which provide open-ended corporate tax credits tied to job creation and capital investment.

Earlier in 2025, Nebraska’s state auditor warned lawmakers to reconsider the structure of these tax incentives, noting that companies are expected to claim more than $1.5 billion in credits over the next four fiscal years. This growing burden threatens to further strain Nebraska’s struggling economy, which currently ranks 36th in terms of size with a GDP of $186 billion as of Q3 2024.

Georgia and Virginia also experienced major spikes in revenue lost to tax breaks, though not as extreme as Nebraska’s. In 2022, Georgia handed out about $134.9 million in tax breaks, but by 2023, that figure had surged to nearly $1 billion. The state offers one of the most generous film and media tax credit programs in the U.S., attracting major productions like The Walking Dead and Stranger Things; the credit is uncapped, allowing studios to claim unlimited amounts if they meet the criteria.

Virginia saw a similar trend, with tax revenue losses jumping from $157.7 million in 2022 to over $776 million in 2023, a 392% increase in just one year. Contributing to the sinking tax revenues is Virginia’s position as a national data center hub, particularly in Loudoun County, known as “Data Center Alley,” where sales and use tax exemptions on cloud infrastructure equipment significantly impact state revenue.

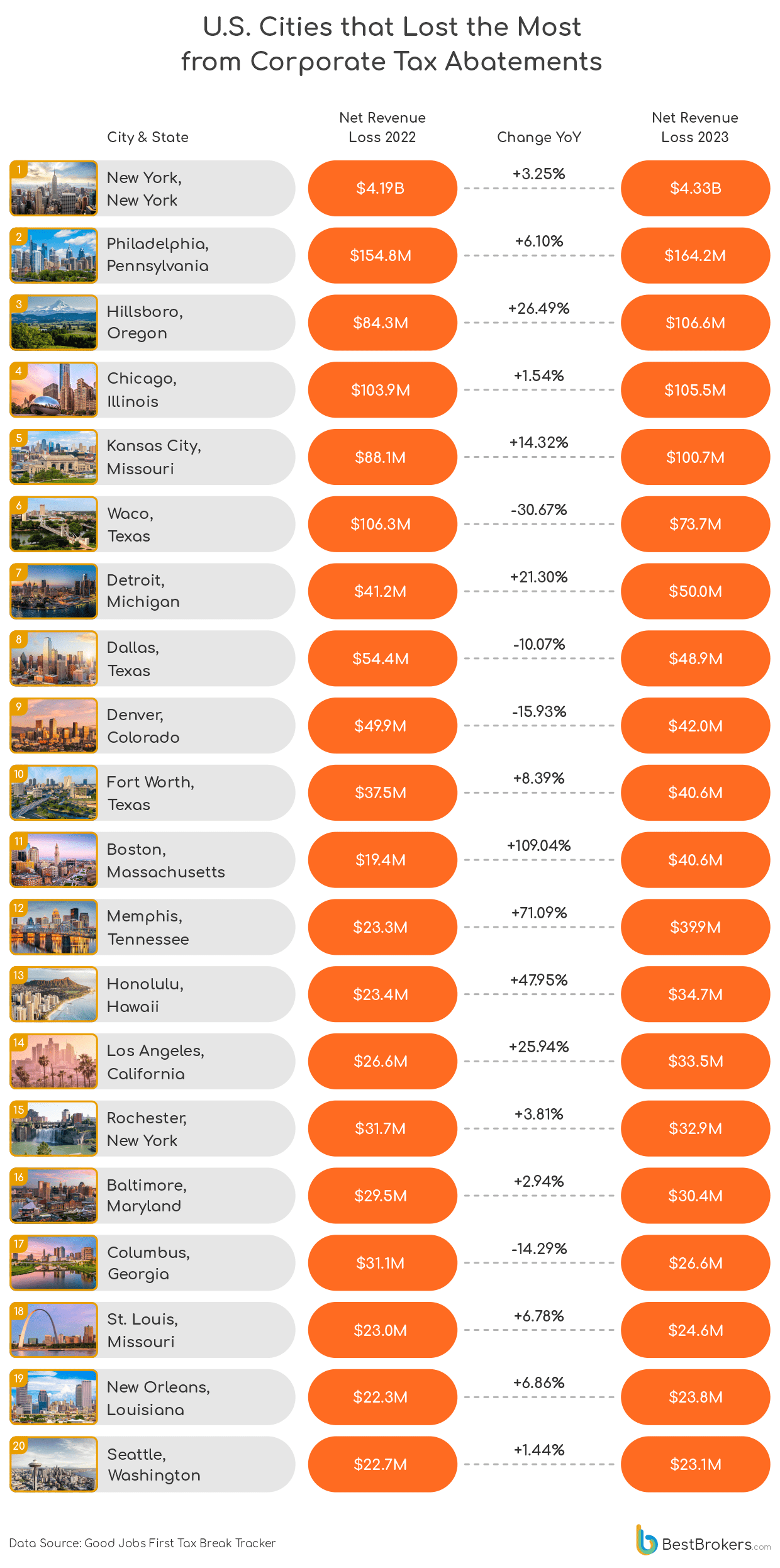

New York City Losing Billions of Tax Dollars Each Year

New York City saw only a modest 3.25% increase in tax break losses between 2022 and 2023, yet it remains the largest contributor to state revenue losses nationwide. The city’s lost revenue amounted to $4.19 billion in 2022 and $4.33 billion in 2023. Despite efforts to modernize its tax code and new revenue streams like congestion pricing (which brought in over $215 million in early 2025), the city of New York still depends on outdated abatements, most notably the 421-a program, which cost $1.77 billion in FY 2022 for roughly 64,000 exemptions.

Philadelphia has the second-highest losses in the country, with tax break losses growing from $154.8 million in 2022 to $164.2 million in 2023. Its 10-year property tax abatement program alone drains an estimated $61 million annually from public schools, while largely benefiting luxury real estate developers. Philadelphia plans to offset this by reducing business tax rates in 2026 to stabilize its tax base.

Several other major US cities also saw notable shifts in tax revenue losses due to state incentives in 2023. Hillsboro, Oregon, recorded one of the sharpest increases, with losses rising from $84.3 million in 2022 to $106.6 million in 2023. This jump is linked to the city’s growing role as a national hub for semiconductor manufacturing, with Hillsboro hosting several of Intel’s key research facilities.

Boston, on the other hand, reported relatively modest losses at $19.4M. However, the city is under increasing financial strain as commercial property values fall, some by more than 50%. With about a third of Boston’s revenue tied to real estate taxes, the decline is pushing more of the tax burden onto homeowners, who may face higher property tax bills in the near future.

US States Lost the Most Tax Revenue in 2023 to Economic Development and Construction Incentives

U.S. states gave up the most tax revenue in 2023 on Economic Development, Construction, and Job Creation programs, losing nearly $9 billion combined across these three categories. This reflects a strong focus on attracting broad business investments and upgrading infrastructure, often at the cost of immediate tax revenue. Construction incentives often overlap with economic development efforts, highlighting a priority on physical growth and revitalization.

High-tech and creative sectors are also key targets, with states spending $1.97 billion on Media incentives and $1.49 billion on Data Center tax breaks, reflecting strategic investments in fast-growing industries despite substantial losses in tax revenue. Housing-related incentives accounted for a significant amount of lost revenue in 2023, with approximately $803 million in tax incentive revenue losses for affordable housing programs alone, underscoring mounting pressures to address housing affordability and urban development challenges.

Methodology

To showcase state and national revenue loss across the U.S due to tax breaks, the team at BestBrokers analyzed tax incentive data from the Good Jobs First Tax Break Tracker, with the most recent figures available from the year 2023. We then ranked the U.S jurisdictions by tax revenue lost.