As of November 2025, eleven companies have crossed the $1 trillion market cap mark. Aside from oil giant Saudi Aramco, Taiwan’s TSMC, and electric vehicle pioneer Tesla, all are U.S.-based tech firms, reflecting how digital innovation continues to dominate the world’s most valuable companies.

In a historic leap on October 29, 2025, American chipmaker Nvidia became the first company to surpass a $5 trillion market capitalisation, fueled by booming demand for AI infrastructure and a massive partnership with OpenAI (in which Nvidia may invest up to $100 billion) to expand high-power AI data-centres. Nvidia now clearly dominates the AI-accelerator market and stands to benefit significantly from new AI data-centre spending. Microsoft and Apple have also crossed the $4 trillion threshold, Apple briefly doing so for the first time on October 28, driven respectively by surging cloud and AI-service demand in Microsoft’s Azure division, and by Apple’s record iPhone 17 sales, alongside growing investor enthusiasm for its on-device ‘Apple Intelligence’ ecosystem. This reflects a broader trend: tech giants at the forefront of AI are not just redefining corporate value, they are reshaping the global economic hierarchy.

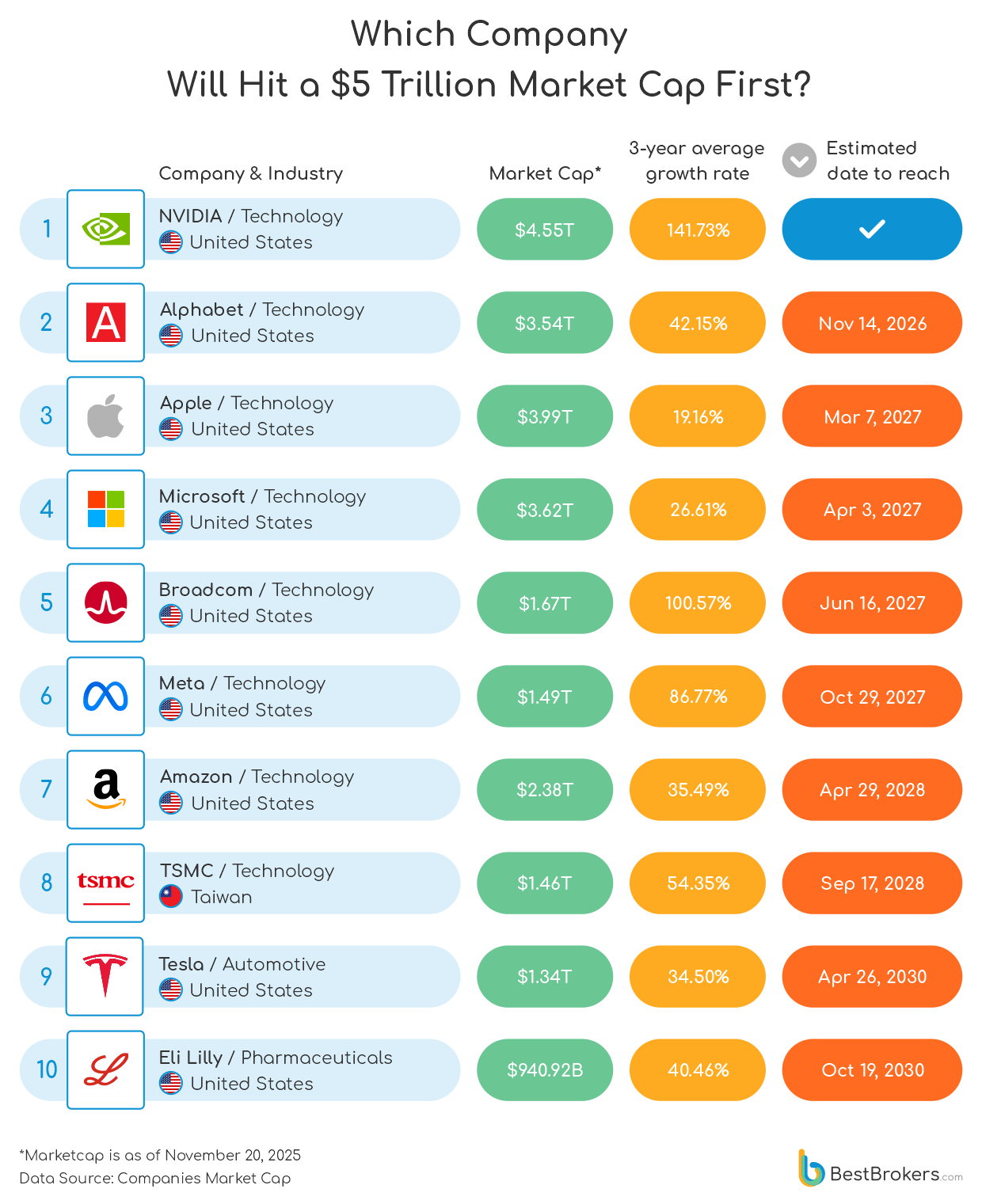

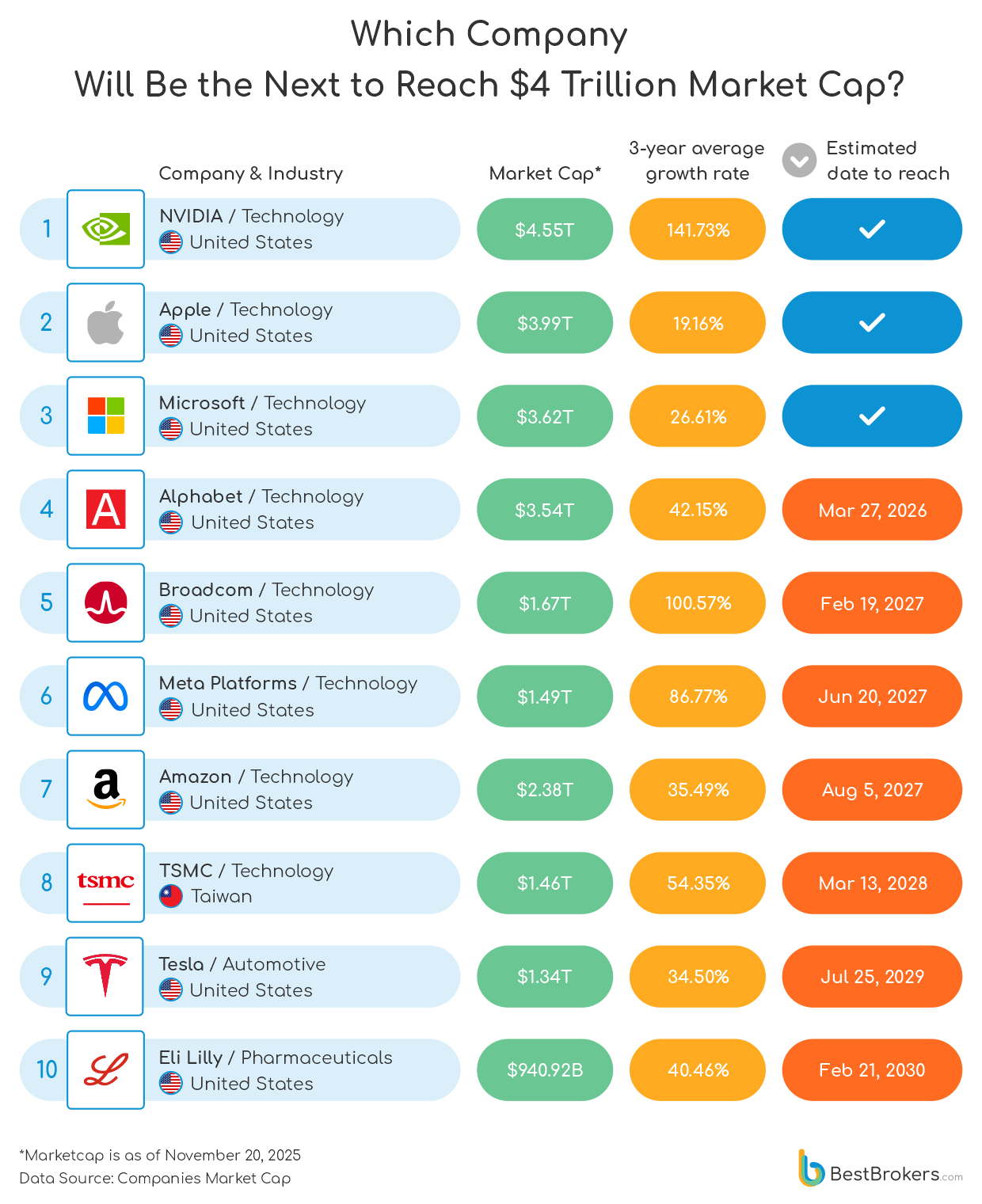

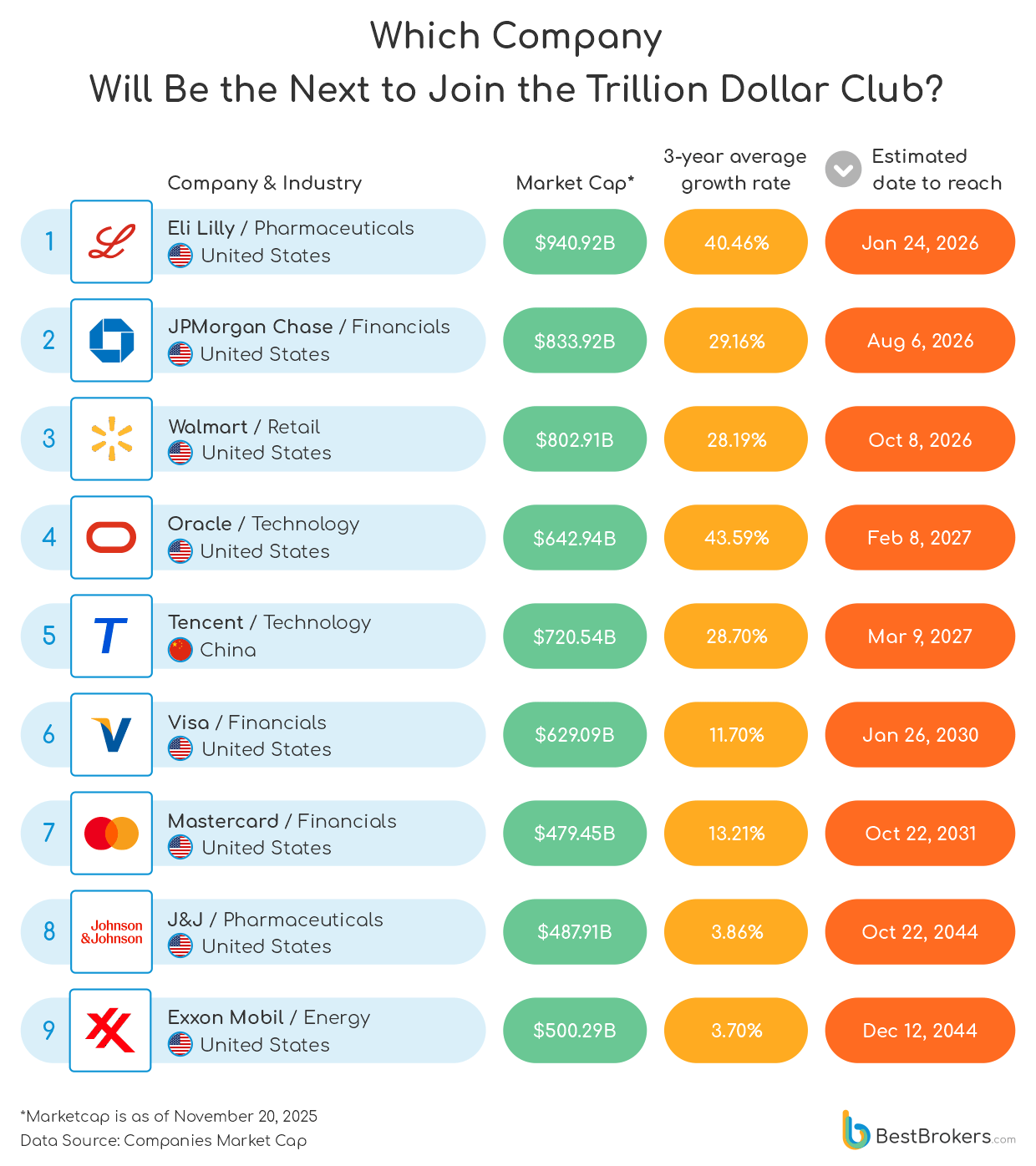

Inspired by these trends, our team at BestBrokers set out to forecast which of the current trillion-dollar giants is poised to be the next one to reach the $5 trillion milestone, which is likely to follow into the $4 trillion tier, and which companies with market caps still under $1 trillion are most likely to cross the trillion-dollar threshold next. We based our analysis on their market capitalisations as of November 20, 2025, extrapolating from their historical average growth rates since 2022.

Our projections indicate that Alphabet (Google) is on track to become the second company to top $5 trillion, potentially in less than a year. Apple is not far behind, with a $5 trillion market capitalisation possible in March 2027. Microsoft is projected to follow in April 2027, while Broadcom, propelled by an extraordinary 100.57% average annual growth rate, is expected to reach the milestone just a couple of months later.

Google has the potential to reach $5 trillion market capitalisation in less than a year

The race to the next major market cap milestones is intensifying after Nvidia crossed the $5 trillion mark, with Google (Alphabet) leading the charge. Recently, Google topped $100 billion quarterly revenue for the first time ($102.35), which surpassed the estimated $99.89 billion, driven by 34% growth in Cloud, strong AI adoption, and a $155 billion backlog of enterprise contracts.

Apple’s average annual growth rate of 42.14% still makes it the second-strongest contender in the race to reach a $5 trillion valuation, putting the company on track to hit that milestone by March 7, 2027 if current trends persist. For a stretch, Apple and Nvidia were the only two firms to sit comfortably above the $4 trillion threshold – a symbolic level that underscored their dominance in an era increasingly shaped by mega-cap giants. But that moment has passed. Apple’s market capitalisation now stands at $3.99 trillion, reflecting a period of cooling momentum amid shifting investor priorities and a broader rotation toward AI-first narratives.

Microsoft is keeping pace with Google and Apple as its cloud and AI businesses scale rapidly. Valued at $3.62 trillion as of November 20, 2025, the tech giant’s market capitalisation surged 16.80%, compared to 2024. If the current pace continues, the company might reach a market cap of $5 trillion by April 3, 2027.

Broadcom has delivered an extraordinary 100.57% average annual growth rate despite its comparatively smaller valuation. This sets up a compelling contrast: while giants like Apple, Google, and Microsoft are moving upward through steady, well-capitalised expansion, Broadcom is sprinting ahead on explosive momentum, the kind that allows a smaller contender to close gaps that would normally take years.

Beyond the front-runners, a second tier of companies is emerging as potential future giants. Meta Platforms, with a market cap of $1.49 trillion and a staggering three-year growth rate of 86.77%, could reach $5 trillion by October 29, 2027, while Amazon and Taiwan’s TSMC are projected for April 2028 and September 2028, respectively. Tesla and Eli Lilly are on longer trajectories toward $5 trillion, with expected milestones stretching into 2030.

As 2025 unfolds, the race toward $5 trillion market caps is about more than just numbers, it reflects where innovation, strategy, and investor sentiment are converging to reshape the global economic landscape. Microsoft, Google, and Broadcom are rewriting expectations, while the industry watches keenly to see who will claim the next milestone.

Who’s Next to Join the $4 Trillion Elite?

While Microsoft reached $4 trillion earlier in 2025, Apple recorded the same success in late October. Less than a year ago, Apple was the world’s most valuable company, just some $150 billion short of а $4 trillion capitalisation. Following the announcement of U.S. President Donald J. Trump’s tariffs, its stock lost roughly 20% of its value within just three days in April. This wiped out nearly $640 billion of its market capitalisation amid a broader impact on the market resulting from the tariff announcements and the ensuing trade war. Since then, Apple stock has surged nearly 50%, bringing the market cap to over $3.8 trillion and eventually securing its position above the $4 trillion mark.

Alphabet (Google) also has the potential to join the $4 trillion elite soon. Now valued at $3.54 trillion with a 42.15% three-year growth rate, it’s projected to surpass $4 trillion by March 2026. Broadcom, meanwhile, shows the strongest growth rate among the top firms, but despite its impressive momentum, it’s unlikely to overtake Alphabet in the race soon, mainly due to Google’s almost twice larger market cap and more diversified global presence.

Meta also shows an impressive average annual growth rate of 86.77%, positioning it as one of the fastest-growing companies in the trillion-dollar group. Despite its current market cap of $1.49 trillion, which is notably lower than Amazon’s $2.38 trillion, the social media giant appears poised to overtake Amazon within the next few years. Projections show that while Meta may reach the $4 trillion mark in June 2027, Amazon is likely to follow it a little over a month later – on August 5, 2027..

Eli Lilly on Track to Outpace JPMorgan, Oracle, and Walmart in the $1 Trillion Race

For the first time, a pharmaceutical company is leading the race to join the trillion-dollar club. Eli Lilly, with a market cap of $940.92 billion and a remarkable 40.46% three-year growth rate, could reach $1 trillion by January 24, 2025, outpacing tech giants, financial titans, and retail behemoths that have long dominated the mega-cap landscape. Its rapid ascent underscores how innovation-driven sectors, particularly in healthcare and biotech, can accelerate value creation faster than sheer size or traditional market dominance.

Following Eli Lilly, JPMorgan Chase ($833.92B) and Walmart ($802.91B) are projected to reach $1 trillion by late 2026. JPMorgan is riding the wave of AI-powered financial services and digital banking, while Walmart’s growth reflects a transformation into a tech-driven retail powerhouse with AI-enabled logistics and e-commerce expansion.

Oracle ($642.94B) and Tencent ($720.54B) trail slightly but remain on track to join the club by early 2027, showing how explosive growth can compensate for smaller current size. By contrast, Visa and Mastercard are expanding steadily but at a slower pace, while legacy players like Johnson & Johnson and Exxon Mobil, with growth under 4%, are unlikely to reach $1 trillion before the 2040s.

The trillion-dollar race today is no longer defined solely by established giants. Speed, innovation, and the ability to scale rapidly in high-demand sectors are increasingly dictating which companies cross the next major milestone first, and Eli Lilly’s lead is a striking testament to that shift.

Methodology

Our team at BestBrokers looked at the 20 most valuable global companies as of November 20th, 2025, sourced from CompaniesMarketCap.com. We calculated how much each company’s market capitalisation has increased on а year-over-year basis between November 2022 and November 2025, and took the average of these percentages. We then applied this average growth rate to every firm’s market capitalisation as of the time of preparing this report. This allowed us to project the approximate time it will take for each company to reach a market value of $1 trillion, $4 trillion, and $5 trillion, starting from the date at the time of writing.