A report from the Global Financial Literacy Excellence Center (GFLEC) shines a spotlight on a worrying trend: Gen Z continues to lag behind older generations when it comes to financial know-how. Across every key area, from budgeting to investing, this youngest cohort consistently scores lower.

Part of the answer might lie in where Gen Z turns for advice. TikTok reigns supreme as their go-to platform, a place where quick tips and flashy hacks dominate the feed. But behind the viral videos tagged #Moneytok, #PassiveIncome, and #Debtfree, lurks a double-edged sword: many influencers doling out financial wisdom have no formal training or credible background. The allure of instant, snackable content often trumps deeper understanding.

Some creators do offer genuine insights, but TikTok’s finance content is also riddled with misinformation, scams, and get-rich-quick schemes designed more for engagement than education. This growing flood of unreliable content is part of the problem. Recognising the risk, the research team at BestBrokers set out to analyse the platform’s finance-related videos, aiming to uncover which trends are misleading (and potentially harmful) for young, impressionable audiences seeking financial guidance.

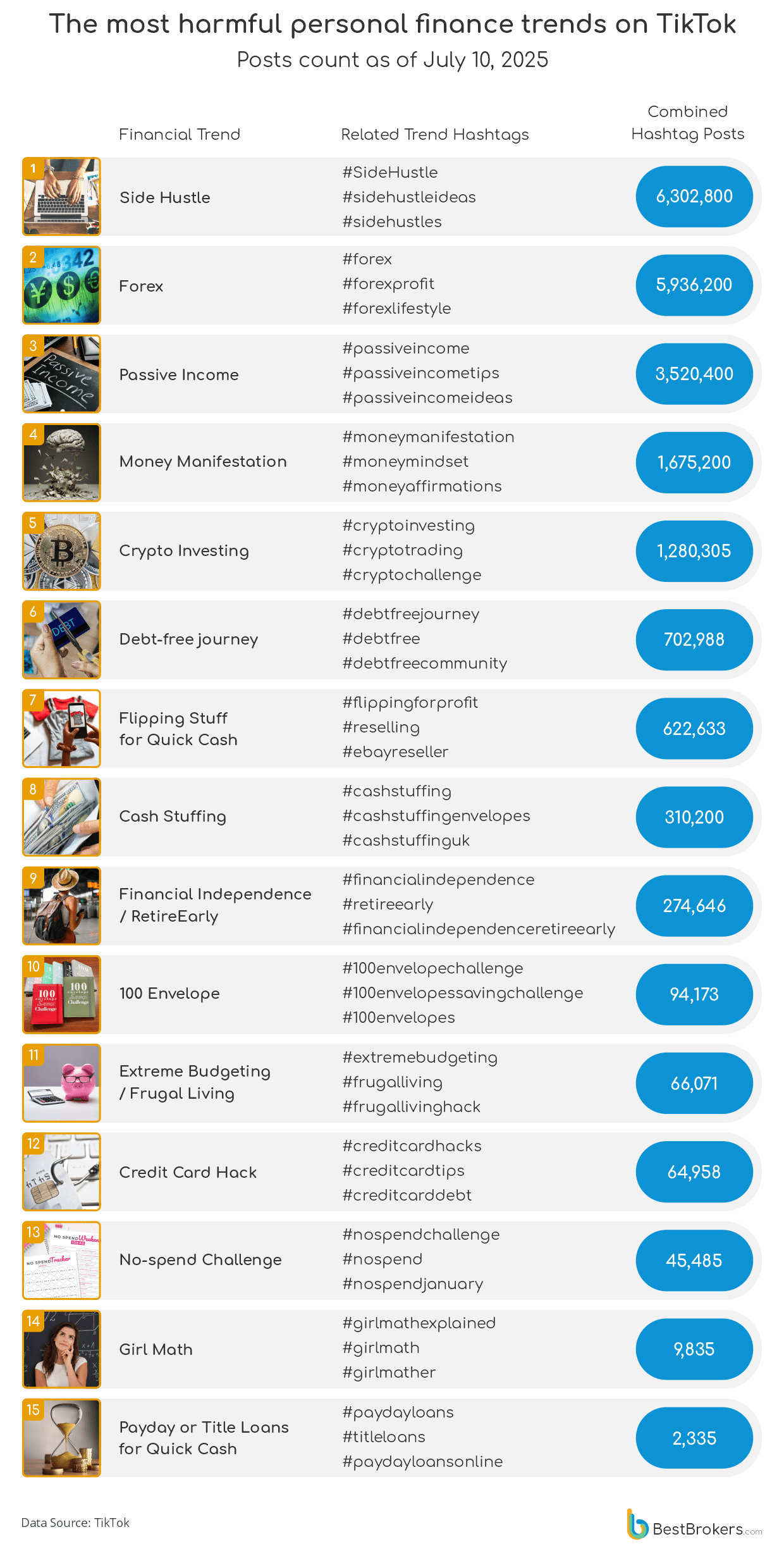

Here are the most harmful personal finance trends we found on TikTok – viral, flashy, but often misleading:

The Most Harmful Personal Finance Trends on TikTok in 2025

In the vast, addictive scroll of social media, wisdom and misinformation often blur together. For millions of young users, platforms like TikTok offer not just entertainment, but also a steady stream of life advice, much of it unsolicited, unvetted, and sometimes dangerously wrong. Nowhere is this more evident than in the world of personal finance, where catchy videos and trending hashtags often substitute for qualified guidance. TikTok, with its global reach and magnetic pull on Millennials and Gen Z, has become an unexpected, and increasingly controversial, classroom for money matters.

As of May 2025, TikTok has 1.59 billion monthly active users (MAU) worldwide. The United States remains the largest TikTok audience, with over 135.79 million users, a staggering 40% of the population.

Some of the most popular videos tied to trends like #SideHustle, #PassiveIncome, and #MoneyManifestation routinely rack up over 10 million views and hundreds of thousands of likes, making them some of the most viral financial content on TikTok.

A finfluencer is an individual who, due to their popularity or cultural relevance, has the ability to influence others’ financial decisions through the promotion or recommendation of financial products or strategies on social media, often without formal qualifications or oversight.

Side Hustling (6,302,800 combined hashtag posts)

- #SideHustle (4.8M)

- #sidehustleideas (783.7K)

- #sidehustles (719.1K)

@calleyblue HOW TO START A DIGITAL MARKETING SIDE HUSTLE‼️ let me know what you think! I’m learning with yall so let’s do this together!!!!! #sidehustle #digitalmarketing #sidehustles

At its essence, the concept of a side hustle mirrors that of taking on a part-time or secondary job to earn additional income. What sets it apart on social media, however, is the way it is presented, often as a ‘lazy way to get rich’ or a method to ‘earn money, while doing nothing’. Promising quick and effortless returns, many of these videos showcase online trading, affiliate marketing, or e-commerce jobs with claims of daily earnings ranging from $100 to $6,000.

In reality, these promises are rarely supported by concrete evidence. Most of the videos lack transparency, frequently omitting key information about how the money is actually made or the initial investment required to get started.

Some of the most trending side hustles include affiliate marketing, dropshipping, and building websites, ventures that are legitimate in theory but, in practice, demand far more time, skill, and research than is typically acknowledged. What is often promoted by finfluencers as easy and universally accessible turns out to be far more complex and demanding.

Still, these videos attract enormous attention. Some of the most popular ones have amassed between 1.6 million and 10.3 million views, drawing in a growing audience of hopeful viewers eager to believe in the possibility of fast, effortless income.

Forex Investing (5,936,200 combined hashtag posts)

- #forex (5M)

- #forexlifestyle (870.6K)

- #forexprofit (65.6K)

@forextrader4k #forex trading #forex trading live #forex trade #live trading #forex trader #trading #forex strategy #day trading #live forex trade #swing trading #fibonacci trading #forex education #trading tips #trading forex #easy trading strategy #best trading strategy #simple forex strategy #millionaire trader #winning forex strategy #forex for beginners #trading strategy #forex market #how to trade #forex course #forex signals #trading strategies #learn to trade #forex #pips #leverage #stoplosses #takeprofit #margin

Forex trading is increasingly marketed on social media as a fast track to wealth, often showcased through flashy TikTok and Instagram videos promising daily profits of $500 to $5,000. As of July 2025, hashtags like #ForexTrader and #FXTrading has racked up more than 12 billion views, with some videos surpassing 15 million individually. These clips often feature young influencers flaunting luxury lifestyles, claiming their success comes from ‘copying trades’ or using ‘secret strategies’.

However, the reality behind these claims is rarely disclosed. Many of the promoted profits stem from demo accounts or misleading screenshots, with little to no mention of the high risks involved. Regulatory agencies in the United States and Europe have issued warnings this year about unlicensed forex signal groups and influencers pushing high-leverage trading without proper risk disclaimers.

Popular schemes include joining paid groups or purchasing bots and courses, often priced between $50 and $1,000. Yet many users report losses or discover that the advice offered is basic and freely available elsewhere. Despite the risks, forex remains a trending side hustle online, driven more by influencer profit motives than by actual trading success.

Earning passive income (3,520,400 combined hashtag posts)

- #passiveincome (3.1M)

- #passiveincometips (281.1K)

- #passiveincomeideas (139.3K)

@tylamarieofficial Girl… the universe can only send you so many signs. This is one of them. Like and comment “SASSIE” for SAAS guide and get moving.💕 #makemoneyonline #inspiration #inspiration #investinyourself #succesful #whatissaas #succesful

The adage, ‘If it sounds too good to be true, it probably is’, could not be more relevant in the realm of passive income videos circulating on social media today. These videos frequently boast astonishing earnings achieved in remarkably short timeframes, requiring minimal effort. Common suggestions include affiliate marketing, property buying and renting schemes, or generating written content through artificial intelligence, among others. While these concepts may appear flawless in theory, each entails specific complexities and should not be pursued without thorough understanding and expertise.

Such videos attract significant attention by employing bold headlines that promise substantial income, thereby generating high engagement for their creators, often referred to as finfluencers. However, beneath this polished facade lies a far more intricate reality. Viewers are frequently left with unanswered questions in the comment sections, as original creators seldom provide further clarification. This proliferation of unsubstantiated promises distorts the financial perceptions of younger audiences, misleading them into believing that hard work and diligent effort are not necessary prerequisites for earning a substantial income.

Money manifestation (1,675,200 combined hashtag posts)

- #moneymindset (1.1M)

- #moneymanifestation (309.1K)

- #moneyaffirmations (266.1K)

@managemywealth_ May kingdom wealth be attracted to you! Type Amen I receive 🔥 #wealthy #wealthymindset #wealthaffirmations #financialfreedom

Money manifestation is a practice that is certainly not suited for everyone. At its core, it centres on attracting and obtaining wealth through the power of the mind, spirit, and soul. No professional qualifications, income, or labour are required, just belief and intention. While exploring the myriad videos claiming to teach how to manifest money, our team encountered a wide spectrum of content, ranging from guided meditations and hypnosis focused on financial abundance to advice on ‘vibrating at the frequency of money’ and even witchcraft rituals.

Although manifesting and ‘The Law of Attraction’ serve as a genuine lifestyle philosophy for some, the practice largely lacks empirical evidence demonstrating measurable results. More often than not, it functions as a form of self-justification, ultimately leading to misguided expectations and disappointment. Vulnerable viewers, particularly those drawn in by creators promising life-altering transformations ‘overnight’, risk becoming influenced by an idealised notion that seldom aligns with reality.

Crypto Investing (1,280,305 combined hashtag posts)

- #cryptoinvesting (338.8K)

- #cryptotrading (939K)

- #cryptochallenge (2.5K)

@youngbullinvestors Stop complicating your trading, it’s actually costing you money. Once your money is made, shut your trading system down! #daytrader #tradingmotivation #success #daytrsdinglifestyle #daytradingadvice #daytradingforbeginners

A recent research by the World Economic Forum found that 41% of Gen Z and Millennials state they would allow an AI assistant to manage their investments.

Investing in cryptocurrency has been a trending topic on social media over the past few years, but it is undoubtedly not everyone’s cup of tea. At best, TikTok may offer the occasional piece of helpful advice on digital assets; at worst, it could convince someone to buy a coin based on a 30-second video and lose their entire investment. The reality is that cryptocurrencies remain highly speculative. They might be an exciting addition to a portfolio, but they are far from being as stable or reliable as traditional assets like stocks, bonds, or real estate.

Thousands of TikToks now focus on crypto trading, yet many are heavily biased in favour of certain coins or platforms. Strategies such as copy-trading, following so-called experts, are often portrayed as guaranteed paths to wealth, when in fact, the real world of crypto is far more complex and uncertain. Both investing in and trading cryptocurrencies require a great deal of knowledge, experience, and a clear understanding of the risks involved. For users hoping to earn a reliable income, TikTok is unlikely to be the most trustworthy place to seek crypto advice.

Debt-free journey (702,988 combined hashtag posts)

- #debtfreejourney (342.7K)

- #debtfree (360.2K)

- #debtfreecommunity (87.6K)

@sarac1409 I see those of you who comment on each one of my videos👀 #debt #debtfree #debtfreejourney #creatorfund #creatorrewardsprogram #payoffdebt

The ‘debt-free journey’ trend has become a staple of TikTok’s financial content, with creators proudly documenting how they paid off credit cards, loans, and student debt. Some users share practical tips, such as using sinking funds or cutting expenses through meal planning, but many present a polished, oversimplified version of financial recovery. Success stories claiming to eliminate five-figure debts in just months often skip over crucial contexts like income level, outside support, or pre-existing savings.

Increasingly, TikTok itself has become part of the payoff strategy. A wave of creators are turning their debt into content, with trends like ‘posting every day until I’m debt-free’ or ‘how much I made from TikTok this month’ blending transparency with monetisation. While some videos aim to educate, others promote bizarre tactics like manifesting wealth by speaking to a glass of water, or raising your frequency by walking through luxury shops. These clips rack up millions of views, but blur the line between inspiration and misinformation. For financially vulnerable viewers, it can be difficult to tell what’s real advice, and what’s just content chasing clicks.

Flipping Stuff for Quick Cash (622,633 combined hashtag posts)

- #flippingforprofit (4.2K)

- #reselling (529.3K)

- #ebayreseller (89.1K)

@jakesjunk $40 challange #couchflipping #goodwill #thrifting #fyp

The TikTok ‘flipping’ trend has become a popular side hustle, with creators showcasing how they turn thrifted furniture, clearance electronics, or discounted items into hundreds or even thousands of dollars in profit. This trend encourages entrepreneurship and practical skills, with users sharing tips on spotting undervalued goods, negotiating prices, and using platforms like Facebook Marketplace, eBay, and Poshmark. Some stories highlight individuals who have earned $10,000 or more by refurbishing furniture bought for as little as $20 or flipping vintage clothes sourced from thrift stores.

But what makes it misleading? Many viral flipping videos exaggerate the ease and speed of making money. Headlines like ‘Turn $20 into $500 in a week’ or ‘I bought a broken laptop for $100 and flipped it for $1,200’ often leave out the hours spent cleaning, repairing, listing, and waiting for buyers. The reality behind these successes involves significant time investment, upfront costs, and risk of unsold inventory. For those attracted by the promise of quick cash, the process is often more demanding and uncertain than it appears on TikTok’s glossy clips.

Cash stuffing (310,200 combined hashtag posts)

- #cashstuffing (242.7K)

- #cashstuffingenvelopes (53.4K)

- #cashstuffinguk (14.1K)

@savingallmycoins HUGE June cash stuffing🤑🤑

The concerning aspect of this trend lies in the encouragement to literally stuff money into a container of one’s choosing. This straightforward budgeting method involves allocating cash to cover specific expenses such as groceries, utility bills, fuel, and healthcare. The physical presence of cash is intended to simplify money management and promote mindful spending.

However, relying on cash carries inherent risks. Unlike savings accounts or certain card-based options, cash is uninsured and offers no protection against theft, natural disasters, fire, or flooding. Additionally, cash does not accrue interest, leaving it vulnerable to the eroding effects of inflation, an issue that has become increasingly acute in recent years. While some savings accounts offer low interest rates, they still provide a safer and more secure environment for funds compared to cash stashed away at home.

Financial independence, retire early, or FIRE (274,646 combined hashtag posts)

- #financialindependence (178.2K)

- #retireearly (88K)

- #financialindependenceretireearly (8.4K)

@miarosemcgrath Can I retire by 40? #firemovement #investing #financialfreedom

57% of Gen Zers surveyed by Qualtrics in 2024 say they consider themselves to be part of the FIRE movement.

A growing wave of rebellious young TikTok creators is challenging the traditional life script of working until retirement age, a path their parents and grandparents followed unquestioningly. Instead, they champion the idea of achieving financial independence and retiring by their mid-30s or 40s, living off carefully accumulated savings. This movement, known as FIRE (Financial Independence, Retire Early), encourages extreme saving, with some advocates recommending setting aside as much as 70% of their annual income to build a nest egg large enough to cover future expenses.

However, sacrificing 30%, 40%, or even 50% of one’s income for essentials like food, rent, and transportation often requires an austere lifestyle, leading to missed opportunities and personal sacrifices. In response, a newer version called FIRE 2.0 has emerged, focusing on financial flexibility through mini-retirements, flexible careers, and intentional living that balances purpose, wellbeing, and income. While more attainable, many younger TikTok viewers remain drawn to the original FIRE’s promise, often without fully grasping the practical challenges involved.

100 envelope challenge (94,173 combined hashtag posts)

- #100envelopechallenge (69.6K)

- #100envlopesavingschallenge (21.5K)

- #100envelopes (3.1K)

@lvsocia The easiest way to save and see your money add up! #100envelopechallenge #envelopebudget #savings #savingsbinder #graduation #vacation #college #savingsaccount #save #gradgift #tiktokshopcreatorpicks #dealsforyoudays #tiktokshopsummerturnup #launchpadleaderboard #toptierjune

This challenge is far from new, it first went viral several years ago, with participants claiming to save around $5,050 with minimal effort. In 2025, some variations have escalated dramatically, with people attempting to save as much as $50,000 through similar envelope or cash-stuffing methods, often with the ambitious goal of buying a house. The process typically involves numbering envelopes and depositing the designated amount each day, resembling a simple savings strategy.

Despite its appeal, if the challenge is not followed through consistently, the money often ends up forgotten, tucked away somewhere. Influencers encourage saving ‘spare change’ or small daily sums, but realistically, how often does one receive $50 or more in change? In practice, these challenges risk leaving large sums idle and overlooked, rather than actively growing or being put to productive use.

Extreme Budgeting / Frugal Living (66,071 combined hashtag posts)

- #frugalliving (65.9К)

- #frugallivinghack (95)

- #extremebudgeting (76)

@simply.mariela I tried living like Bradley on a budget for a week straight. I hope he sees this video. He is my favorite de-influencer 😅 #frugalliving #deinfluencing #underconsumption #savingmoney #bradleyonabudget @Bradley On A Budget

In 2025, this trend has evolved from practical money-saving strategies into some of the most baffling extremes showcased on social media. While saving money and cutting unnecessary expenses remain sensible goals, some creators push these ideals into the realm of the extraordinary. At its best, frugality fosters financial discipline and resourcefulness, but for many, the pursuit of extreme savings has turned into an all-consuming challenge.

From living on just a few dollars a week by surviving on instant noodles or dumpster-dived groceries, to refusing to heat homes in winter to cut energy costs, the lengths some go to are staggering. Viral videos show people reusing tea bags multiple times, wearing the same outfit for months, walking miles daily to avoid transit fares, or subsisting solely on free store samples and expired food ‘hacks’. While these stories rack up millions of views, they often blur the line between savvy budgeting and harmful deprivation, raising concerns about the physical and mental toll such lifestyles can take.

Credit card hacks (64,958 combined hashtag posts)

- #creditcarddebt (46.9K)

- #creditcardtips (13.5 K)

- #creditcardhacks (4.6K)

@rich.somers Chase Credit Card Hack: $300K At 0% Interest?! | @thealbertpreciado #credit #creditcards

Credit card ‘hacks’ continue to flood TikTok feeds, often blurring the line between clever optimisation and risky behaviour. Among the most popular are travel credit cards, with influencers boasting free flights, luxury hotel upgrades, or VIP lounge access, all earned simply by paying for groceries, rent, or subscriptions. Many of these tactics are grounded in legitimate points-earning strategies, yet the presentation often skips over crucial disclaimers like annual fees, credit score requirements, or the consequences of revolving debt.

Other trends are more questionable. Some creators promote ‘loops’ that involve buying gift cards or money orders with credit, then using those to pay the card off, pocketing the points in the process. While technically possible, such tactics often incur fees, violate card issuer terms, and risk account suspension. Even more troubling are the ‘glitches’ or fraudulent methods circulating under hashtags like #MoneyHack, with users exploiting bank policies, mobile apps, or even ATM deposits. Though usually short-lived, these tricks often result in frozen accounts or criminal charges. As credit experts repeatedly warn in 2025, what looks like easy money on TikTok could come at a very high cost.

No-spend challenge (45,485 combined hashtag posts)

- #nospendchallange (30.8K)

- #nospend (9.1K)

- #nospendjanuary (5.6K)

@baddie.brad Could you do a no spend day?

The premise of the ‘no-spend’ challenge is simple: limit purchases strictly to essentials such as rent, groceries, and utilities, while avoiding all discretionary spending for a set period, often a week, a month, or even longer. Participants often document their progress on calendars or social media, aiming to rack up the highest number of consecutive days without opening their wallets.

While temporarily cutting out non-essential expenses can lead to modest short-term savings, the challenge can quickly become mentally draining. The strictness of the rules may foster feelings of deprivation, leading to frustration and an eventual relapse into old spending habits. Much like restrictive dieting, the no-spend approach can trigger a backlash effect, once the ‘fast’ ends, participants may find themselves binge-shopping, undoing the very progress they set out to achieve.

Girl Math (9,835 combined hashtag posts)

- #girlmathexplained (9.1K)

- #girlmath (531)

- #girlmather (182)

@girlmathgang NYC street interview Why pay for shipping cost if you can just get another item?🛍️#girlmath #streetinterview #nycinterview #imjustagirl

The Girl Math trend is less about mathematics and more about making impulse purchases feel like strategic wins. This TikTok-fuelled phenomenon offers humorous yet surprisingly widespread rationalisations for everyday spending: using gift cards feels like getting something for free, buying on sale equals saving money, even if the item was never needed, and paying in cash somehow does not ‘count’.

While it began as a satirical take on consumer habits, its viral spread has highlighted how normalised emotional and convenience-based spending has become. Many users frame it as empowering, justifying everything from daily coffees to luxury handbags as ‘investments’ in happiness. But beneath the humour lies a concerning trend: a growing disconnect between perceived value and actual financial impact. Wrapped in pink, playful language, Girl Math might seem harmless, but it often masks behaviours that prioritise instant gratification over long-term financial well-being.

Payday or Title Loans for Quick Cash (2,335 combined hashtags)

- #paydayloans (1.9K)

- #paydayloansonline (153)

- #titleloans (194)

@ninadoesmkup

As financial stress continues to weigh on younger generations in 2025, payday and title loans have once again gone viral on TikTok as supposed quick fixes for urgent money problems. Influencers frame them as an easy solution, borrow a few hundred dollars today and pay it back with your next paycheck. But what these short videos often leave out is the steep cost. Payday loans can carry annual percentage rates (APRs) well above 400%, while title loans risk forfeiture of a borrower’s vehicle for a relatively small sum.

Though marketed as convenient and accessible, these loans frequently trap users in a cycle of debt. A $300 advance might balloon into $1,000 or more in just a few months, especially if the borrower struggles to repay it in full and on time. With millions of views, the trend romanticises dangerous borrowing without addressing the long-term consequences, making financial vulnerability look like a viable path to short-term relief.

Is it even worth it to look for financial advice on TikTok?

Despite the widespread presence of misleading financial influencers on TikTok, there remains a growing body of valuable content shared by qualified professionals. Under broader and more curated hashtags such as #FinTok, #BudgetTok, and #SmartMoneyMoves users can find credible advice from certified financial planners, investment advisers, and personal finance experts. Many of these creators openly disclose their credentials, which can be verified through official databases such as the Investment Adviser Public Disclosure website. Others, while not certified, are widely respected in their fields and provide practical, experience-based insight into everything from basic saving strategies to more advanced investing concepts.

Although many of TikTok’s financial trends and challenges blur the line between entertainment and education, the platform does host a vast and growing library of informative videos that help build financial literacy, especially among younger users. That said, TikTok’s primary audience remains Gen Z, many of whom are just beginning to manage their own income, savings, and credit. Even more concerning is the platform’s significant popularity among teenagers and preteens, a group particularly vulnerable to idealised notions of overnight wealth and unrealistic promises. In 2025, distinguishing between credible advice and viral gimmicks has never been more important.

Methodology

To better understand the financial trends gaining traction on TikTok, the team at BestBrokers conducted a comprehensive analysis of personal finance content circulating on the platform in July 2025. We focused specifically on trending videos that included unverified financial claims, so-called ‘money hacks’ promoted by teenagers and other unqualified creators, and viral clips promising quick, effortless profits.

From this pool of content, we identified and categorised 15 distinct trends based on recurring themes and messaging. For each trend, we determined the three most frequently used hashtags and ranked them by total post volume, giving us a clearer picture of what financial narratives dominate TikTok’s algorithm.

Finally, for every trend, we selected a representative TikTok video that best explained the concept in an informative or illustrative way, favouring accuracy over virality, and included a direct link for reference.