A recent study by the Forbes Advisor found that 80% of young people get financial advice from social media. Given that TikTok is the most favored social platform for Gen Z (those born between the mid-to-late 1990s and early 2010s) many find themselves taking financial tips and hacks from influencers with no particular expertise or reliable economic background. Hashtags such as #FinTok, #MoneyTok and #StockTok are just some of the trends for financial guidance that are quickly growing in popularity right now.

Of course, they can sometimes give interesting insights and ideas; however, the app is also packed with fraudulent information, scams and false promises for quick money that aim at generating more views and engagement from audiences for their creators. Driven by that alarming trend, the team at BestBrokers decided to dive into TikTok’s vast ocean of finance-related videos and pull out the trends that might be more deceptive and harmful rather than helpful.

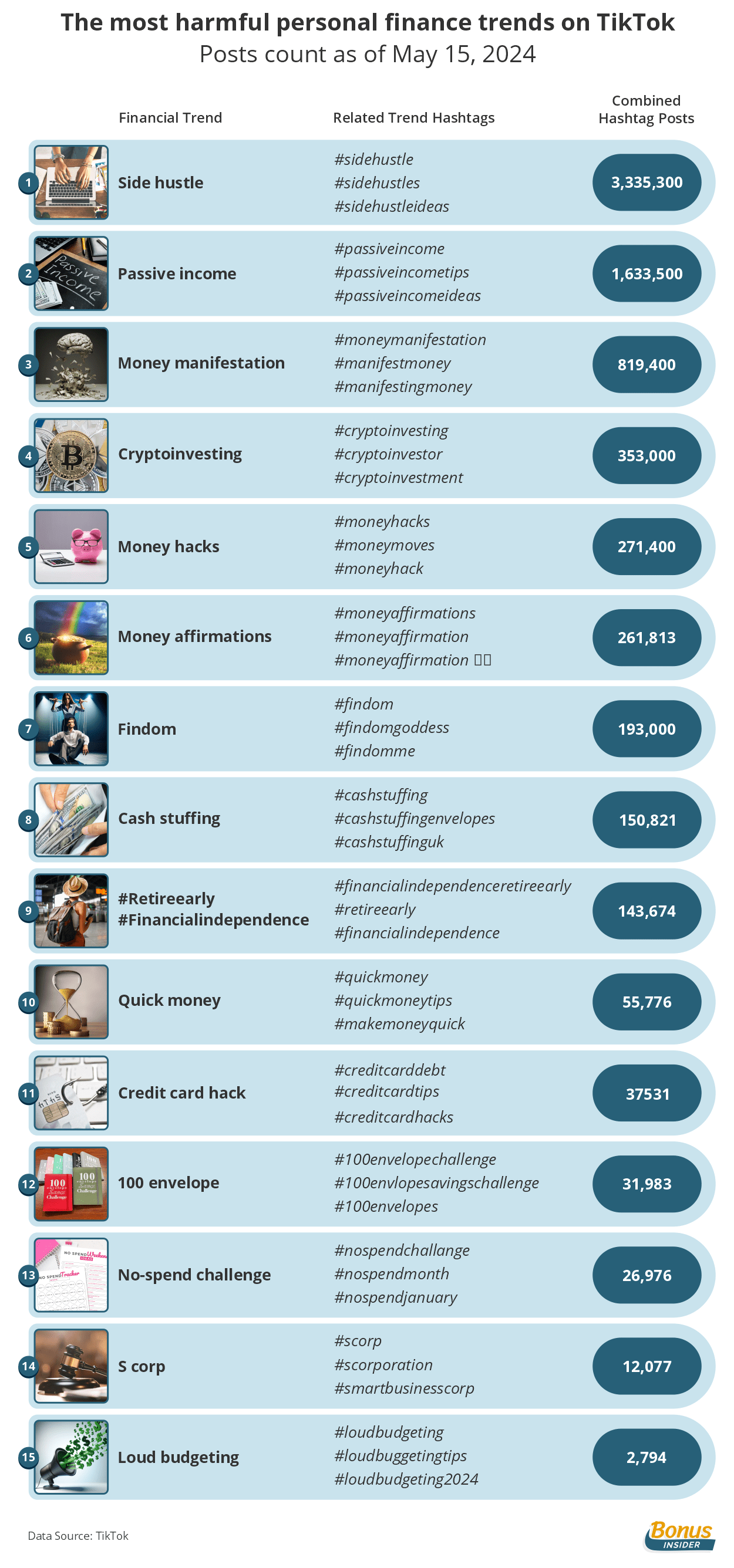

Here are the most harmful TikTok trends on personal finance we have found:

The Most Harmful Personal Finance Trends on TikTok in 2024

While social media can be a never-ending source of enlightenment and entertainment, it can also pose a great threat with misleading information and false advice, especially to unsuspecting younger audiences in serious matters such as finances. The role of TikTok, in particular, is undeniable given its massive audience around the world and its appeal to Millennials and Gen Zers.

As of January 2024, the largest TikTok audience was in the United States. Roughly 148.9 million Americans, a staggering 43.6% of the population, watched short videos on the popular platform.

Last year, the Motley Fool cited a study in which more than 50% of TikTok users sought financial advice on the platform, but only 41% fact-checked the information they received.

The same study showed that 66% of those watching videos with the #FinTok hashtag used the number of likes to determine whether a video was trustworthy.

A recent survey by Qualtrics discovered that more than a quarter (26%) of Gen Z say social media posts about people quitting their 9 to 5 jobs have motivated them to quit their corporate jobs.

A finfluencer is a person who, on account of their popular or cultural status, has the ability to influence the financial decision-making process of others through promotions or recommendations on social media.

Side Hustling (3,335,300 combined posts)

- #sidehustle (2.6M)

- #sidehustles(407.9)

- #sidehustleideas (327.4)

@makingmoneywithstephjo Hands down the BEST way to make money online! #passiveincome #waystomakemoneyonline #sidehustlesthatwork #sidehustlesuccess #makemoneyfromhome

Fundamentally, the idea of a side hustle is similar to having a part-time or a second job for extra income. The main difference is that often, the side hustle ideas are presented in videos as “lazy ways to get rich” or “do nothing and earn money” concepts. Promising schemes for quick earnings, a large portion of the videos offer online trading, selling, or marketing jobs with supposedly easy income of $100-$3,000 a day. The reality, however, is backed up with little or no evidence for any certain income, with most videos concealing the actual details of the money-making process or the additional initial capital required.

The most trending side hustles are about starting affiliate marketing, online retail trading, or creating websites. The market, however, is flooded with them; not to mention such jobs take far more time, research and creativity to achieve success. What is often promoted by finfluencers as a side hustle, suitable for anyone with no particular skill or experience, turns out to be the opposite in real life. Some of the most popular videos have between 1.3M to nearly 8M views, gaining more and more naive viewers, eager to earn easy money for doing close to nothing.

Earning passive income (1,633,500 combined posts)

- #passiveincome (1.4M)

- #passiveincometips (163.7K)

- #passiveincomeideas (69.8K)

@maddyglynn_ My “lazy girl job” makes me $100k a MONTH 💸✨🥂 #workfromhomejob #passiveincomelifestyles #makemoneyonline #makemoneyfromhome

We have all heard the saying “If it’s too good to be true, it probably isn’t (true)” and in this case, it applies 100%. A vast majority of passive income videos state incredible earnings in a short period of time requiring little to no effort. Many of the suggestions include affiliate marketing, schemes for buying and renting properties or creating written content for profit using AI, to name a few. Despite all of them being picture-perfect on paper, each has very specific particularities and shouldn’t be undertaken unless the person is well-acquainted with the matter.

The passive income videos secure views and likes for the finfluencers by having a bold headline about how much one can earn and click-baiting users. Behind the facade of easy income hides a complex process; most users resort to asking questions in the comment section, but rarely receive an answer from the original creator. Filled with false promises with no backup, this notion distorts the financial culture of young viewers by suggesting that hard work and effort are not always necessary to earn good money.

Money manifestation (819,400 combined posts)

- #moneymanifestation (284.7K)

- #manifestingmoney (269,9K)

- #manifestingmoney (264.8K)

@divineraventarot How to bring in money fast #fypシ #moneymagick #abundancemanifestation #manifest #vvitchtips #babywitchtips #vvitchtok #psychic #tarot #trending #777

Money manifestation is a practice that definitely isn’t for everyone. The method is based on attracting and obtaining wealth in your life by harnessing the power of your mind, spirit, and soul. That’s it! No profession required, no income, and certainly no work! Digging through the hundreds of videos about how to manifest money into one’s life, our team stumbled on all kinds of intriguing posts, some more obscure than others, from meditations and hypnosis about money to ‘learn how to vibrate in the frequency of money’ and witch rituals.

Although manifesting and “The Law of Attraction” might be a way of lifestyle for some, it predominantly lacks any empirical proof of measurable results, serving as a justifying tool, eventually leading to misguiding and frustrating outcomes. Moreover, susceptible viewers are prone to influence and idealization of a concept that can potentially “change your life overnight” as many TikTok creators guarantee.

Crypto investing (353,000 combined posts)

- #cryptoinvesting (240.4K)

- #cryptoinvestor (99.3K)

- #cryptoinvestment (13.3K)

@lorionenterprises Replying to @Pupper Peak How to trade (part 1) #entrepreneur #investing #trading #crypto#greenscreen

A recent report by the Financial Industry Regulatory Authority (FINRA) states that U.S. Gen Z investors 18 and over primarily invest in cryptocurrency (55%)

Investing in cryptocurrency has been a hot topic on social media over the past few years, but it is undoubtedly not everyone’s cup of tea. While at best, you could find some helpful advice about cryptocurrencies and investments on TikTok, at worst, you might decide to actually buy some coins based on the tips you saw and lose your investment. The reality is that all cryptocurrencies are speculative as an investment; they might be an interesting and exciting addition to an investment portfolio but aren’t as reliable as traditional assets such as stocks, bonds, or real estate.

Thousands of TikToks also focus on cryptocurrency trading but the majority of videos are highly biased toward certain coins and exchanges. Numerous strategies, such as mimicking what expert traders are doing, are often portrayed as foolproof methods for guaranteed returns by influencers, but in real life, things are quite different. Both crypto investment and crypto trading are complex and risky fields requiring experience and deep understanding. If TikTok users want to stand a chance to earn a decent income and not gamble their savings away, maybe TikTok is not the best place for them to take crypto advice.

Money hacks (271,400 combined posts)

- #moneyhacks (138,6K)

- #moneymoves (108,8K)

- #moneyhack (24K)

@tox23 #money #savingmoney #moneysavingtips #moneysavinghacks #crisis #help #howto #hack #energy #hilarious #uk #dark

A fair share of the so-called “money hacks” are mostly tricks and stunts using cash. Some videos are almost close to conspiracy theories, linking numerology and sacred numbers to when you should or shouldn’t spend. A number of videos are simple, common sense shopping practices such as purchasing discounted items or shopping in bulk, while others…..well others, like this fellow with his kettle, risking to not only destroy it but potentially burn his house down, driven by the mind-blowing idea of how to save a few cents are maybe, just maybe, not worth it.

The risks associated with “money hacks” are the same as with any other hack you would find on the Internet. It is more likely to lose your money or fall victim to a scam than to “hack the system”.

Money affirmations (261,813 combined posts)

- #moneyaffirmations (254.4K)

- #moneyaffirmation (5.5K)

- ##moneyaffirmations💸💸 (1.9K)

@themillionarechick Unlock the power of daily money affirmations for abundant wealth! 💸✨ Did you know? Consistently practicing money affirmations can yield remarkable results. By affirming your financial goals and desires, you align your mindset with abundance, inviting prosperity into your life. As the Bible teaches, “God is able to do more than we ask.” Simply ask, believe, and receive! By repeating this powerful affirmation three times daily for the next seven days, prepare to witness the amazing influx of money and abundance flowing into your life. 🙏🏿✨ #MoneyManifestationMonday #Wealth #Abundance #ManifestYourDreams #positiveaffirmations #declare #iam #thepowerofwords #confessions #marketplaceministry #christianposts #kingdomentrepreneur #kingdomrealestate #christiancommunity #realtorlife #godismyceo #christianinspiration #realtorwhoprays #realtorwithfaith #realtorofinstagram #bronxrealestate #bronxrealtor #ctrealestate #ctrealtor #connecticutrealtor #realtorofinstagram #christianentrepreneur #christianofinstagram #moneychallenge #moneymantra #moneytips #manifestation #moneymanifestation #spiritualtiktok #spirituality #spiritualawakening

“I get paid to exist. Wealth is my birthright. Abundance is my birthright. Abundance is my destiny.”

Money affirmation is yet another abstract idea, based on aspirations and wishes rather than practical actions that are more likely to aid when having financial issues. From Bible-inspired verses to chants and recipes for how to draw money your way by repeating certain quotes, money affirmations often promise that cash will start pouring in a matter of days.

This approach is very likely to instil unsubstantiated ideas and to fuel negative qualities in still-developing young minds like entitlement, narcissism and the belief that things should just come on a silver platter if you simply want them badly enough. The example above is used in multiple videos about affirmations. Apparently, the slogan should be repeated daily in order to bring money into one’s life.

Financial domination (193,000 combined posts)

- #findom (95.3K)

- #findomgoddess (81.4K)

- #findomme (16.3K)

@yournewaccountant And yes this can all be done completely online!!! #findom #findomgoddess #money #sidehustle #passiveincome #spoiled #princess #abundance #delulu

This viral trend is based on a relationship between a submissive (almost always a male who provides money) and a financially dominant partner (in most cases a woman) who spends the money given to them. In return, the dominant humiliates the submissive and establishes superiority.

Although the practice might sound like a quick and easy way for girls to earn extra cash, the message and moral value it spreads to young women is concerning. In addition, the thousands of scams and fraud schemes online can lead to great financial and/or emotional damage to either party.

Cash stuffing (150,821 combined posts)

- #cashstuffing (110.8K)

- #cashstuffingenvelopes (32.3K)

- #cashstuffinguk (7.7K)

@amanda_cleans Being able to do this for my daughter has been a dream come true ❤️ #momsofteens #graduationgifts #newmacbookpro #cashstuffingenvelopes #savingmoney #collegebound

The concerning thing about this trend is the encouragement of literally stuffing money into a container of your choosing. It is a simple budgeting method in which you allocate budgets to certain expenses such as groceries, utility bills, gas, health, etc. The cash part is supposed to allow easy management of your money.

However, cash has risks; unlike saving accounts (and partially, cards) cash is not insured. You cannot protect your savings from home robbery, natural disasters, fire or flood. Of course, you won’t be earning interest and inflation will slowly (or not so slowly as we’ve experienced in the past few years) eat away your money. Of course, the same can be said about saving accounts paying low interest.

Financial independence, retire early, or FIRE (143,674 combined posts)

- #financialindependence (87.4K)

- #retireearly (49.6K)

- #financialindependenceretireearly (6.7K)

@herfirst100k take my free money quiz in my bio for personalized resources! #financetiktok #moneytiktok #budgeting #debtfree #feminist #careergoals #retireearly

57% of Gen Zers surveyed by Qualtrics say they consider themselves to be part of the FIRE movement.

A large number of videos on this topic come from rebellious young TikTokers explaining that you shouldn’t work until retirement age (as your parents and grandparents did). Instead, you should achieve financial independence and retire by your middle 30s or 40s, living off of your savings. How, you ask? FIRE supporters aim to save as much as possible, some reaching up to 70% of their annual income for their retirement when they would eventually use that money for their expenses.

However, the big problem with this idea is the 30% (or 40%, 50%, etc.) of income left. This limits the funds available for food, rent, transportation, and bills. Moreover, such a frugal lifestyle means unfulfilled dreams, missed opportunities, and could’ve, would’ve, should have’s. Of course, we do not deny the possible good execution of this plan when adding investments or other types of accumulating savings. The issue is that younger people, the predominant age group on TikTok, might be influenced into deciding they want that lifestyle early on without actually considering the steps of how to do it and their proper implementation.

Quick money (55,776 combined posts)

- #quickmoney (40.1K)

- #quichmoneytips (11.7K)

- #makemoneyquick (4K)

@carter.simplifies #sidehustle #easysidehustle #fastmoney #onlinemoney #business #cartersimplifies #sidehustlesecrets #sidegig #onlineincome #sidehustleideas

This is another trend for speedy earnings, similar to the majority of side hustle ideas on TikTok which also lacks adequate follow-up. Let’s take the video we’ve picked as an example. The boy promises the fastest $20 you can earn. How? By selling a pre-made logo taken from an online template editor app. It may seem harmless but the logo isn’t yours to sell; another individual or business owns the intellectual rights.

Even if the template is available to everyone for free, the person using it will still face intellectual property violation charges depending on how the logo has been licensed. It is also interesting to see how much one could make from such a scheme considering the competitive nature of this market and the low intrinsic value of the stolen design.

Credit card hacks (37,531 combined posts)

- #creditcartdebt (26.8K)

- #creditcardtips (7.5K)

- #creditcardhacks (3.2K)

@krish.kara 3 Credit Card 💳 Need to Knows #LearnOnTikTok #creditcard #credit #creditcardtips #personalfinanceuk #personalfinance #moneytips #personalfinancetips

A recent survey by Global Findex found that in the UK and the U.S., more than 60% of people over the age of 15 had at least one credit card in 2021. The dangers of credit cards are real, however, and young people can easily find themselves trapped in debt. Once you miss a payment, you start incurring interest.

Many TikTokers with no adequate education or professional expertise commonly advise their followers on how to use credit cards and how to improve their credit card scores. They also have sponsored videos about which credit cards to apply for. As always, when it comes to finances, it is best to turn to a professional advisor or the card supplier.

No hack can teach you self-control, mindful spending or how to keep your balance low. There might be useful hacks for storing your credit card information securely, however.

100 envelope challenge (31,983 combined posts)

- #100envelopechallenge (24.7K)

- #100envlopesavingschallenge (5.3K)

- #100envelopes (2K)

@budget.with.milly8 Finally i saved all this money with this 100 envelope saving challenge 🤩

This challenge isn’t new, it went viral several years ago, with people claiming to save up to $5,050 with little to no effort. First, they take a hundred envelopes and number them; each day they put the amount shown on the envelope label. Similar to the cash stuffing challenge, the idea sounds like a good savings plan, but if it’s not followed up and completed promptly, the money might just end up sitting somewhere in your house indefinitely.

Influencers promote the process of saving up “from spare change”, but in reality how often does one receive $50 or more as change? Once again, this challenge may just leave some part of your money collecting dust in a notebook pilled up somewhere.

No-spend challenge (26,976 combined posts)

- #nospendchallange (15.8K)

- #nospendmonth (7.2K)

- #nospendjanuary (4K)

@streetcents Challenging myself to spend zero dollars on non-essentials for a week 🤐 #NoSpendChallenge #Budgeting #PersonalFinance #WhatISpend #StreetCents

The idea of this challenge is to spend money only on rent, groceries, and other necessities, and the goal is to avoid paying for anything else for as long as possible or a set period like a month. Partakers keep track of their progress on a calendar, attempting to achieve the most consecutive days without spending money.

Although eliminating unnecessary items could result in some small savings for a while, it can also lead to frustration and weariness from your own limitations. Furthermore, even if the challenge is a success and some money is indeed saved, there is a significant risk of returning to the old spending habits. And much like diets, after your “spending fast” is over, you are more likely to binge shop.

S corp (12,077 combined posts)

- #scorp (10.8K)

- #scorporation (758)

- #smartbusinesscorp (519)

@melissa.san.roman This is how to correcty pay yourself as an S Corp #entrepreneur #business #scorp #smallbusiness #businessfinance #businesstips #finances

One of the most misleading concepts circulating in TikTok includes videos stating that you don’t have to pay taxes if you form an S corp. While S corporations do exist, they are only eligible for certain tax breaks because of a very particular type of corporate structure. It is a “pass-through entity”; the profits (and losses) are calculated as owners’ personal income and are therefore free of corporate tax. However, such businesses undergo even more detailed tax audits by government bodies and if the company is not a legitimate and operating registered business, becoming an S corp will be considered tax evasion among other risks.

Loud budgeting (2,794 combined posts)

- #loudbudgeting (2.6K)

- #loudbuggetingtips (84)

- #loudbudgeting2024 (81)

@cnbcselect This new trend could actually help you reach your financial goals. 👀🎯 #cnbcselect #personalfinance #loudbudgeting #budgeting #budgeting101 #howtobudget #beginnerbudget #budgetingideas #savingtips #howtosavemoney #financialadvice #whatisloudbudgeting #creativeinspiration

Loud budgeting went viral earlier this year but then, it quickly dropped in popularity. The trend promotes limiting your social and unnecessary expenses such as eating or drinking out with friends, going to the cinema, or any other activity that requires spending money (similar to the no-spend challenge).

While it is always good to have some sort of plan for your finances in the future, it’s important to find a balance between saving and engaging in enjoyable activities. Without it, the person attempting the challenge might suffer socially and emotionally from turning down all of those social invitations, suggesting that this trend can also lead to frustration and emotional distress.

Is it even worth it to look for financial advice on TikTok?

Despite the many fraudulent influencers on TikTok, there are some good and helpful practices from financial experts, many of which are quite active on social media. Under more general hashtags such as #personalfinance #savingstok, and #moneytok, you can find decent advice from bankers, stockbrokers, and investment advisors, whose credentials can be checked through many sites such as the Investment Adviser Public Disclosure website. There are also influencers who are widely considered reliable and knowledgeable in various fields like finance, investments, and even riskier activities such as trading.

It is true that many of the finance-related trends and challenges on TikTok can broaden our financial culture with thousands of educational videos out there for young people to see. Others are ridiculously entertaining, which should probably be the point of most stuff on social media. Still, TikTok is mostly used by Gen Zs, those 20 to 30-year-olds who are still new to earning, saving and investing money. The platform is even more popular among children, who are even more easily swayed into thinking anyone could be a millionaire just because they want it.

Methodology

First, the team at BestBrokers analysed trending TikTok videos related to personal finances from May 2024 and identified the most commonly used hashtags. We examined the hashtags often used in videos with unsubstantiated financial advice, financial hack TikToks by teenagers and other seemingly inexperienced creators, and videos that make bold claims about quick, easy profits.

We then grouped the hashtags and ended up with a total of 15 trends that appeared the most. We found the three most relevant hashtags for each trend and ranked them by the combined number of posts.

Lastly, we selected the best TikTok video we could find that explains the trend as accurately as possible and included a link.