After absolutely devastating 2022, economy-wise, 2023 appeared to bring some sort of revival to pretty much all markets, including crypto. When the Fed’s rates hit 4.50% in December 2022 (from 0.25% in January) most analysts predicted recession which would affect all economic aspects and crypto markets were on target as the riskiest.

However, a number of pauses in the interest rate increase as well as very positive CPI and economic growth data lifted the optimism throughout 2023. Additionally, some very meaningful events happened in the crypto world alone, one of which was the long-awaited Ethereum Shanghai Upgrade. It brought reduction in gas fees for layer-2 applications plus the ability off stakeholders to

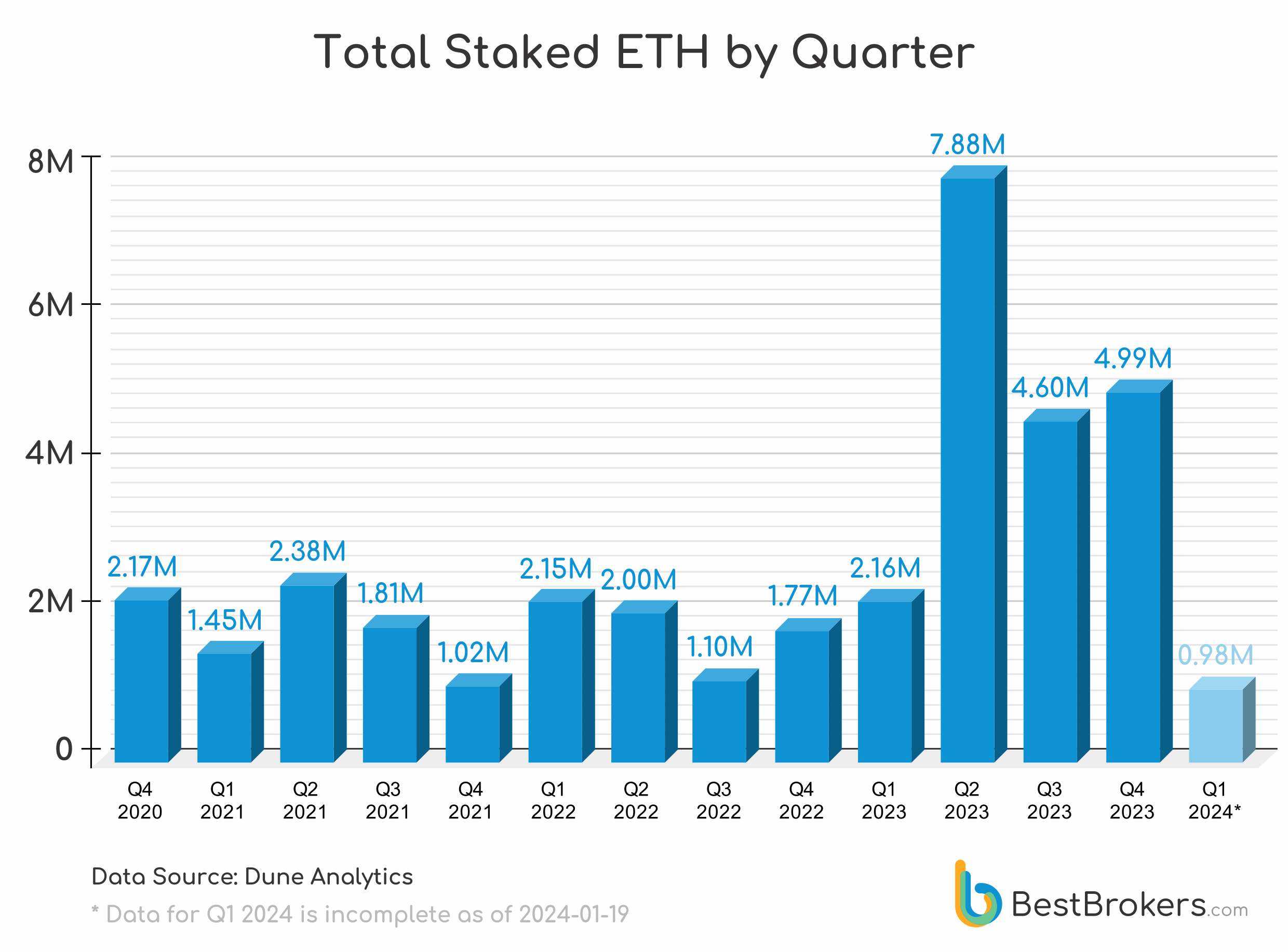

Our team at BestBrokers decided to look into the Ethereum staking activity in 2023 and run several raw queries on the Dune Analytics platform. It turns out ETH deposits bloomed in 2023 with 279.62% increase, compared to 2022.

“2023 was way better economically than it was initially predicted. Despite the ongoing geo-political tensions and recession fears, 2023 proved to be a foundation for a brighter future at least when crypto is concerned. Ethereum is among the beneficiaries as after the Shanghai Upgrade ETH deposits skyrocketed. The almost 280% increase in 2023 vs 2022 is beyond impressive. It is a clear sign that traders trust Ethereum and believe it is going to be a successful investment over time.”

– comments Alan Goldberg, market analyst at BestBrokers.

More deposits mean lower APY, but is that actually bad?

The way staking works means the more staked Ether will result in lower APY. However, the more staked ETH means an increased number of validators which makes the network more secure.

On the economic side, more staked Ether means more investors and ETH holders which directly affects its price in a positive manner. Actually, the boom in ETH deposits in 2023 not only brought rewards to stakers, but significantly increased their ROI:

While S&P 500 marked a staggering 24% rise in 2023, ETH price almost doubled with a 91% increase.

“The crypto market in 2023 once again proved to be very appealing it is to investors. Although usually considered riskier, many crypto markets once again were profitable for traders. Bitcoin ETF is surely a landmark in economic history, but Ethereum is closely following with so much trust and investors gained in 2023. On the pure numbers side, the 24% S&P 500 price surge, which is surely impressive, can barely be compared to the 91% ETH price boom. And that is without accounting the rewards staking investors earned which ranged between 3.5% and 6% APY in 2023.”

– added Alan.

2024 is starting in a promising matter

We can see 980,780 ETH staked in the first 18 days of January, 2024. When extrapolated this comes at around 4.5M for Q1 2024, which is on par with the 2023 Q3 and Q4 numbers, proving once again the elevated interest in Ether staking is continuing.

Raw Data

| Quarter | Staked ETH |

|---|---|

| Q4 2020 | 2,170,754 |

| Q1 2021 | 1,451,488 |

| Q2 2021 | 2,384,224 |

| Q3 2021 | 1,813,984 |

| Q4 2021 | 1,018,544 |

| Q1 2022 | 2,148,224 |

| Q2 2022 | 1,997,203 |

| Q3 2022 | 1,095,650 |

| Q4 2022 | 1,774,720 |

| Q1 2023 | 2,156,624 |

| Q2 2023 | 7,875,927 |

| Q3 2023 | 4,596,264 |

| Q4 2023 | 4,988,695 |

| Q1 2024* QTD (19 Jan 2023) | 980,780 |