JustMarkets Account Types in Brief

JustMarkets offers a diverse suite of account types tailored for various trading styles, although availability depends on your country of registration due to regulatory restrictions. Retail traders in Europe are typically offered Pro and Raw Spread accounts, with the possibility of upgrading to a professional account with higher leverage ratios (1:300) if certain criteria are met. Globally, clients of the Seychelles-based entity have a broader choice, which includes the Standard, Standard Cent, Pro, and Raw Spread accounts.

The Standard account is commission-free and requires a low minimum deposit of $10, which makes it popular among casual traders. The Standard Cent account is designed for beginners and clients with a limited budget, allowing positions in cent-lots for reduced risk. More experienced customers can opt for the commission-free Pro account, which offers tighter spreads but has a higher barrier to entry.

Raw Spread accounts provide spreads as low as zero pips, alongside a lot-based commission. Additionally, all main account types are available in a swap-free format to the benefit of Muslim traders. The Seychelles entity also facilitates copy trading via Standard and Pro accounts with minimum deposit requirements of $10.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

JustMarkets Minimum Deposit Requirements

The minimum deposit required to start trading with JustMarkets is generally low, ensuring the broker’s services are accessible to all onboarding customers. Deposits typically begin at $10 when using common methods like credit and debit cards and e-wallets. Bank transfers, however, require a higher minimum of $100. Cryptocurrency deposits are available only to customers of the offshore entity, with minimum thresholds of $30 for Bitcoin, Litecoin, Tron and Ethereum, and $15 for Tether and USD Coin.

It is important to note that the barrier to entry also can vary depending on the chosen account type. Standard and Standard Cents accounts at the international entity require only $10, while the Pro and Raw Spread options require €100 in Europe or $200 for clients from other regions.

What Can You Trade at JustMarkets?

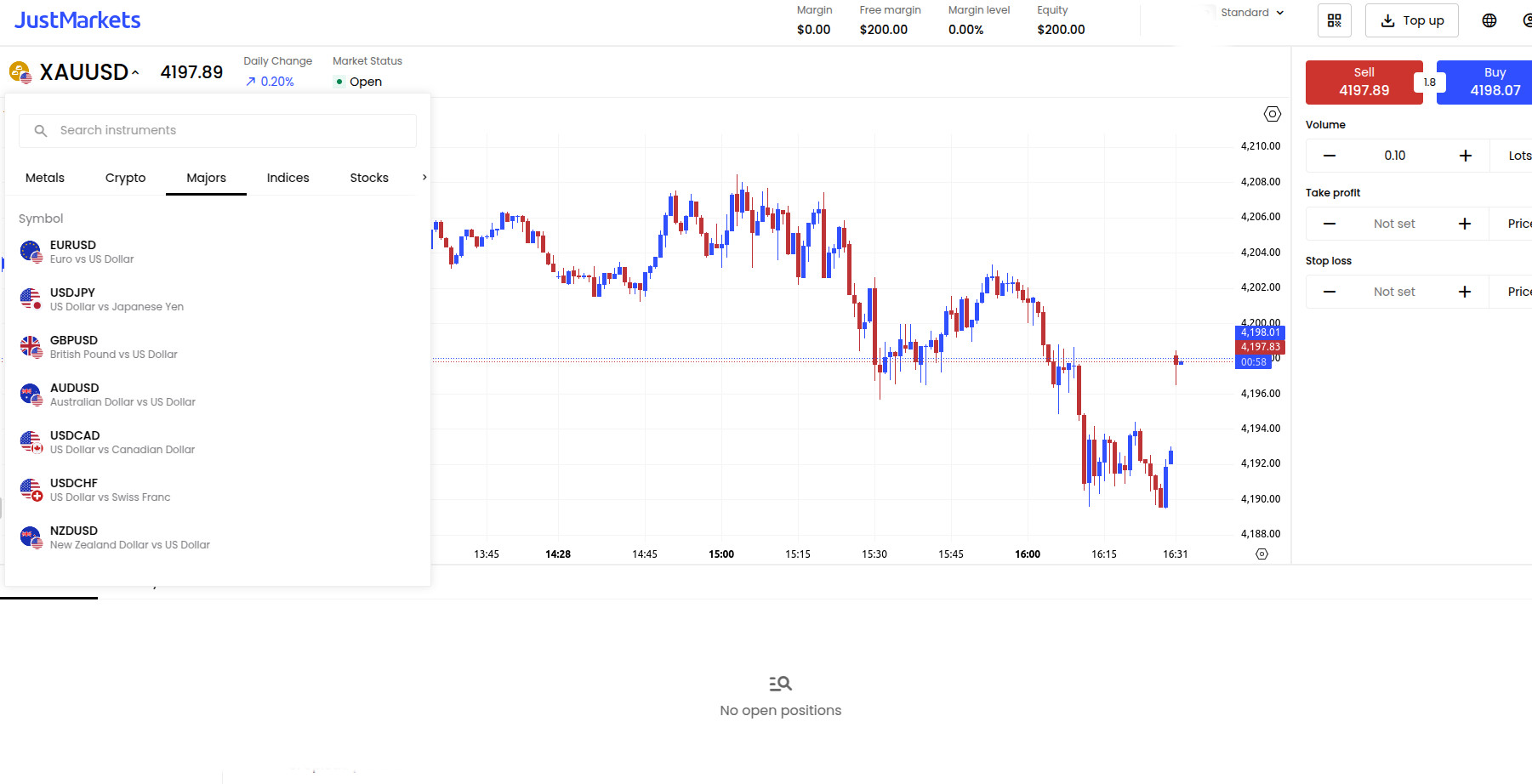

JustMarkets offers a streamlined product lineup, featuring around 260 tradable instruments across five main asset classes. The broker specializes in the provision of CFD trading services, so clients cannot purchase physical shares or exchange-traded funds. The forex selection is extensive enough, with 69 currency pairs ranging from popular majors to more exotic crosses.

Stocks receive somewhat limited coverage as the broker quotes prices for approximately 170 leading companies from Europe and the US. Traders also have access to 11 CFDs based on major indices like the S&P 500 and Nikkei 225. Additionally, the portfolio includes 8 precious metals and energies and 11 cryptocurrencies all quoted against the US dollar. The platform does not support trading options or futures on regulated exchanges.

Step-by-Step Registration at JustMarkets – Takes Around 10 Minutes

- Open www.justmarkets.com in your mobile or desktop browser and initiate registration by clicking the blue Register button in the top right screen.

- Select your country of residence and enter a valid email address registered in your name. Then choose a solid password and confirm you are not a tax resident of the United States.

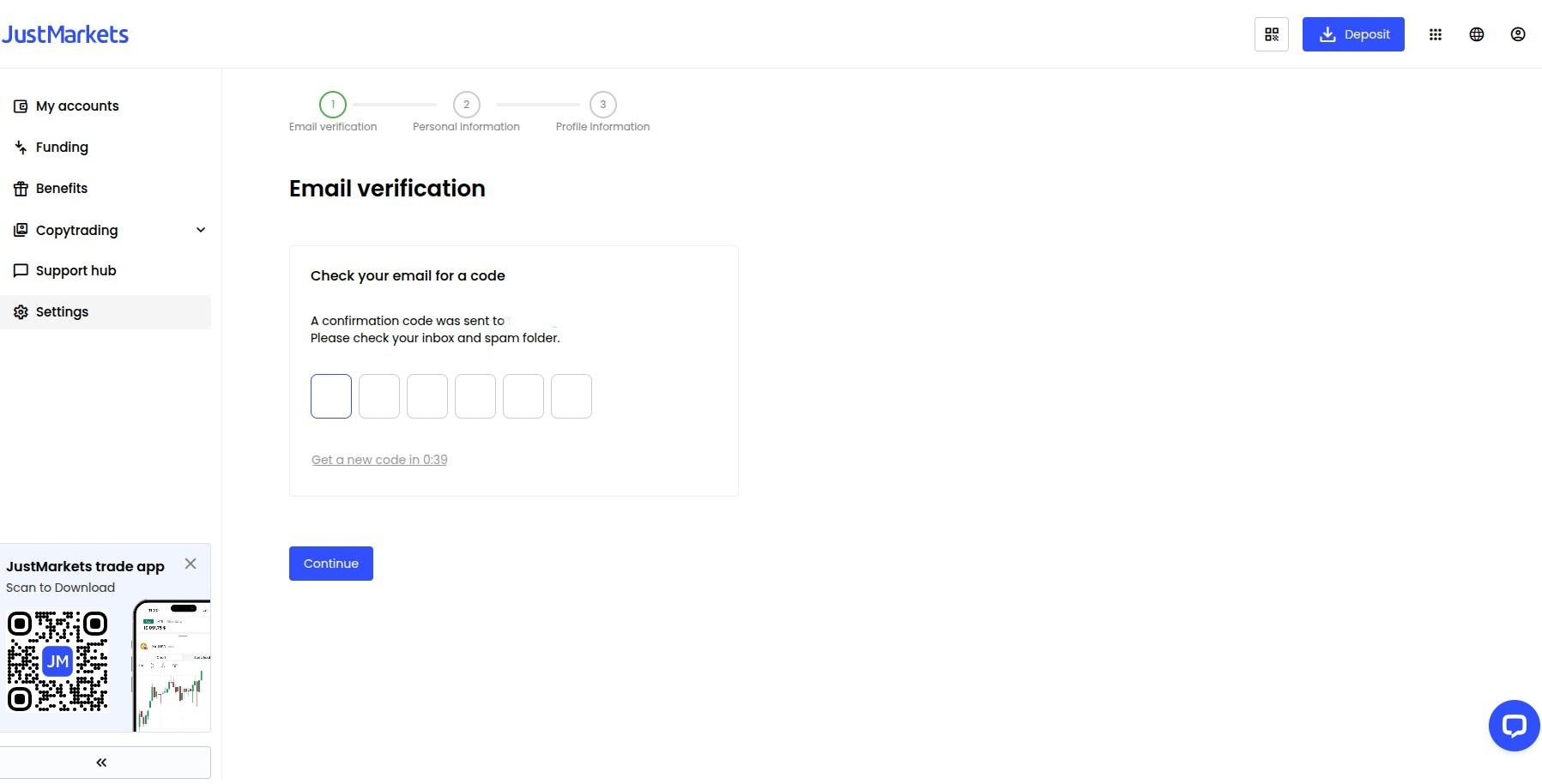

- After you click Continue, the broker will send you a 6-digit verification code you must enter in the designated field to confirm your email address.

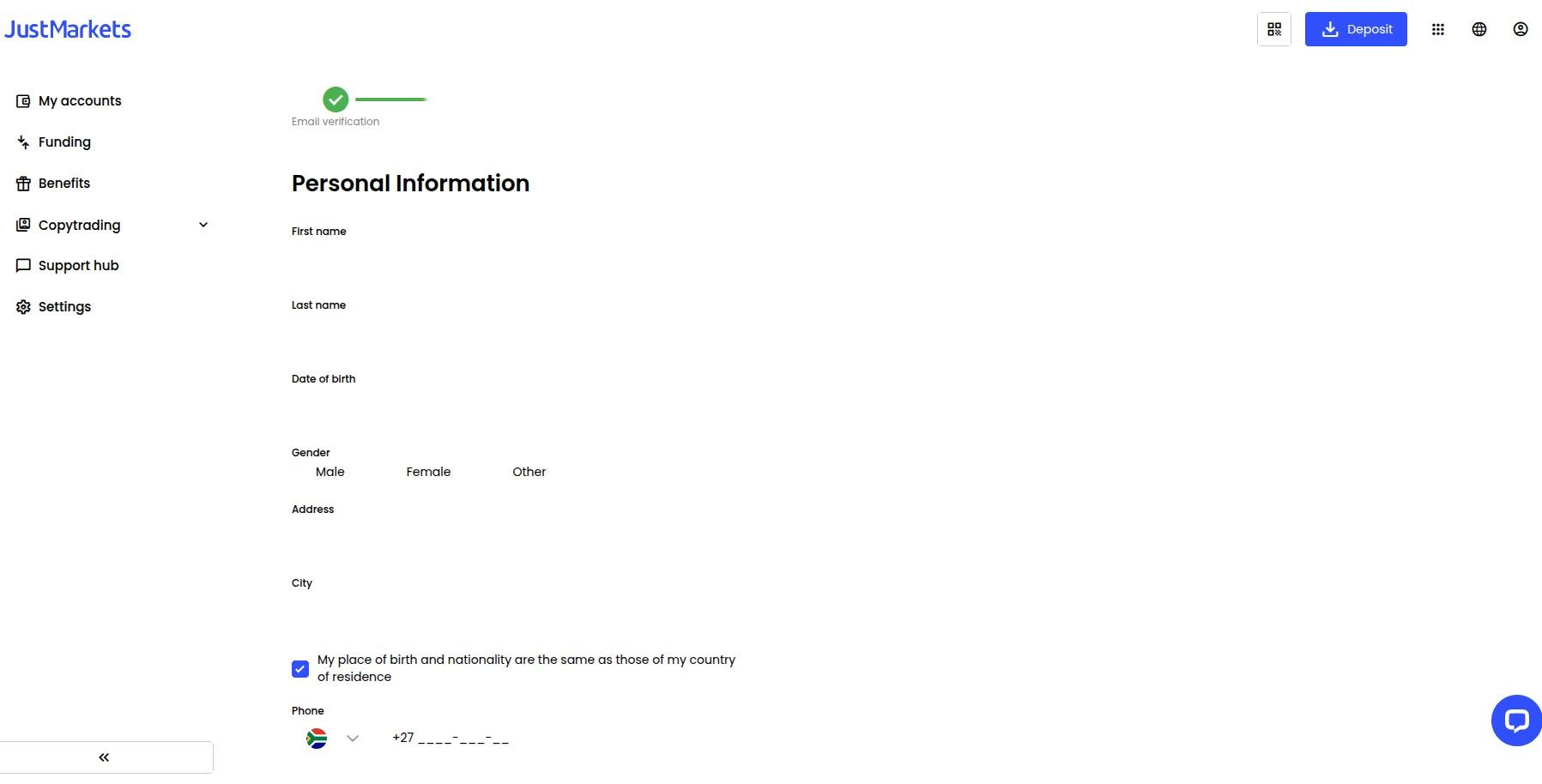

- Once you verify your email, you must provide some personal information, including your first and last name, birth date, gender, city, and residential address. You must also enter a valid mobile number to verify your phone. The broker may also ask you to provide your tax identification number but you can skip it and return to this step later.

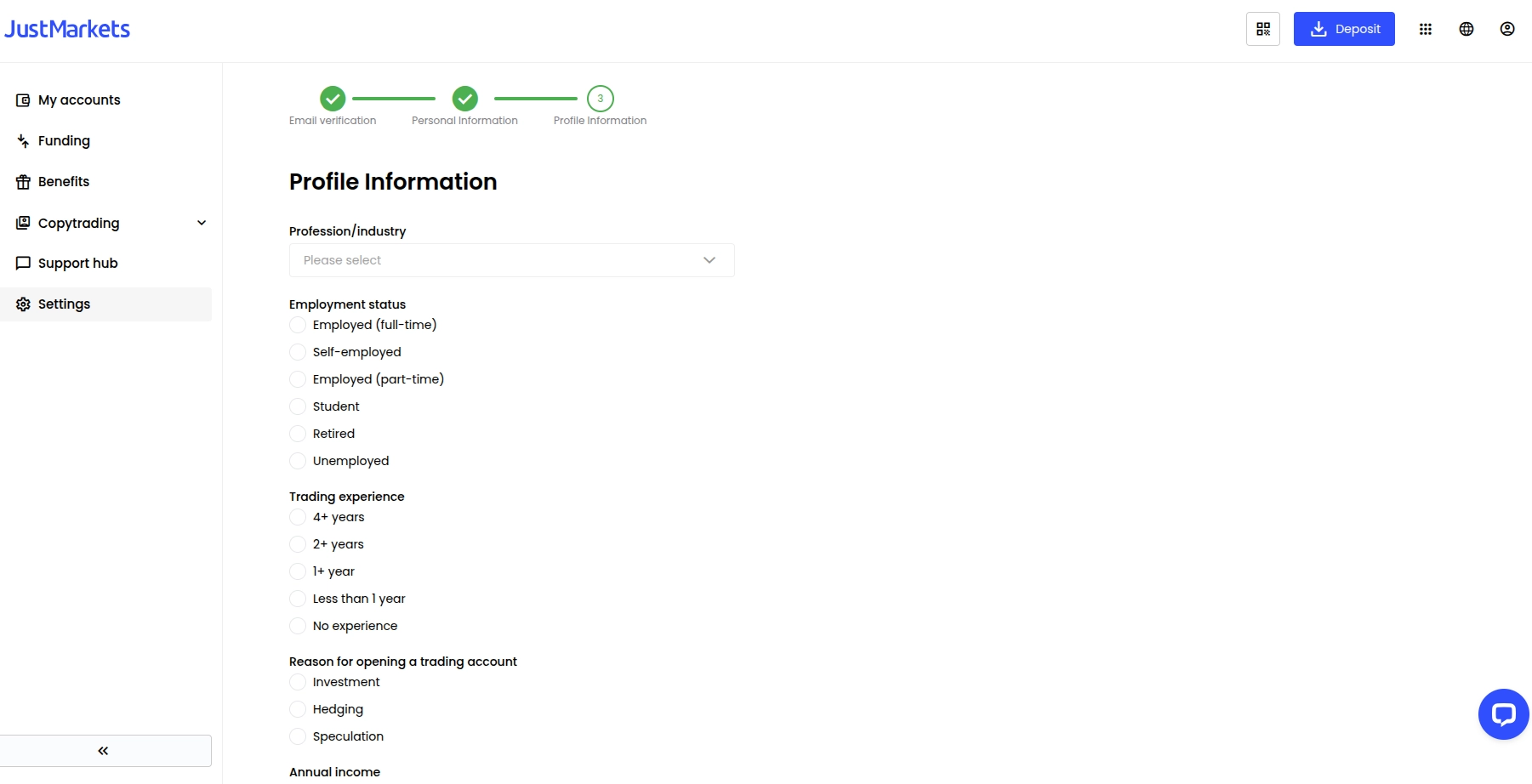

- What follows is a brief questionnaire that aims to establish your source of funds and wealth. They will ask about your employment status, annual income, trading experience, and reasons for creating an account. You must also specify the amount you intend to deposit and whether you are a politically exposed person. Tick the box at the very button to confirm your information is correct.

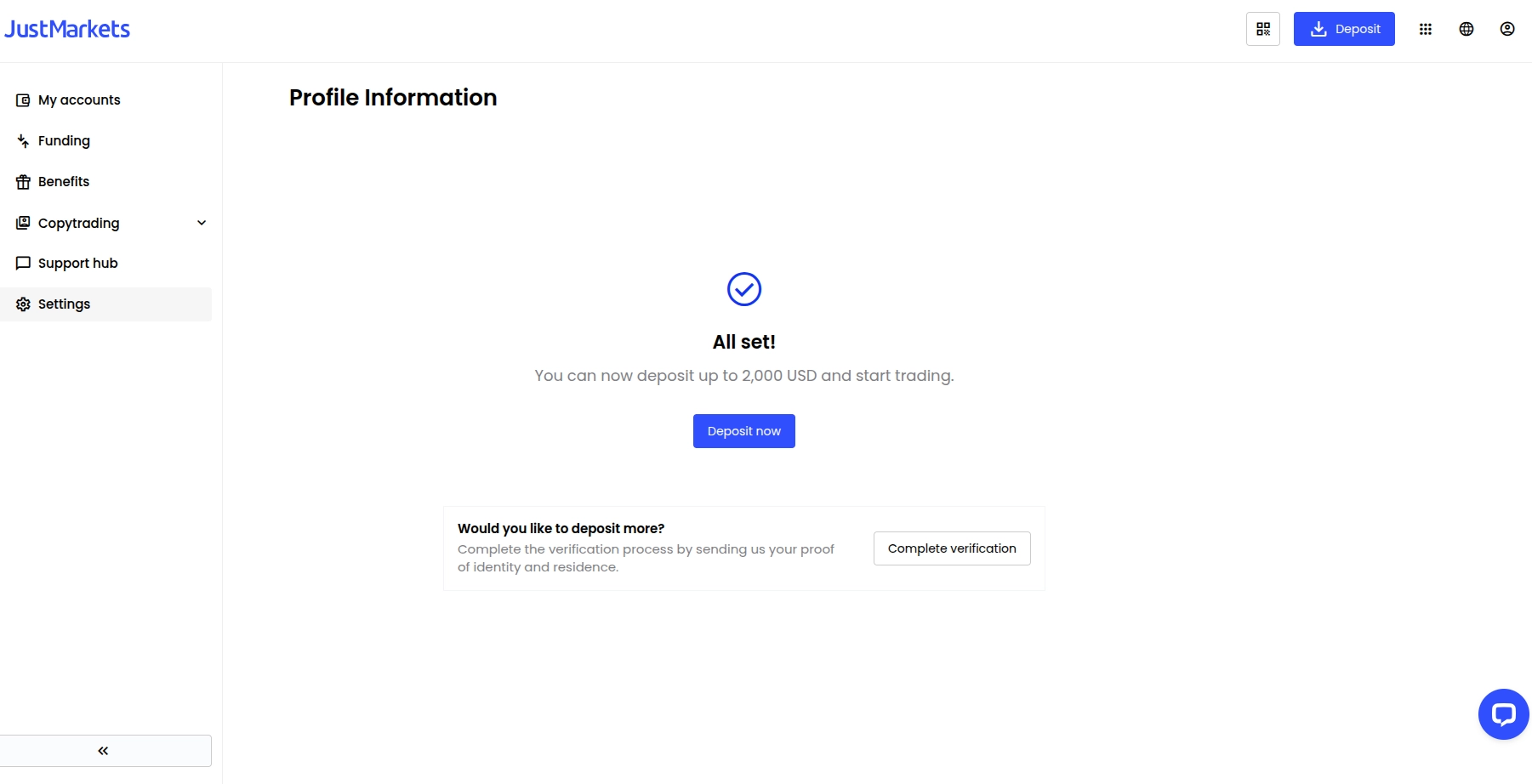

- At this stage, you will be able to start trading with your live account but your deposit will be limited to $2,000. You can lift this restriction, by completing your full account verification.

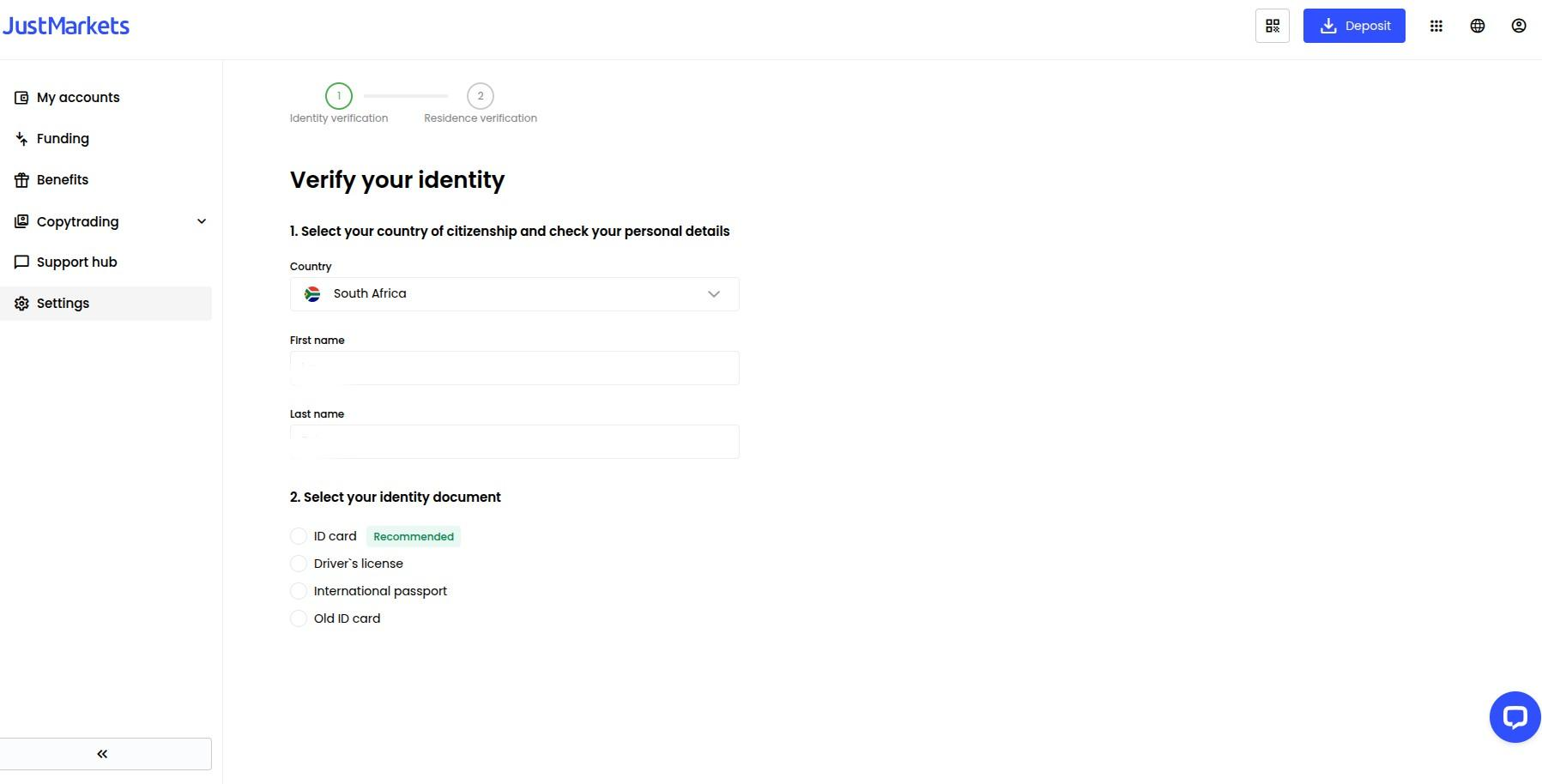

- Assuming you wish to undergo full verification, you must upload copies of your documents to confirm your identity. JustMarkets accepts identification cards, international passports, or driver’s licenses. Customers must ensure their documents display their full photo, citizenship, issue and expiration dates. The documents must be valid for at least a month from the day of upload.

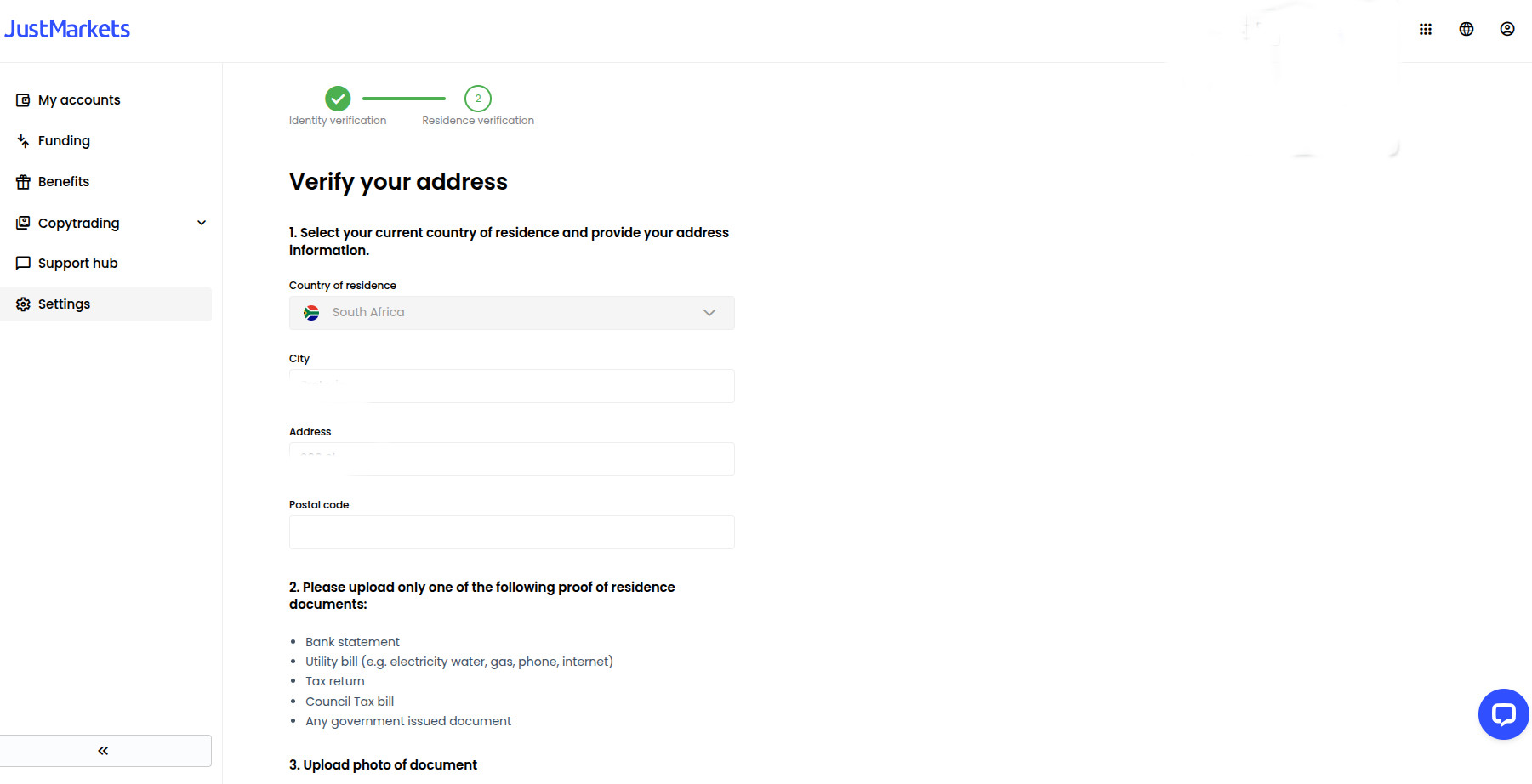

Customers will fail verification when uploading expired, blurry, or unfocused documents. Black and white copies and screenshots are not accepted, either. All corners of the document should be clearly visible. - The next step involves address verification by uploading a bank statement, utility bill, tax return, council tax bill, or other government-issued documents. The accepted documents may differ from one country to the next. Whatever you choose to upload, make sure the photo contains your full name, address, and the issue date of the document.

JustMarkets accepts photos, PDF documents, and color scans, with all corners visible. Your documents must be issued within the last 6 months. You can upload copies from your desktop computer or use your mobile phone camera to capture the photos. - If all your documents are in order, JustMarkets will verify your account within the same day. You can now deposit more than the initial limit of $2,000 and start trading with your live account. Here is a snapshot of the proprietary browser-based platform of JustMarkets.

Final Impressions

The JustMarkets account registration process is refreshingly straightforward and aligns closely with industry standards. The initial setup, which involves email and phone verification, can be completed quickly. It takes a couple of minutes to get a live account with a $2,000 deposit limit. The steps are easy to follow, requiring standard personal information and a brief income questionnaire. Full verification, which lifts the deposit limit, requires around 8 minutes in total and involves the typical submission of an ID and proof of address, with the broker processing documents efficiently, often within the same day.