MultiBank Group Account Types in Brief

MultiBank Group provides traders with access to a vast array of leveraged financial derivatives, covering major asset classes such as forex, metals, shares, indices, commodities, and cryptocurrencies. Understanding that traders have different needs, the broker offers three main account types, Standard, Pro, and ECN, to accommodate various experience levels and pricing preferences. While the Standard and Pro accounts feature a commission-free structure, the ECN account provides tighter, raw spreads in exchange for a commission.

To ensure broad accessibility, MultiBank Group provides swap-free accounts for eligible Islamic customers, who can convert their existing Standard or Pro accounts. Additionally, all prospective traders can easily open a complimentary demo account by providing minimal details (name, email, and phone number), allowing for risk-free practice.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

MultiBank Group Minimum Deposit Requirements

MultiBank Group maintains an accessible entry point for trading, with a minimum trade size of 0.01 lots across its Standard, Pro, and ECN accounts. However, the initial minimum deposit requirements vary significantly based on the account tier: the Standard Account requires $50, the Pro Account $1,000, and the premium ECN Account $10,000. To help traders manage costs, the platform supports several base account currencies, including USD, GBP, EUR, CHF, AUD, NZD, and CAD, which helps in avoiding conversion fees.

The process for opening an account is straightforward, beginning with a quick online registration and KYC verification. Once verified, traders can fund their account using various methods such as bank cards, bank transfers, or e-wallets, and then choose their preferred platform. It is important for all traders to note the broker’s trading conditions: the stop-out level is reached when equity falls below 50% of the required margin. For technical limits, the MetaTrader 4 (MT4) account allows a maximum of 300 open positions, while the MetaTrader 5 (MT5) account supports up to 1,000.

What Can You Trade at MultiBank Group?

Established in 2005 and backed by over 17 regulatory licenses globally, MultiBank Group has cemented its position as a world leader by offering an extensive portfolio of over 20,000 financial derivative products. This diverse catalog caters to nearly every trader, starting with forex, where clients can access more than 55 currency pairs, including majors, minors, and exotics.

Beyond currency traders, the broker appeals strongly to equity traders by offering over 20,000 shares from the world’s largest stock exchanges, alongside major global Indices like the Nasdaq, S&P 500, and DAX. For portfolio diversification, traders can access key commodities such as crude oil and natural gas, as well as precious metals like Gold and Silver, which boast competitive spreads starting from $0.02 and $0.01, respectively. Finally, MultiBank Group supports the trading of popular cryptocurrency derivatives, including assets like Bitcoin, Ripple, and Ethereum.

Step-by-Step Registration at MultiBank Group – Takes Around 15 Minutes

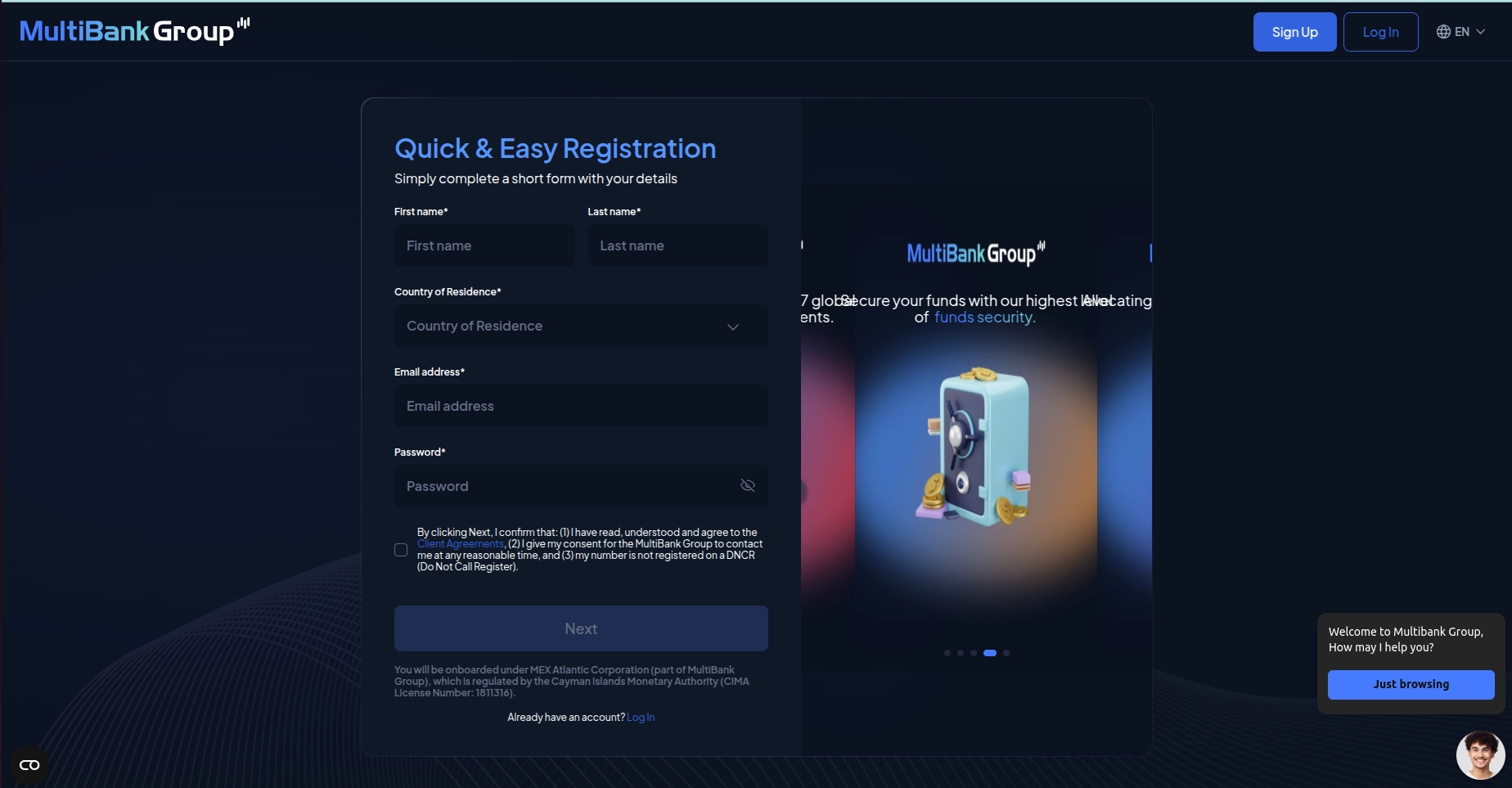

- MultiBank Group provides a quick and straightforward account registration process. Prospective clients begin by completing a short online form, providing essential details, such as their name, country of residence, email address, and a secure password. Before proceeding, they must confirm their agreement to the Client Agreement. It is important to note that these initial registration steps apply specifically to customers being onboarded under MEX Atlantic Corporation, which is a regulated entity within the MultiBank Group, overseen by the Cayman Islands Monetary Authority (CIMA).

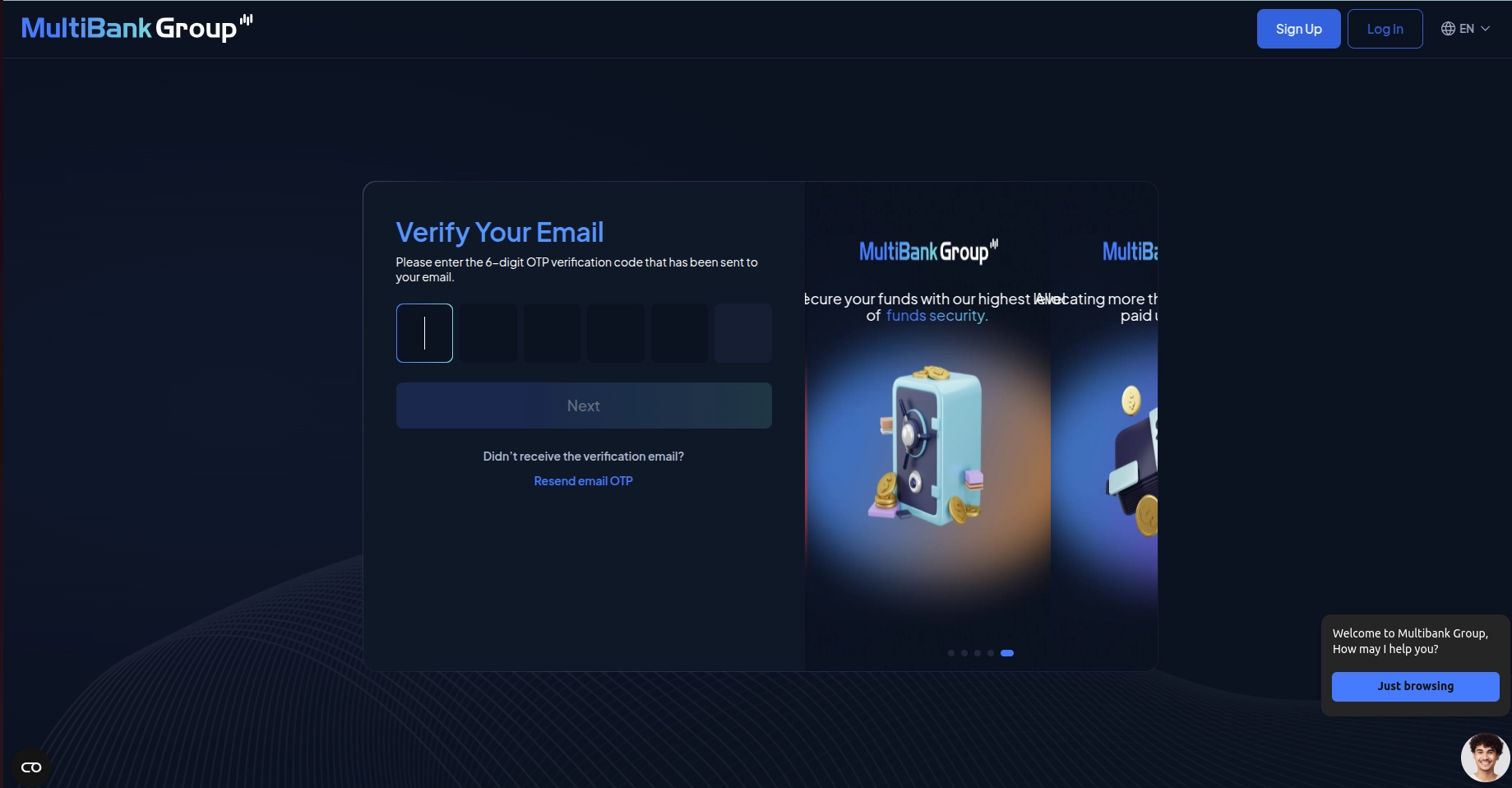

- Next, traders are prompted to verify their email by submitting the six-digit one-time password that has been sent to their registered email address.

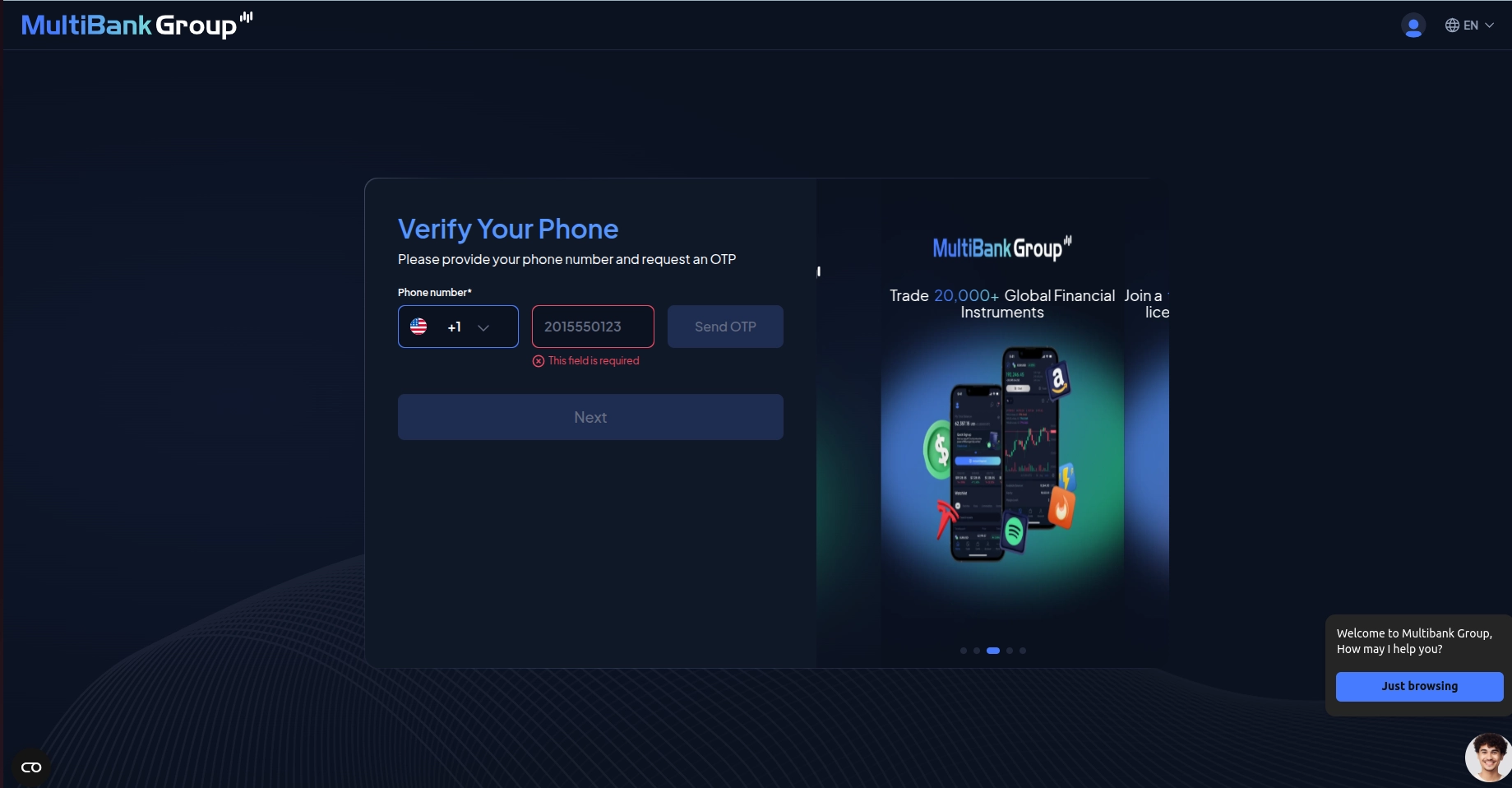

- Once the email is verified, traders proceed to verify their phone number. They must enter their number and click the ‘Send OTP’ button, after which they will receive a one-time password to be entered in the designated field to continue the registration.

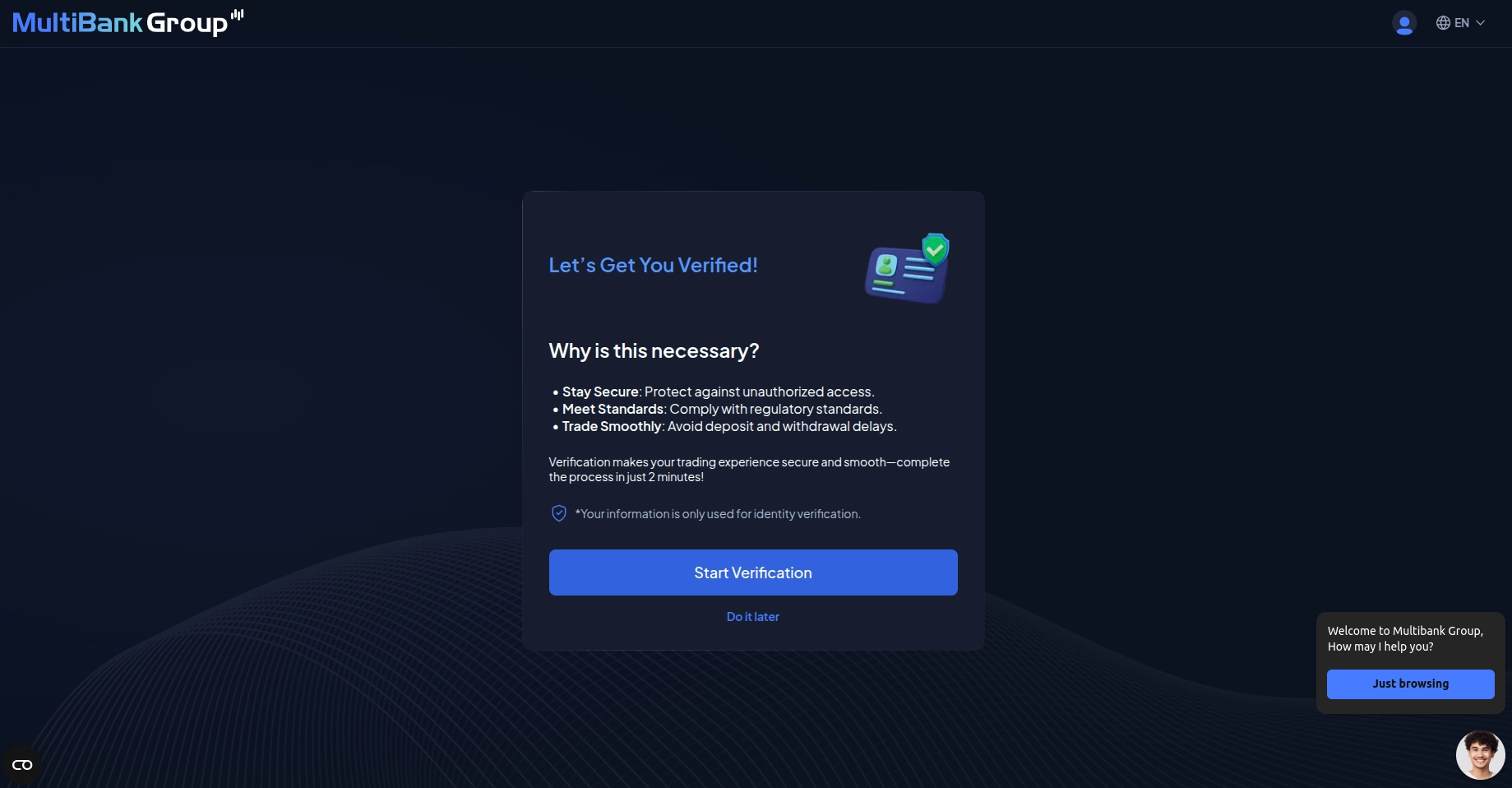

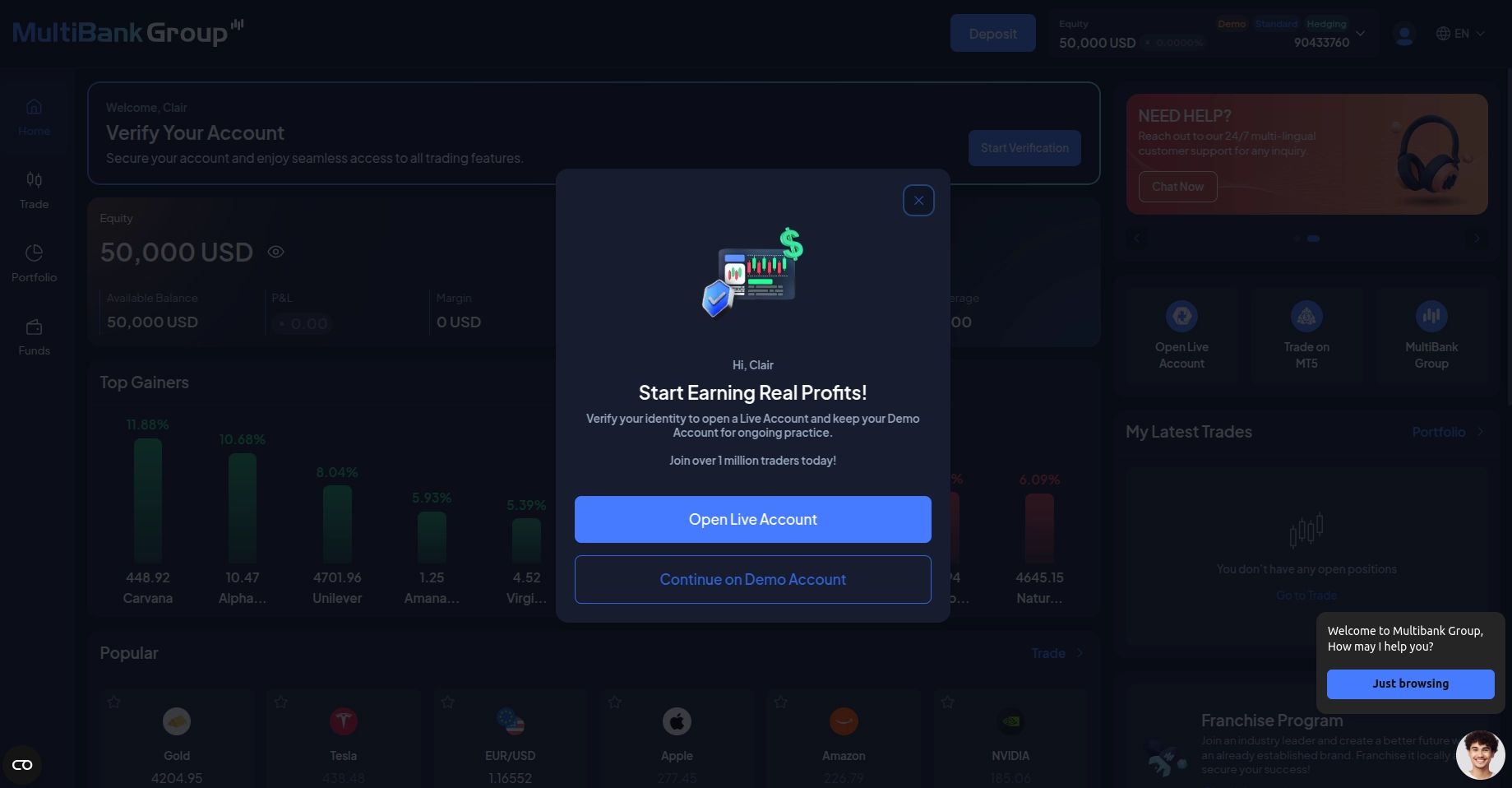

- The next essential step is account verification. MultiBank Group requires this step to ensure account security, maintain compliance with industry standards, and facilitate a smooth trading process. While the broker encourages immediate completion, users have the flexibility to pass the verification at this stage or postpone it.

- With the next step, traders either choose to verify their identity and address and open a live account or continue with a demo account. MultiBank Group, like all regulated financial institutions, adheres to Know Your Customer (KYC) protocols, which generally require two categories of documents to verify your identity and residency: Proof of Identity and Proof of Address. The Proof of Identity document must be a valid, government-issued photo ID that is an International Passport, National ID Card, or Driver’s License. Eligible documents for Proof of Address typically include a recent utility bill, bank statement, or credit card statement.

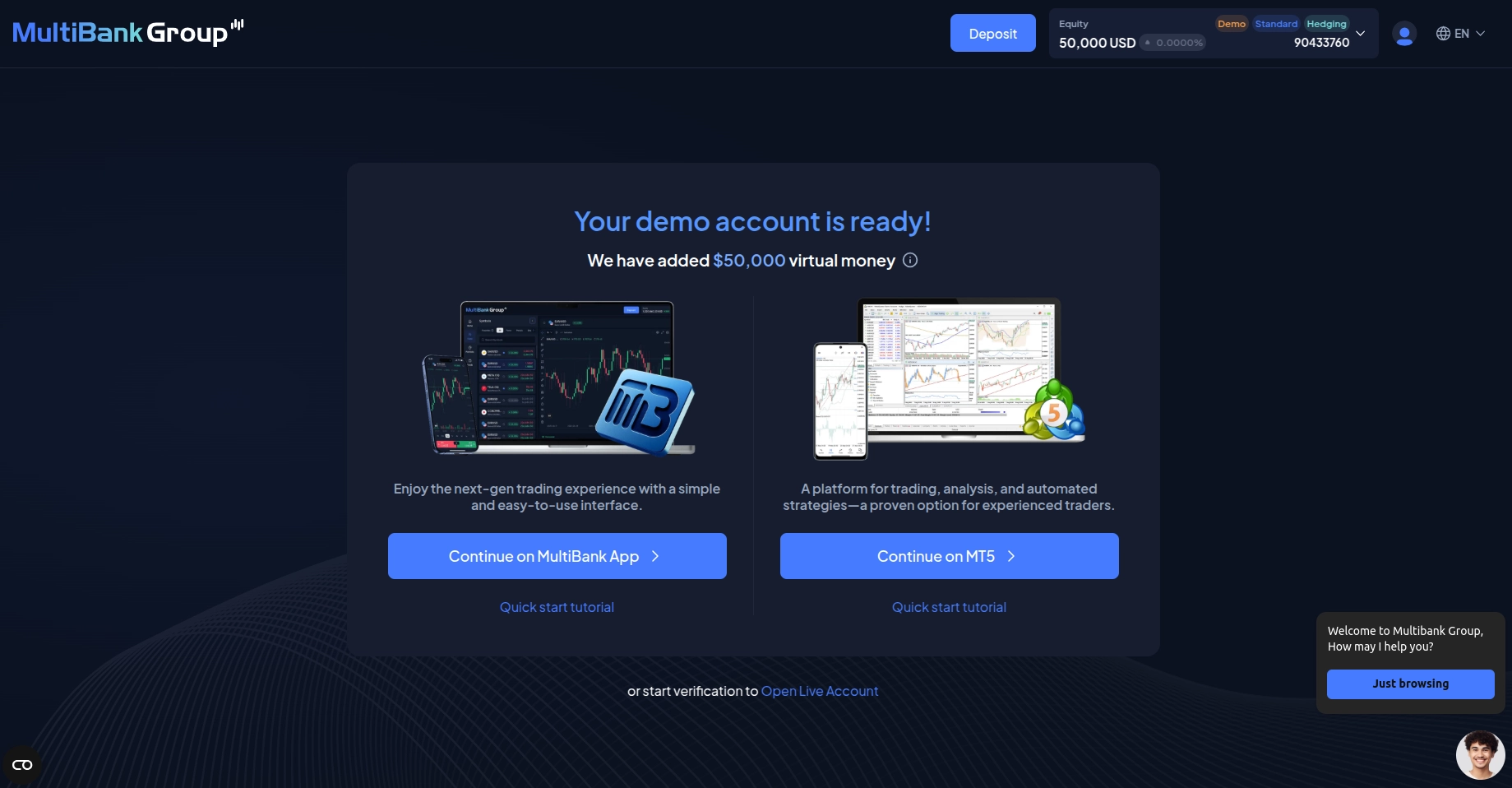

- If traders choose to open a risk-free demo account first, they must select their preferred trading platform: either MultiBank Group’s proprietary app or third-party MetaTrader software. Regardless of their choice, they must download and install the respective software, then check their email inbox for the necessary platform login credentials and further instructions. For those using the MT5 demo, they will receive $50,000 in virtual balance to explore the markets and practice their trading skills.

Final Impressions

MultiBank Group offers a compelling account opening experience that balances accessibility with depth. The broker caters to diverse needs, providing three core account types (Standard, Pro, and ECN), Islamic options, as well as MAM/PAMM accounts. The registration process is quick, streamlined, and clearly outlines the necessary KYC steps. With a vast portfolio of over 20,000 products across forex, shares, commodities, and crypto, MultiBank Group is an excellent choice for traders seeking a broad market selection and regulatory security.