M4Markets Account Types in Brief

M4Markets is a multi-regulated forex and CFD broker offering a curated selection of trading instruments, focusing on the most liquid and popular markets to ensure high-quality execution. While the portfolio is compact, it is highly specialized, covering essential assets required for a diversified strategy. The instrument offering includes nearly 50 forex pairs, commodities, indices, share CFDs, and several cryptocurrencies.

Operating under the oversight of the FSA (Seychelles), CySEC (Cyprus), and DFSA (Dubai), M4Markets provides a secure, tiered trading environment. Clients benefit from an average execution speed of 30 ms, competitive spreads, and flexible leverage options. The broker’s technical infrastructure is built on the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, with the advanced cTrader platform available for traders in jurisdictions regulated by CySEC and DFSA.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

M4Markets Minimum Deposit Requirements

To choose the right account for your capital, it is essential to understand how deposit requirements scale across M4Markets’ global entities. Depending on whether you are trading under the FSA, CySEC, or DFSA framework, the entry barriers vary to accommodate both retail beginners and professional high-volume traders. Below, we break down the minimum deposit thresholds for each primary account type:

Under its FSA-regulated entity, M4Markets supports the industry-standard MT4 and MT5 platforms, where it offers highly accessible entry options, including the Standard, Dynamic Leverage, and Cent accounts, with minimum deposits as low as $5. For more experienced traders, the Raw Spread and Premium tiers are available with requirements of $500 and $10,000, respectively.

Meanwhile, the sophisticated cTrader platform is provided for clients operating under its CySEC and DFSA entities. The account options include a Standard account, requiring a minimum deposit of €100, a Premium account, featuring a minimum threshold of €5,000, and a VIP account necessitating a minimum of €10,000. Eligible traders can opt for a Professional trading account, designed for customers demanding excellence and precision.

Specifically under the DFSA framework, the account types and deposit requirements mirror the CySEC structure, with the added provision of Sharia-compliant Islamic accounts designed for interest-free trading. Setting up a free demo account is possible across all entities of the broker, providing traders with a secure, risk-free environment to upskill or test out new strategies.

What Can You Trade at M4Markets?

M4Markets maintains a refined instrument suite that strikes a strategic balance between market variety and operational excellence. While all entities provide access to core markets, including forex, commodities, and indices, the broker offers an expanded asset catalog exclusively under its FSA-regulated entity to include share CFDs and cryptocurrencies.

The broker quotes nearly 50 currency pairs, encompassing major and minor crosses alongside select exotics, such as USD/HUF and EUR/NOK. The commodities offering includes a decent metals suite featuring Gold, Silver, Platinum, and Palladium against the US Dollar, while Gold can be traded against the Euro too. Energy markets cover both US Crude (WTI) and UK Brent oil. For index traders, M4Markets provides access to key global benchmarks, including the US30, US500, NAS100, DE40, UK100, and JP225, in addition to a curated selection of European and Asian mid-cap indices.

Traders operating under the FSA-regulated entity benefit from approximately 130 share CFDs, primarily focusing on US technology leaders, such as Apple, Tesla, and Microsoft, alongside a select range of major European and British blue-chip equities. This entity also supports cryptocurrency CFDs, allowing for 24/7 exposure to digital assets such as Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash.

Step-by-Step Registration at M4Markets – Takes Around 15 Minutes

Now that we have covered M4Markets’ account types, minimum deposit requirements, and tradable assets, we can examine the account registration process, which is streamlined and designed for rapid onboarding. The entire procedure, from initial sign-up to accessing the client portal, is optimized to minimize friction while adhering to strict global regulatory standards.

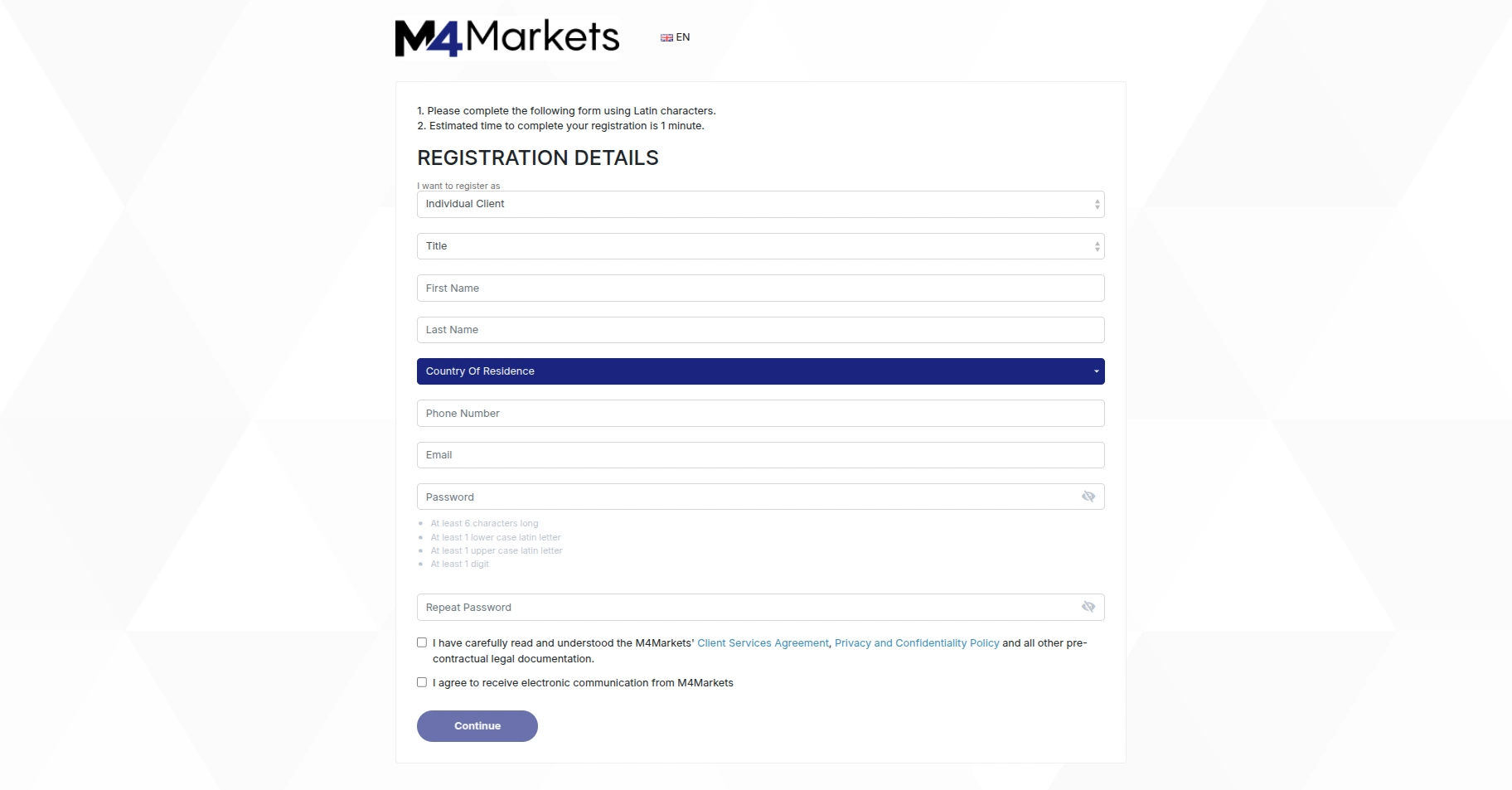

- To open an account at M4Markets, visit the broker’s website, select your primary regulatory entity (FSA, CySEC, or DFSA) based on your residency, and navigate to the ‘Open Account’ button in the top right-hand corner.

-

You will be prompted to provide basic contact information, including name, country of residence, phone number, and a valid email address.

-

The broker then sends a confirmation PIN to the registered email, which needs to be entered in the designated field, to verify your contact details.

-

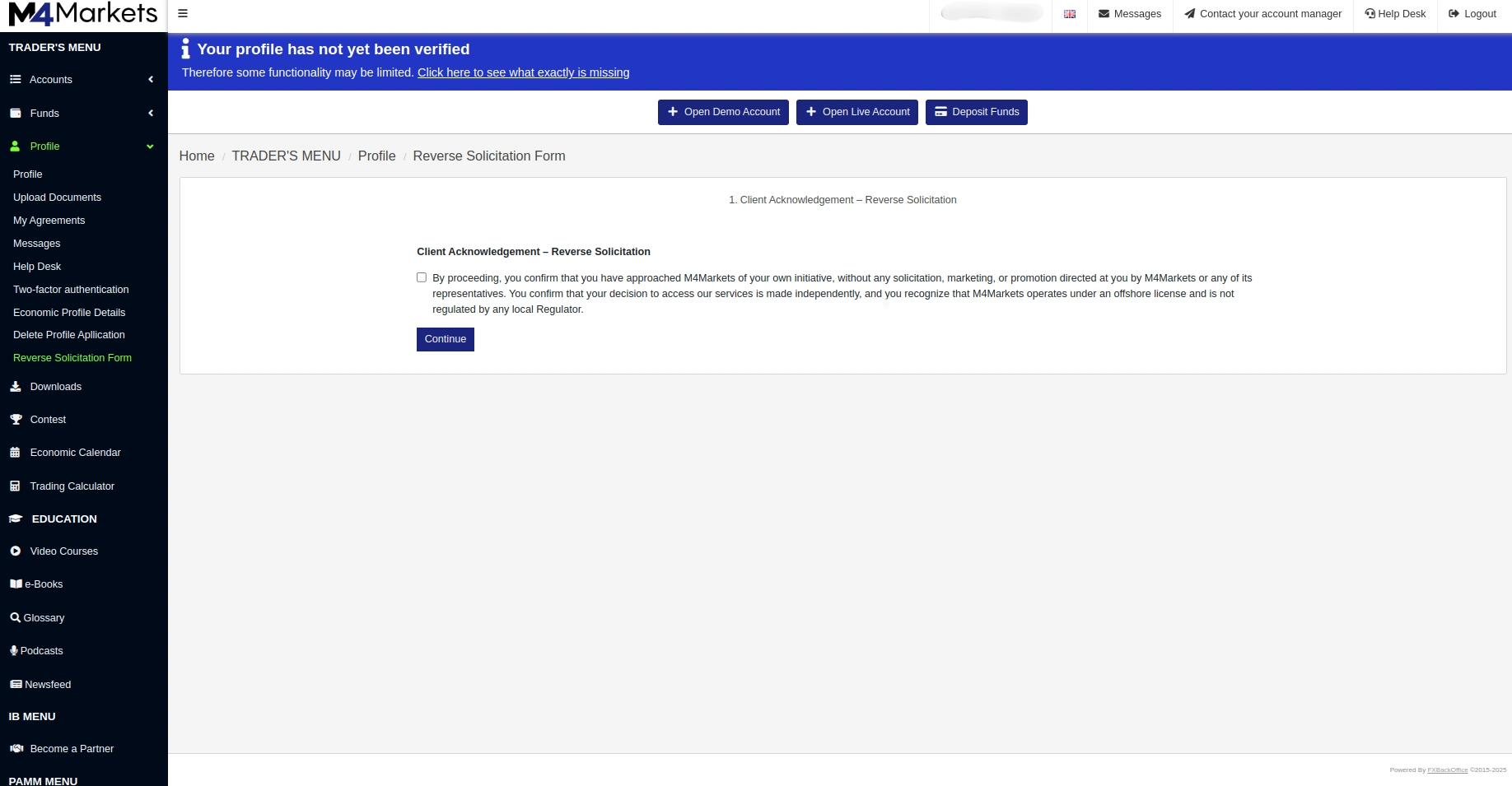

With the email confirmation done, traders can access the trader’s menu, where they can open a demo or live account and deposit funds.

-

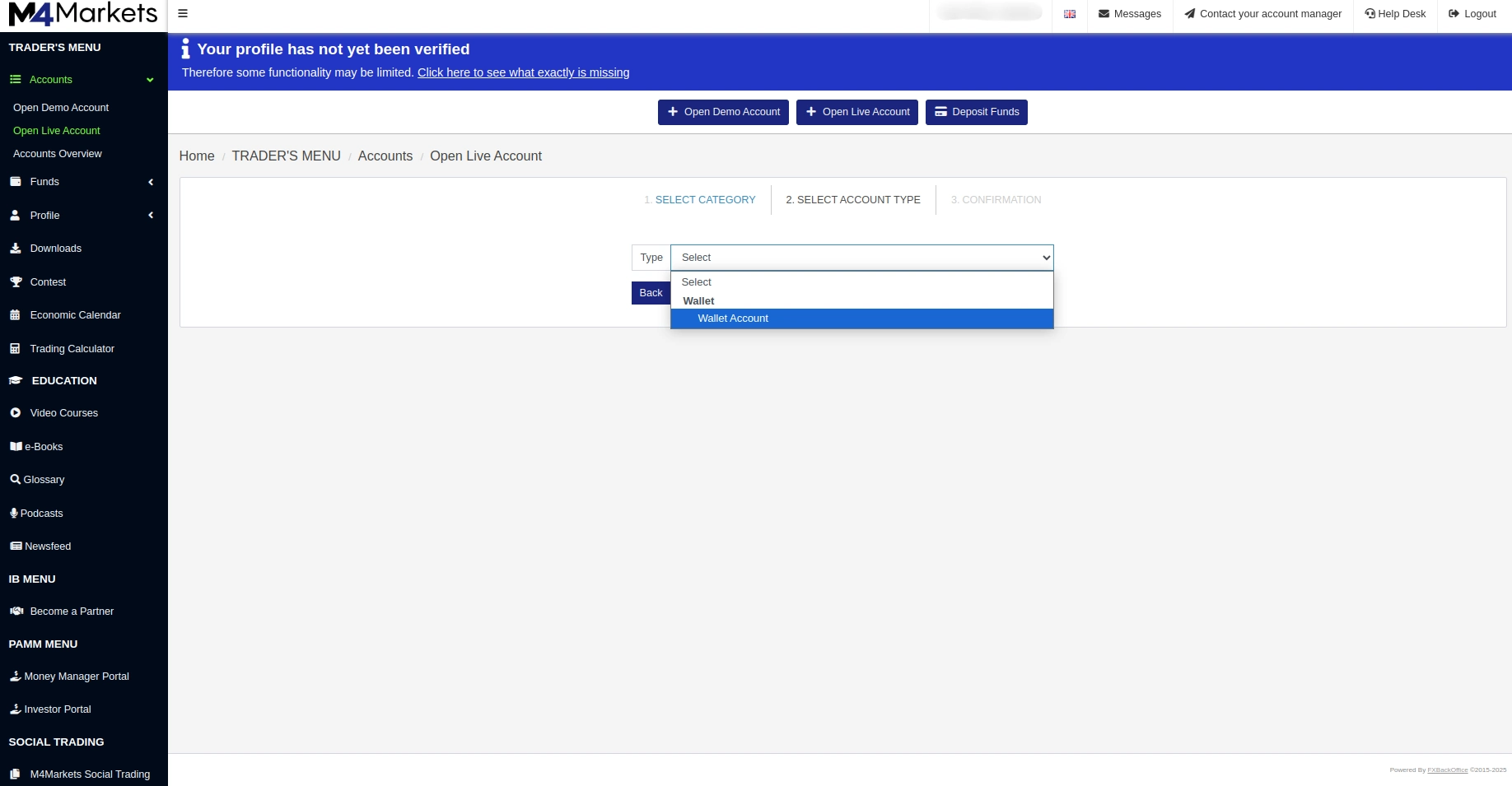

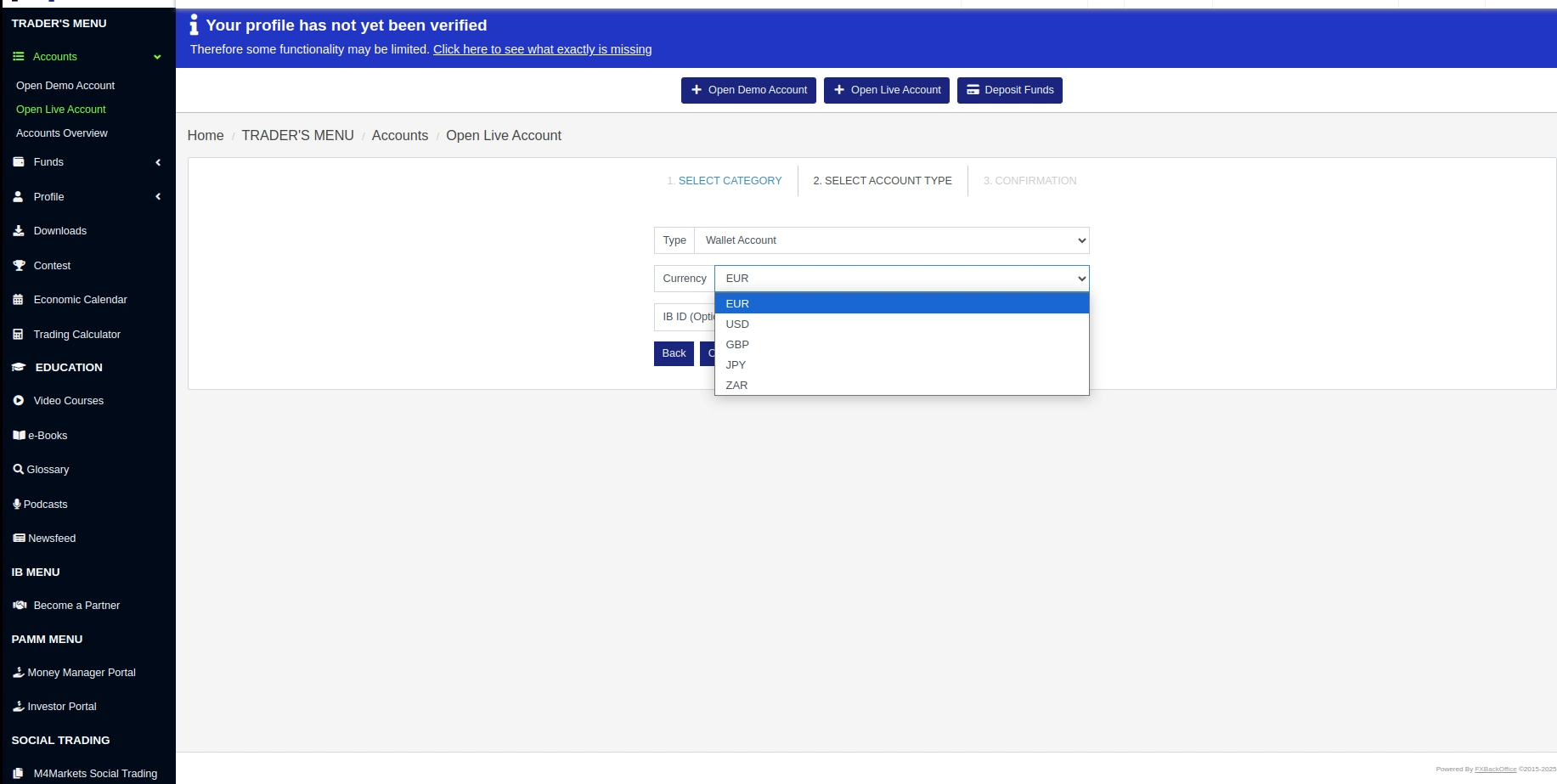

During registration, clients are asked to choose between a Wallet and a Wallet Account. The Wallet functions as a central funds management area where deposits and withdrawals are processed, while a Wallet Account is a trading account linked to the wallet and used for placing trades on the platform. Funds must first be deposited into the wallet and then transferred to a wallet account before trading can begin.

-

At this stage, you must also designate your base account currency, with options typically including USD, EUR, GBP, JPY, and ZAR. Traders must choose their desired trading platform, account type, leverage, and starting account balance (in case of opening a demo account).

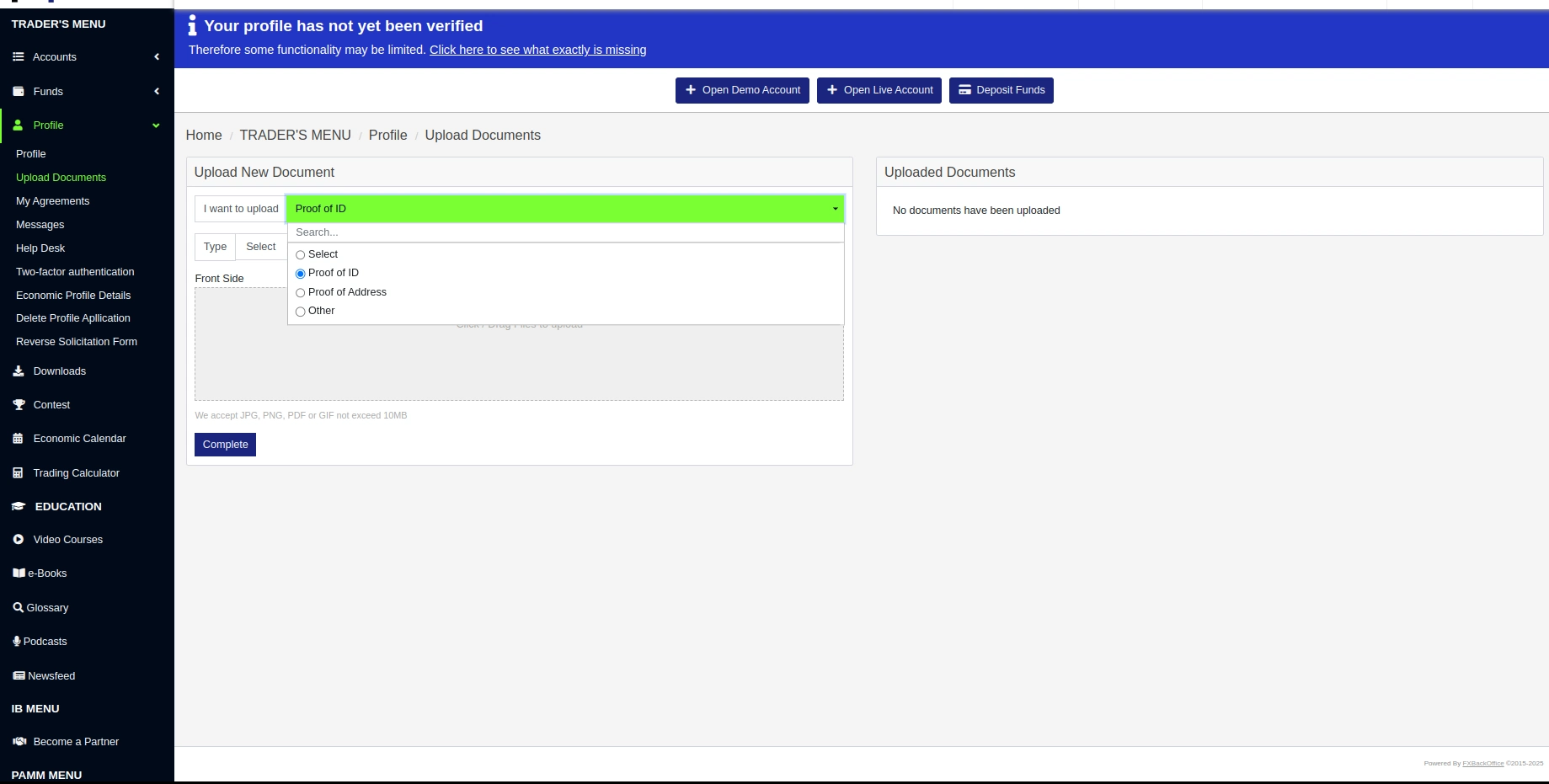

- To unlock full account functionality and enable withdrawals, you must upload two primary documents for verification: Proof of Identity (PoI) and Proof of Address (PoA). To complete the first part, submit a high-resolution color scan of a valid passport, national identity card, or driver’s license, ensuring all four corners and the expiration date are clearly visible.

-

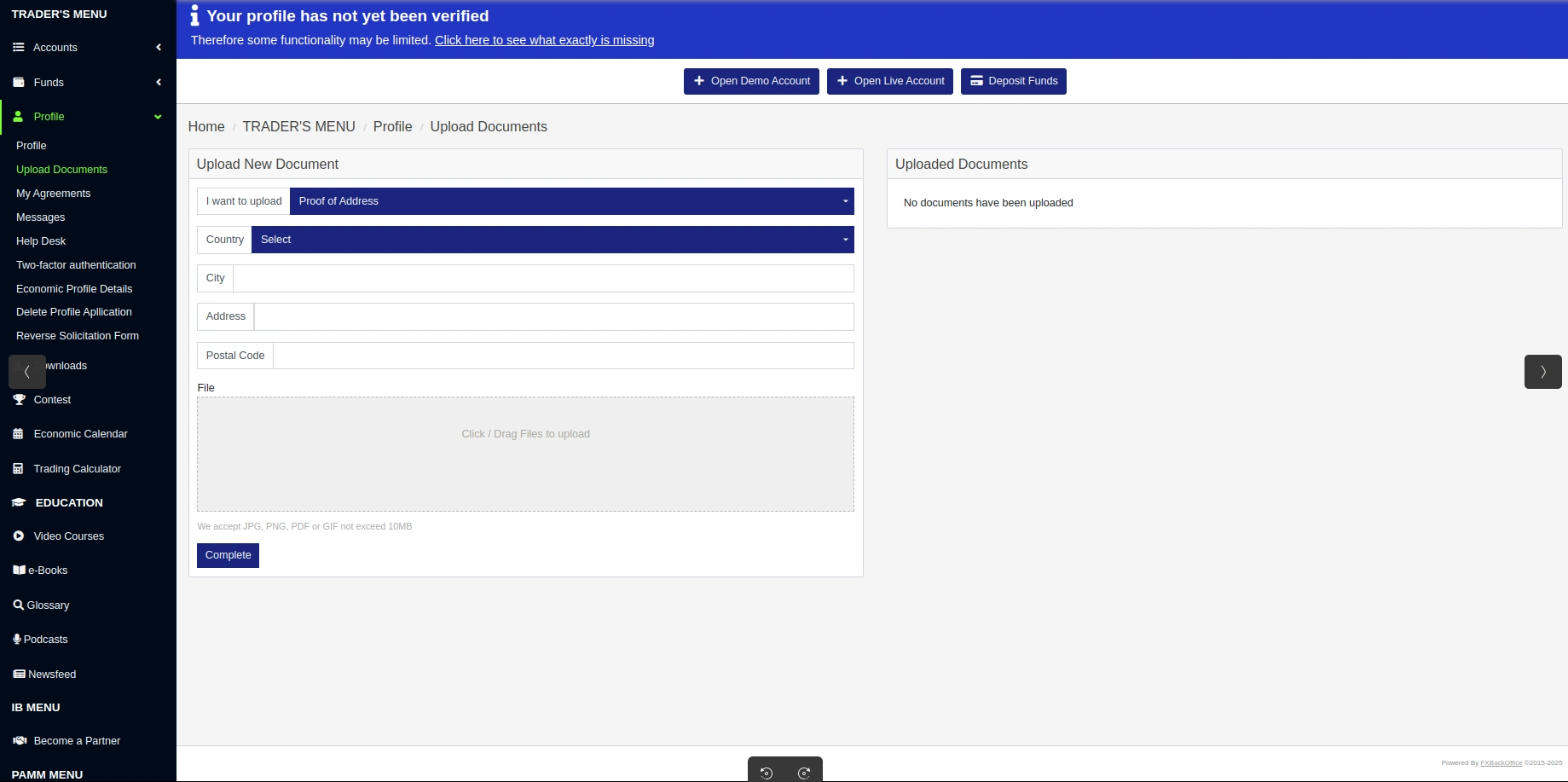

Provide an official document, such as a utility bill, bank statement, or local tax bill, issued within the last six months that clearly displays your full name and registered residential address.

-

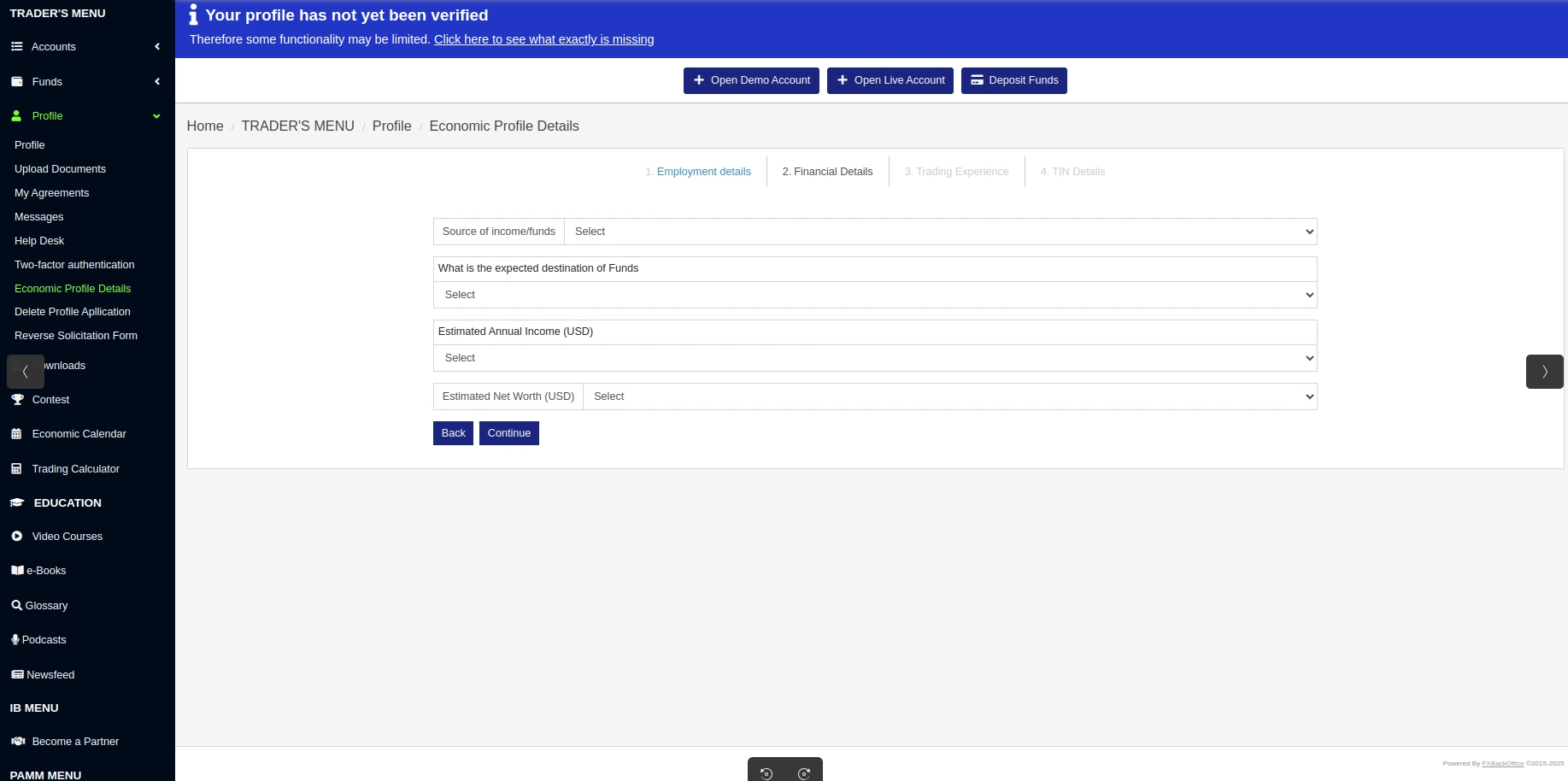

The last part of the account configuration process covers various economic details, including traders’ employment status, financial information, trading experience, and TIN details. The ‘Employment Status’ section, for example, covers information on source of funds, expected destination of funds, estimated annual income, and estimated net worth.

Final Impressions

M4Markets excels by lowering entry barriers through an exceptionally diverse account ecosystem. From the accessible Cent and Standard accounts for retail beginners to high-tier Raw and Premium options for professionals, the broker ensures that capital levels never dictate execution quality. Whether utilizing MetaTrader or cTrader across various global entities, traders receive a customized experience aligned with their specific regulatory needs. Ultimately, the broker demonstrates a commitment to suit the needs of every trader while maintaining institutional-grade performance.