Account Types at HF Markets

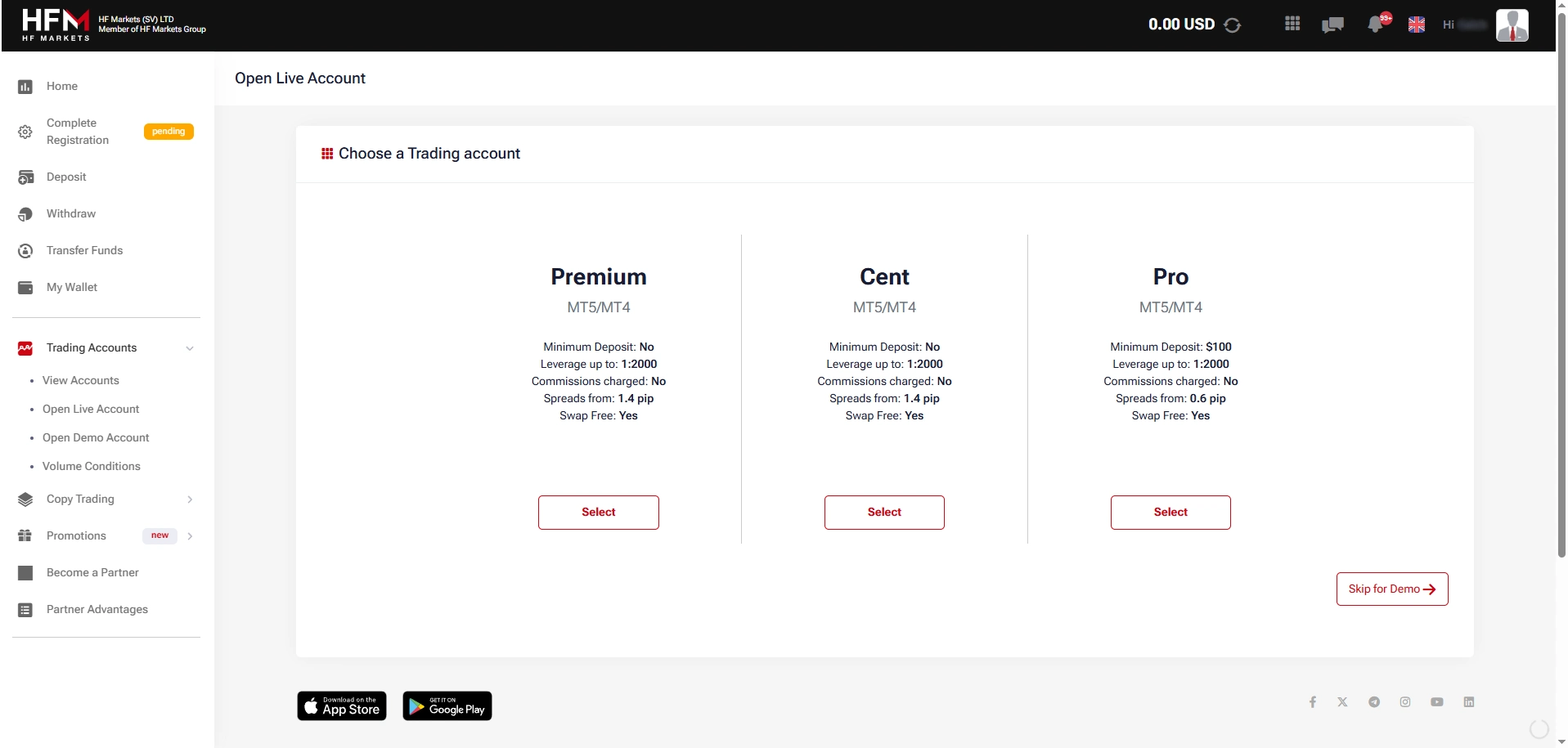

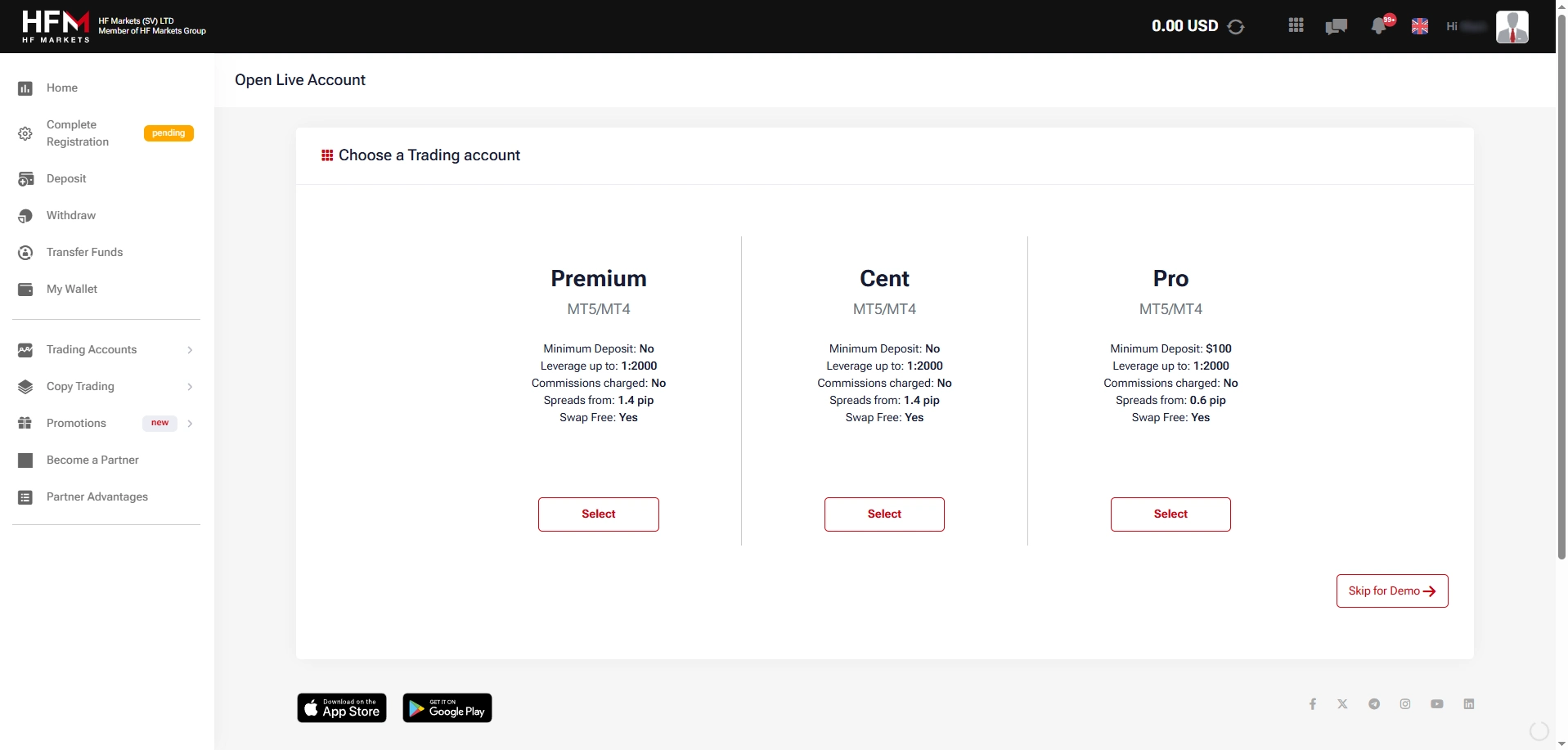

A diverse range of account types ensures that HF Markets (HFM) can accommodate traders the world over. The first option, dubbed Premium, is the broker’s standard spread account offering. It supports all base currencies, does not require that users pay additional commissions when they trade, and its spreads start at 1.4 pips. Cent accounts are similar but require that clients utilize the USC (US Cent) currency, and trading is conducted with micro lots.

Another zero-commission account type suitable for retail traders is named Pro. Its spreads can go as low as 0.6 pips, but you are required to deposit at least $/€100 if you decide to create such an account.

As for those willing to pay commissions and reap the benefits of spreads that can drop to 0.0 pips, Zero accounts are the perfect option. The commission stands at $6 per trade (round turn), which is reasonable, and when accounting for the ultra-low spreads this account offers the best trading conditions in terms of costs.

A region-exclusive account type of note is the Professional Account. This option is available in the UK and allows locals to enjoy leverage far higher than the FCA-mandated 1:30 cap. If you reside in the UK and are looking to become a professional trader at HFM, you would need to meet no less than two of the requirements outlined below:

- Have a capital of more than €500,000

- Have 1+ years of professional experience in the financial sector

- Have a trading portfolio comprising 40 traders that have been conducted within the last four quarters

Muslim traders have also been taken into consideration. Each of the aforementioned account offerings is also available for swap-free trading, giving users who must follow Sharia laws ample options to pick from.

Copy trading and PAMM accounts are also present in HFM’s account catalog, allowing novices to leverage the skills of seasoned traders. As for those who would like to avoid passive trading but are complete beginners, opening a demo account is a great way of honing your skills and expanding your knowledge without the risk of losing real cash. If you would like to learn how to create such an account, this publication offers a step-by-step guide that outlines the entire process.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

HF Markets Minimum Deposit Requirements

The vast majority of HF Markets’ retail accounts do not demand that you meet minimum deposit requirements. The one exception, as established, is the Pro account, which needs a reasonable deposit of $/€100. The base currencies are USD, EUR, GBP, ZAR, and US Cent, though the exact roster of viable currencies differs by location and account type.

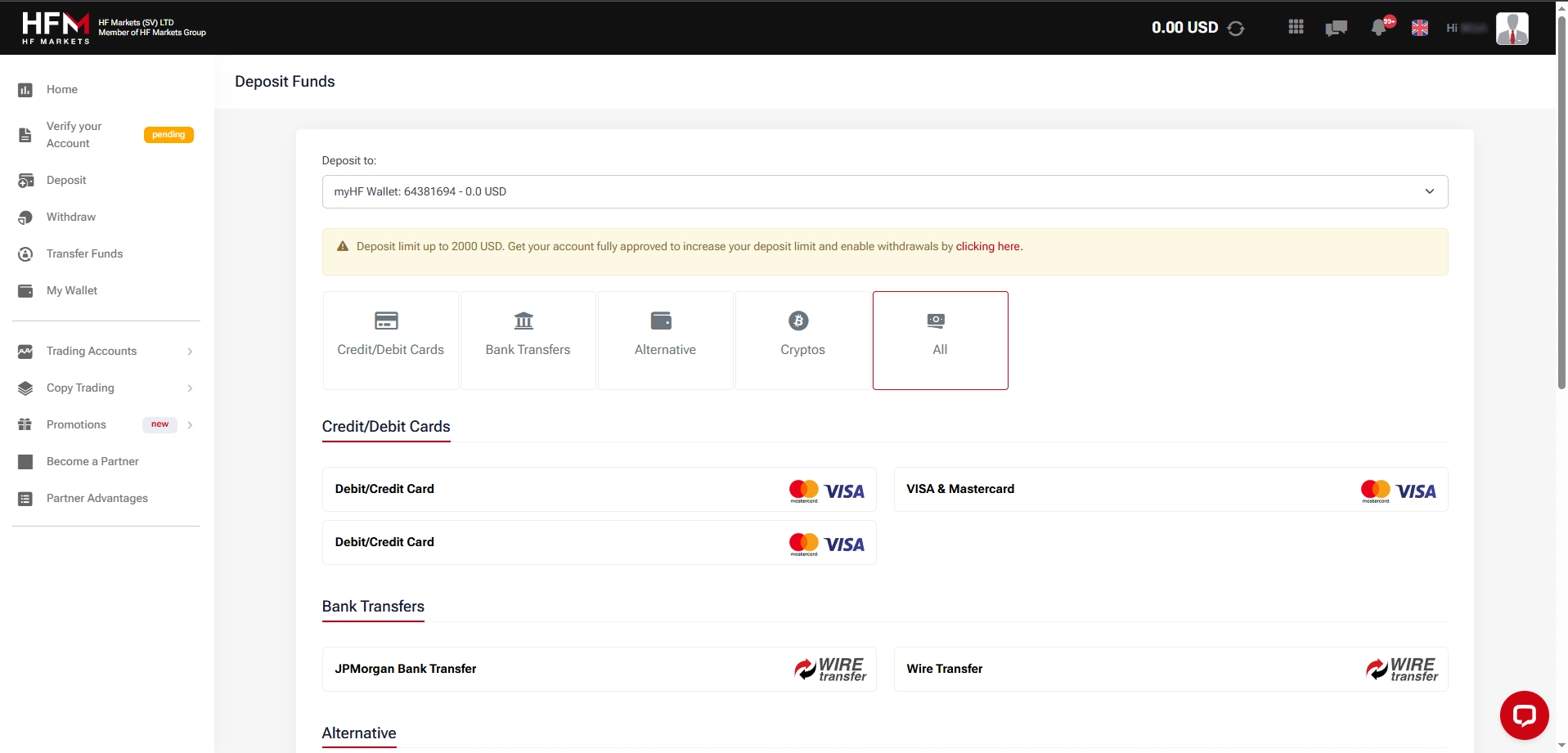

Do keep in mind that you may still need to adhere to a deposit minimum based on your payment method of choice. Bank cards require that you deposit at least $5 per transaction, and the same applies to Fasa Pay and Neteller transfers. Topping up one’s account via Skrill, meanwhile, can be done with $10 or more, while crypto payments start at $30. Finally, wire transfer deposits involve a minimum amount of $100.

The aforementioned figures and banking solution options apply to client accounts created at the HF Markets entity based in St. Vincent and the Grenadines, so make sure to check the deposit terms and conditions of your local HFM branch before you register.

What Can You Trade at HF Markets?

HF Markets’ catalog boasts a decent range of trading instruments, starting with over 50 forex pairs. Majors, minors, and exotics are all included in the broker’s offering, and EUR/USD spreads can fall to 0.0 pips if you open a Zero account.

In terms of commodities, metals and energies are given their dedicated pages on the official HFM website, with XAU/USD, XAG/USD, palladium, UK Brent oil, and US Crude oil being some key examples. Users interested in soft commodities, meanwhile, can speculate on the price fluctuations of US cocoa, coffee, copper, US cotton, and sugar.

Major indices such as the S&P 500, the German DAX, and the UK FTSE 100 are a few of the instruments comprising HFM’s index offering, and individual stocks of companies like Meta, Apple, Tesla, and other industry giants are also on offer. Another perk of trading HFM is access to bond and ETF markets, both of which can be traded through CFDs.

Last but not least, blockchain mavens have a notable 70+ coins to choose from. This roster far outdoes the crypto offering of many FX brokerages, and the leverage of up to 1:1000 is another perk for HFM-registered crypto enthusiasts.

Speaking of leverage, HF Markets’ St. Vincent and the Grenadines branch boasts leverage ratios that can reach 1:2000 when it comes to certain instruments. However, the broker also stresses that clients should be familiar with the significant risks tied to trading with leverage before they decide to utilize it, seeing as it has the potential to amplify profits and losses alike.

Step-by-Step Demo Account Registration at HF Markets – Takes about 4 Minutes (SVGFSA)

- Go to HF Markets’ website and follow the “Free Demo Account” link.

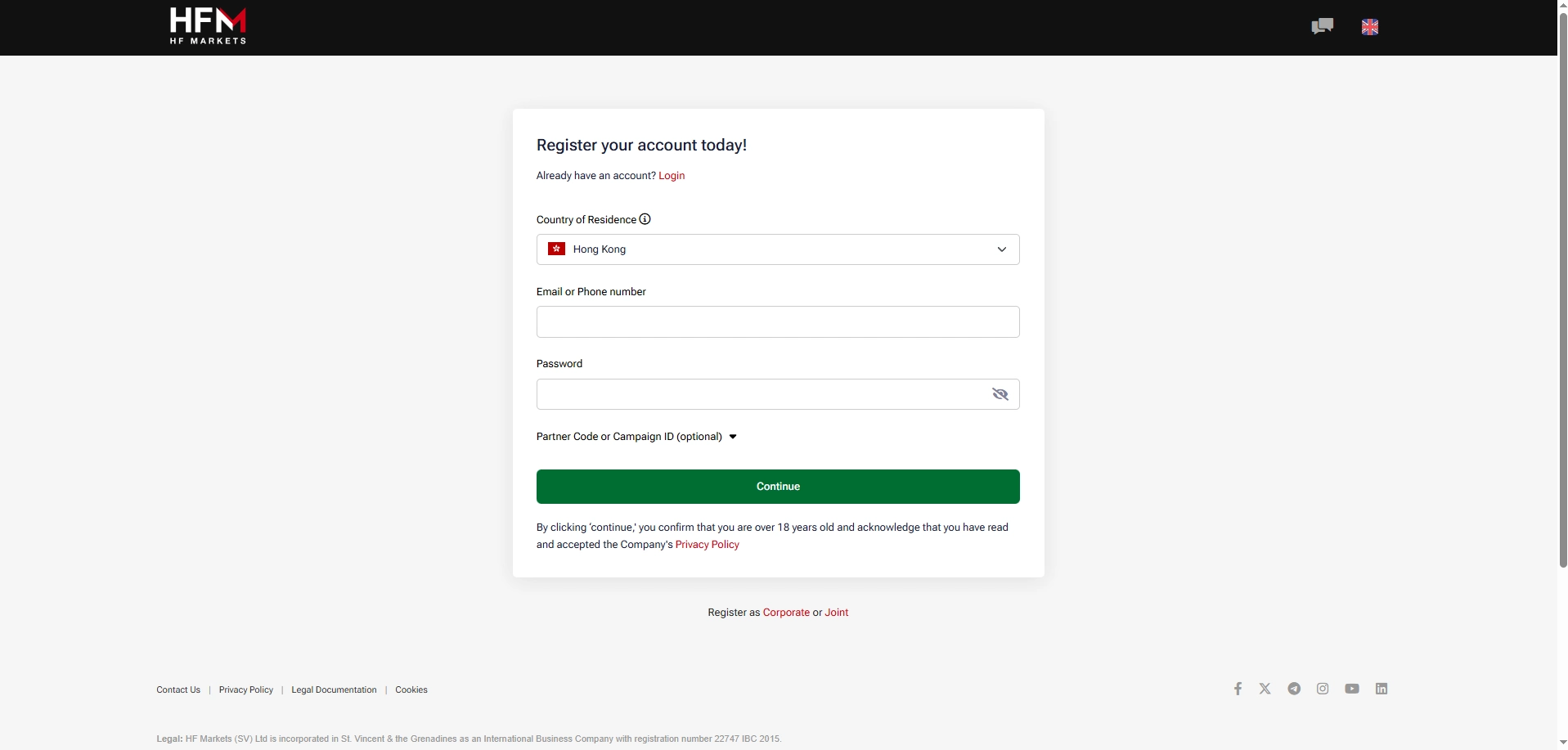

- Choose your country of residence, provide your email or phone number, and input a strong password. If you have a Partner Code or Campaign ID, you can use them here well. Otherwise, click Continue.

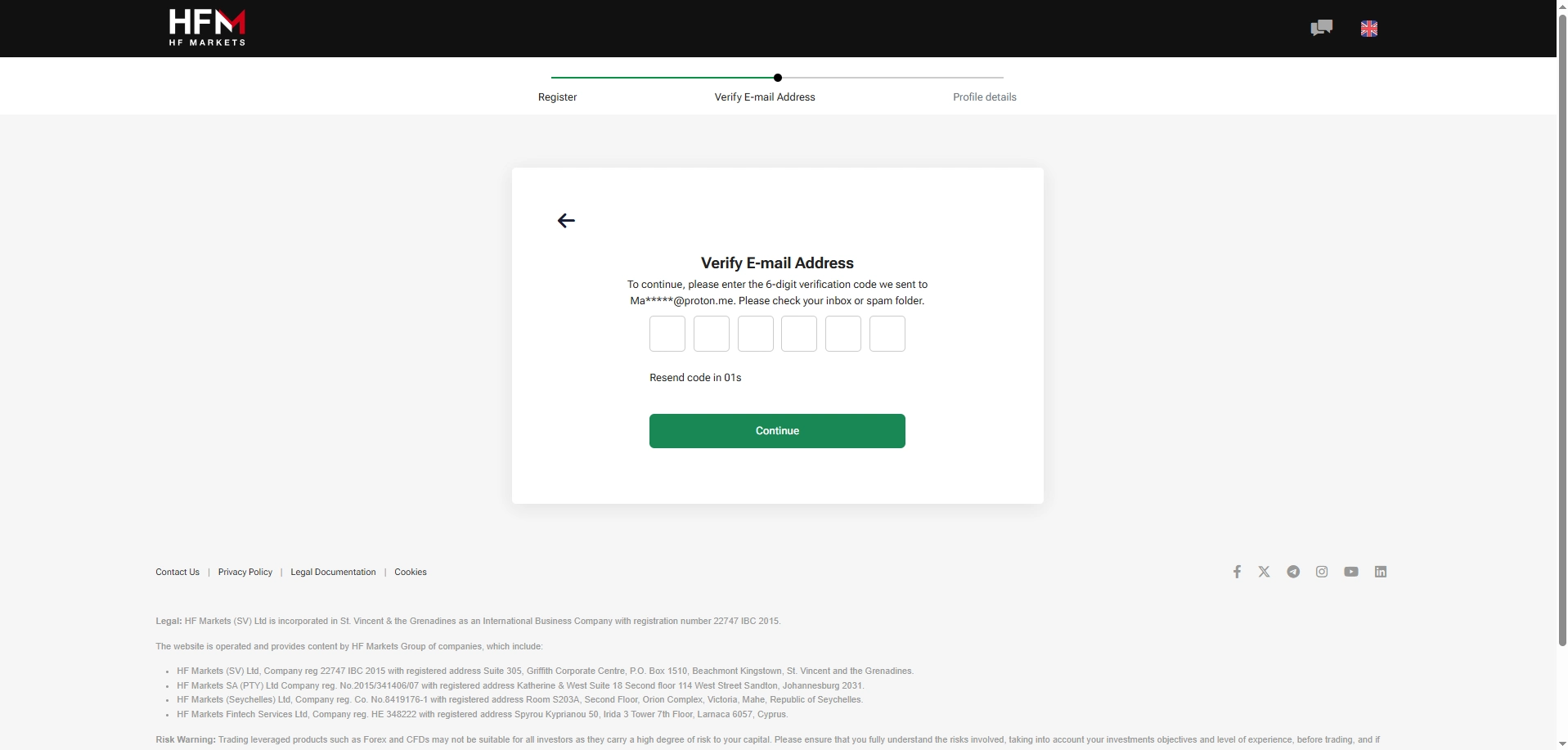

- Completing the previous step will result in HF Markets sending you an email with a 6-digit verification code. Check your inbox and input the provided code in the designated field on the website.

- Provide key profile details such as your first and last name, phone number, and date of birth. Choose your myHF currency, then confirm that you have read and agree with the broker’s Terms and Conditions.

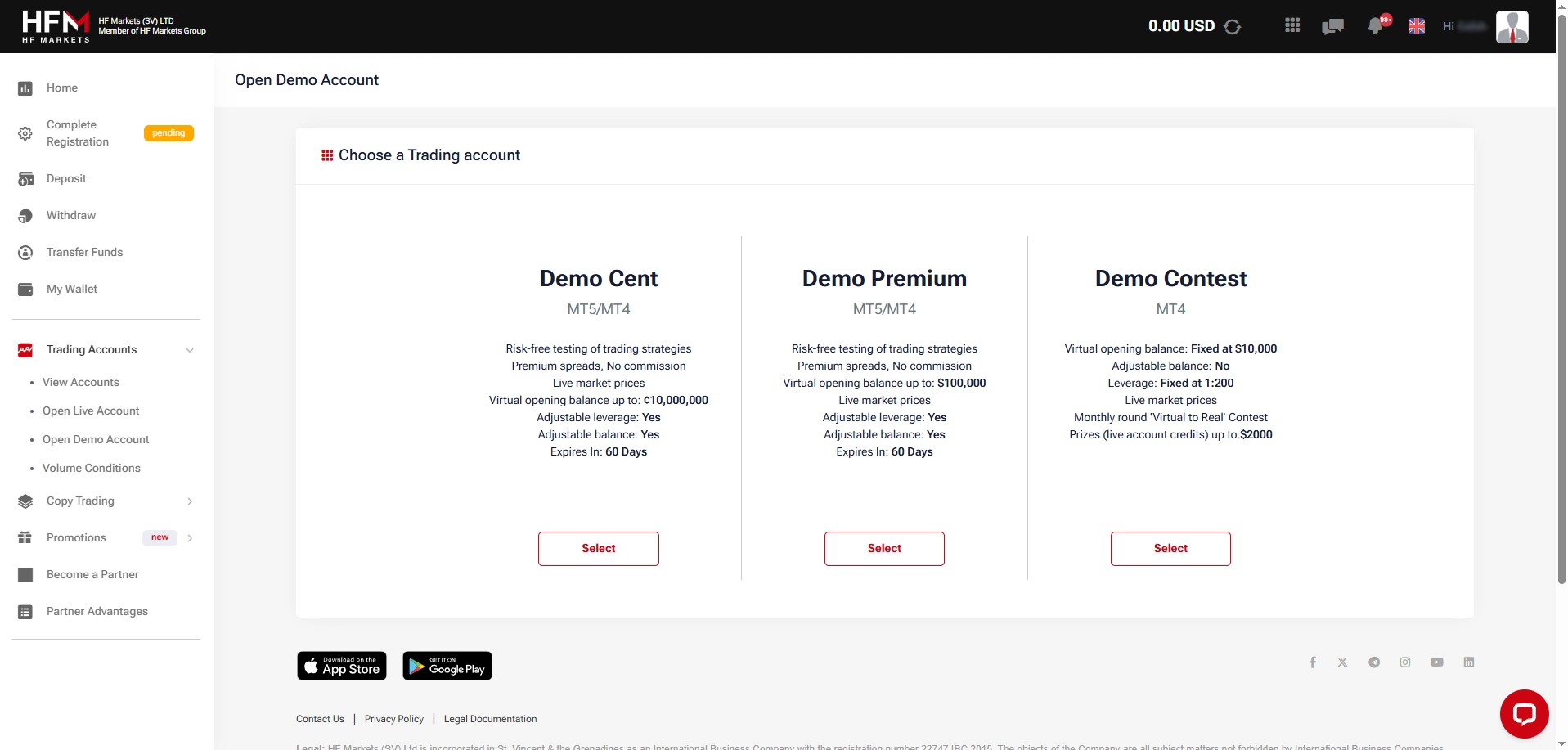

- Select the Trading Accounts menu on the left and click Open Demo Account.

- Pick the demo account type you plan on opening. The options vary based on the HF Markets entity and its respective licensing. In this case, we can open Demo Cent, Demo Premium, and Demo Contest accounts, with the former two being temporary accounts that expire within 60 days after opening. To proceed to the next step, click Select under your chosen account type.

- Configure your account details by picking a platform, the account currency, the leverage cap, and the virtual balance amount. Then, create a password, and tick the Terms and Conditions box. This concludes the demo account creation process.

Step-by-Step Live Account Registration at HF Markets – Takes about 10 Minutes (SVGFSA)

Opening a live account at HF Markets is generally straightforward and will not take up too much of your time. Nonetheless, we should stress that the process can differ slightly based on your country of residence and the regulator that oversees the local financial sector. In the UK, for example, creating an account also involves inputting your tax number and completing the Appropriateness Assessment. Meanwhile, registering at the Saint Vincent and the Grenadines HFM entity involves neither.

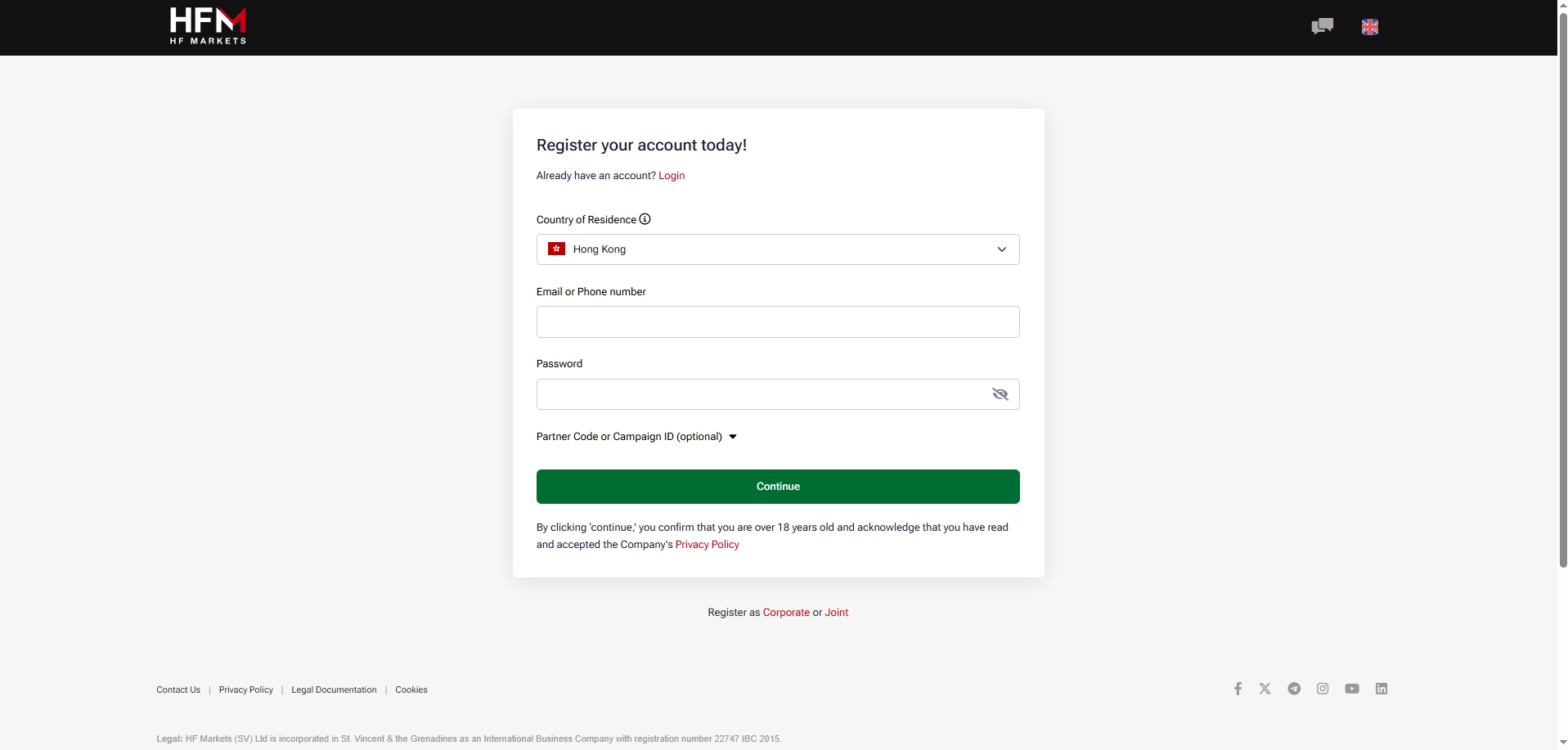

- Pay a visit to HF Markets’ official website and click the Register button, which is located at the top right.

- Select your country and input your phone number or email. Then, create a password and provide your Partner Code or Campaign ID. The latter two are optional.

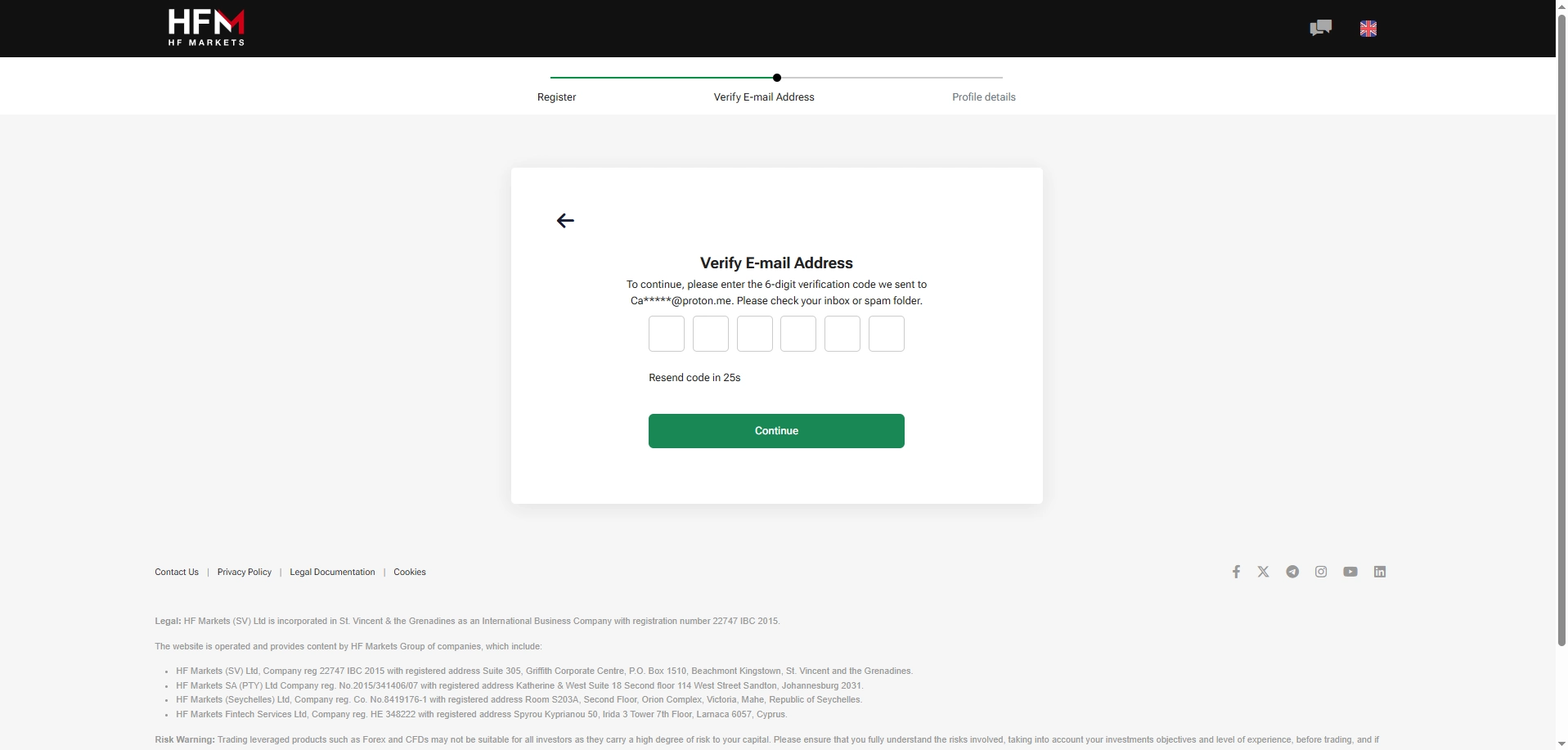

- Verify your email by inputting the code that HF Markets sent to your email. If you cannot find the email in your main or spam folder, you can request that the code be resent.

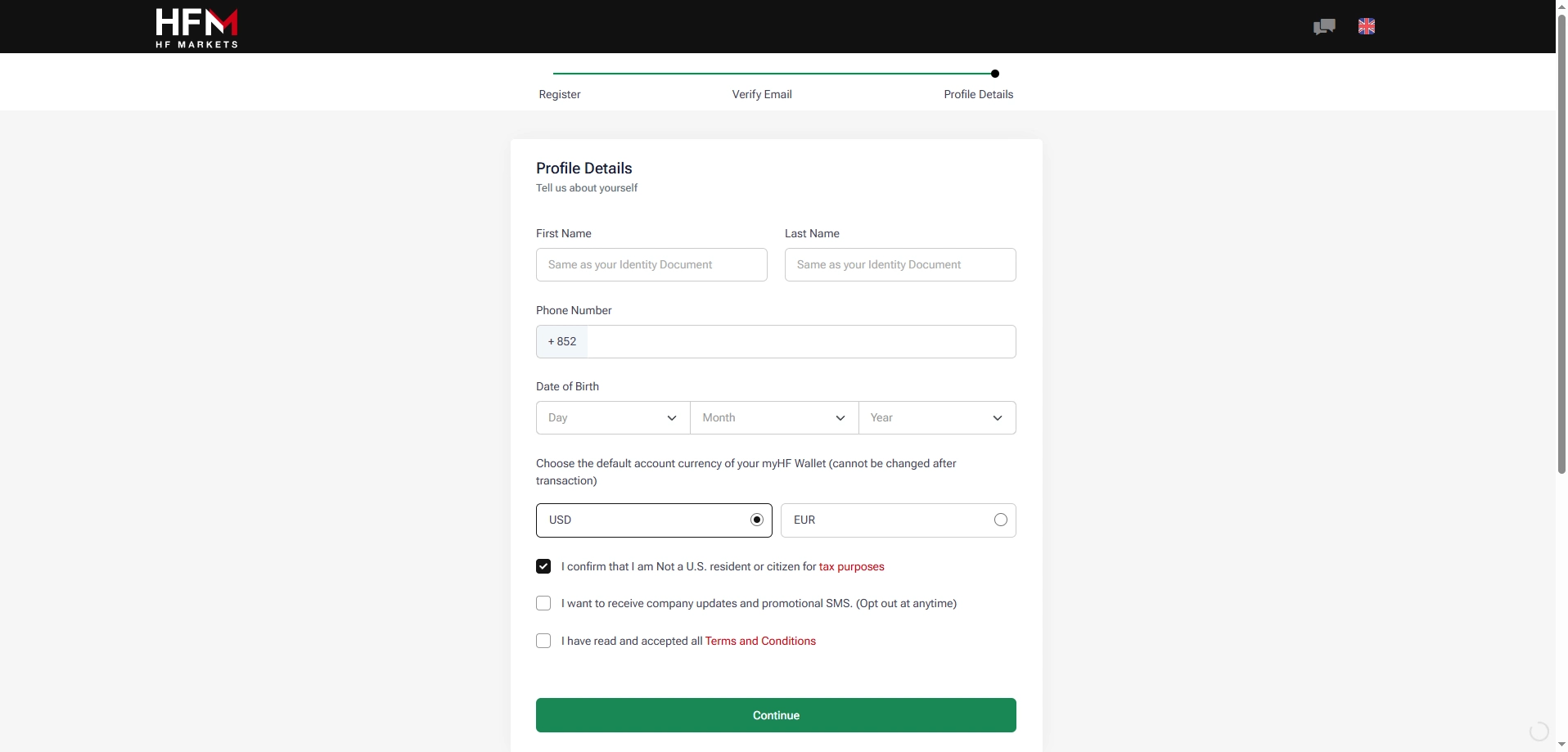

- Write your first and last name and phone number. Input your date of birth, then pick a myHF Wallet currency. Finally, tick the “I have read and accepted all Terms and Conditions” box before clicking Continue.

- You can choose to create a live account right away, with the options typically being Premium, Pro, Cent, and, depending on your jurisdiction, Zero.

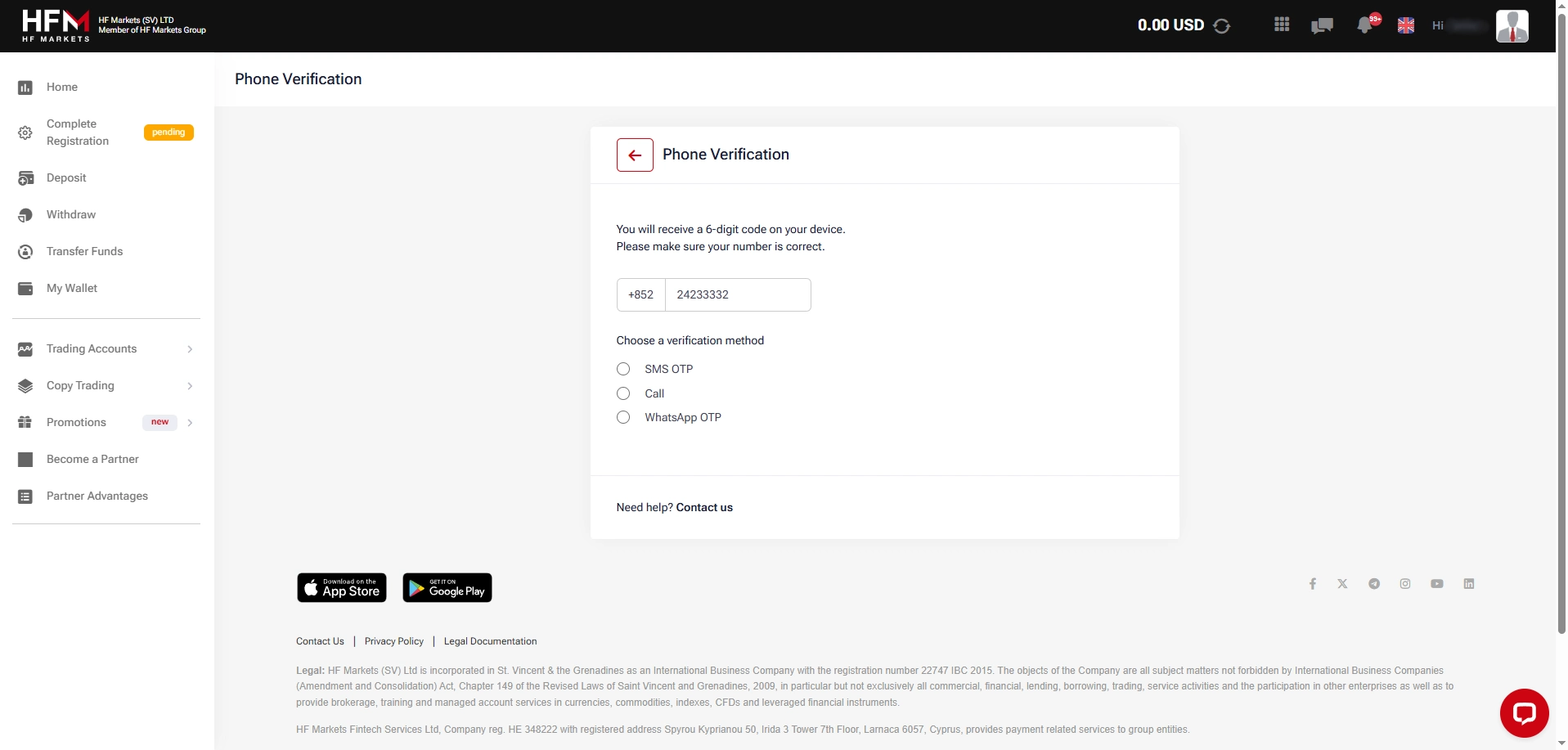

- If you click select, you will need to verify your phone number via SMS OTP, Call, or WhatsApp OTP. However, as the functions of your trading account (including deposit limits) will be restricted without fully registering and verifying your details, it is advised that you Complete Registration by selecting the relevant link from the menu on the left.

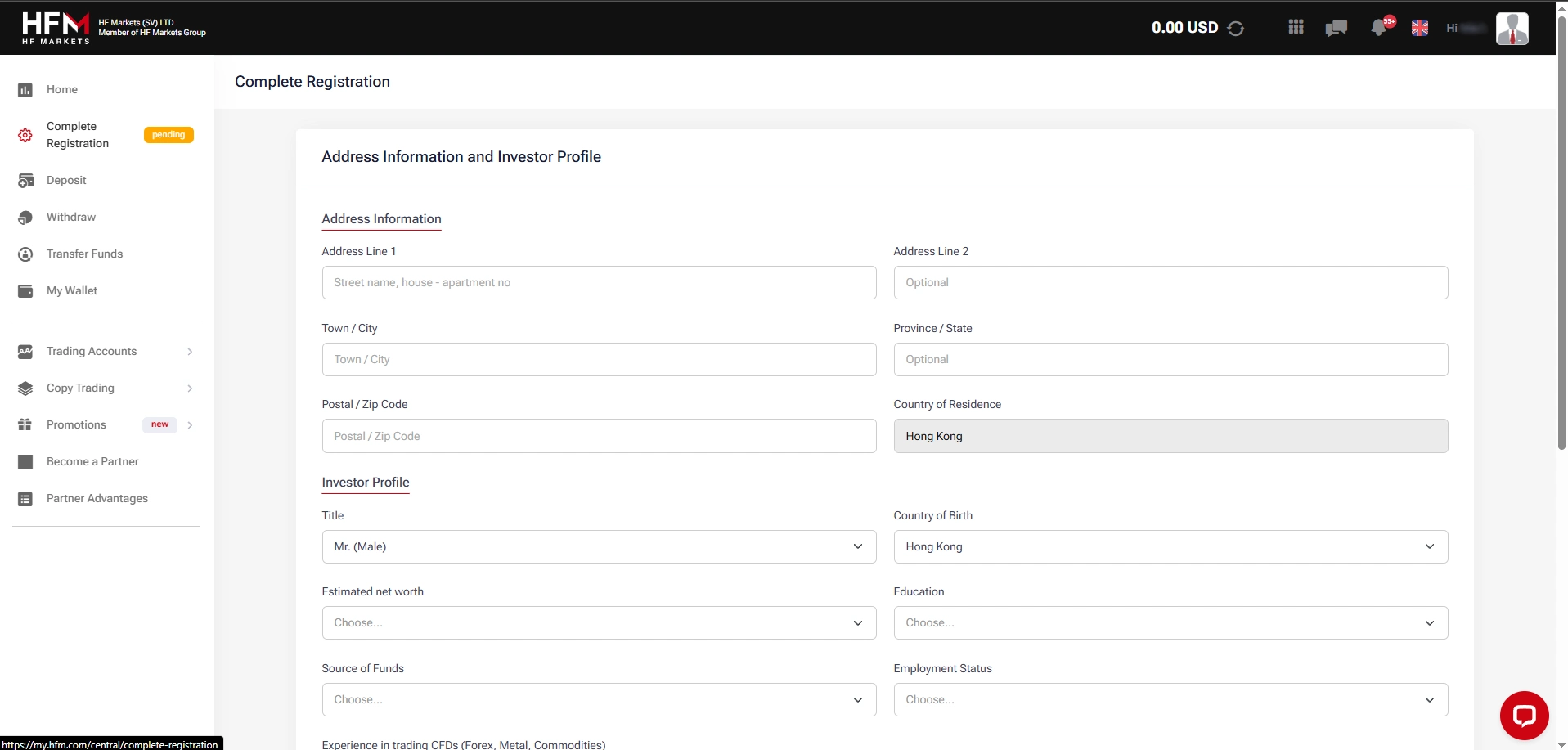

- Fill out your address and complete your investor profile. This will require that you specify your estimated net worth, education level, the source of your funds, and employment status. Finally, clarify what experience you have with trading CFDs.

- You will be prompted to top up your balance. As established, doing so before completing verification will limit the amount of money you can deposit, so you can instead pick “Verify Your Account” from the menu on the left.

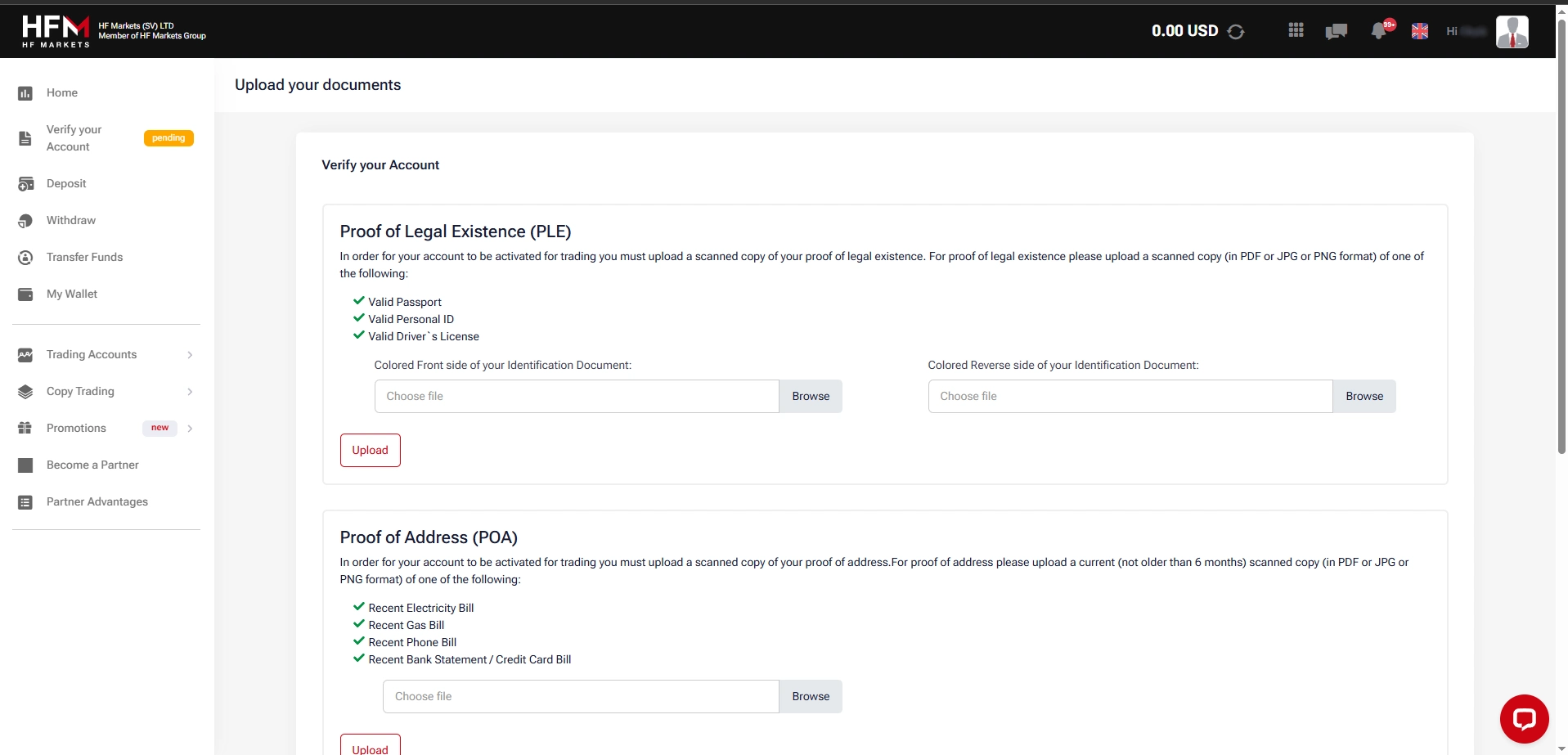

- You will be asked to submit Proof of Legal Existence documentation, with the valid options being a passport, ID, and driver’s license. Providing Proof of Address (POA) is also mandatory, and the document types you can pick from include a recent electricity bill, gas bill, phone bill, and bank statement/credit card bill. Once you complete the verification process, you will be ready to deposit, configure your account details, and start trading.

Overall Thoughts

All in all, creating an account at HF Markets is a relatively swift process. Demo accounts in particular require no verification or the provision of extensive personal information to be functional. However, as stated previously, some of these accounts are not permanent.

As for opening a live account, this takes more steps, but if you follow the above instructions, you are unlikely to face any hurdles throughout the process. Still, it is worth noting that HFM’s customer support team is equipped to assist clients should something go wrong, so do not hesitate to get in touch with a representative of the support staff if necessary.