ActivTrades Account Types in Brief

ActivTrades offers a diverse selection of accounts designed to suit the needs of traders at different experience levels. The broker provides individual retail accounts, swap-free and demo accounts. Individual accounts enable commission-free trading across all asset classes bar stocks, with support for micro-lot trading and the option to register jointly with a relative. Customers looking to comply with the Sharia law can engage in swap-free trading via Islamic accounts where overnight positions incur administrative fees in place of overnight funding charges.

European clients trading under the CMVM and FCA-licensed entities have the additional option to register professional accounts provided they meet the criteria. Upgrading to a professional account is associated with various perks including higher leverage of up to 1:400, eligibility for cashbacks, and participation in exclusive seminars. Fledgling traders can opt for the demo account to practice in a realistic, risk-free environment with up to $200,000 in virtual funds and customizable leverage. The broker supports over 10 base currencies, including USD, EUR, CHF, and GBP.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

*MAM accounts are available to institutional clients only.

ActivTrades Minimum Deposit Requirements

ActivTrades generally maintains a low barrier to entry for onboarding customers, imposing no minimum initial balance requirements on clients registered under the FCA, FSC, and CMVM-regulated entities. Customers from certain countries like Brazil and China must start with at least R$100,000 and $500, respectively. The broker works with a comprehensive suite of deposit methods, including bank transfers, e-wallets like PayPal and Skrill, credit and debit cards, and even cryptocurrencies for those registering through the Bahamas and Mauritius divisions.

While most deposit methods facilitate free transactions, withdrawals via bank transfers may attract an additional fee of $12.50 when initiated via dollar-denominated accounts at the European division. Deposits are processed quickly, often within half an hour with cards and e-wallets. It is advisable to fund your account in your native currency to avoid the 0.5% conversion fee.

What Can You Trade at ActivTrades?

ActivTrades provides a strong selection for portfolio diversification, offering over 1,100 contracts for difference across 7 major asset classes. This comprehensive range includes roughly 54 currency pairs, a vast lineup of over 1,000 stocks, and a solid selection of commodities and indices, including cash and futures contracts. A distinctive feature of ActivTrades is the availability of more sophisticated instruments like exchange-traded funds and bonds, also tradable through contracts for difference.

While the broker offers a modest selection of roughly 15 cryptocurrencies, their availability is jurisdiction-dependent, as FCA-regulated retail clients cannot trade them. Maximum leverage also varies significantly based on the entity, ranging from the European retail cap of 1:30 for major pairs up to an impressive 1:1000 under the Mauritius entity.

Step-by-Step Registration at ActivTrades – Takes Around 15 Minutes

- Access the ActivTrades entity regulated in your respective jurisdiction in your desktop or mobile browser and click the blue sign-up button in the upper right corner. UK customers are recommended to register at www.activtrades.co.uk, while traders from other European countries should navigate to www.activtrades.eu.

-

Select your country from the drop-down menu, and enter your first and last name, along with your email and preferred password.

-

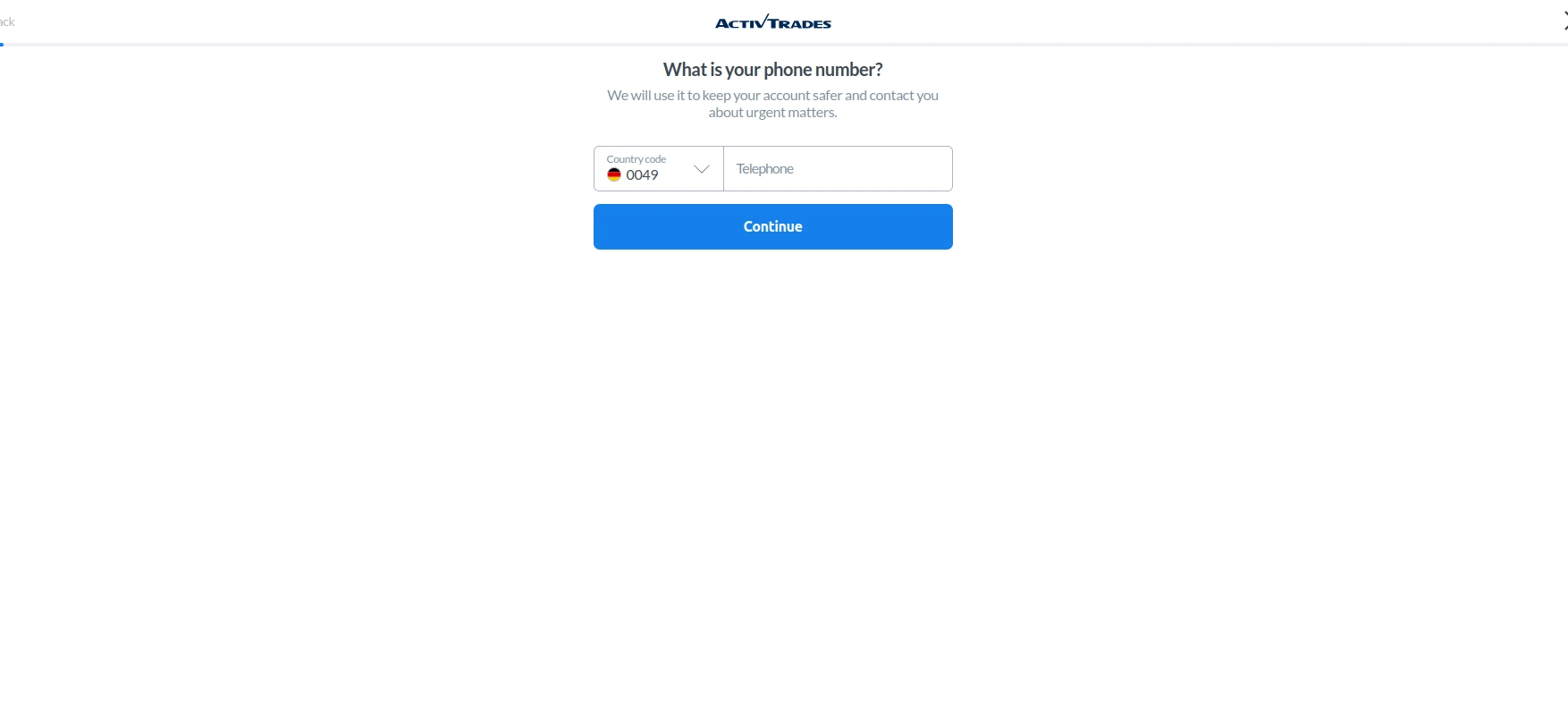

Next, you will be prompted to provide a mobile number so that ActivTrades can contact you should something urgent emerge. The broker will send you a six-digit code that expires after 60 seconds. You must enter it in the designated field to proceed to the next step.

-

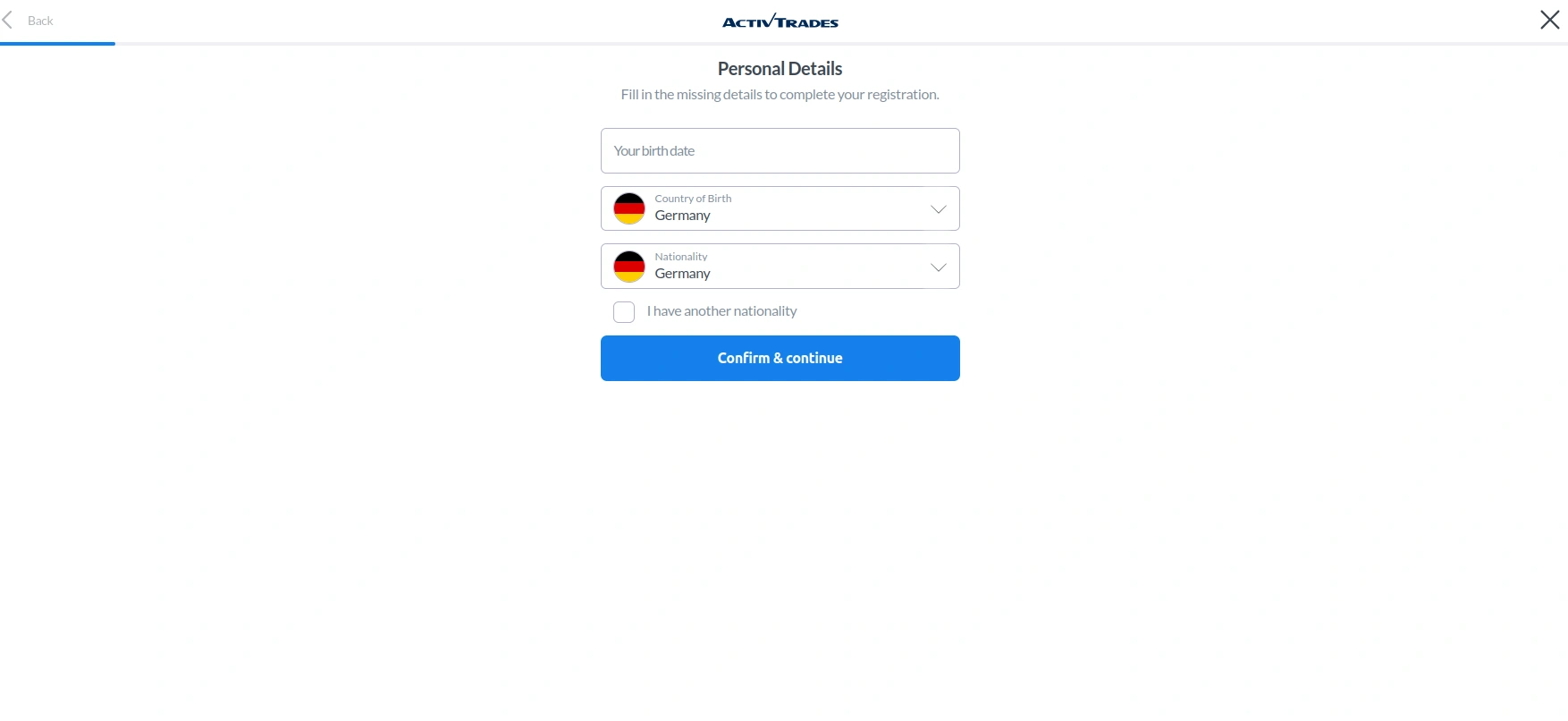

ActivTrades will then prompt you to select your native country and nationality and enter your birth date.

-

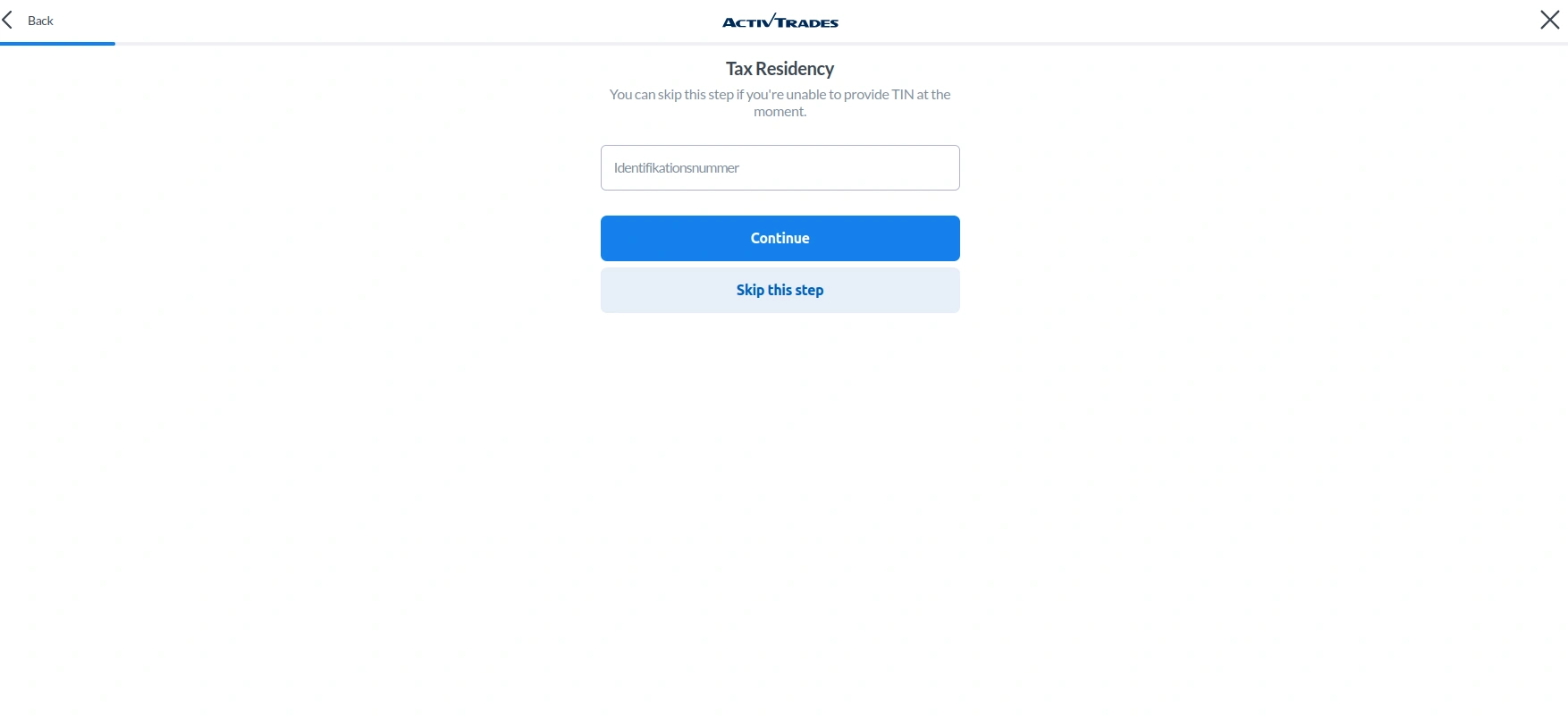

Depending on where you register from, the broker may require you to provide your tax identification number during this step. You can skip this and provide the number later. We recommend entering the number immediately, as this would speed up the registration process and ensure an automatic review of your account.

-

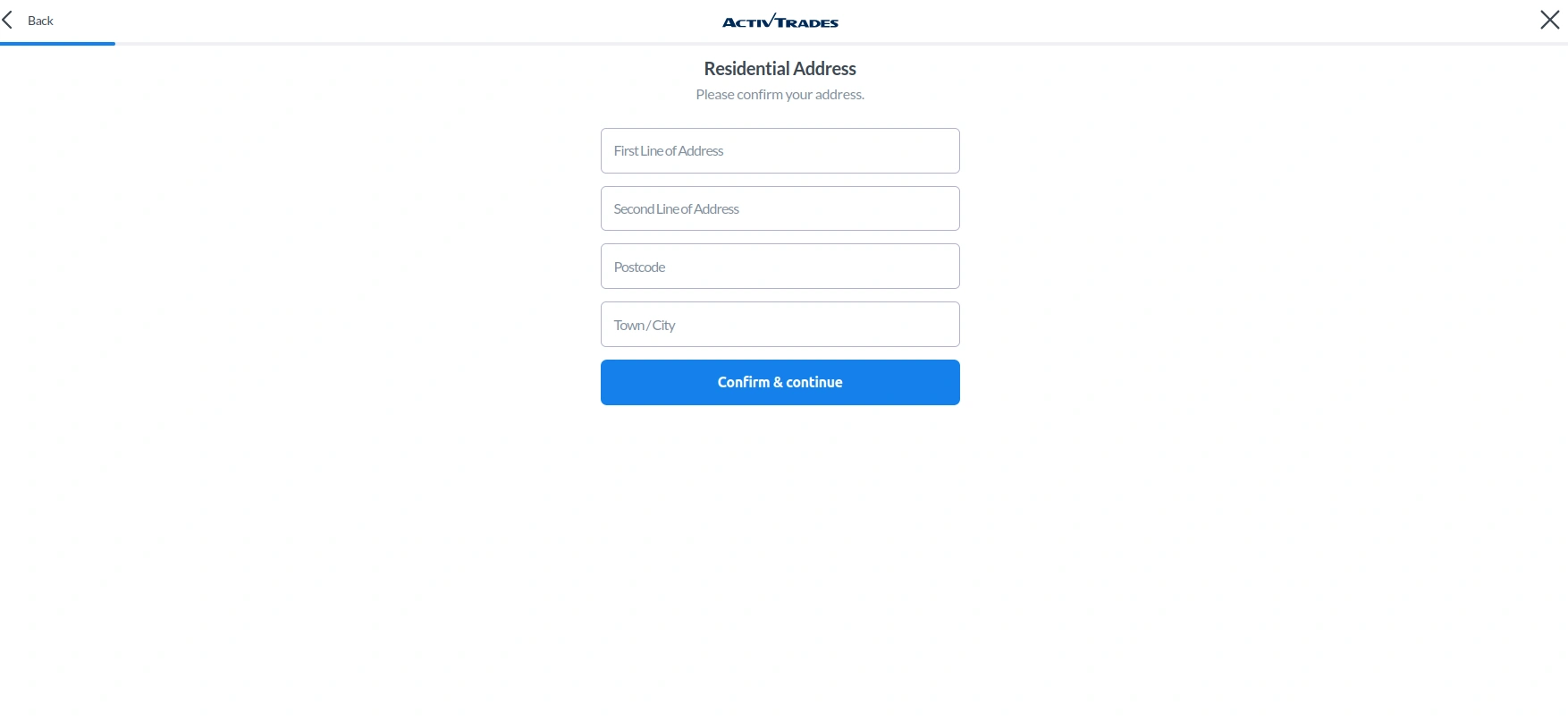

Enter your residential address, along with your town or city with the respective postal code.

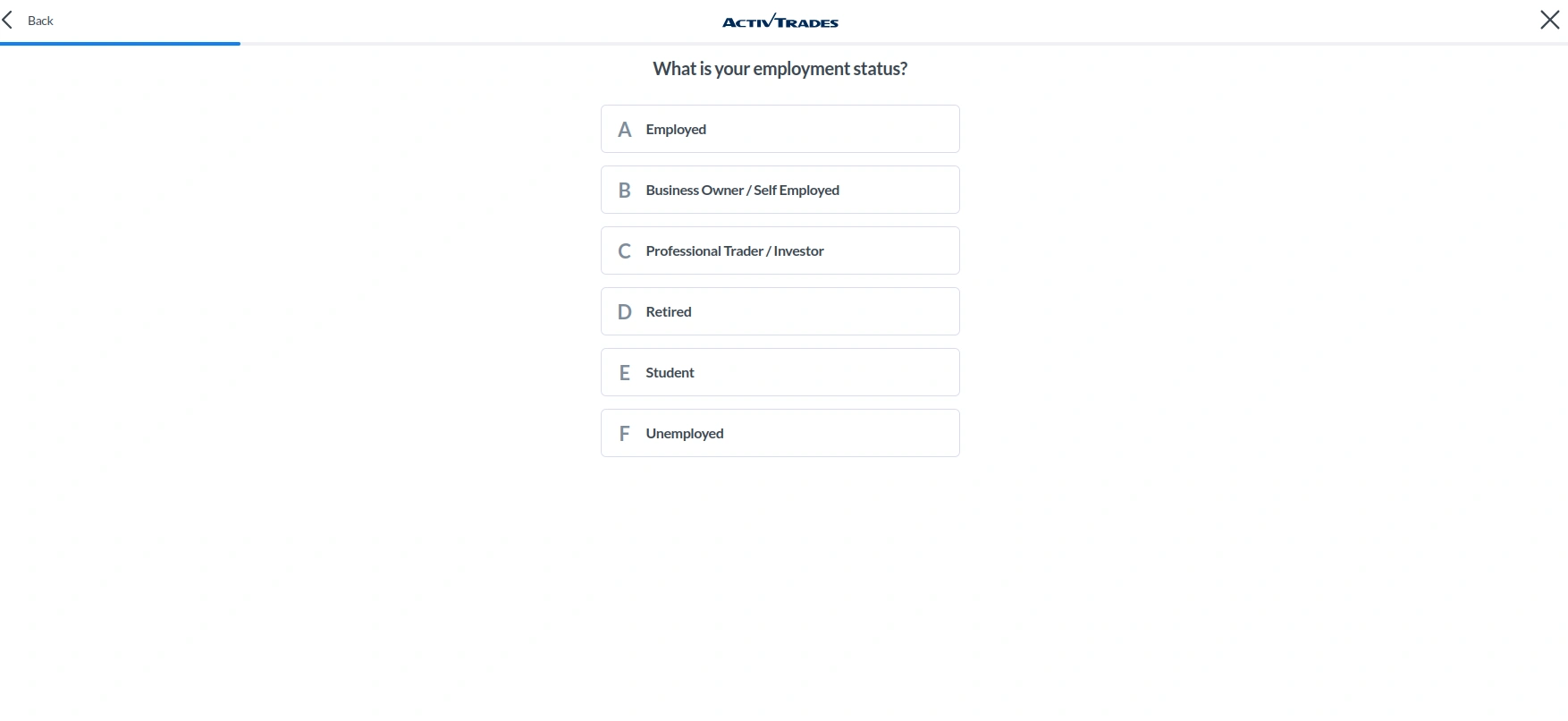

ActivTrades will ask about your employment status during these next few steps. Employed individuals must also provide information about their employer, their job title, and industry sector.

-

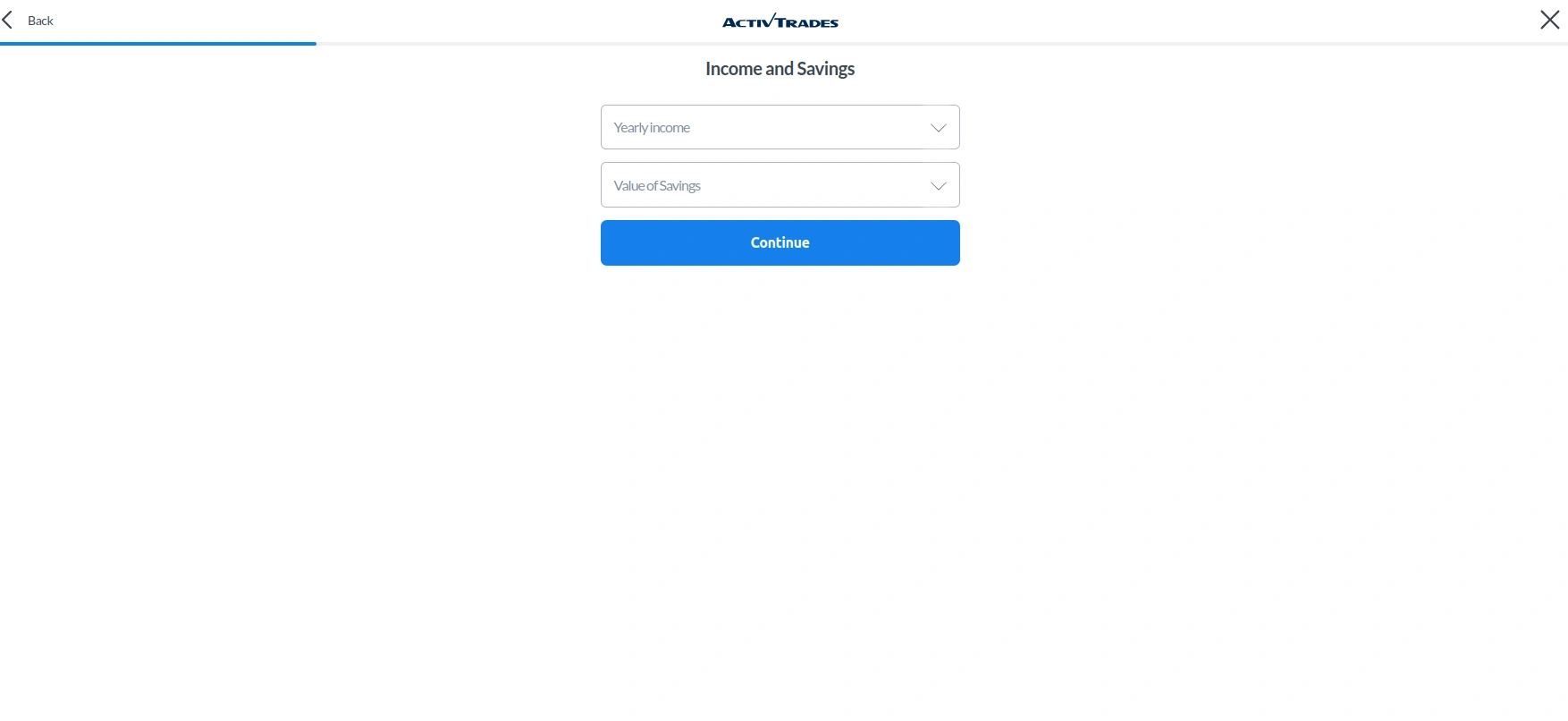

Additionally, you must provide information about your annual income and savings. This enables the broker to adequately assess whether onboarding clients are financially fit to engage with high-risk leveraged derivatives. They will also inquire how much you intend to deposit the first time. Onboarding customers must also specify what is the source of their deposited funds (employment, savings, inheritance, or investments).

-

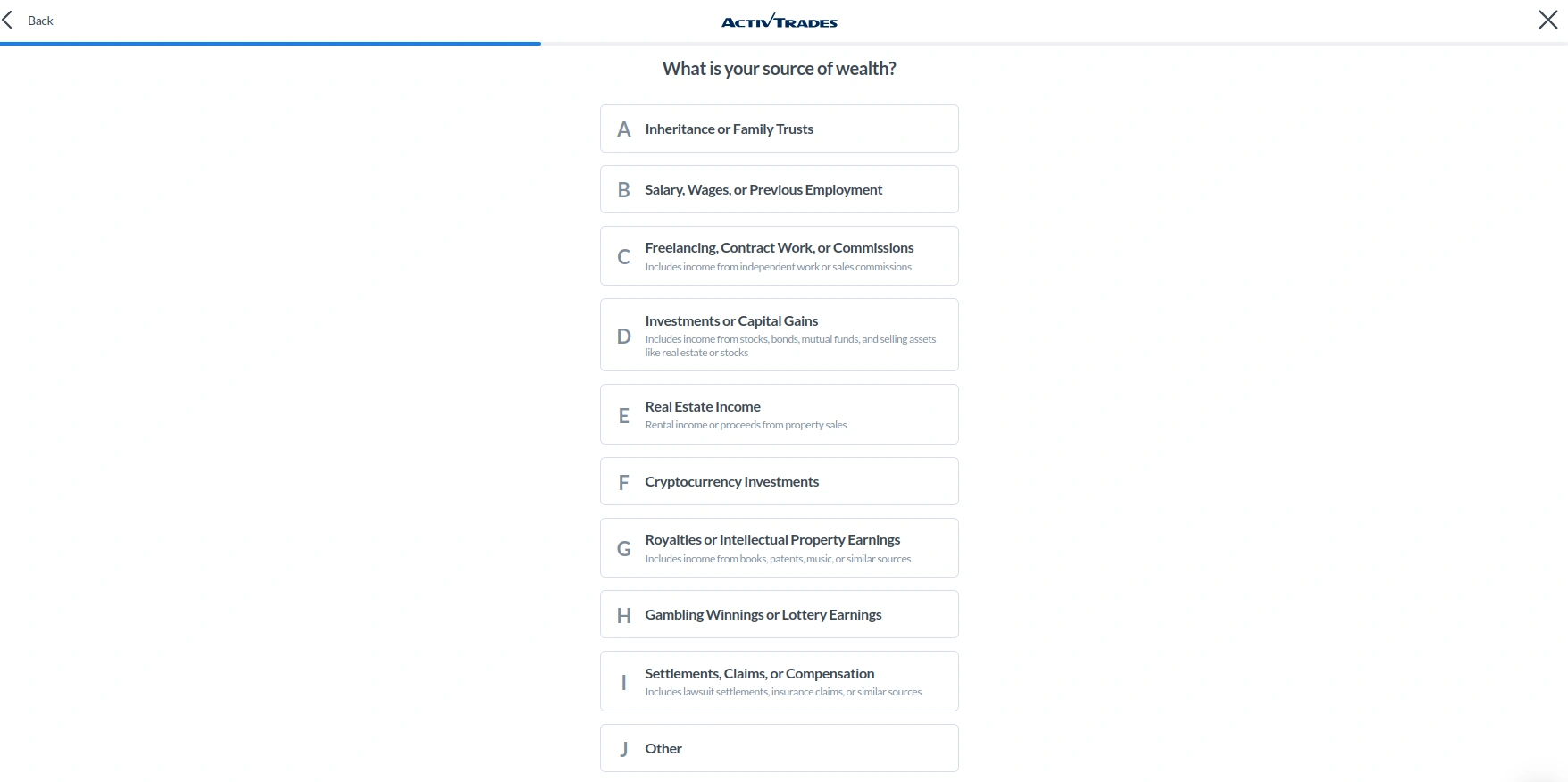

During this step, new registrants must select their source of wealth from the long list of available options, as shown below.

-

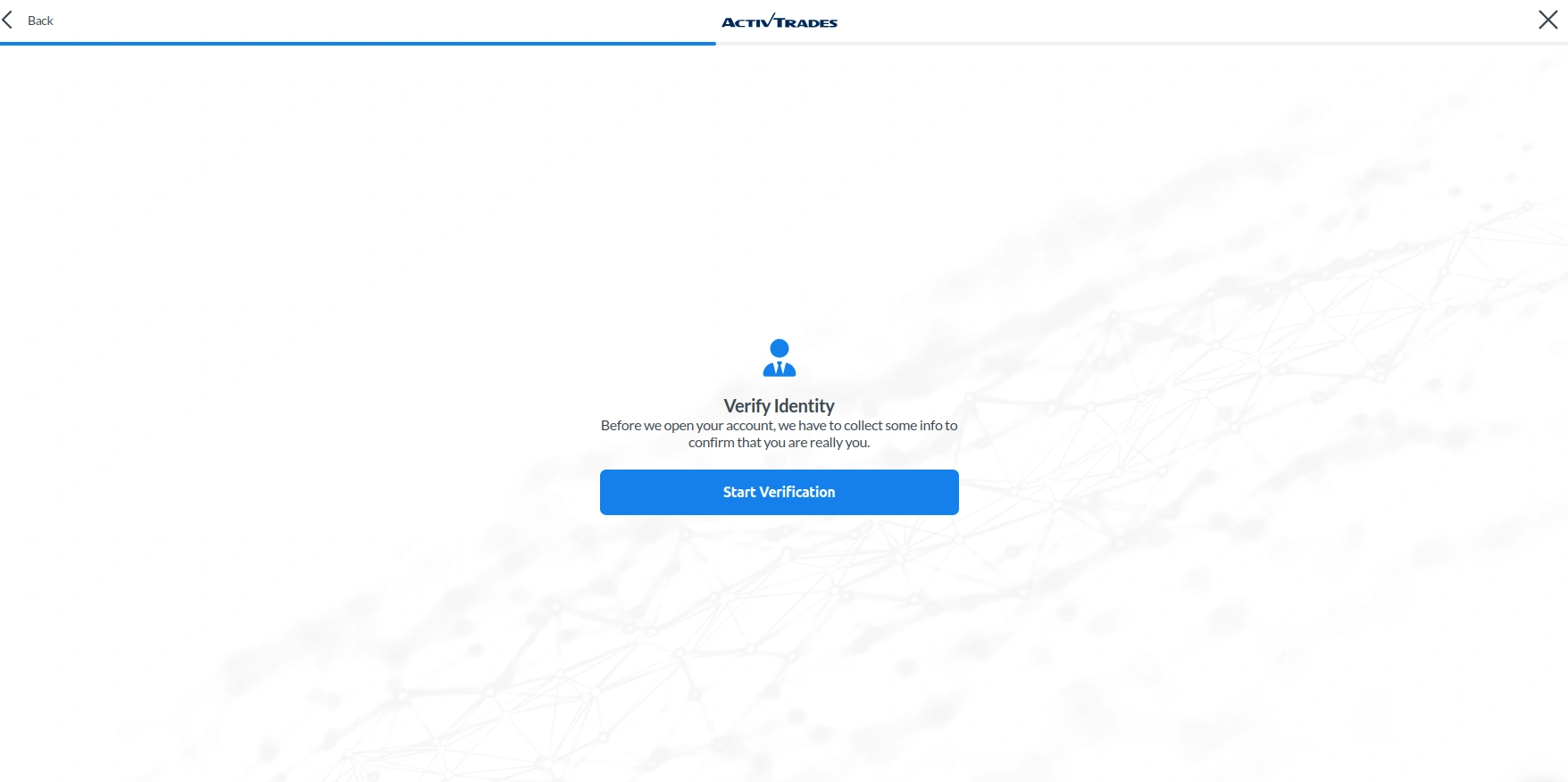

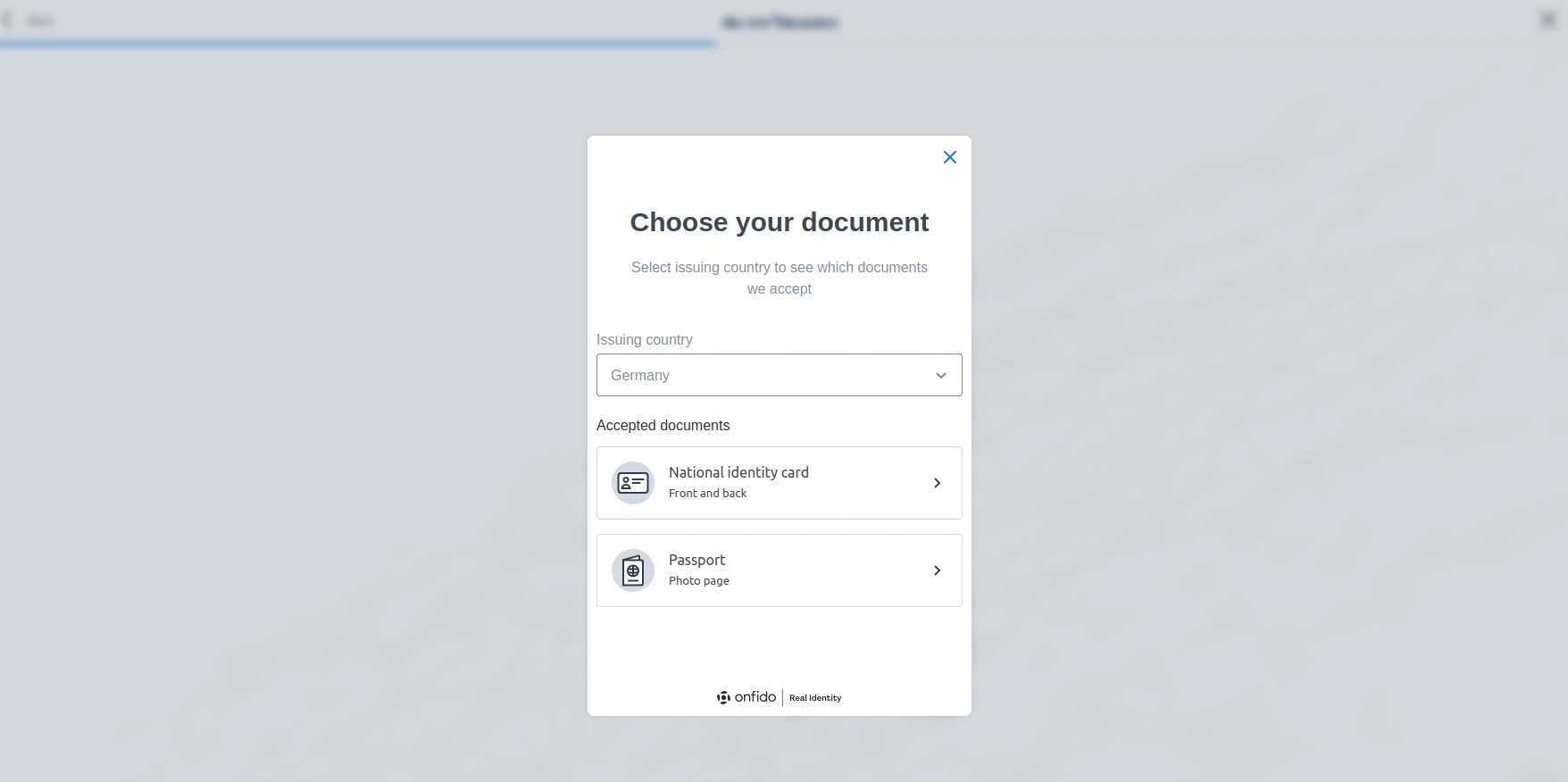

Finally, you must verify your identity by uploading a photo of your passport or government-issued identity card. Customers from some countries may also provide their driver’s license.

If you choose your identity card, you must provide clear and legible photos of the front and back.

If uploading your passport, keep in mind that scans and photo copies are not accepted. It would be best to take the pictures with your smartphone camera but make sure you move away from direct light to prevent glares. All details should be visible.

-

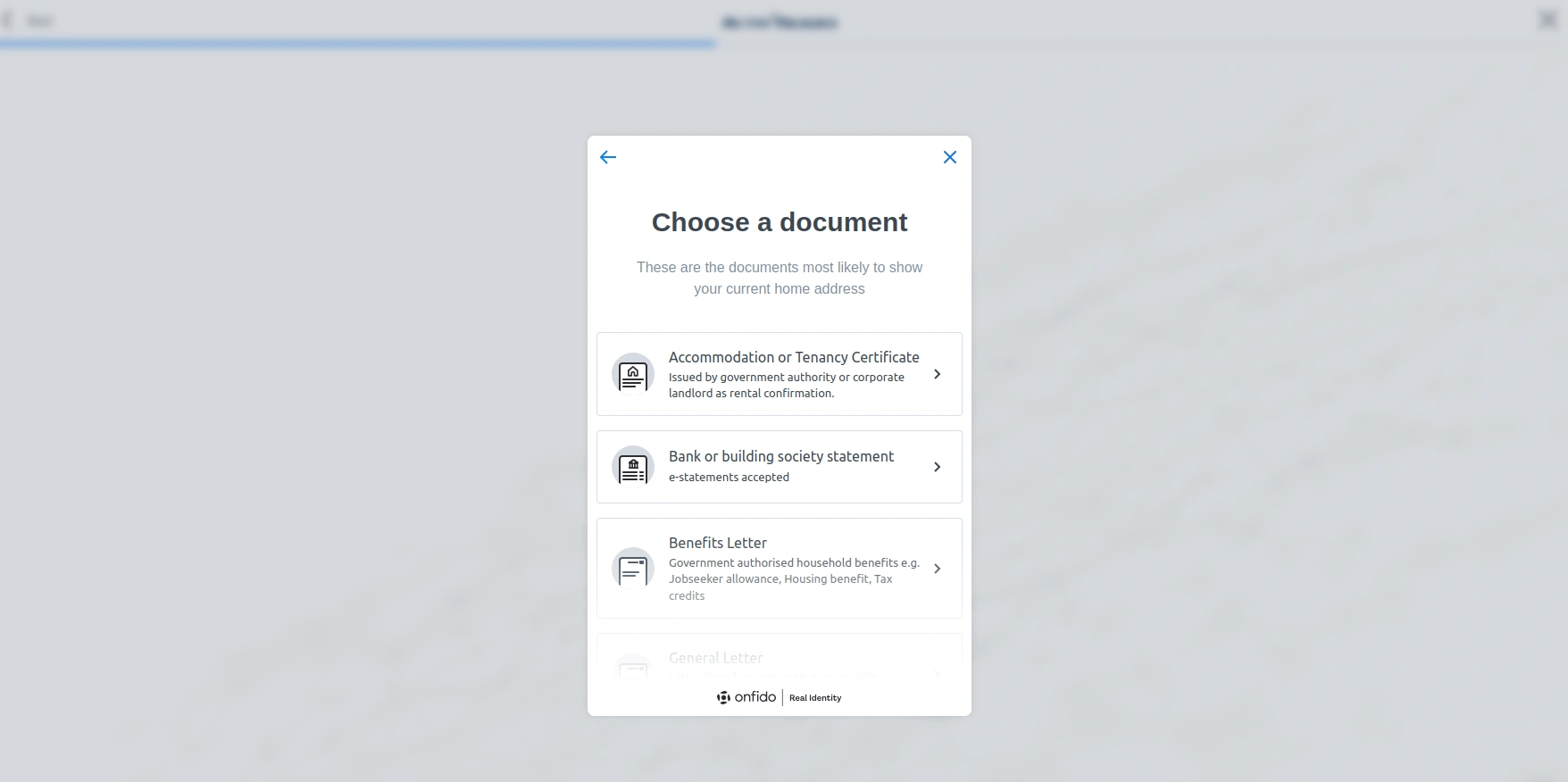

Additionally, ActivTrades will ask you to upload a separate document to confirm the address matches the residential information you entered earlier. The broker accepts various documents, including utility bills, general letters, tenancy certificates, bank statements, mortgage statements, and more. The range of accepted documents is country-specific, however. The document should have been issued within the last 3 months.

-

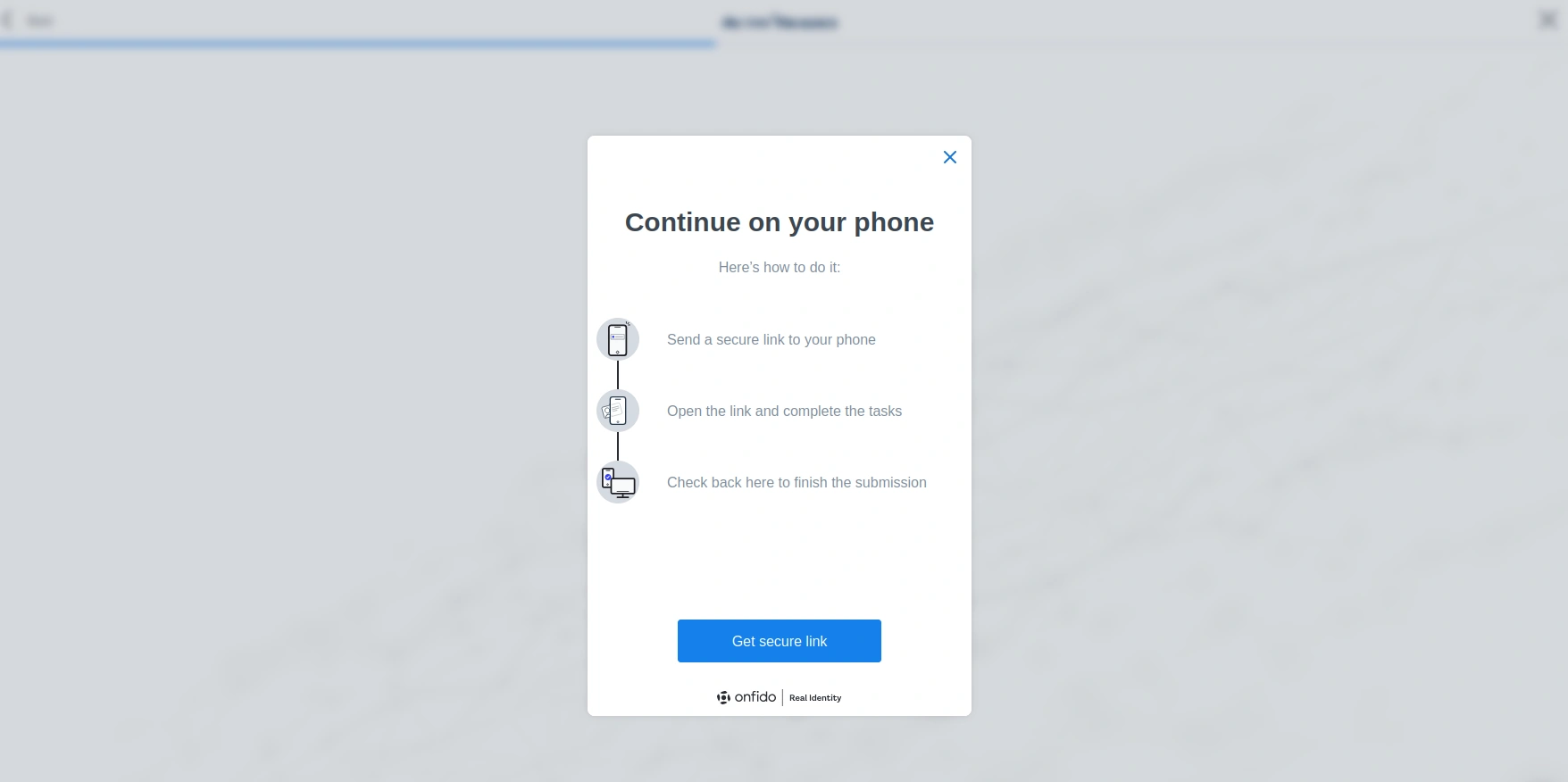

After you upload all necessary documents, the broker will perform a liveness check to ensure you are a real person. You can do this on your smartphone by scanning the QR code or opening the link ActivTrades will email you. They will ask you to perform several random tasks and go through a short quiz to evaluate your investment experience.

-

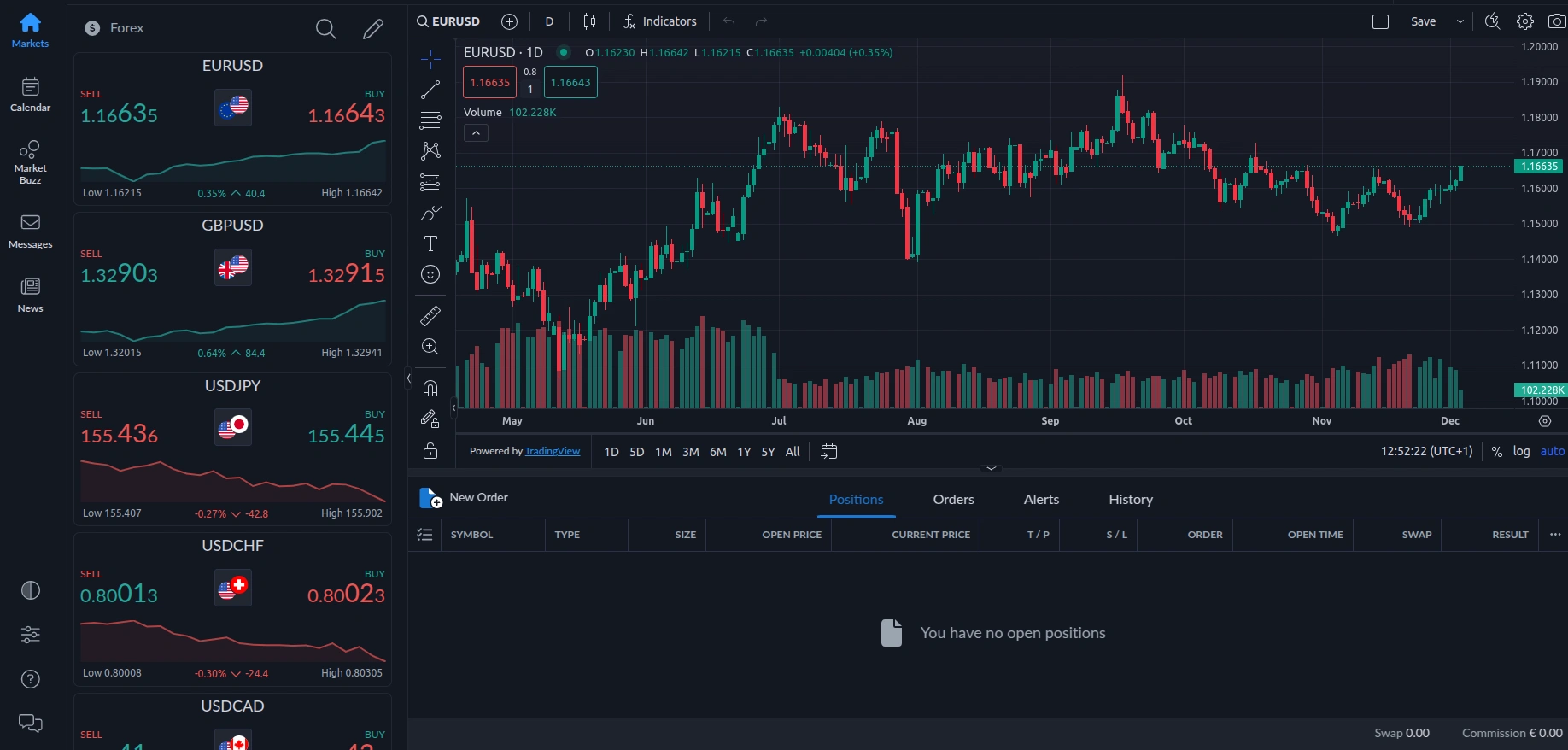

After your account is verified, you will be able to deposit and open a live position. Here is what the proprietary ActivTrades platform looks like.

Final Impressions

The account registration process at ActivTrades is efficient and quick, taking approximately 15 minutes to complete. The registration is pretty standard and includes providing personal details, financial information, and documents for verification. While new traders can easily activate a demo account to practice risk-free, live trading requires a thorough verification, including a liveness check and a short investment experience quiz. By following the outlined steps, customers can set up their fully verified live account and deposit funds quickly to access the broker’s diverse range of instruments.