Blueberry Markets Account Types in Brief

Blueberry Markets offers access to a diverse portfolio of over 2,000 financial instruments, including forex, commodities, indices, share CFDs, and crypto CFDs. The broker focuses on ultra-tight spreads, low fees, and lightning-fast execution, powered by deep liquidity from top-tier providers, making it suitable for both beginner and professional traders.

The supported trading software includes the industry favorites MetaTrader 4 (MT4) and MetaTrader 5 (MT5), alongside TradingView and cTrader, and the proprietary platform, Blueberry X. Traders are offered two main account options: the commission-free Standard account, where trading costs are incorporated into the spread (starting from 1.0 pips), and the Raw (or Direct) account. The latter provides raw interbank spreads starting from 0.0 pips, complemented by a transparent commission of $7 per standard lot, round-trip.

Note that the reduced spreads on the Raw account apply to forex and gold. Spreads on the rest of the supported instruments are the same for both Standard and Raw accounts. Beyond these main offerings, the broker provides Swap-Free (Islamic) accounts and two Premium account tiers for eligible, high-volume clients. All prospective traders can utilize a complimentary Demo account to explore markets risk-free.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Blueberry Markets Minimum Deposit Requirements

To start trading live, Blueberry Markets requires a minimum deposit of $100 (or the equivalent currency) across all retail account types. This low deposit threshold allows traders of all levels to access the market with ease, offering flexibility and inclusivity.

The broker supports a total of eight options for base account currency, including: AUD, CAD, CHF, EUR, GBP, NZD, SGD, and USD. In terms of trading size, clients can begin with a minimum trade size of 0.01 lot (1,000 currency units), scaling up to a maximum order size of 100 lots for major FX pairs.

For high-volume traders, the broker offers two exclusive VIP tiers: the Premium account, which requires maintaining an account balance of $10,000, and the invite-only Premium+ account, requiring a balance of $50,000 for maximum benefits.

What Can You Trade at Blueberry Markets?

Blueberry Markets began operations in 2016 as an online forex and CFD broker, headquartered in Sydney, Australia. The broker operates under a multi-jurisdictional framework, holding a primary license from the Australian Securities and Investments Commission (ASIC). To serve its international clientele, the broker also holds offshore licenses from the Vanuatu Financial Services Commission (VFSC) and the Financial Services Commission (FSC) of Mauritius.

Blueberry Markets supports a comprehensive trading portfolio of over 2,000 financial instruments, covering forex, share CFDs, crypto CFDs, commodities, metals, and indices. The broker provides a detailed product list under its informative FAQ section.

Traders have access to 65 major, minor, and exotic forex pairs. The portfolio includes a total of 23 commodity instruments. Major contracts like Spot Brent Crude Oil, Spot WTI Crude Oil, and Natural Gas are available. Silver and gold are tradable against several major currencies. Other metals such as Palladium, Platinum, Aluminum, Copper, Lead, Nickel, and Zinc are primarily traded against the US dollar. The offering also includes soft commodities, such as Coffee, Cotton, Cocoa, and Sugar.

As far as digital currencies are concerned, Blueberry Markets offers an above-average portfolio spanning 60 cryptocurrencies traded against the US dollar. A total of 18 global indices are available for trading, including popular global benchmarks like the AU200, FR40, GER40, NAS100, SP500, and UK100.

Available exclusively through the MT5 platform, the broker lists share CFDs across major international exchanges, allowing access to key market segments, including: NASDAQ and NYSE (New York), LSE (London), FWB (Frankfurt), ENX (Paris), and BME (Madrid).

Step-by-Step Registration at Blueberry Markets – Takes Around 15 Minutes

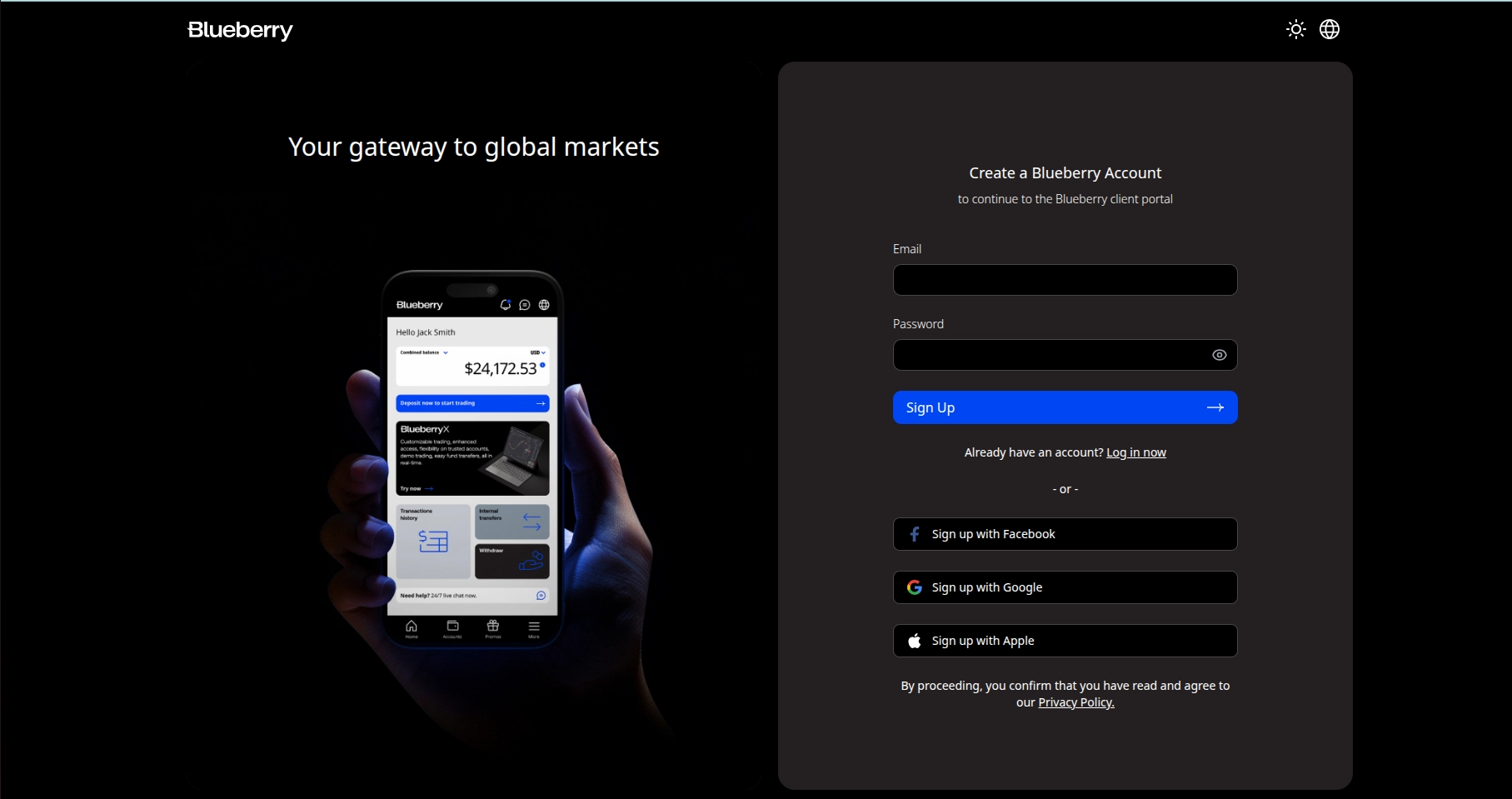

- To begin the live account application process, clients simply need to visit the broker’s website and locate the ‘Open Account’ button.

- They will be redirected to the initial Sign Up form. Here, prospective clients have the option to register quickly by entering an email address and password, or by using their Facebook, Google, or Apple accounts. By proceeding, the client confirms that they have read and agreed to the company’s essential legal documents, including the Privacy Policy.

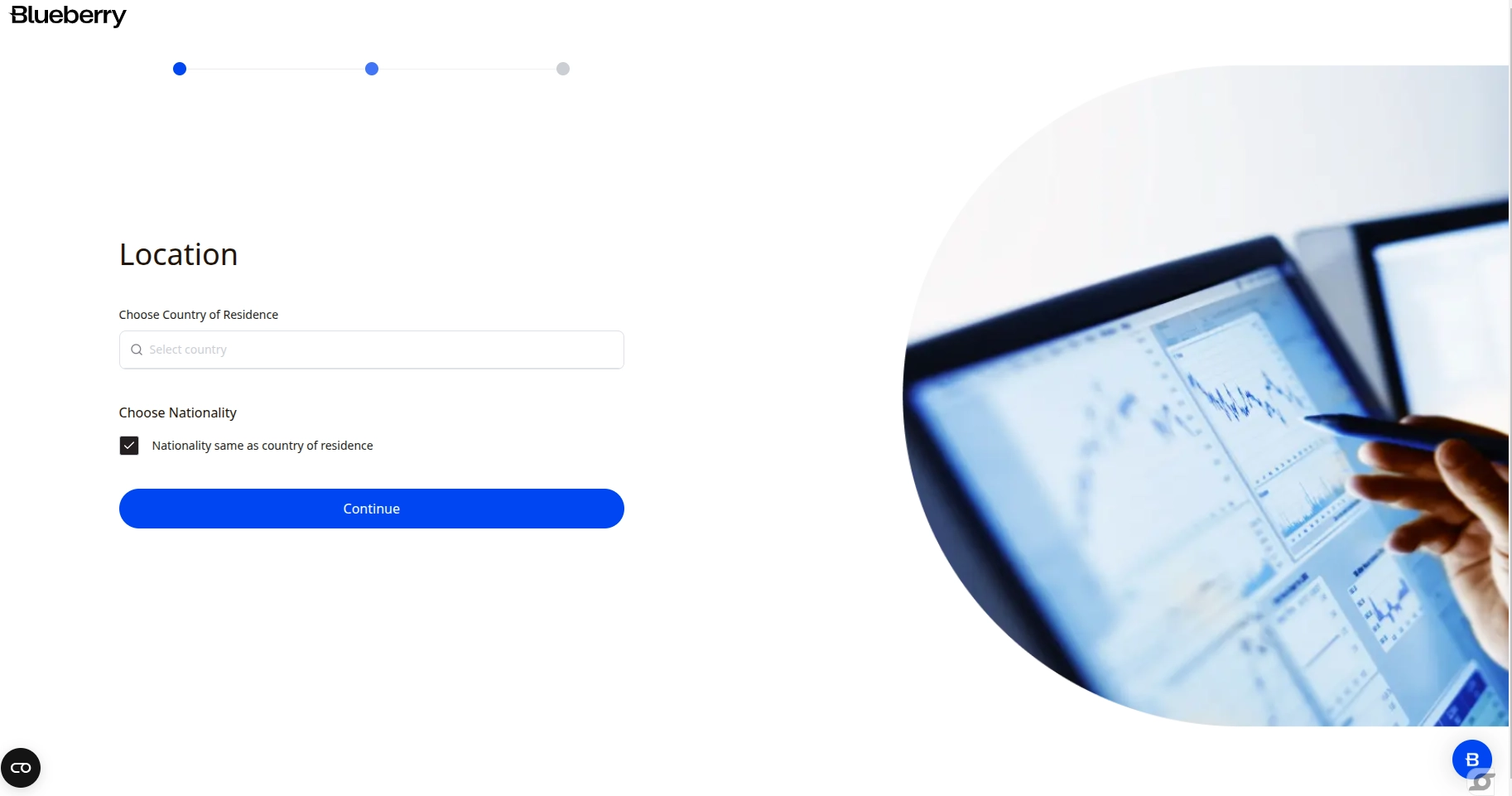

- In the next step, traders need to choose their country of residence from a drop-down menu and proceed.

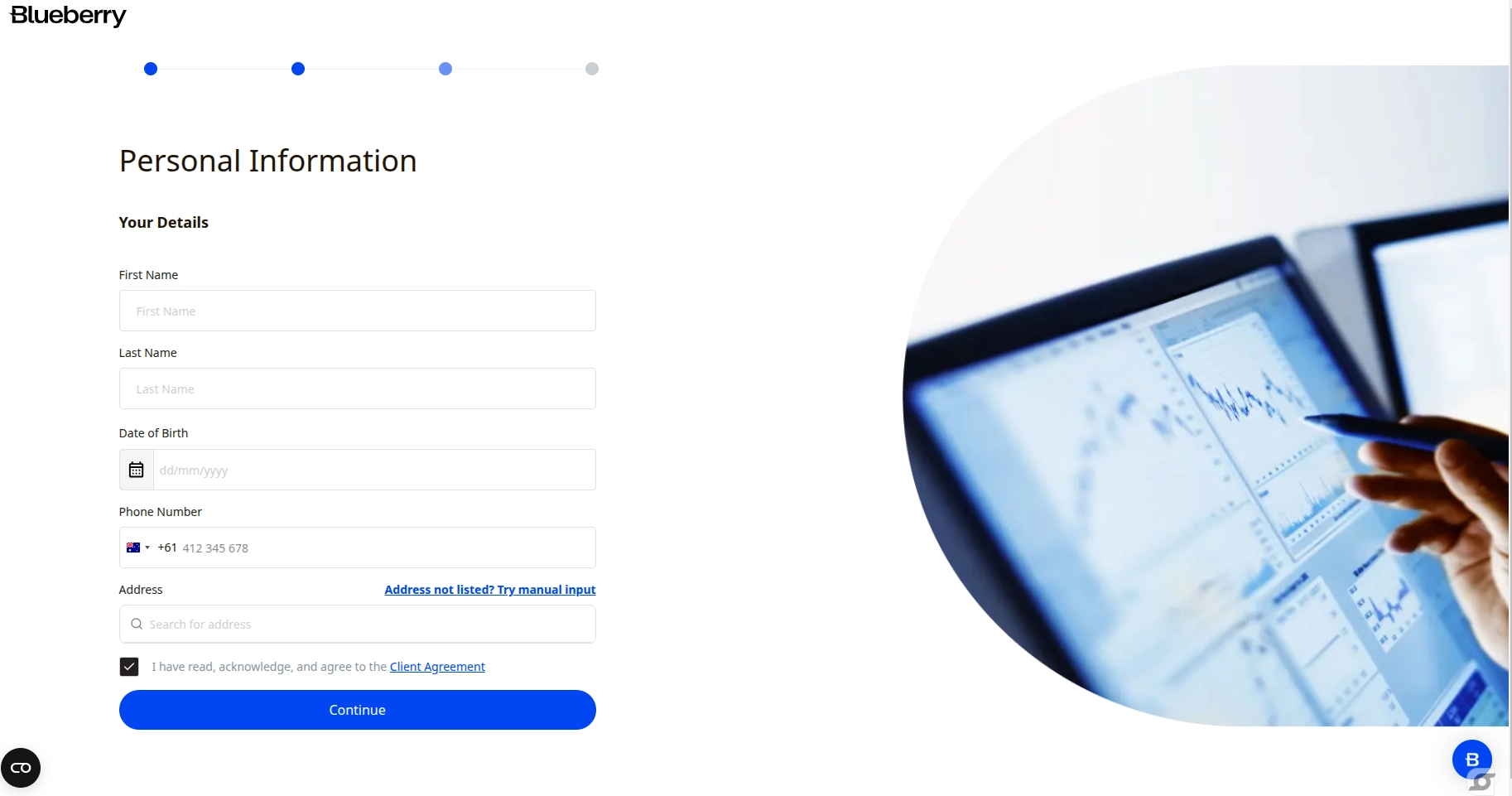

- The next step involves filling in personal information in a form, including name, date of birth, phone number, and address. Traders need to confirm they have read and agreed to the Client Agreement.

- Immediately following this selection, traders are prompted to verify their account by uploading the necessary Know Your Customer (KYC) documentation. At this stage, however, account verification is not mandatory and can be postponed.

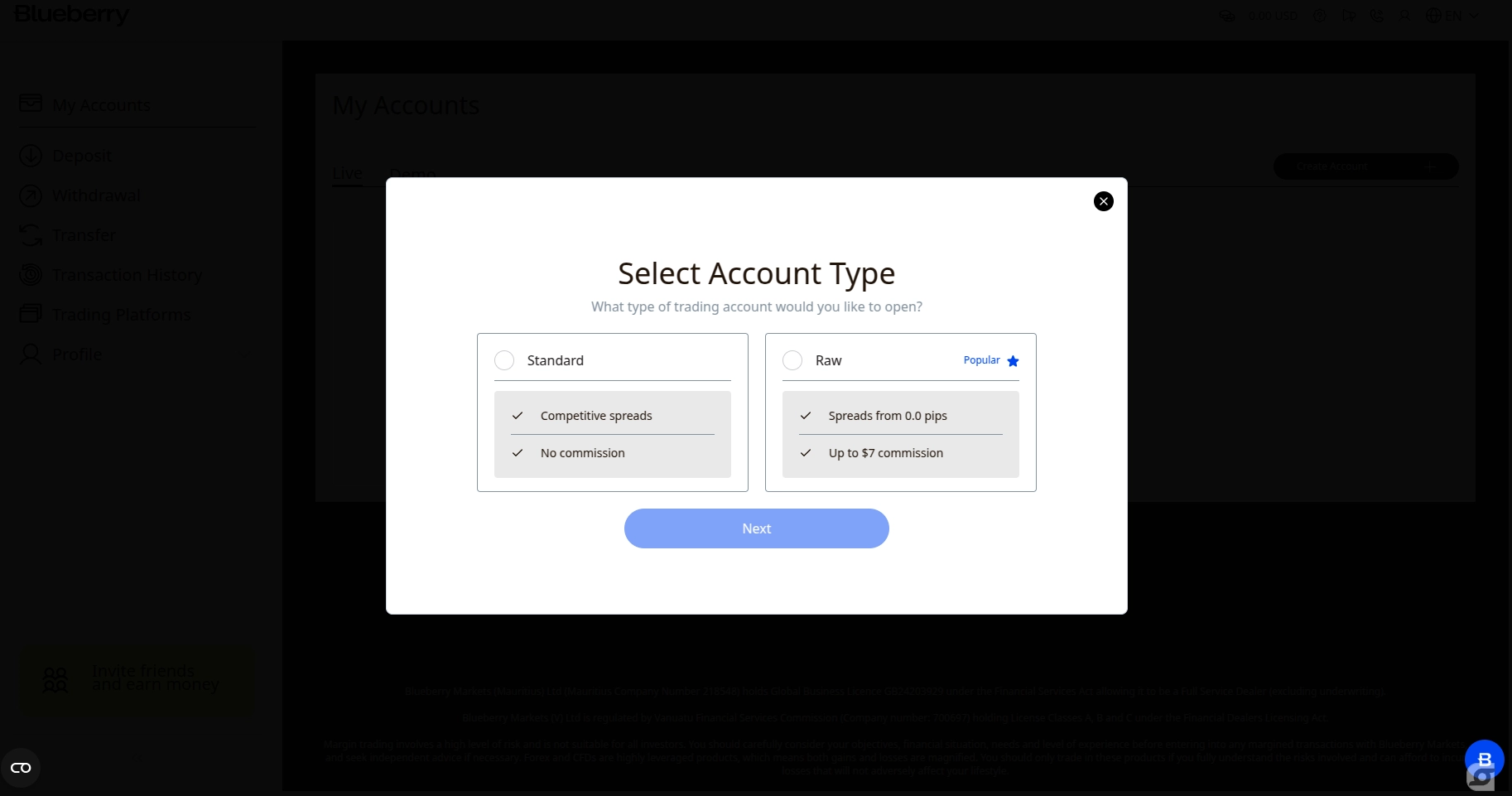

- The next step involves selecting the account type, where traders can choose between two main options: Standard Account (this is the commission-free option, where trading costs are built into the spread, which starts from 1.0 pip) and Raw (Direct) Account (designed for professionals and high-volume traders, this account offers interbank spreads starting from 0.0 pips, complemented by a fixed commission of $7 per standard lot, round-turn, for major FX pairs.)

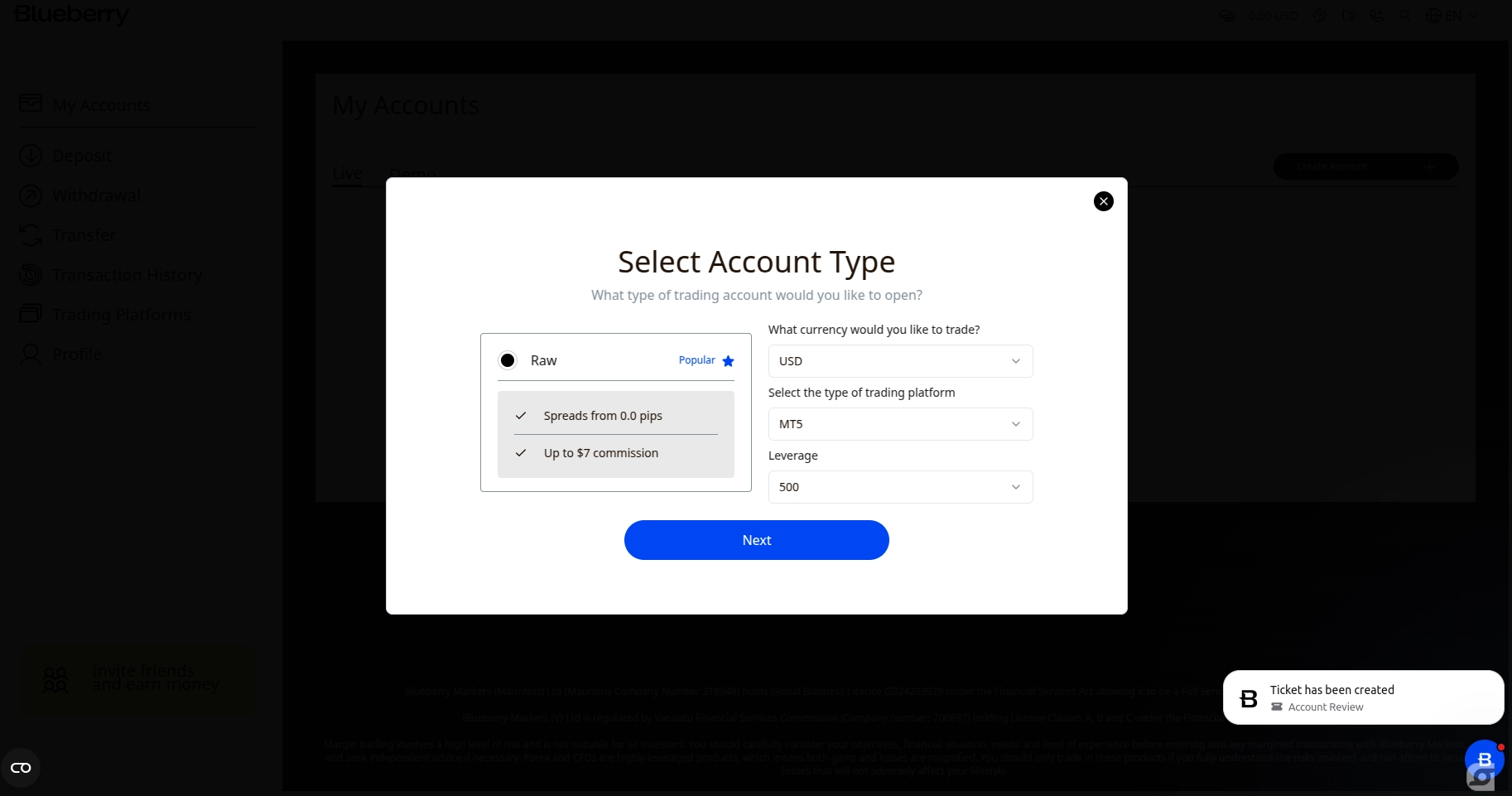

- The next form inquires about the account currency that traders would prefer, the trading platform, and leverage.

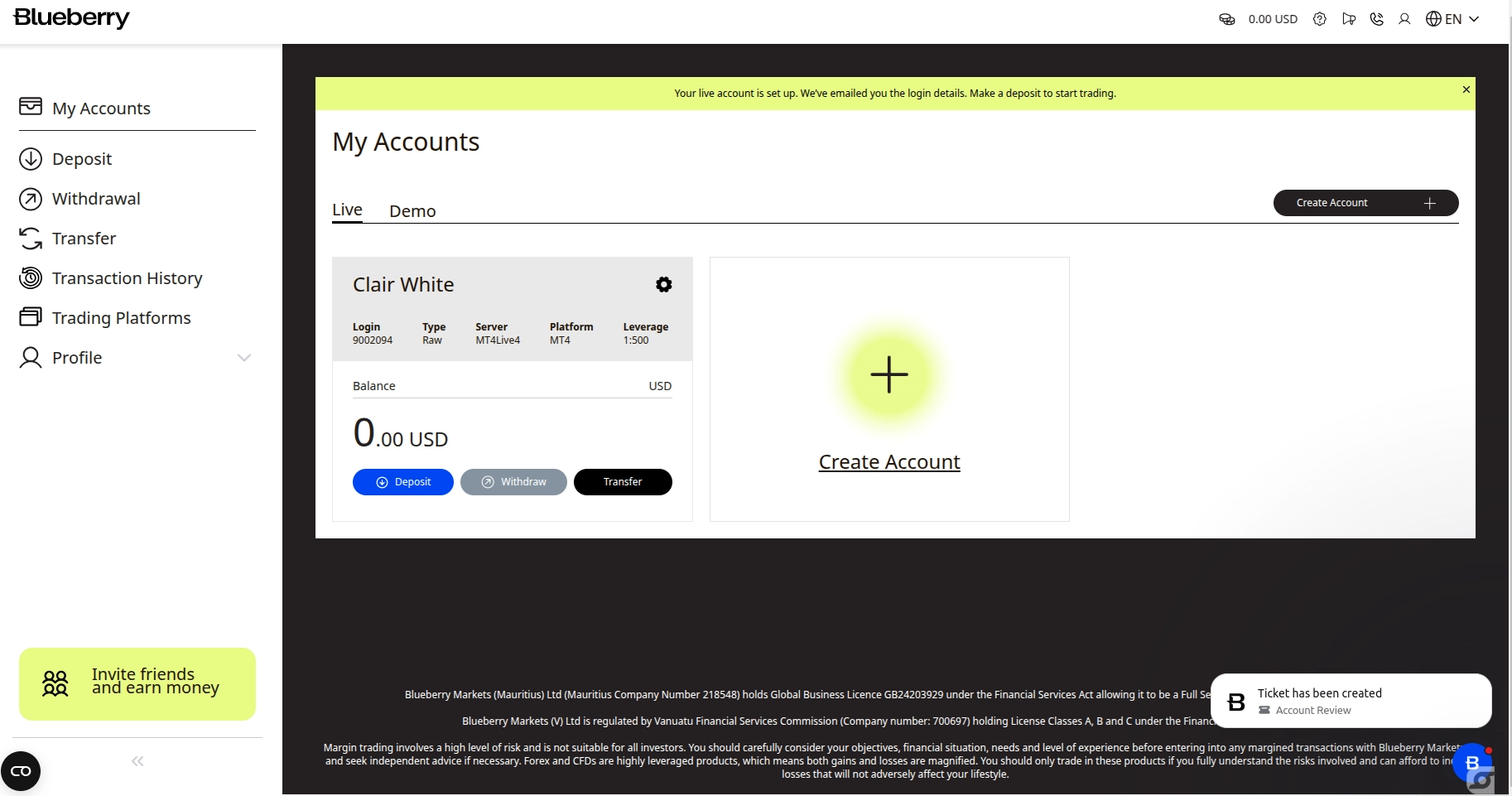

- With this step completed, the live account is set up, reviewed by the support team, and the broker sends the login details to the trader’s registered email.

- The next step is account funding. To ensure compliance and unlock the highest deposit ceiling, traders must first verify their accounts by submitting the required documentation. While accounts pending full verification may have a temporary deposit limit (up to $5,000), fully verified accounts gain access to significantly higher funding limits, allowing for deposits exceeding $100,000.

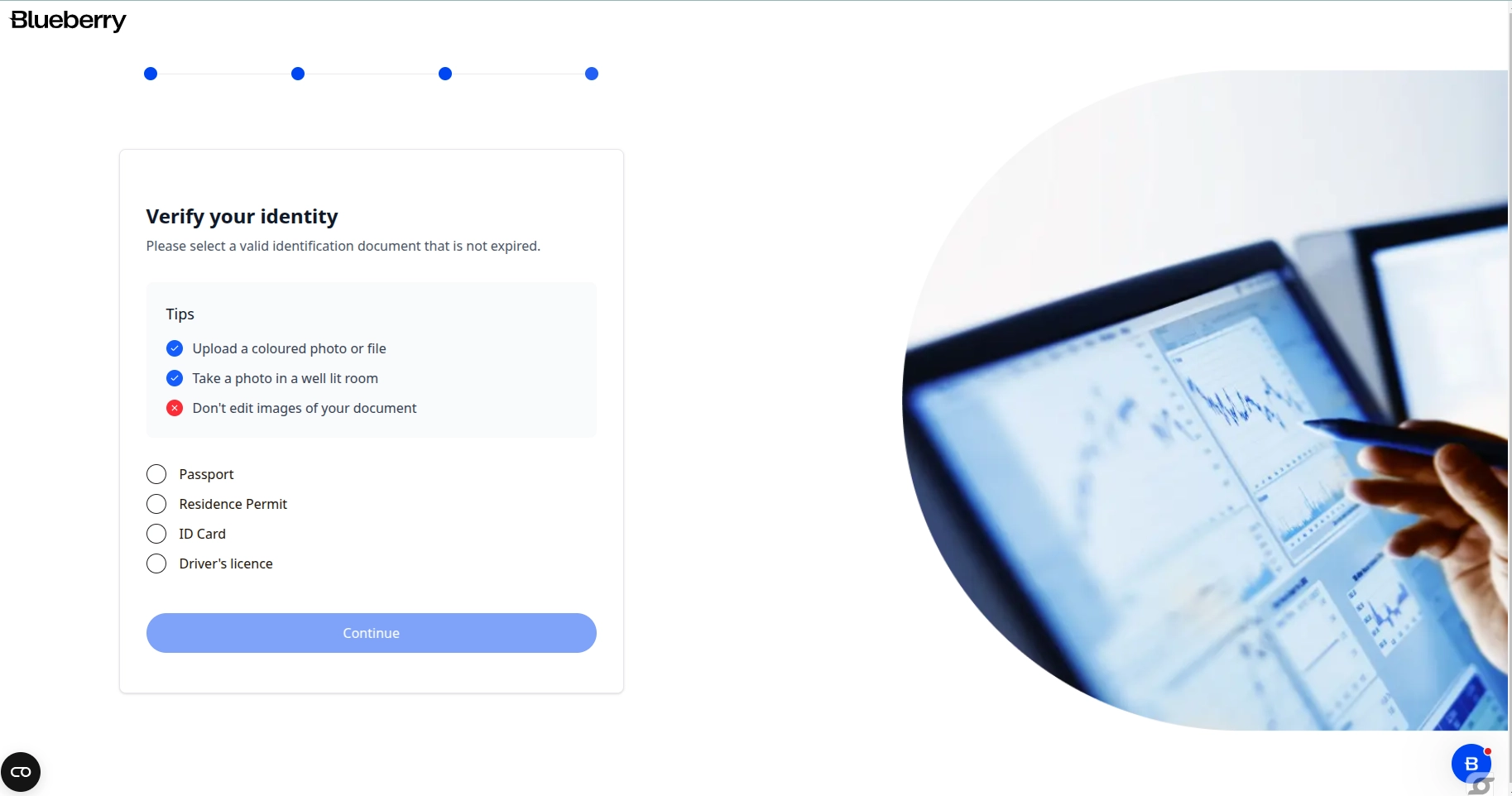

- Finally, to complete the process and fully activate the account, traders must proceed to verify their identity and address by providing the necessary Know Your Customer (KYC) documentation. This typically involves submitting a government-issued Photo ID and a recent Proof of Residence document, such as a utility bill or bank statement.

Final Impressions

The account registration at Blueberry Markets is designed to be effective, easy, and stress-free. The process begins with a quick sign-up via email or social media. After efficiently entering personal details and selecting a preferred account type (Standard or Raw), the account is quickly set up. With a low $100 minimum deposit, new clients can fund their account immediately. By completing the final KYC verification with a Photo ID and Proof of Residence, traders unlock maximum functionality and high deposit ceilings, ensuring a swift and compliant start to trading.