EC Markets Account Types in Brief

EC Markets delivers a flexible lineup of account types to suit most customers, from complete beginners to high-volume institutional traders. The broker offers three main retail account options, namely Standard, ECN, and Pro. Customers who are just starting out will surely appreciate the Standard and ECN accounts, which have an impressively low entry barrier. The Standard account skips commissions entirely and is ideal for those looking for a simple pricing model where all trading costs are incorporated into the spreads.

On the other hand, the ECN and Pro accounts cater to frequent and large-scale traders by delivering deep liquidity and raw prices. ECN spreads start from 0.0 pips, coupled with a round-turn commission of $3 per standard lot. The Pro account also offers spreads from 0.0 pips on major pairs, with no commissions, but it has a substantially higher barrier to entry. Swap-free versions of Standard and ECN accounts are available upon request.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

EC Markets Minimum Deposit Requirements

EC Markets maintains an exceptionally low barrier to entry, positioning itself as an attractive choice for those testing the waters. Both Standard and ECN accounts require a minimum deposit of only $10. The Pro account is intended for active, large-volume traders and necessitates a $5,000 minimum. The supported base currencies typically include USD, EUR, GBP, AUD, and NZD, but the options depend on where you reside.

Deposits can be made via credit/debit cards, bank transfers, and local methods like VNPay or POLi. Most options are processed instantly or within 30 minutes and are fee-free, except for POLi, which carries a 4% charge. International bank wires remain free but may take up to 5 business days to process.

What Can You Trade at EC Markets?

The broker’s market selection is a bit limited, as it encompasses only about 100 leveraged CFDs. Traders can speculate on the price movements of 48 currency pairs, including major, minor, and several exotic crosses. The indices category is equally modest, featuring 13 global benchmarks like the S&P 500, Nikkei 225, and Nasdaq 100.

Commodity enthusiasts are restricted to gold, silver, and crude oil, as soft commodities and natural gas are currently unavailable. While 7 popular cryptocurrencies are offered, they are inaccessible to UK residents and customers of the Mauritius branch. CFDs on individual stocks and ETFs are entirely absent, leaving the lineup feeling sparse compared to many competitors.

Step-by-Step Registration at EC Markets – Takes 5 to 10 Minutes

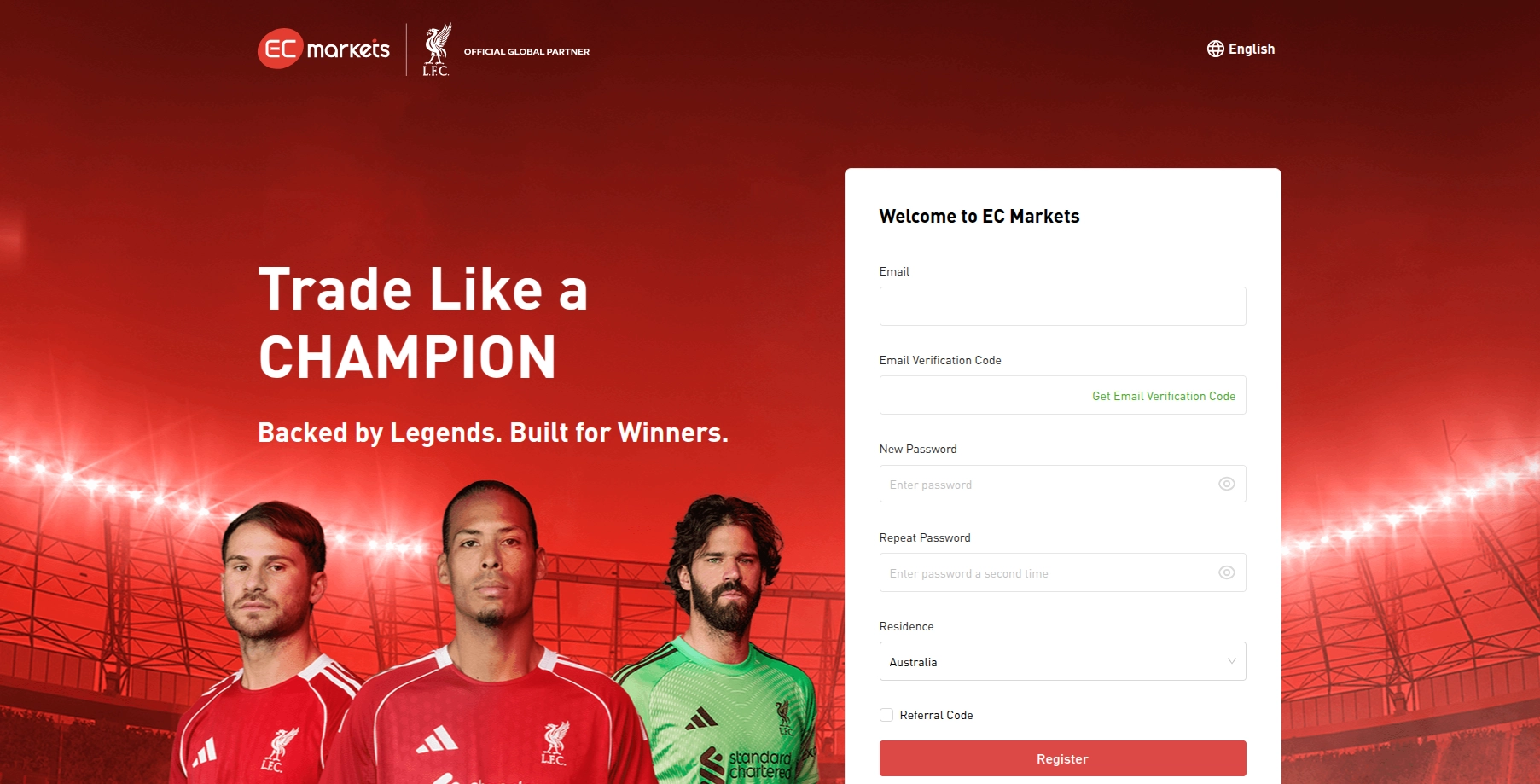

- Open the website of the respective regulated entity of EC Markets you wish to join, and click the red Register button in the top right corner.

- Enter a valid email address registered in your name and type in the 5-digit code below to verify your email. The code expires after 15 minutes, but you may request a new one to continue. Select a strong password, repeat it, and choose your country of residence to proceed to the next step.

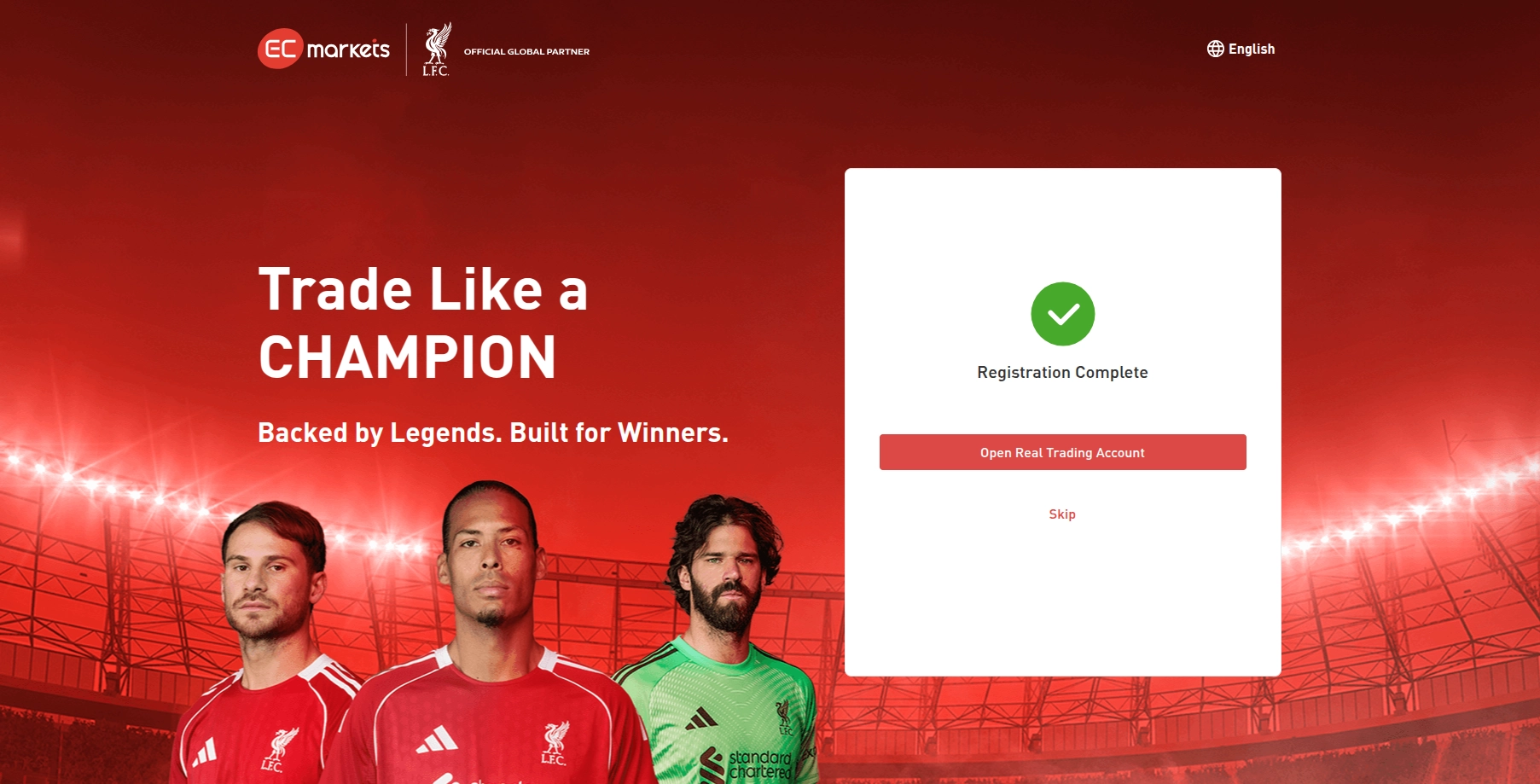

- Select Skip if you wish to start with a demo account or click on the live account option to continue your application.

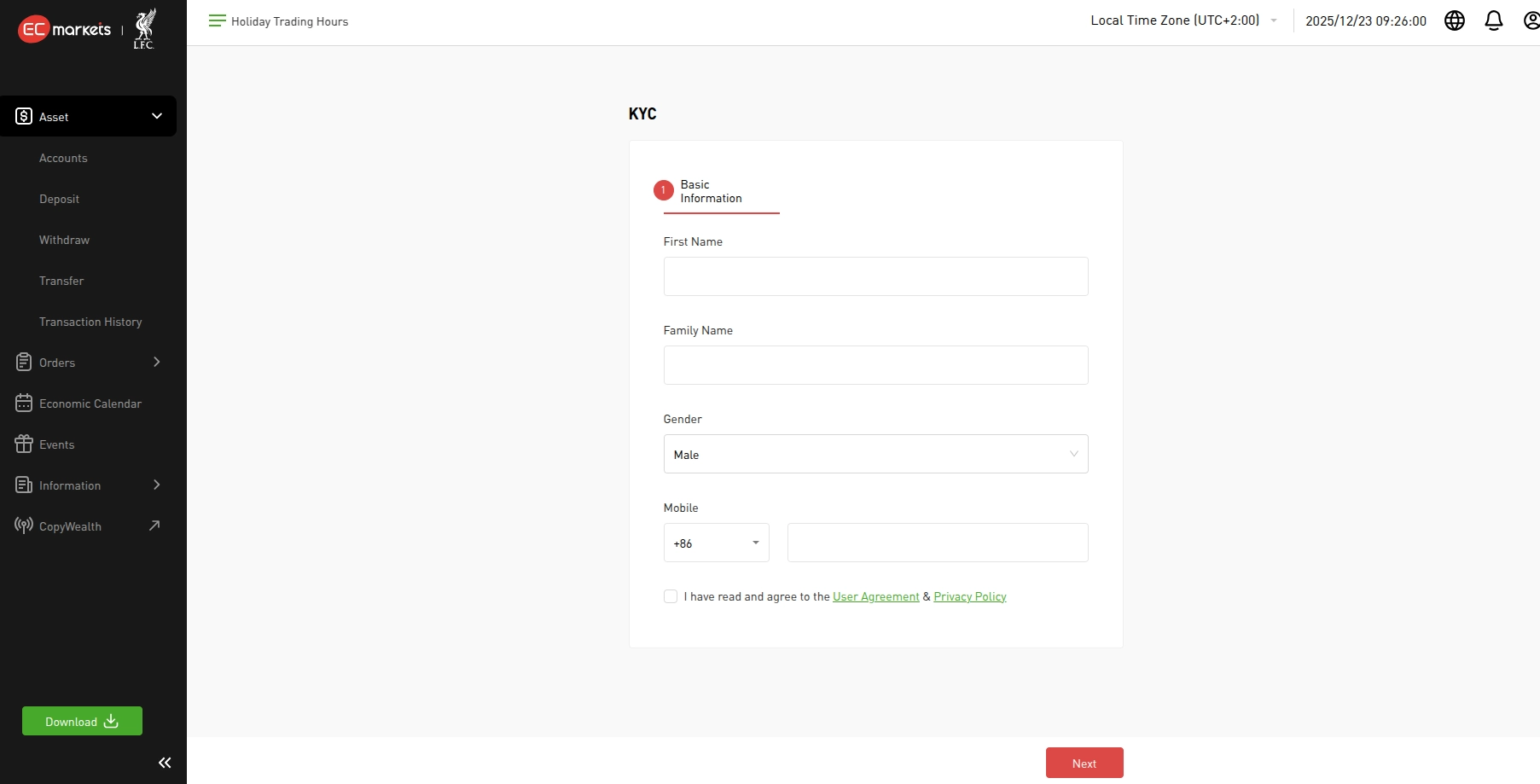

- Next, you must provide some basic information, including your first and last name, gender, and mobile phone number. Tick the box to confirm you agree with the broker’s Terms of Use and Privacy Policy.

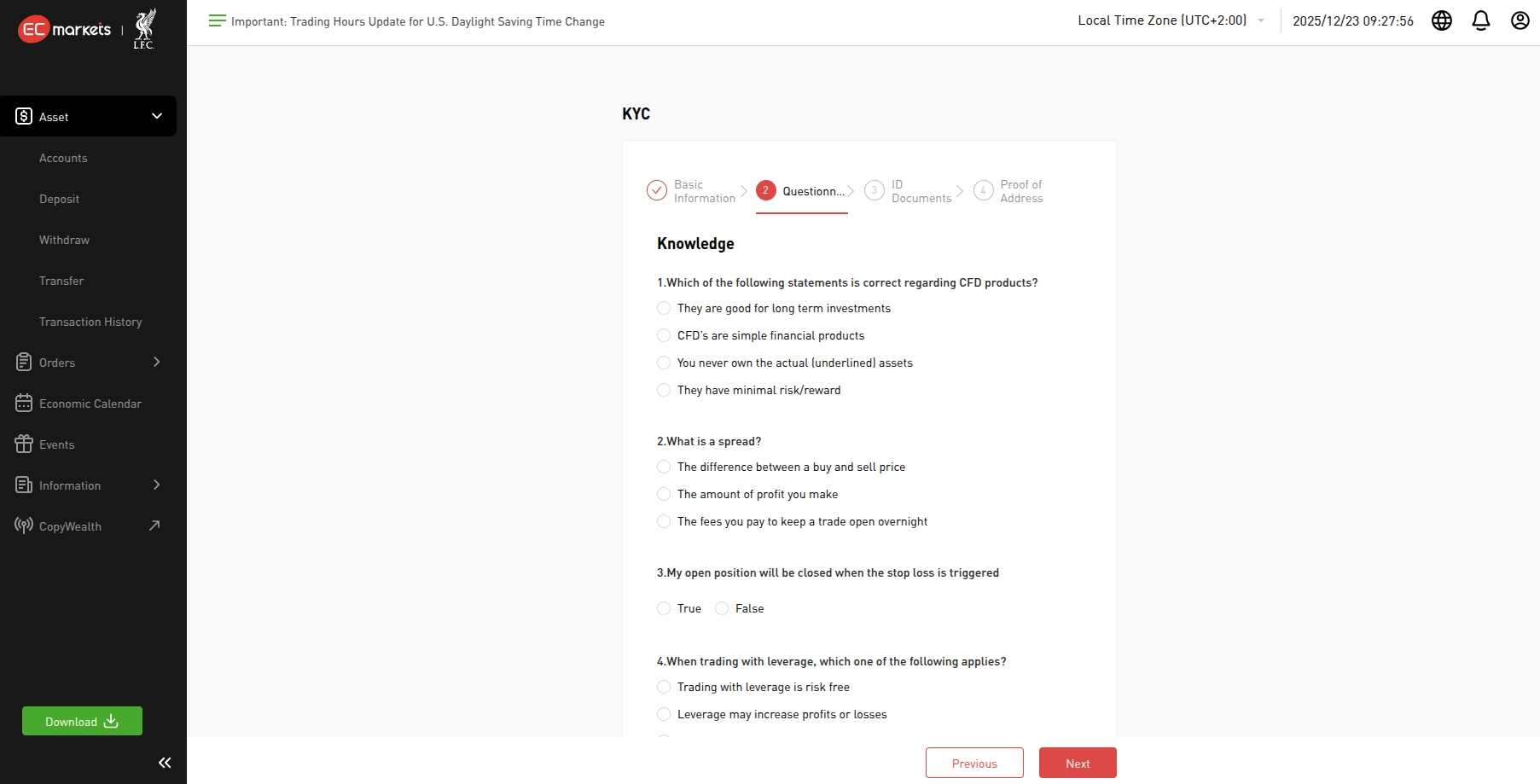

- What follows is a brief questionnaire to evaluate your knowledge of derivatives and trading in general. Some questions are related to basic concepts like the spread, while others are more specific and aim to assess your understanding of using leverage. Take your time with your answers, as failing this test may cause the broker to turn down your application.

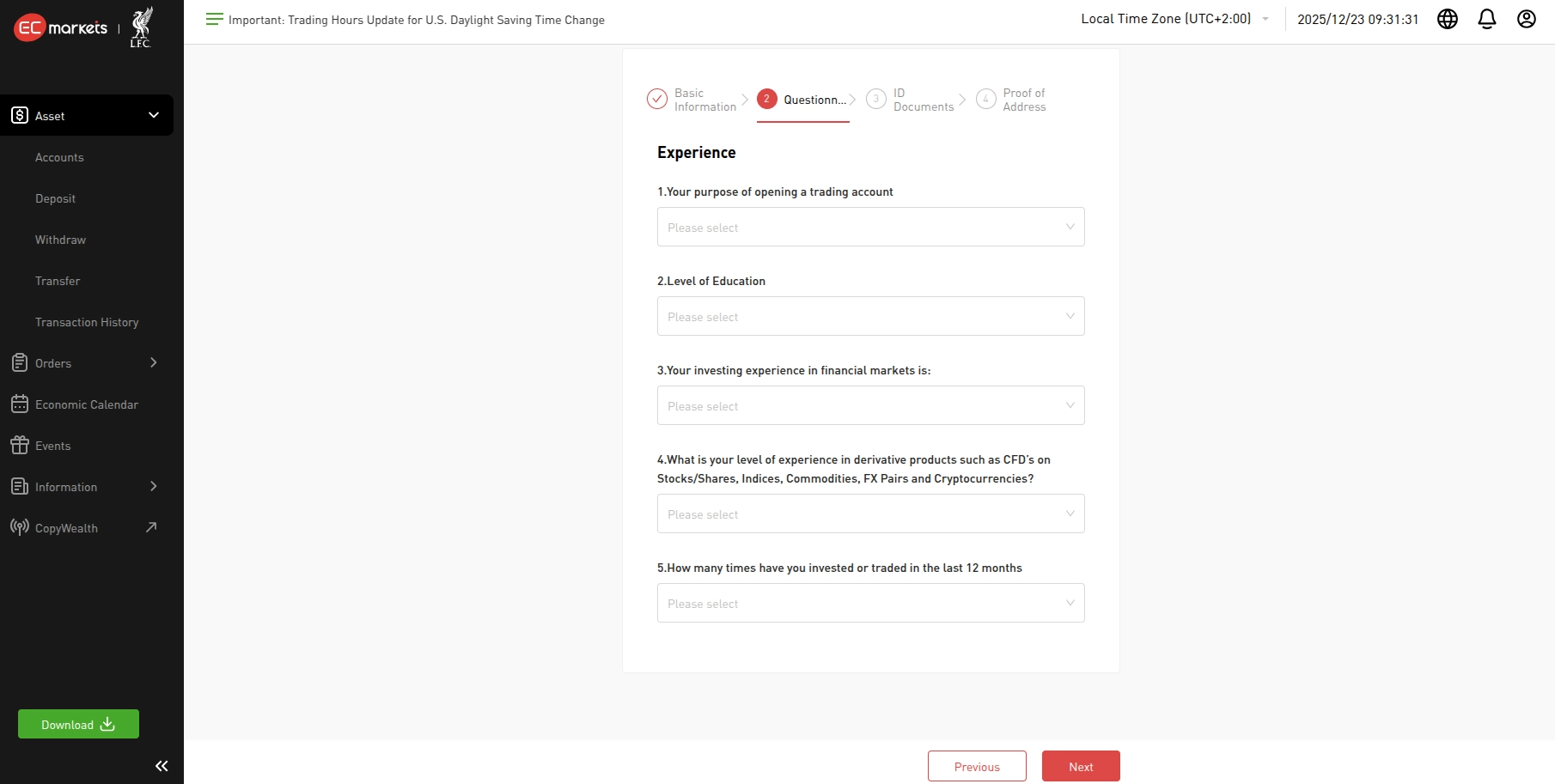

- EC Markets must also assess whether you have sufficient experience in derivative trading. To this end, the broker will ask several questions related to your level of education, experience in investing, and your reason for opening a live account (short-term trading, hedging, speculation, and so on). You must also specify how many trades you have entered over the last year.

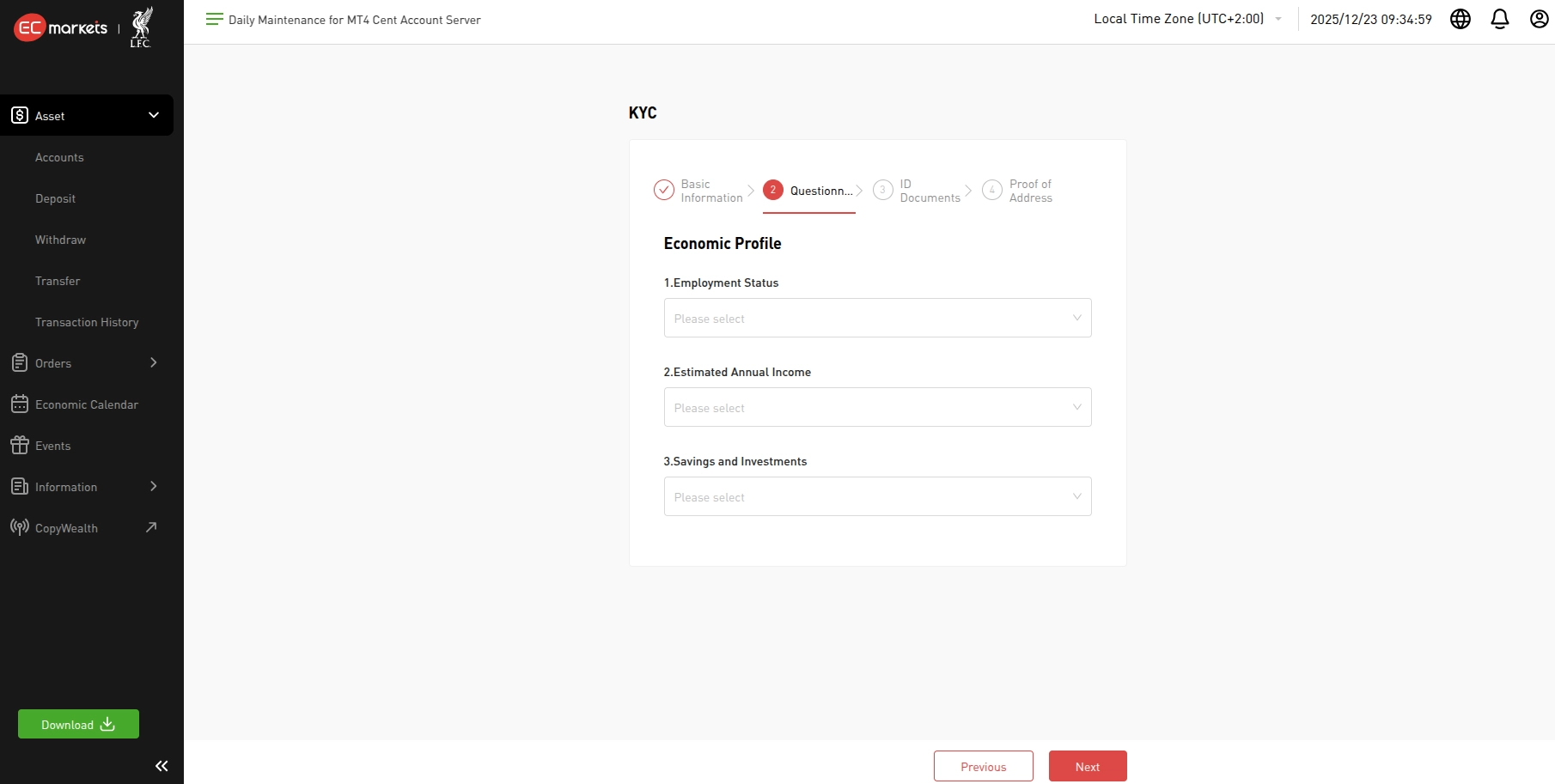

- Next, you must provide information about your current financial situation. You will be asked about your current employment status, annual income, savings, and investments.

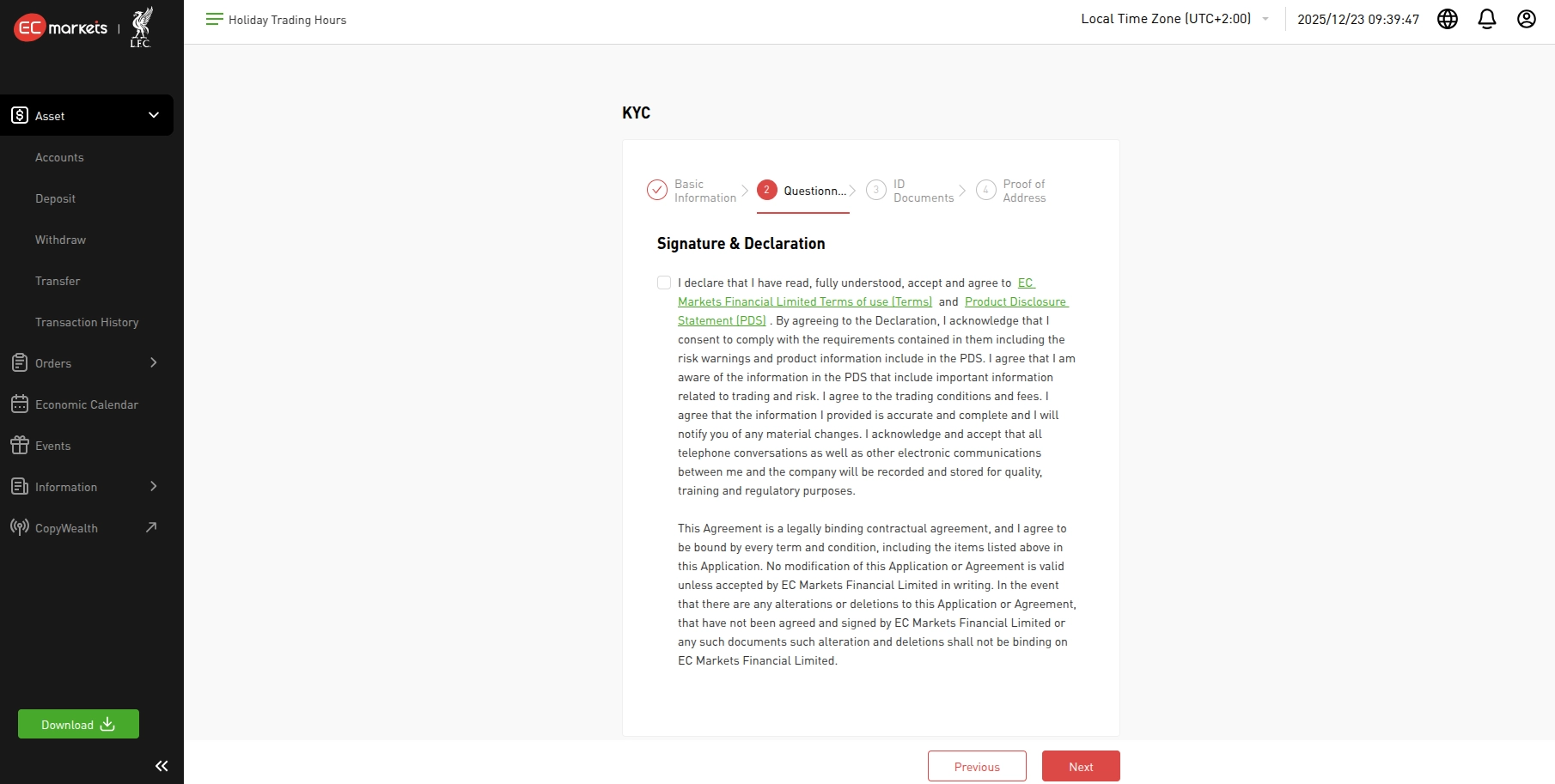

- Tick the box to confirm you have read the broker’s Product Disclosure Statement and Terms of Use.

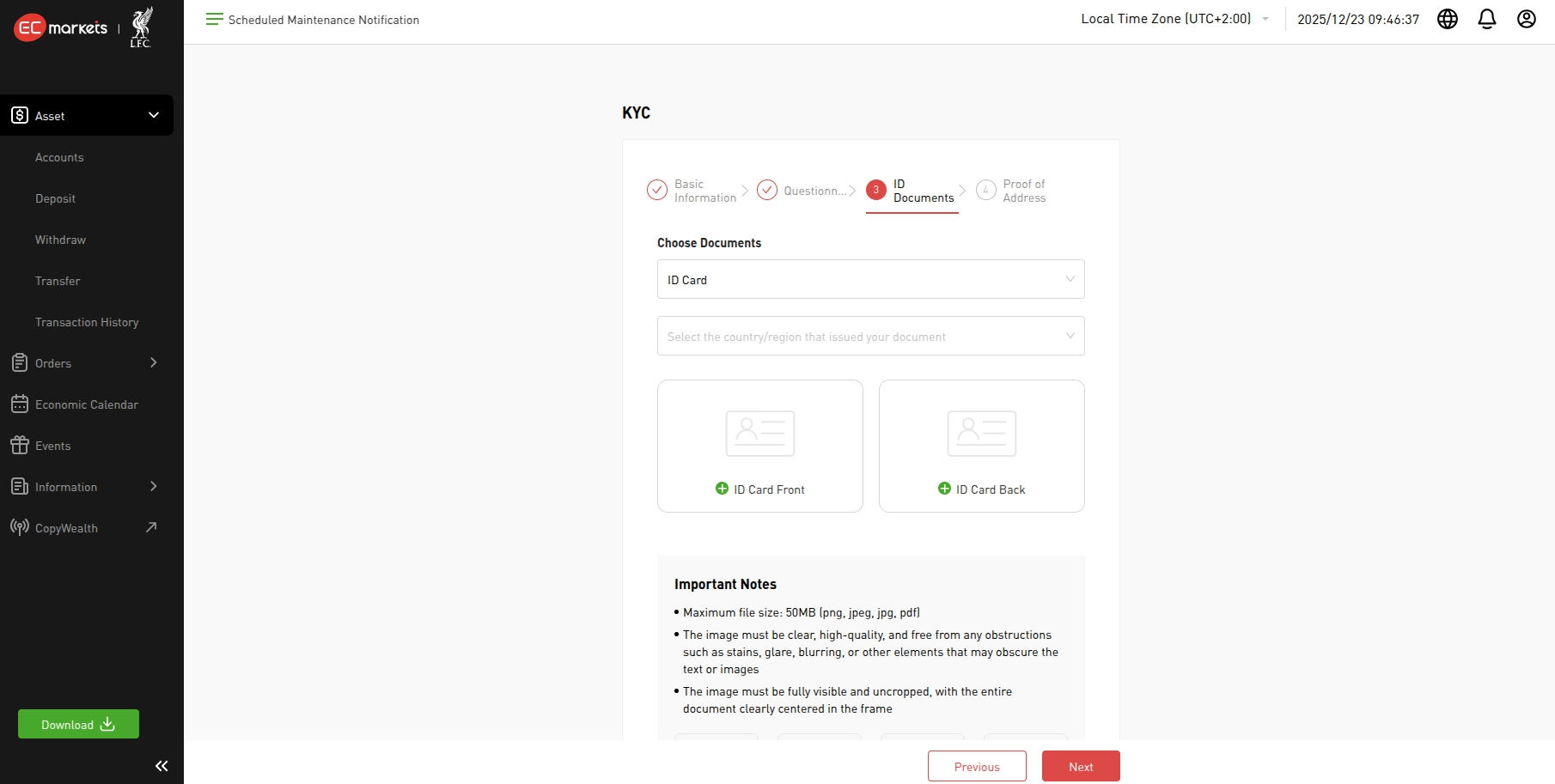

- You are now at the final stages of registration and must upload your documents for identity verification. Select the issuing country and choose a type of document to upload. Typically, onboarding customers can choose from government-issued identification cards, driver’s licenses, or passports, although residence permits are also accepted at the ASIC-regulated branch

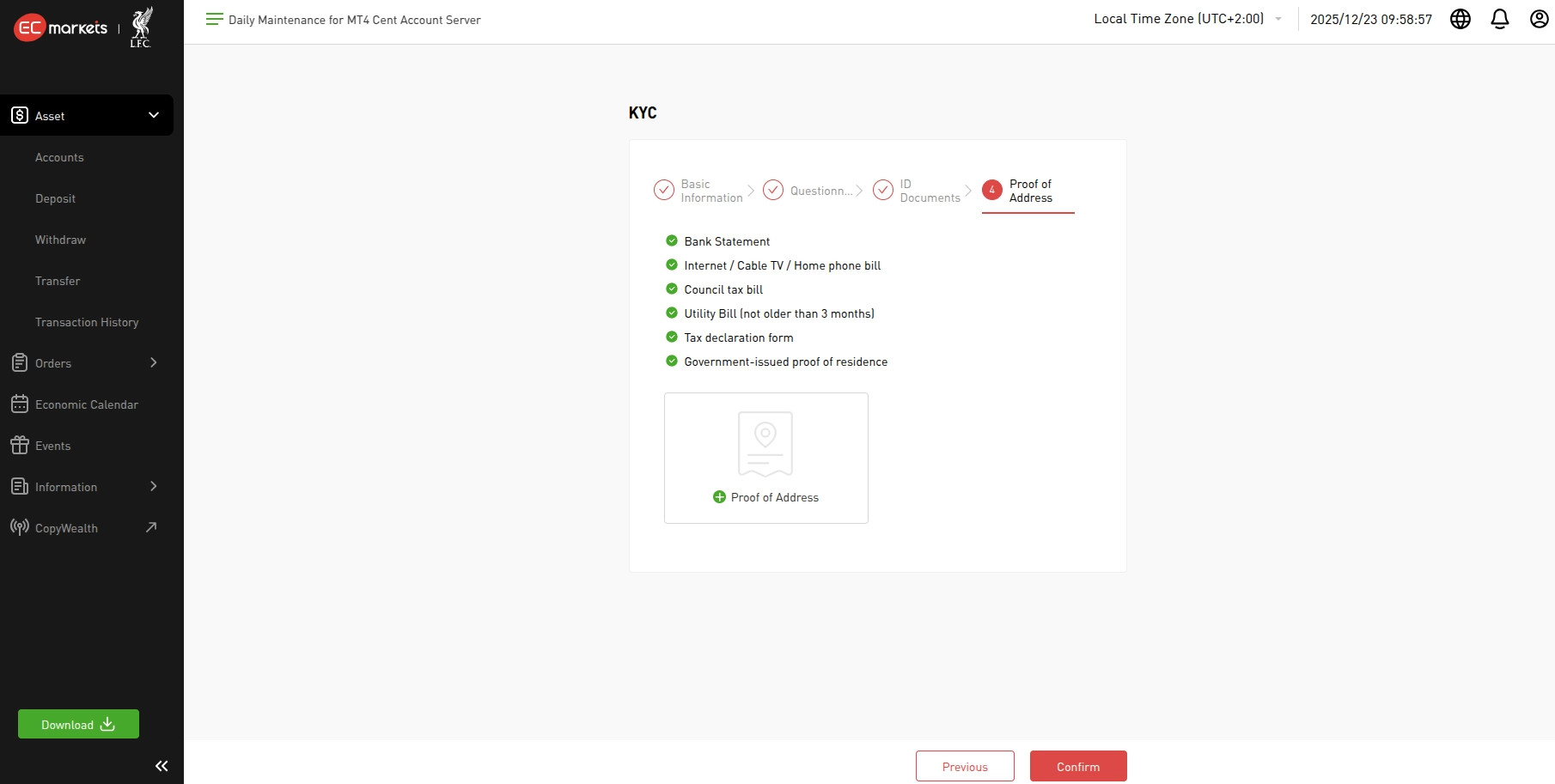

- To complete the verification, you must upload proof of residence. Note that stained or blurry pictures and screenshots are generally not accepted. EC Markets accepts various documents for this purpose, including bank statements, tax declaration forms, council tax forms, and utility bills. Regardless, your document should be no older than 3 months.

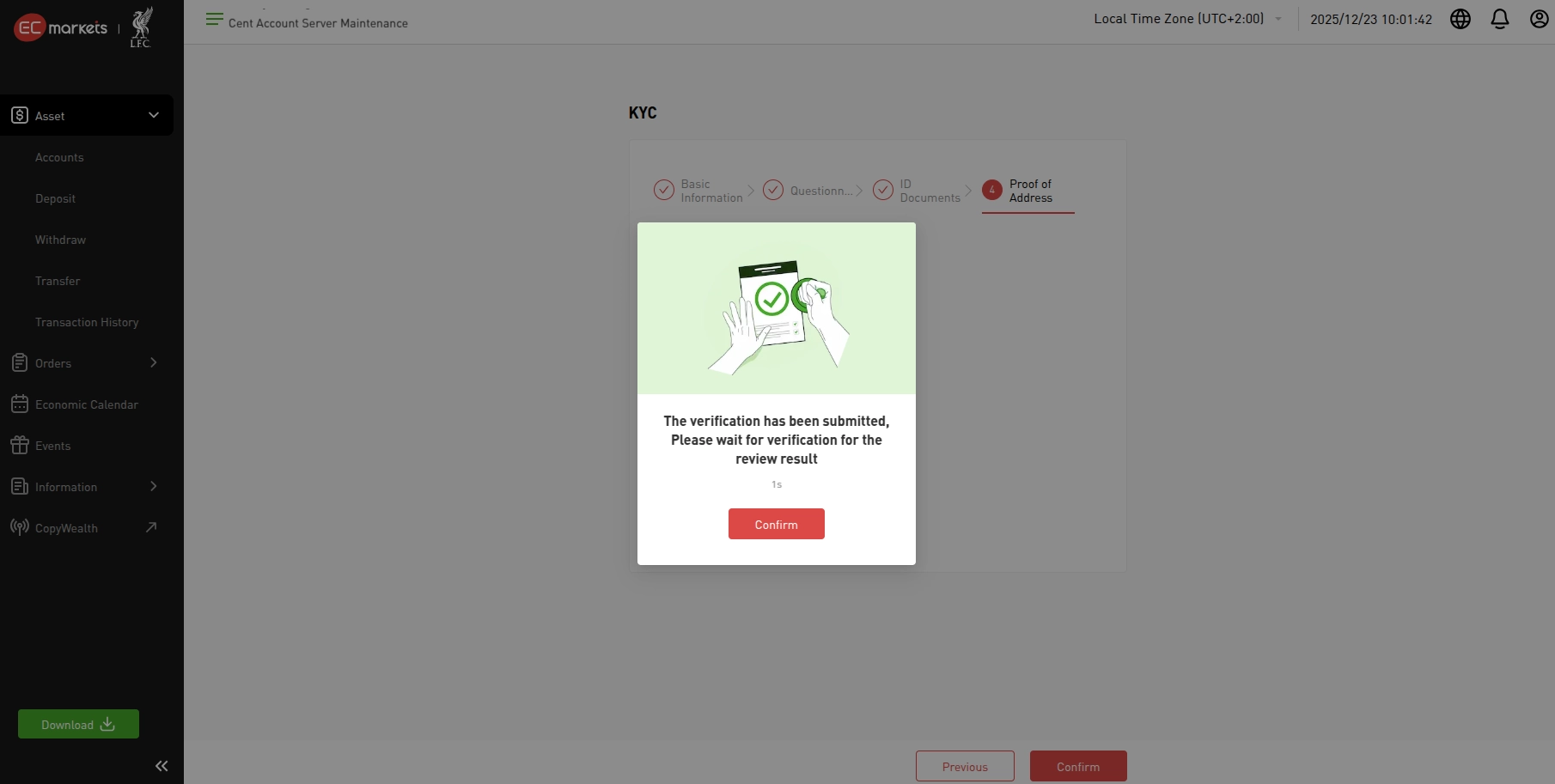

- If all your photos satisfy the criteria, the system will pass them on for evaluation. All that is left to do is wait for the results

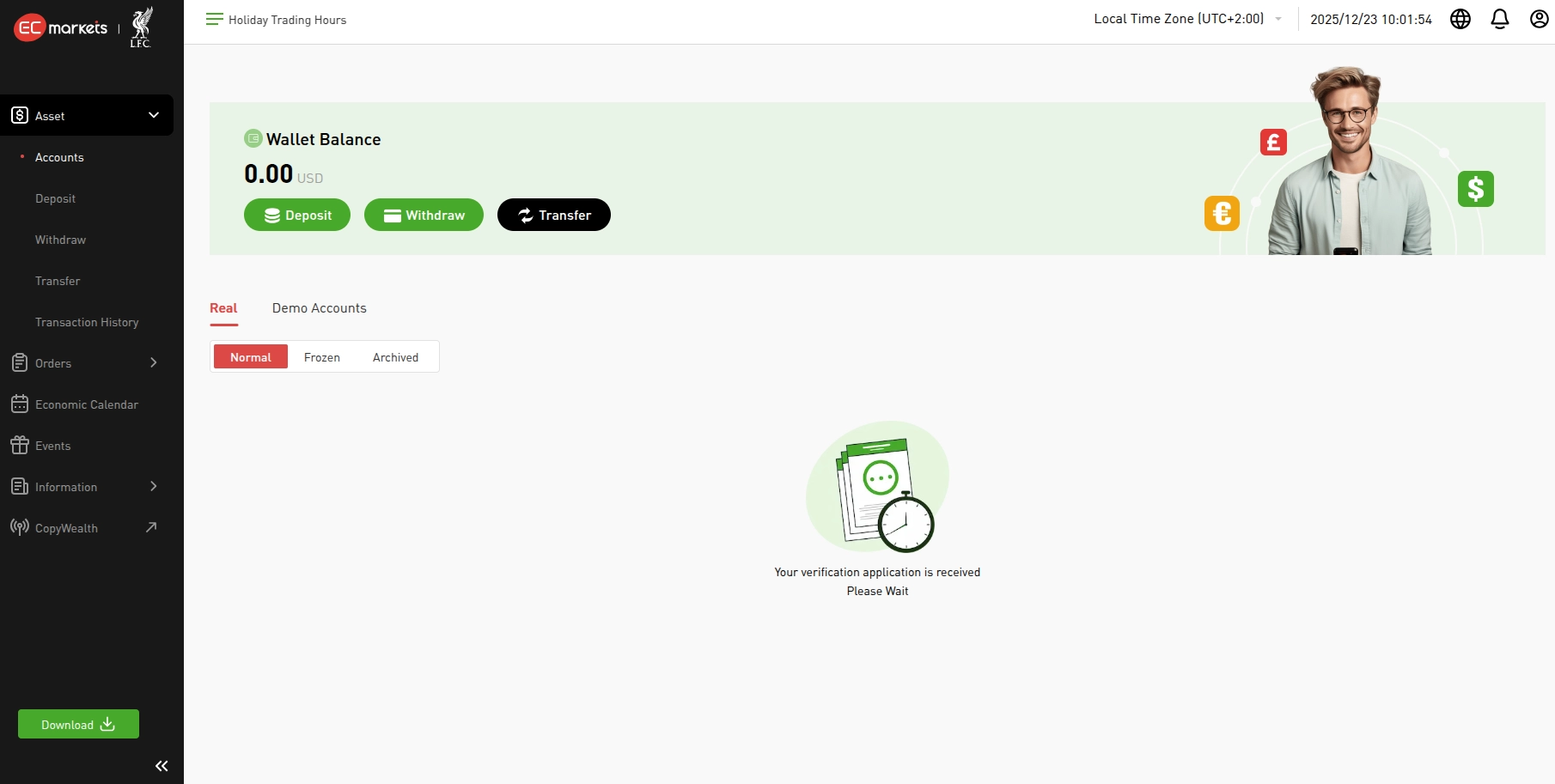

- EC Markets typically approves newly registered accounts within the same day, although the timeframe may extend to 2 business days in certain cases, for example, if the customer’s documents require translation. Once verified, you can access your secure client portal and proceed to fund your live balance. Various funding options are available, including bank transfers, credit and debit cards, e-wallets, and international wire transfers.

Final Impressions

The account opening process at EC Markets is quite efficient and involves pretty much the usual steps one goes through when registering with any regulated online brokerage. Transitioning from a demo to a live account is straightforward, though the identity verification stage can slow you down, especially if you have not prepared your documents beforehand. Most accounts are approved within 1 to 2 business days tops. Overall, the low $10 minimum deposit makes EC Markets an accessible and user-friendly choice for beginners and intermediate traders.