Hantec Markets Account Types in Brief

Hantec Markets offers a diverse range of account types tailored to various trading styles, including the Hantec Global, ECN Hantec Pro, and Hantec Cent. The Global and Cent accounts are perfect for traders who favor a simple, commission-free structure. In contrast, the ECN Hantec Pro account is designed for professionals, providing ultra-tight pricing coupled with competitive commission rates.

For practice and risk management, Demo accounts are readily available, alongside swap-free (Islamic) accounts for adherence to religious principles and PAMM accounts for money managers. Account holders can choose to denominate their accounts in several currencies, including USD, EUR, GBP, and NGN. Furthermore, every Hantec Markets account is equipped with Hantec Balance Guard, a feature that provides Negative Balance Protection, ensuring your account balance can never fall below zero, offering an essential layer of security. The feature is automatically applied at no additional cost.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Hantec Markets Minimum Deposit Requirements

Hantec Markets establishes itself as a trusted and reliable partner for traders ready to enter the dynamic world of CFD trading, distinguishing itself by imposing an exceptionally low minimum entry barrier. Specifically, the minimum deposit requirement for all account types, the Global, Pro, and Cent, is set at $10. Furthermore, risk management is supported by a minimum trading volume of just 0.01 lot across these three accounts, allowing for precise position sizing and strategy testing with minimal capital exposure. As mentioned above, all accounts are fully equipped with the complimentary Balance Guard feature, which guarantees Negative Balance Protection.

The seamless process of getting started involves four simple steps: first, registering an account, second, verifying the account, and finally, funding and starting trading. The supported funding methods are versatile, accommodating global clients through options like VISA, Mastercard, and bank wires, as well as plenty of local payment solutions. Hantec Markets maintains a client-friendly policy of zero fees on deposits and withdrawals, ensuring a cost-effective experience. This is combined with fast execution from 2 milliseconds, ensuring that your trades are placed instantly to capture market opportunities.

What Can You Trade at Hantec Markets?

Hantec Markets provides a diverse offering of over 2,650 Contracts for difference (CFDs) across 6 asset classes. All instruments are tradable through CFDs. The broker’s comprehensive market coverage includes nearly 100 forex pairs, indices, more than 1,980 individual stocks, metals (such as gold and silver traded against various currencies), a selection of commodities, and over 60 cryptocurrencies.

The type, count, and availability of these instruments are determined by the relevant jurisdiction and the specific Hantec Markets entity. For instance, the selection of cryptocurrency CFDs spans over 60 instruments, but their availability varies. The Financial Conduct Authority (FCA), for example, does not allow retail trading of crypto CFDs. Furthermore, the maximum allowable leverage is dependent on both the regulatory framework and the client’s account type and tradable instrument. Maximum leverage limits for major forex pairs are: 1:500 for the Global and Pro accounts, and 1:1000 for the Cent account.

Step-by-Step Registration at Hantec Markets – Takes Around 15 Minutes

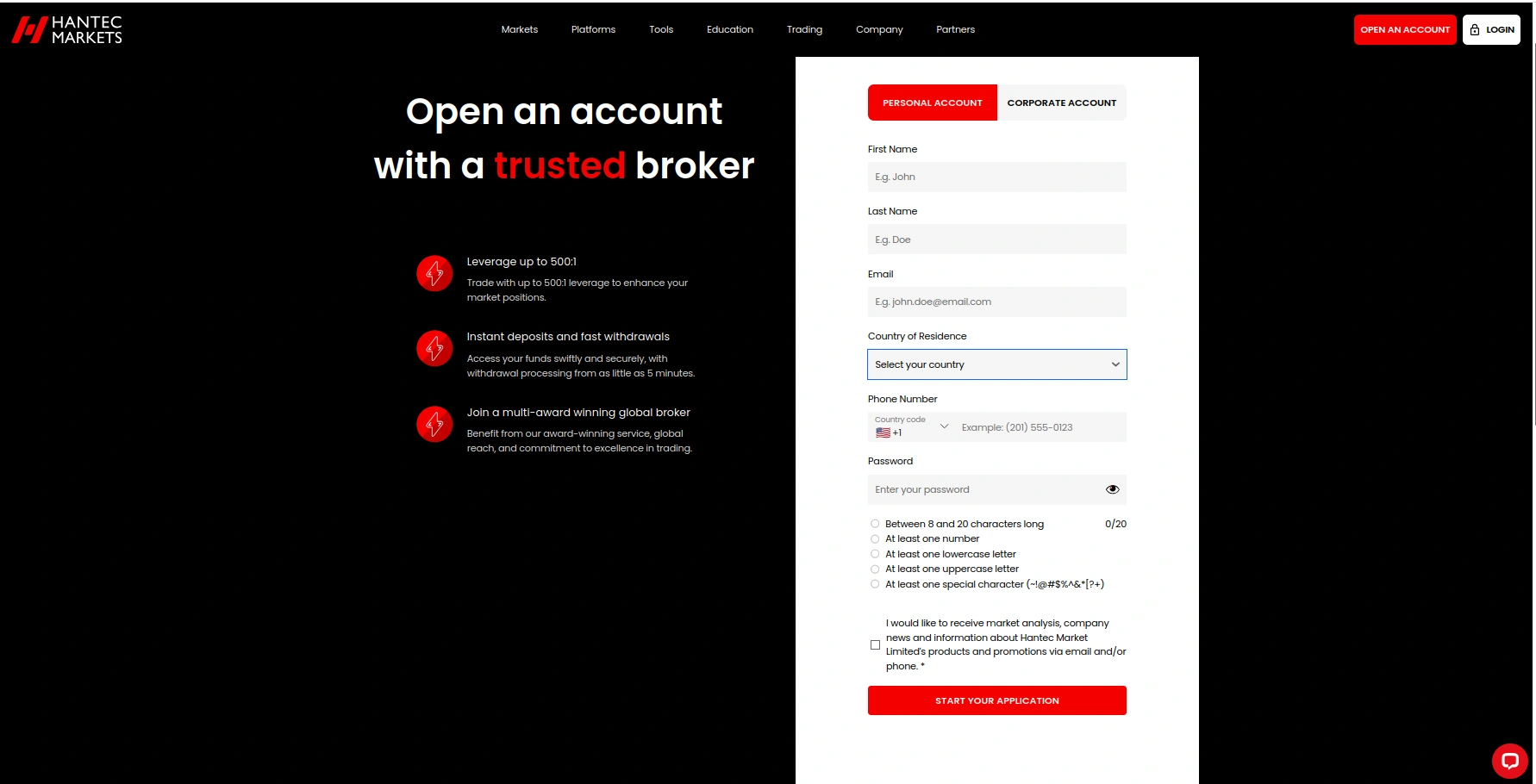

- Since Hantec Markets operates under the oversight of several financial regulators, traders must first select the specific entity under which they wish to establish their account. To open an account with the Hantec Markets entity, which is regulated by the Financial Services Commission (FSC) of Mauritius, users should navigate to hmarkets.com on their web or mobile device and then select the red ‘Open an Account’ button.

- To initiate the account opening process, retail traders should pick the ‘Personal Account’ option. They must complete the registration form by providing their personal details, which include name, email address, country of residence, and phone number. Additionally, they are required to set a strong password, containing between eight and 20 characters, at least one number, one lowercase letter, one uppercase letter, and one special character.

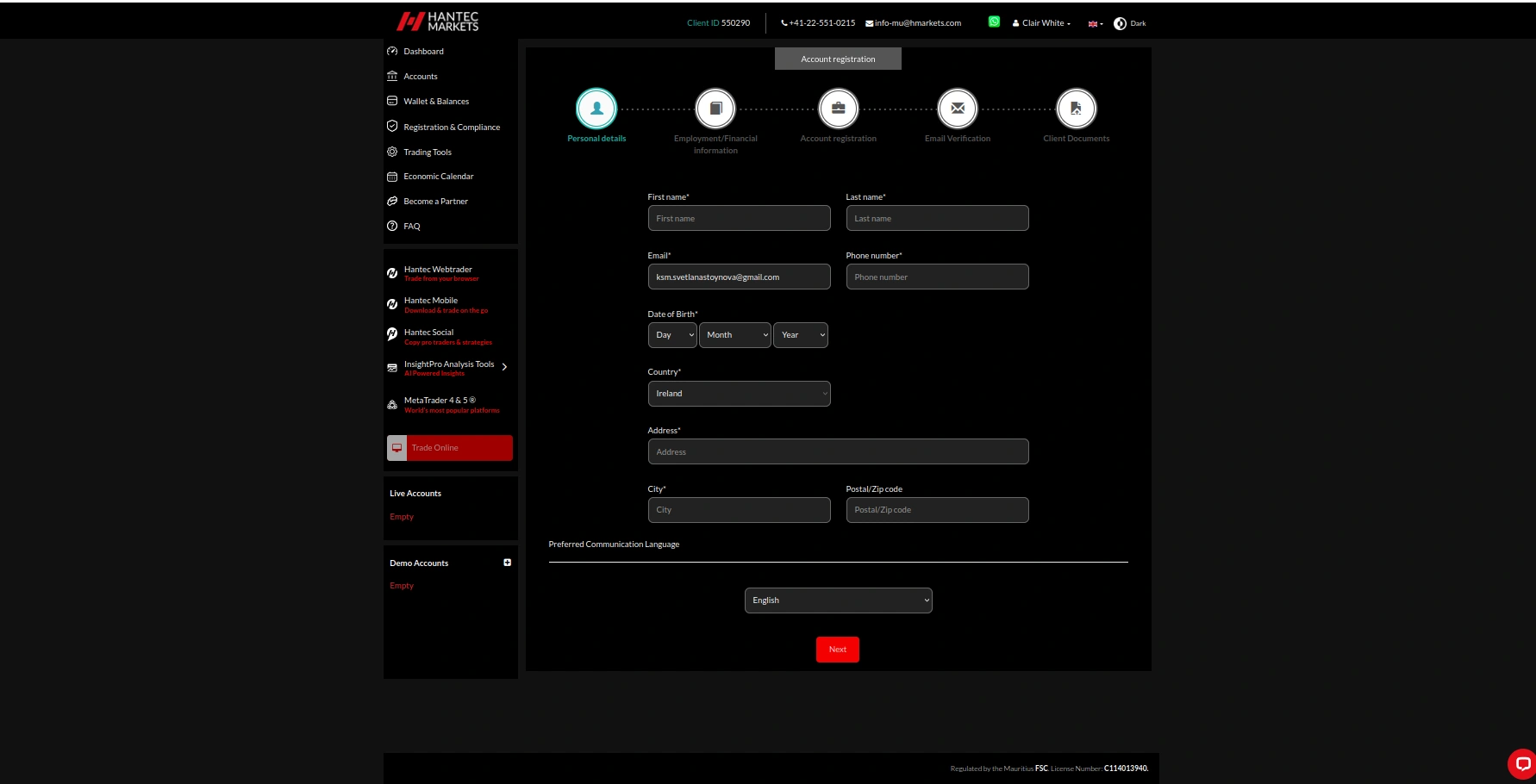

- Following the initial sign-up, the next step requires users to provide additional personal details to complete their profile. This involves entering your date of birth, residential address, city of residence, and postal code. Additionally, users must pick a preferred communication language from the available options, which include: English, Spanish, Portuguese, Chinese, Vietnamese, Thai, Korean, and Japanese.

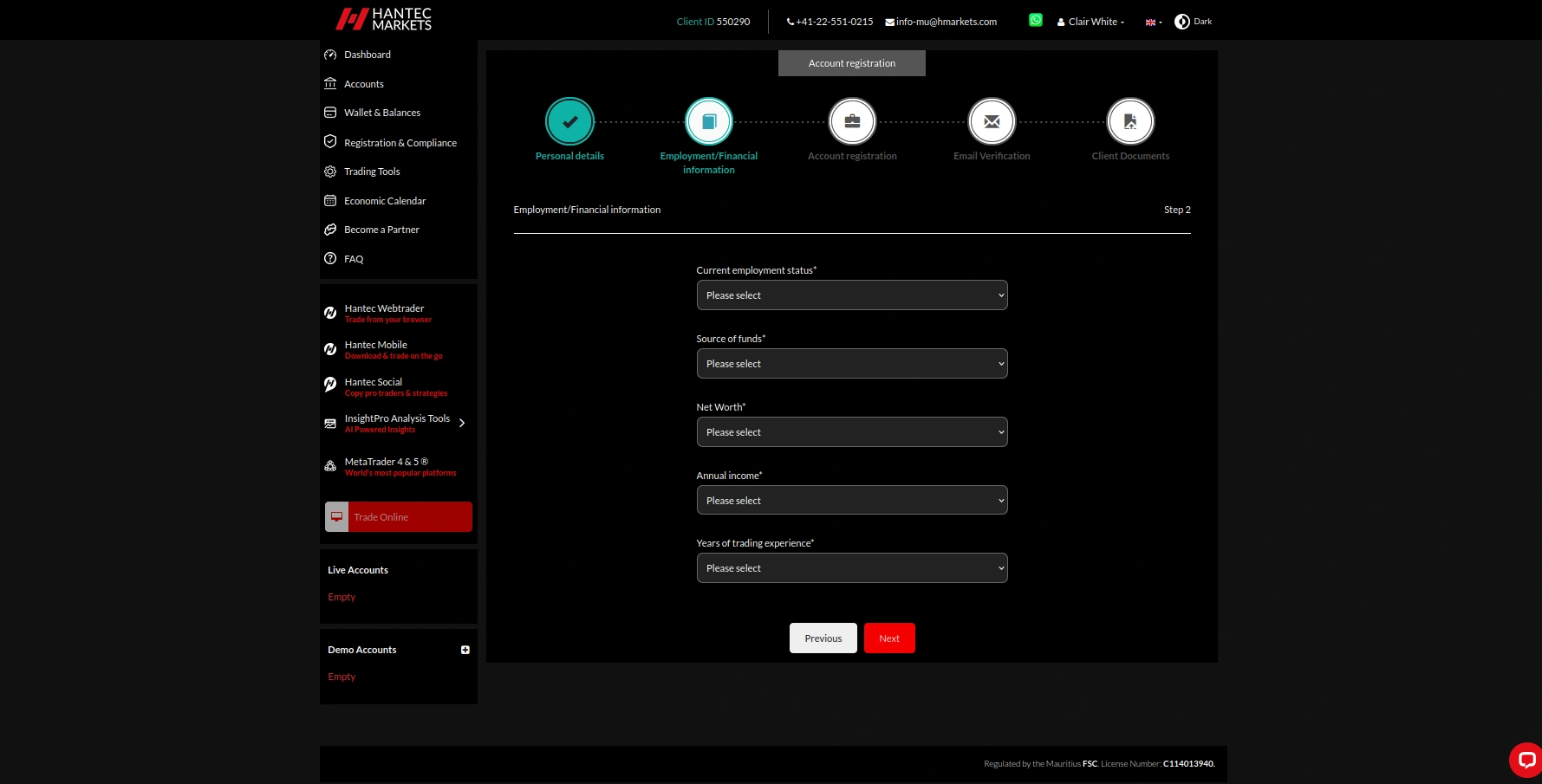

- The next step requires traders to provide essential employment and financial information. This profile helps the broker assess the client’s suitability and financial background. The required details include current employment status (employed, self-employed, retired, or unemployed), source of funds (employment income, rental income, pension plans, or other sources), net worth (ranging from $0-$20,000 to over $250,000), annual income size (ranging from $0-$5,000 to over $150,000), and years of trading experience (ranging from ‘no experience’ to 10+ years).

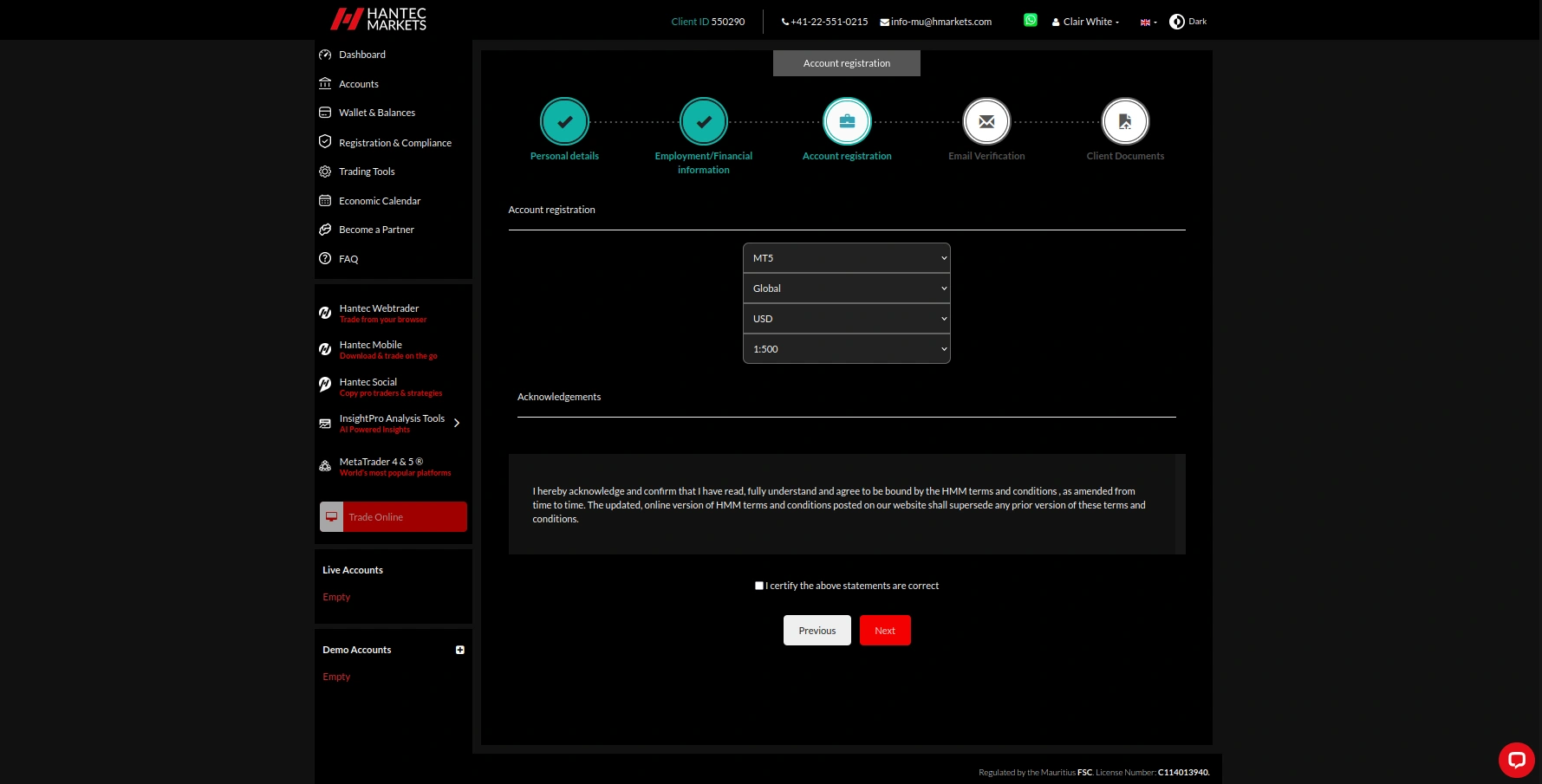

- The ‘Account registration’ step requires the trader to choose their trading setup. Specifically, traders must select a preferred trading platform, an account type, their base account currency, and the desired maximum leverage. Finally, traders must formally acknowledge that they have read, comprehended, and agreed to Hantec Markets’ terms and conditions.

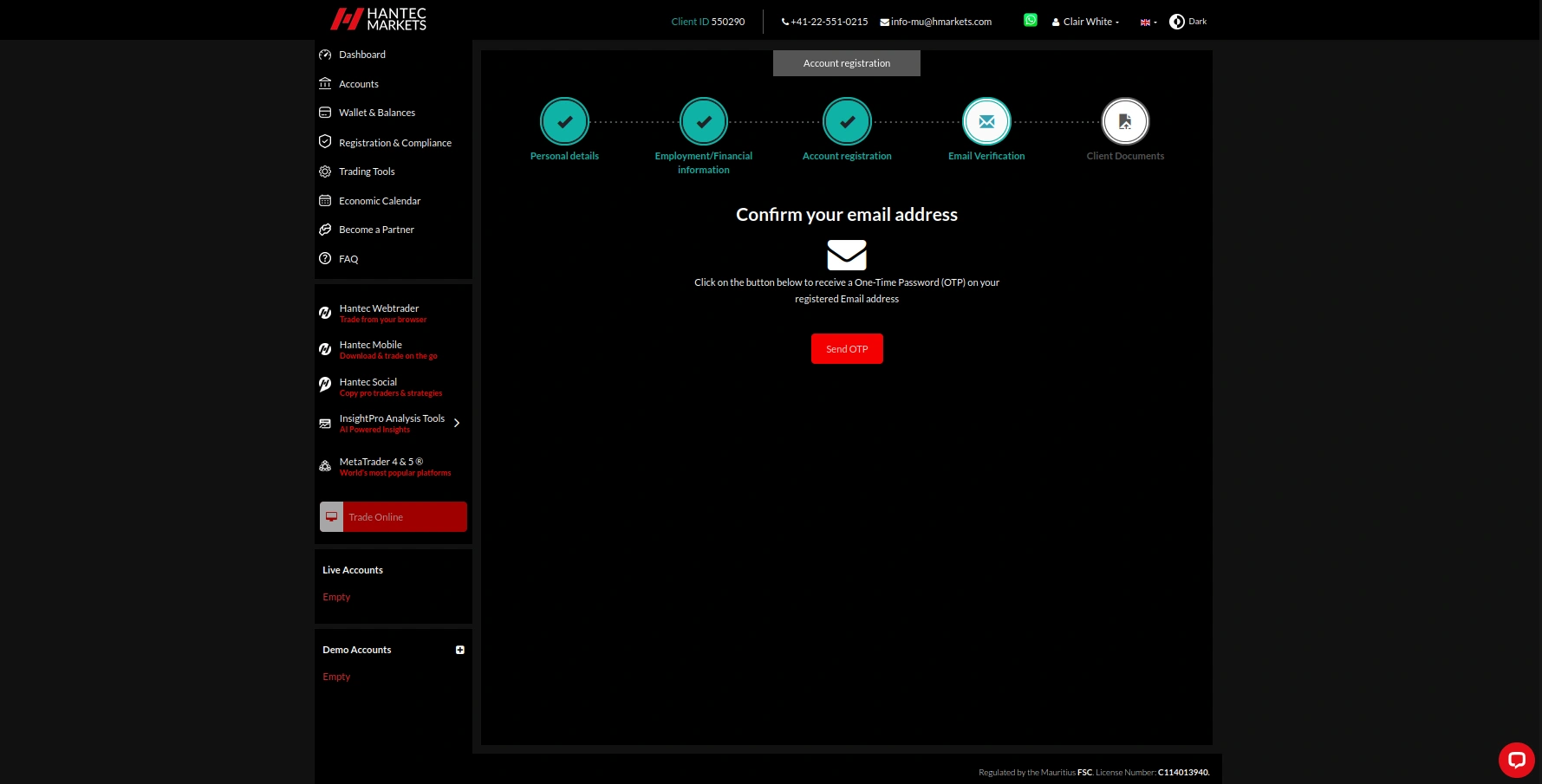

- The next step is the ‘Email verification’ process, which is designed for quick confirmation. Traders are prompted to click or tap a designated button to receive a one-time password sent directly to their registered email address.

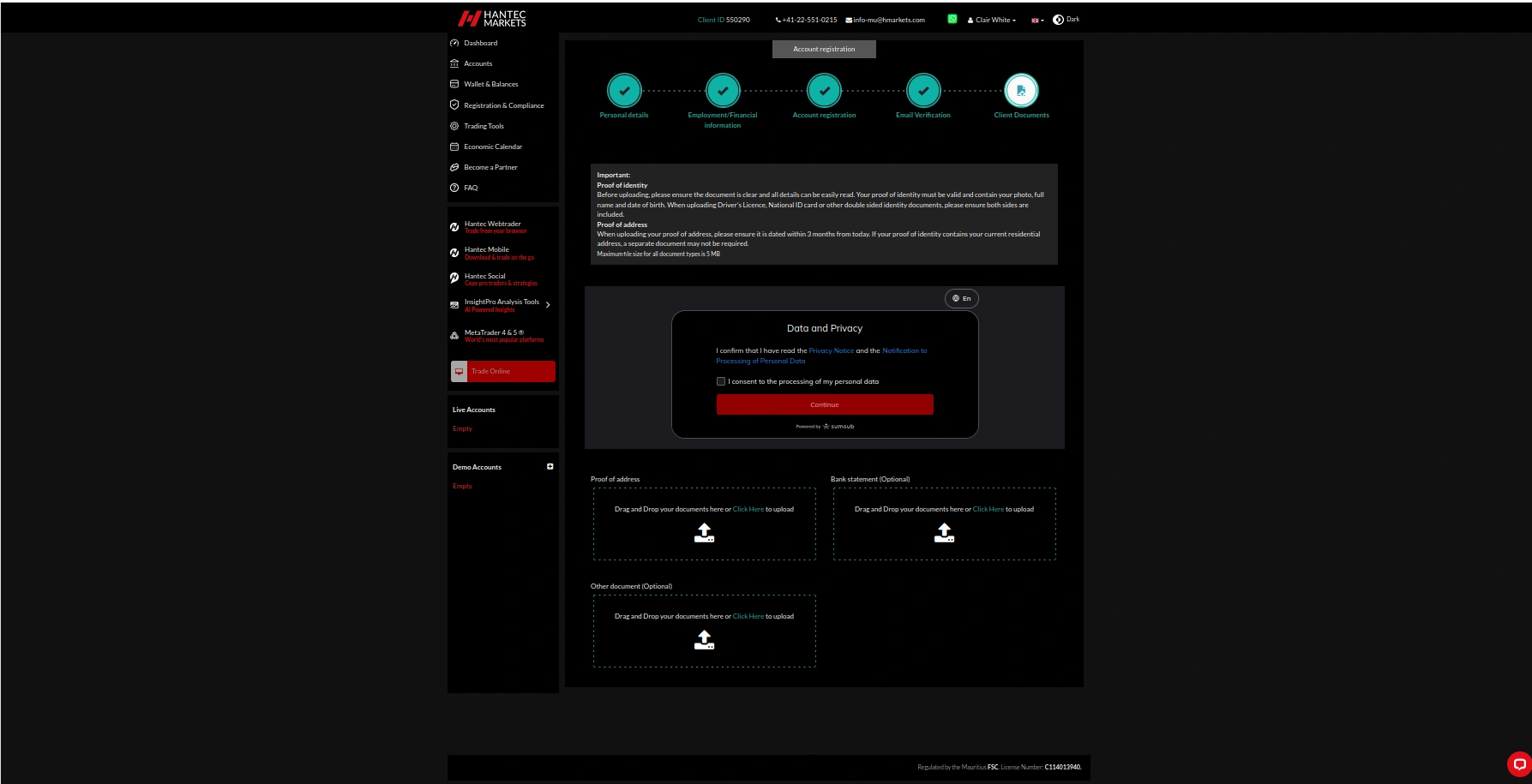

- To complete the application, traders must upload a Proof of Identity and Proof of Address. The proof of identity must be valid, legible, and include your photo, full name, and date of birth. If it is double-sided, both sides must be included. The proof of address must be dated within the last three months, though a separate proof of address may not be required if your current residential address is already on your proof of identity document.

Final Impressions

The account opening process at Hantec Markets is both streamlined and efficient, designed to take no more than 15 minutes from start to finish. The process guides traders through selecting their regulated entity, providing personal and financial details, choosing their platform and account settings, and completing final verification via email and document upload. After successful account registration and verification, traders can proceed directly with funding their account, which has a low minimum requirement of just $10, and immediately access the broker’s extensive range of over 2,650 CFD instruments across six asset classes.