Account Types at Scope Markets

Scope Markets features several account types that can be opened by European traders. The first two are its traditional live accounts:

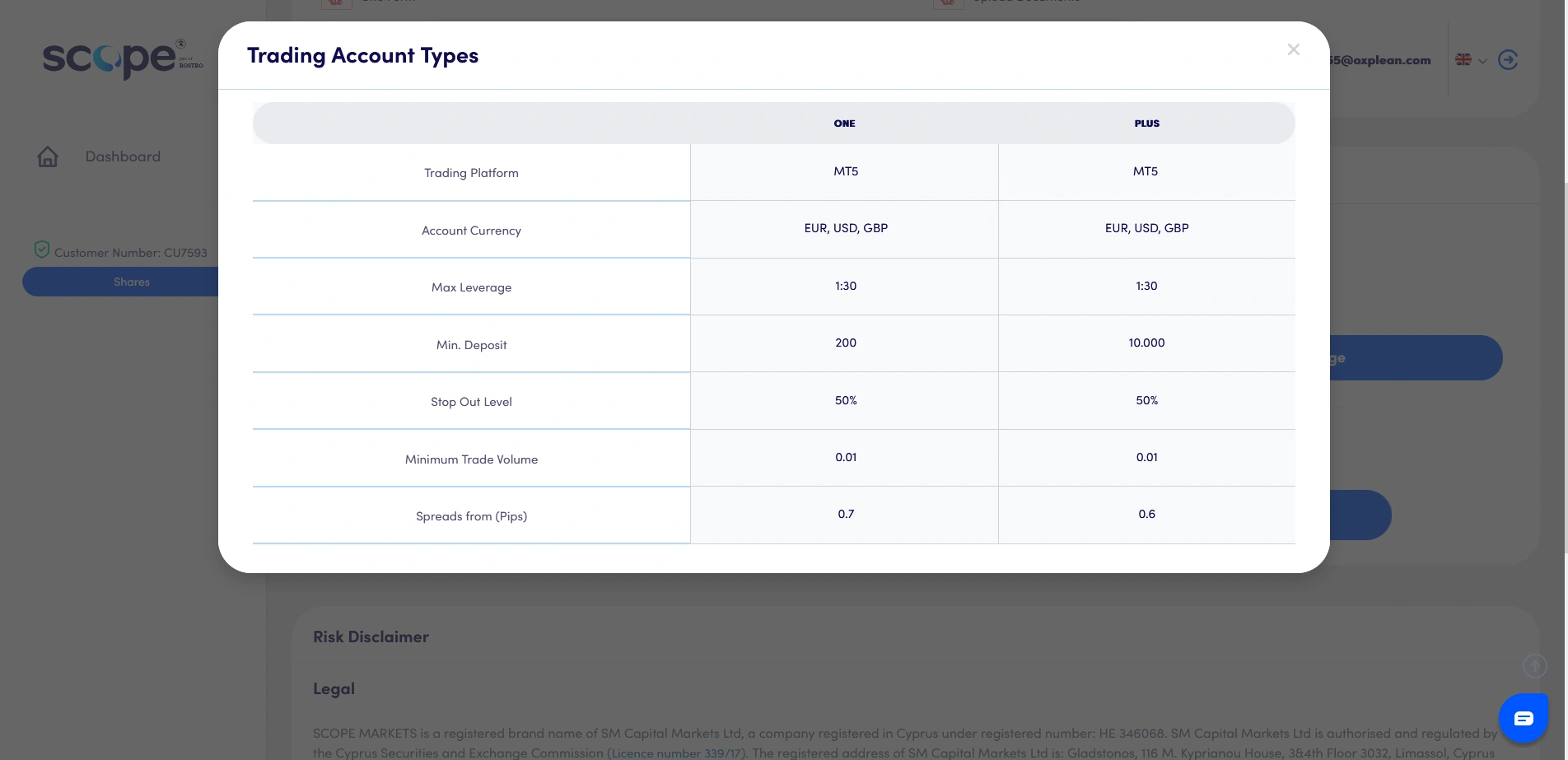

- One Account: This option comes with spread averages from 0.7 pips, and its minimum deposit is $200.

- Plus Account: Its spreads can drop slightly lower to 0.6 pips, but it does come with a steep deposit minimum of $10,000.

Both account types have a leverage cap of 1:30, a stop out level of 50%, enable micro lot (0.01) trading, and support MT5. The available markets include forex, commodities, cryptocurrencies, indices, shares, and futures. FX trading is commission-free.

Muslim traders are also welcome at Scope Markets Europe and can open a live swap-free account by contacting support. Another account type enables demo trading for strategy testers and beginners.

The last account offered by SM Capital Markets Ltd, the company that operates the CySEC-licensed entity, is the one designated for professional traders. It comes with leverage limits of 1:200, but you will need to meet at least two of MiFID II’s professional designation requirements in order to open such an account:

- Trading experience amounting to 40 significant trades within the last year

- An investment portfolio of over €500,000

- 1+ year of professional experience in the financial sector

Furthermore, professionals waive their rights to negative balance protection and are no longer eligible for the investor compensation fund.

As established, the above accounts are what you can find at Scope Markets’ European entity. If you reside elsewhere, the available account types will differ. Registering at the Belize-licensed offshore entity (RS Global Ltd), for instance, will allow you to create a Scope Elite account, whose spreads can go as low as 0.0 pips, and a commission per side of $3.5 applies. Multi-Account Manager (MAM) and Percentage Allocation Management Module accounts are available too, as is the Scope Invest account for trading fractional shares with typical spreads from 0.01 pips.

The Scope Markets branch operating in Kenya features unique account types as well, namely Silver, with average spreads from 1.1 pips, and Gold, whose spreads may hit 0.2 pips, but a commission of $3.5 (per side) is present.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

Traders residing in Europe will be able to trade at Scope Markets after depositing at least $200 into their balance, provided they go with the One Account. While the $200 barrier is higher than some of the popular discount brokers operating in the region, it is nonetheless reasonable. Those seeking lower spreads may open a Plus Account instead, but as established, its deposit requirements jump exponentially to $10,000.

As for Scope Markets’ offshore entity, most live accounts have a deposit minimum of a mere $10. The one exception is Scope Elite, as opening such an account entails making a deposit of at least $20,000. In Kenya, the lowest amount traders can deposit is $100, while South Africans can top up their balance with $50 or more.

Traders should keep in mind that, beyond account creation, the deposit minimums will be dependent on the payment methods they utilize. Top-up transactions made via international bank transfer at RS Global Ltd, for example, require that the user deposit at least $50.

Tradable Instruments

Scope Markets features a comprehensive library of CFD (Contract for Difference) instruments that will suit the preferences of most traders. In terms of forex, over 40 major, minor, and exotic pairs are available, with key examples being EUR/USD, GBP/USD, EUR/CAD, and GBP/JPY.

Stock CFDs are abundant at Scope Markets, and users can trade US, UK, and European shares. The Nasdaq 100, Nikkei 225, S&P 500, and a dozen or so more indices can be traded as well. Index futures are another option.

Commodities traders will be satisfied with what Scope Markets has to offer. Crude oil and natural gas are what you can pick from in terms of energies, while the metals section includes gold traded against the US dollar and the Euro, as well as XAG/USD (Silver). Soft commodities like coffee, sugar, and wheat are also included in Scope Markets’ catalog.

Last but not least, crypto enthusiasts will have the opportunity to trade coins like Bitcoin, Ethereum, and the like through CFDs. However, this option is not available to clients of the offshore entity.

Instrument availability can also differ depending on one’s account type. At RS Global Ltd, Islamic account holders can only trade EUR/USD, XAU/USD (Gold), NAS100, SP500, WS30, and the DAX40.

Step-by-Step Registration at Scope Markets – 2 Minutes in Total (Demo Account)

Traders can create a Scope Markets Demo Account in a matter of a few minutes. There are eight steps in total, and we have outlined the entire process below.

-

Go to Scope Markets’ homepage and scroll down until you see the Try Demo Account.

-

Input your first and last name, email, and phone number. Then, select your country of residence, and create a complicated password. Finally, tick the Privacy Notice field, and agree to receive marketing communication if you would like to be sent emails regarding important account information. Once done, click Register.

-

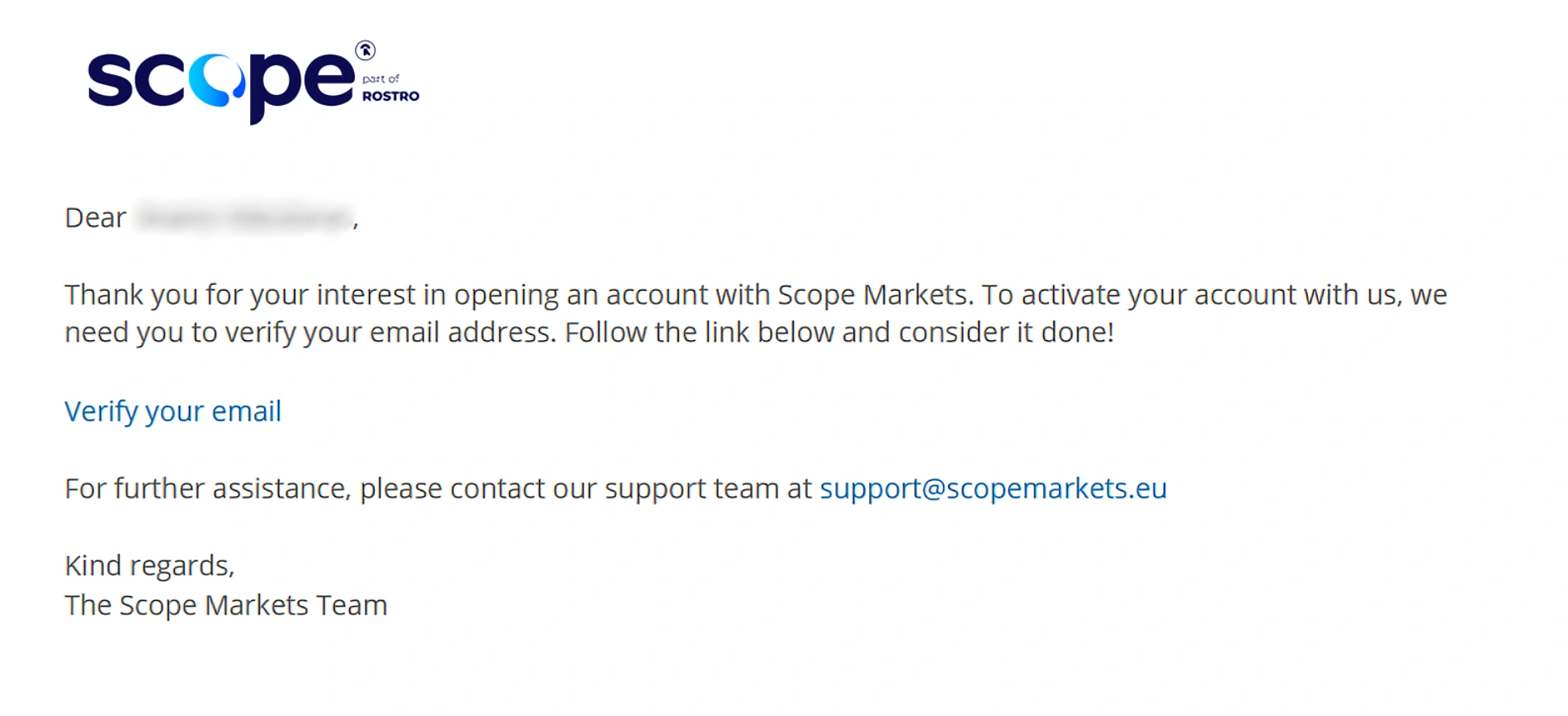

Next, you need to open the email sent by Scope Markets and follow the “Verify your email” link.

-

Close the Personal Information window, as you do not need to undergo additional verification steps when it comes to demo trading.

-

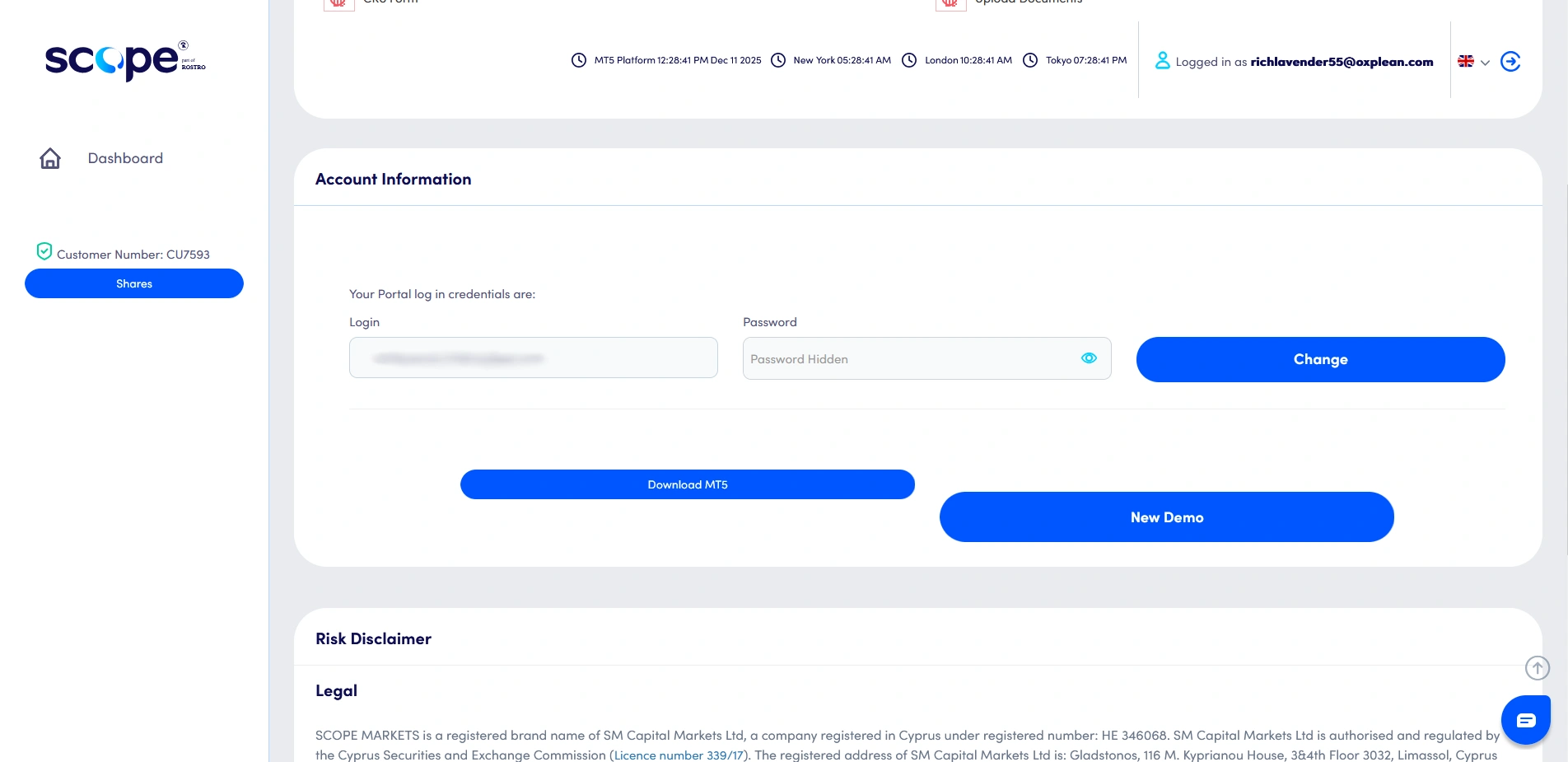

Scroll down and select the New Demo button.

-

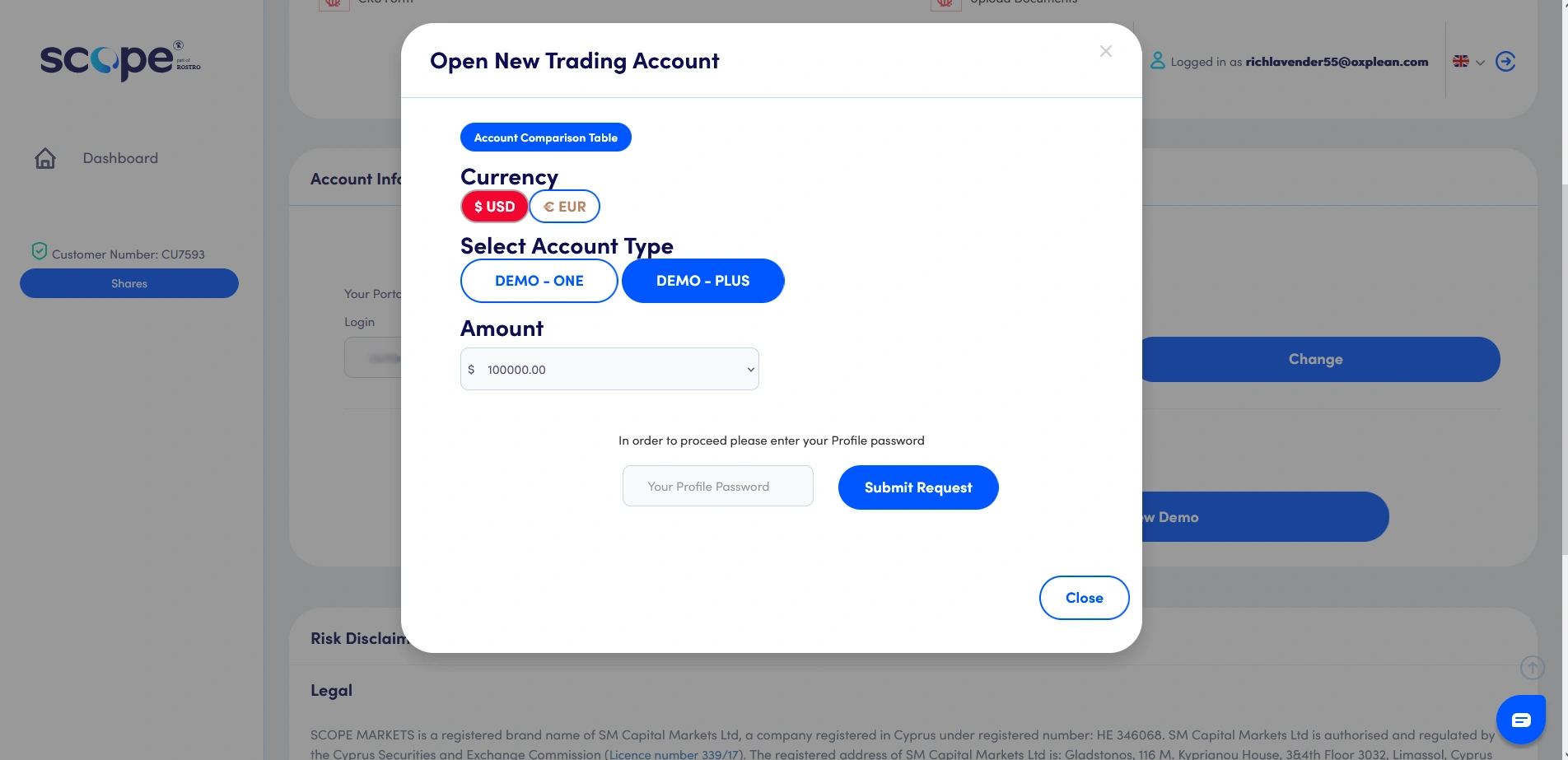

Here you can choose your base currency and the amount of virtual funds you will have at your disposal.

-

If you would like to see a side-by-side overview of the account types, click Account Comparison Table. Keep in mind that the available options can differ based on the Scope Markets entity you plan to trade at.

-

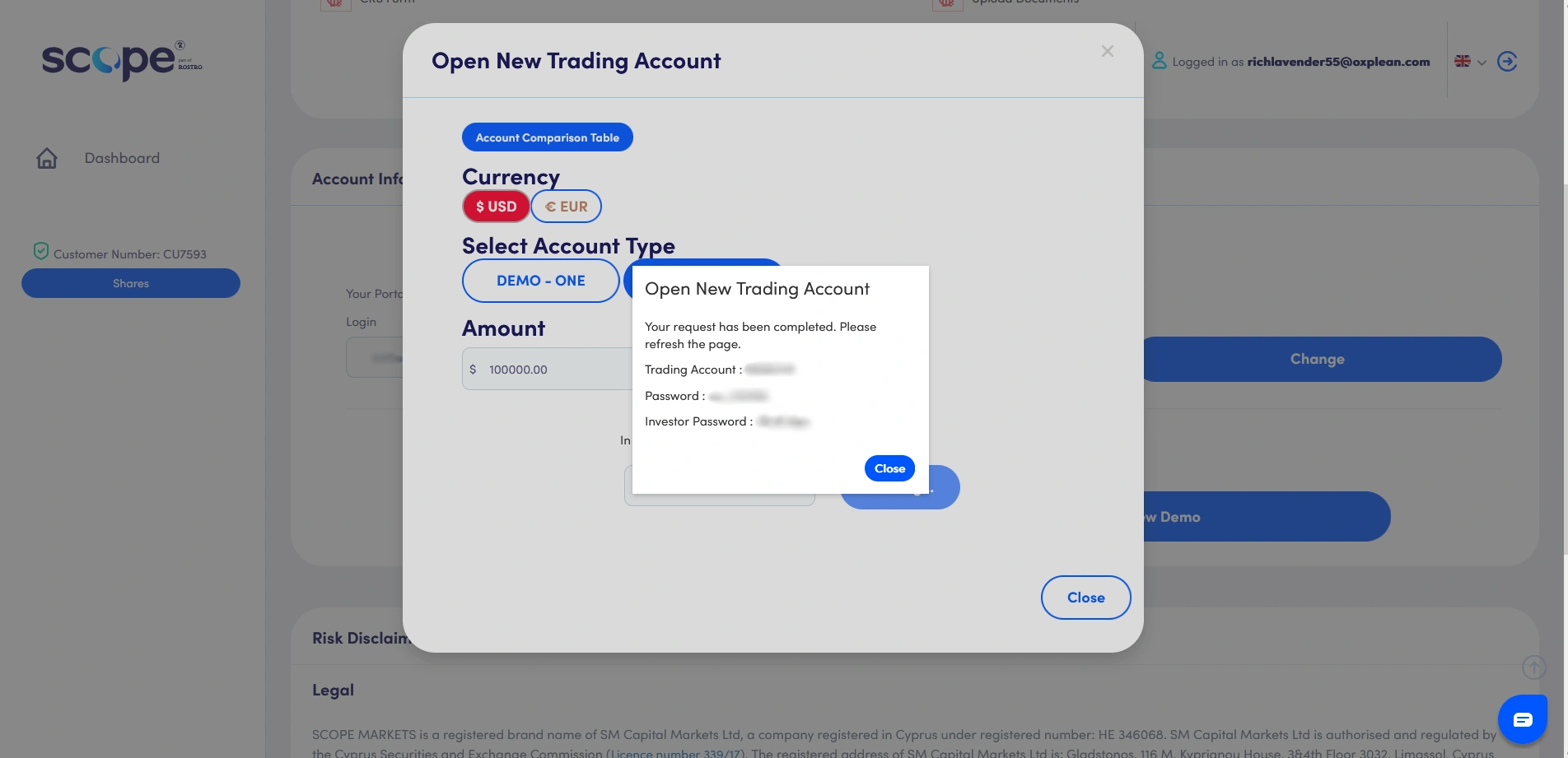

Once you are satisfied with your account properties, type in your password and click Submit Request. This will open a window outlining your account number, password, and investor password. With this, you are ready to use your Scope Markets Demo Account.

Step-by-Step Registration at Scope Markets – 15 Minutes in Total (Live Account)

Registering is relatively straightforward at Scope Markets. On the client’s end, the entire process will take no more than 15 minutes if you follow the steps below.

Pay a visit to Scope Markets’ homepage and navigate to the registration page by clicking Open Account.

-

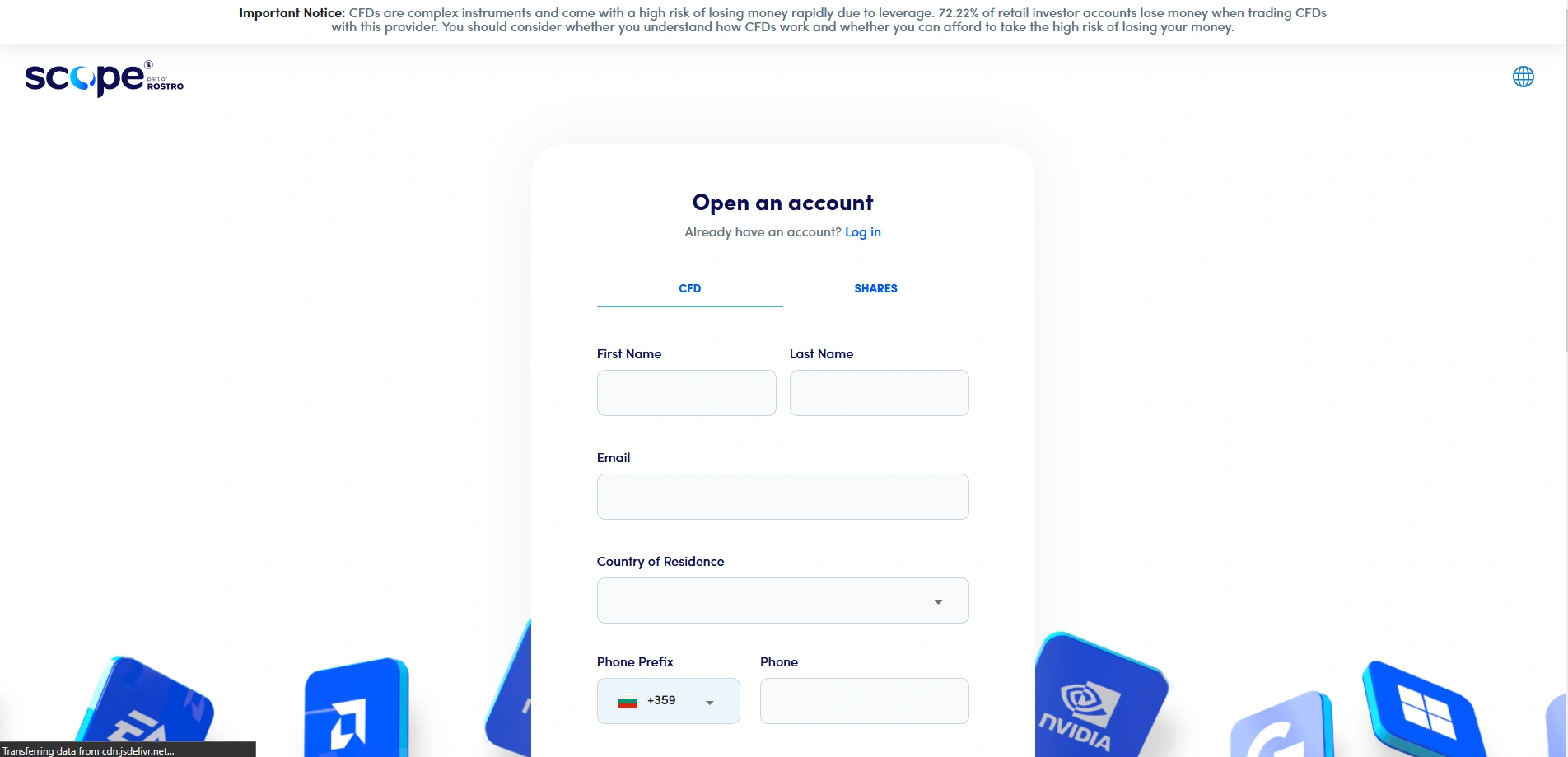

Input your name, email, and find your country of residence in the drop-down menu. Write down your phone number and create a password. Then, confirm that you have read the broker’s Privacy Notice, and agree to receive marketing information, as Scope Markets warns that such emails may contain important information regarding your account.

-

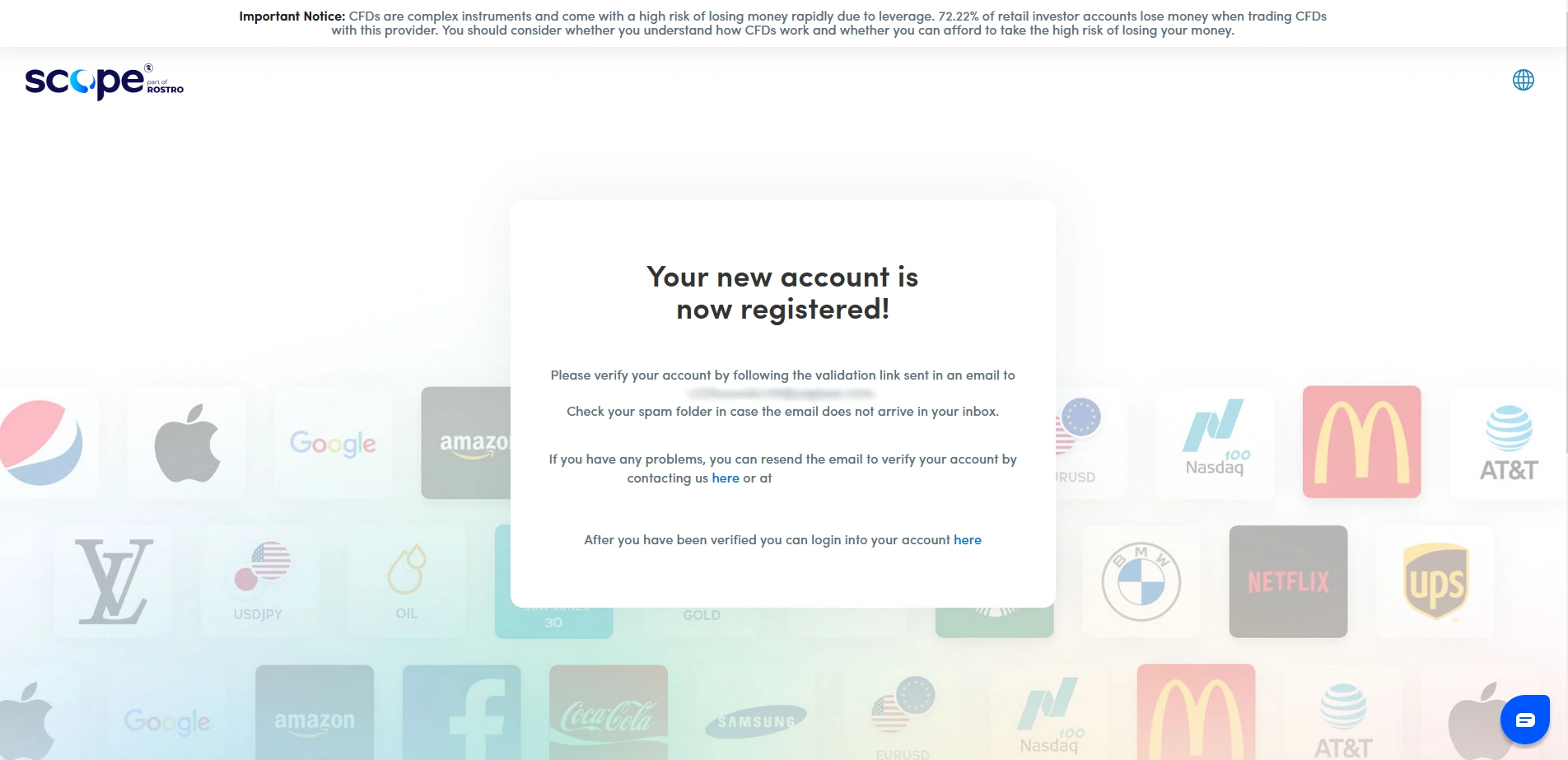

Open the email sent by Scope Markets and click “Verify your email.” This will take you back to the website.

-

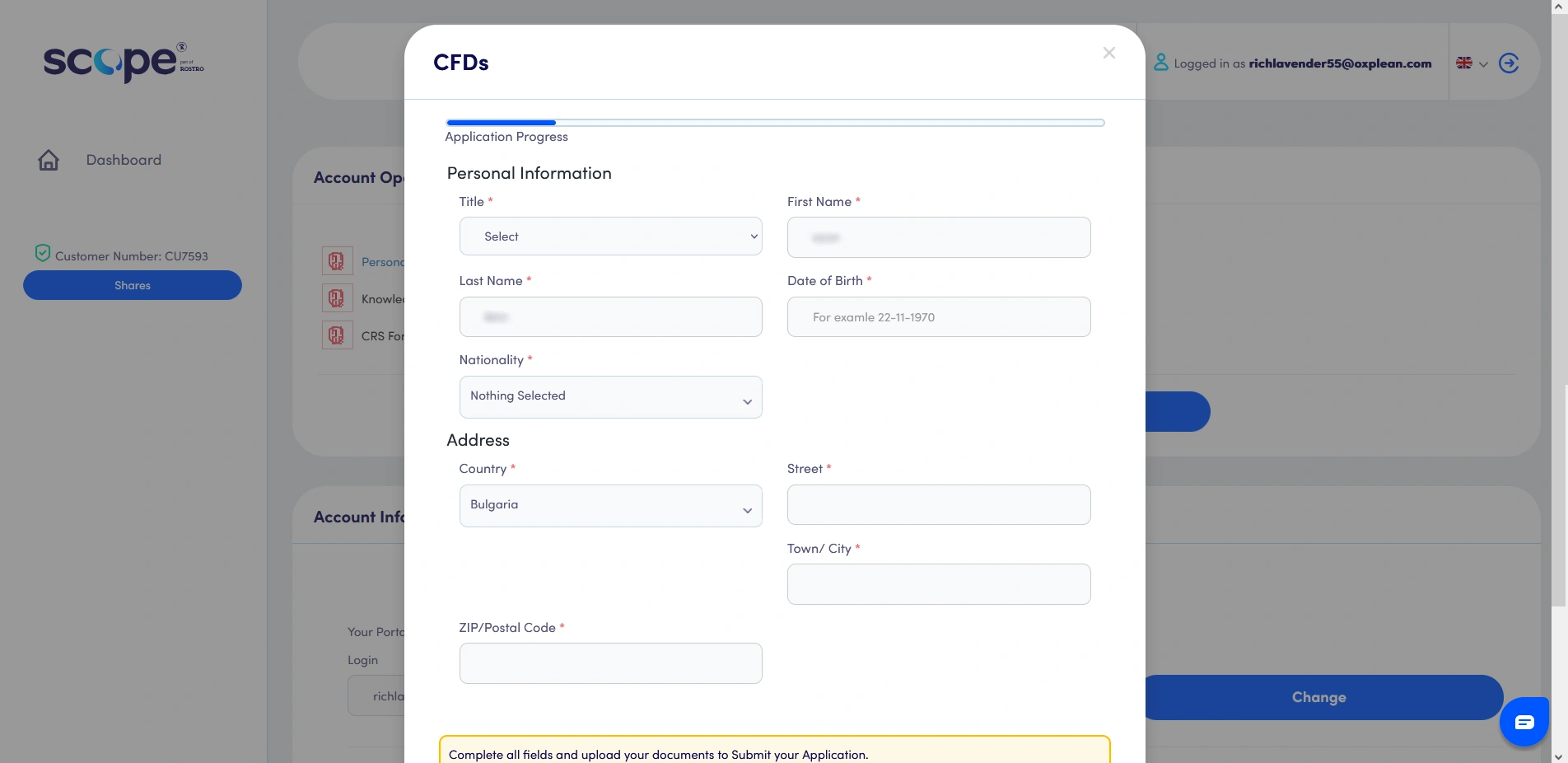

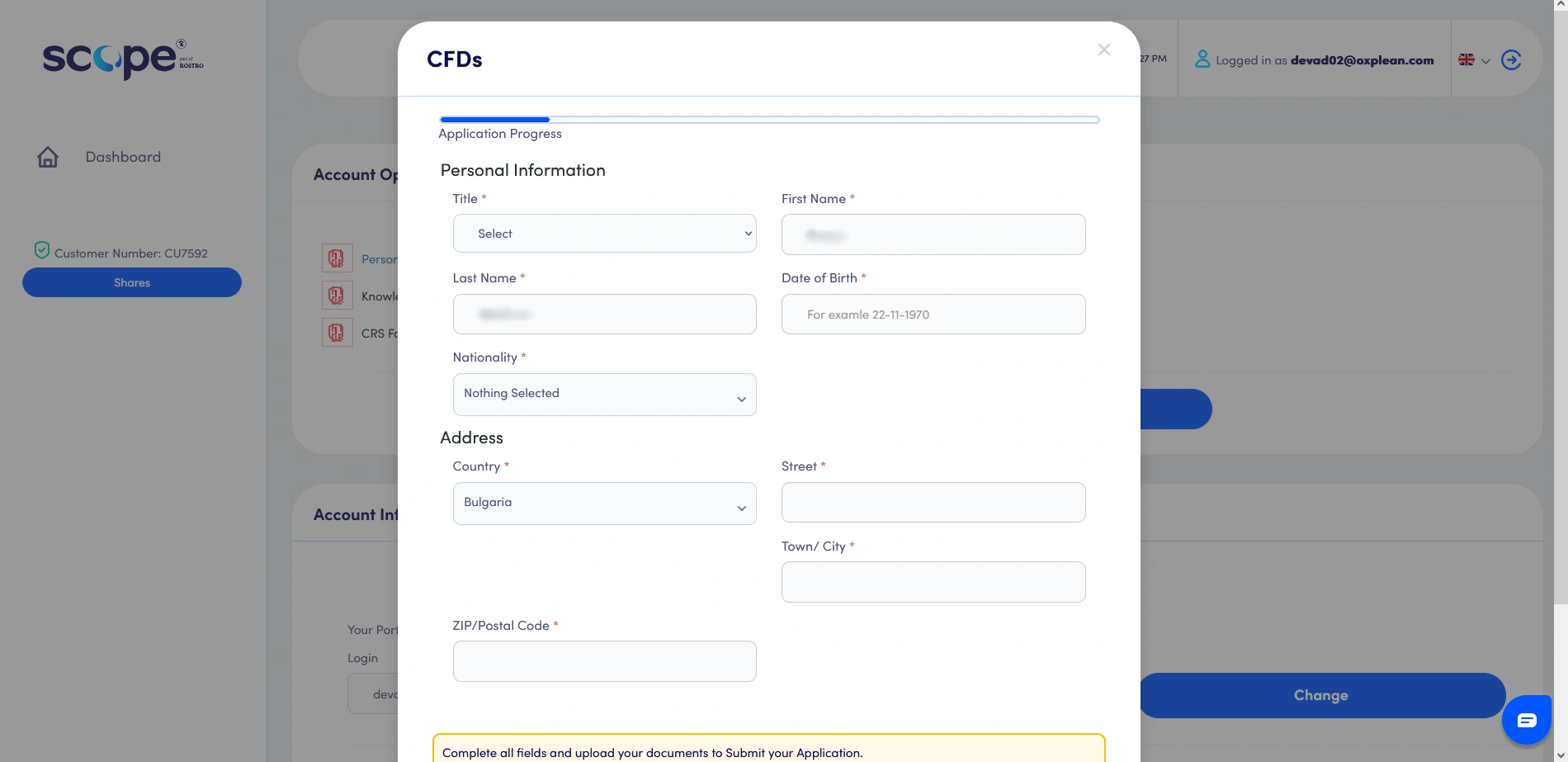

Select your title and provide the requested personal information, including your date of birth, nationality, and address.

-

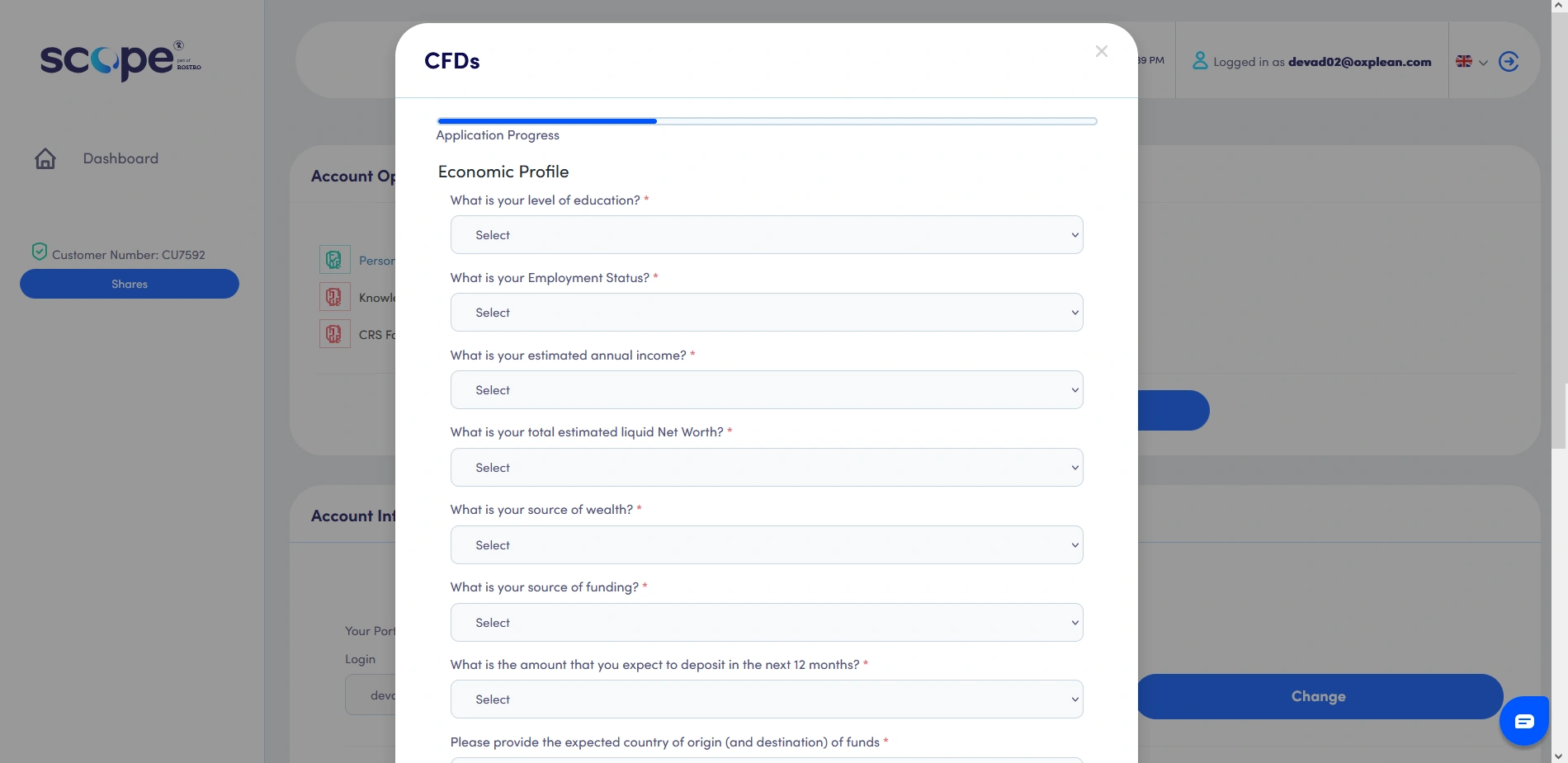

Here, you will be required to give Scope Markets information regarding your economic profile. The questions involve your level of education, employment status, income and savings, the source of your funds, and the like.

-

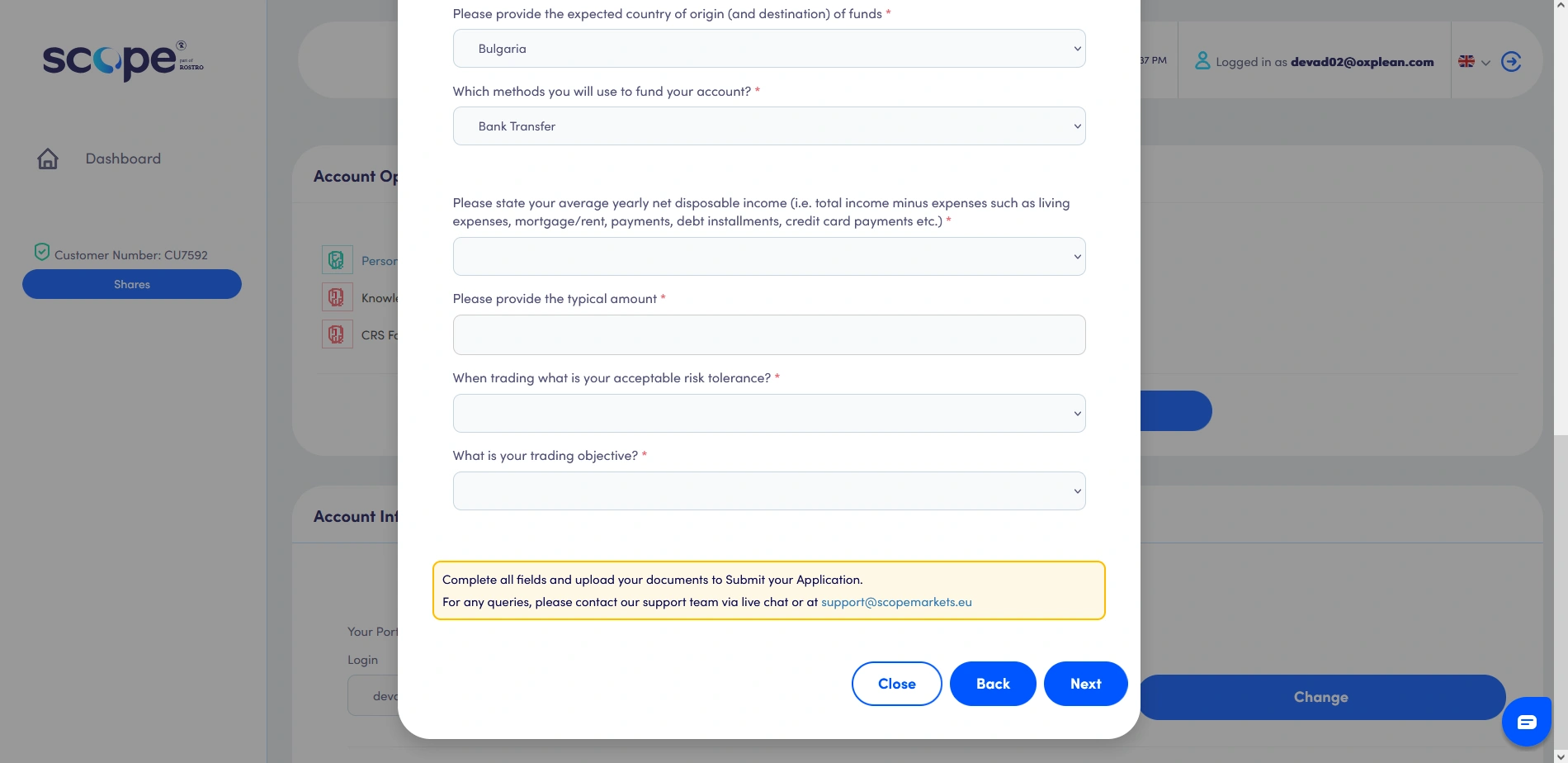

Specifying your average yearly net disposable income will add additional questions regarding your risk tolerance and your trading objective.

-

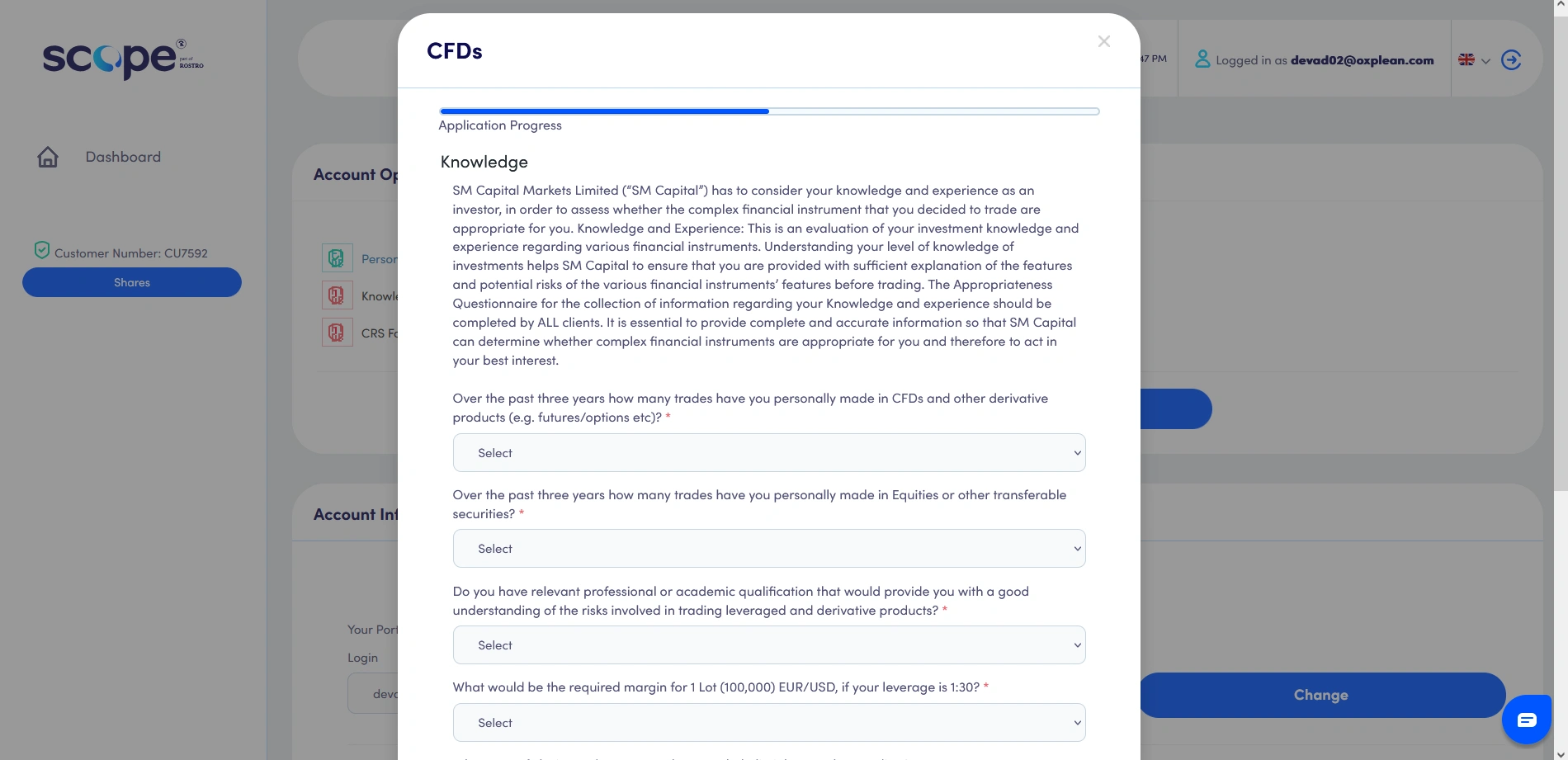

What follows is a questionnaire that aims to assess your trading experience and knowledge. Answer each question and proceed to the next step.

-

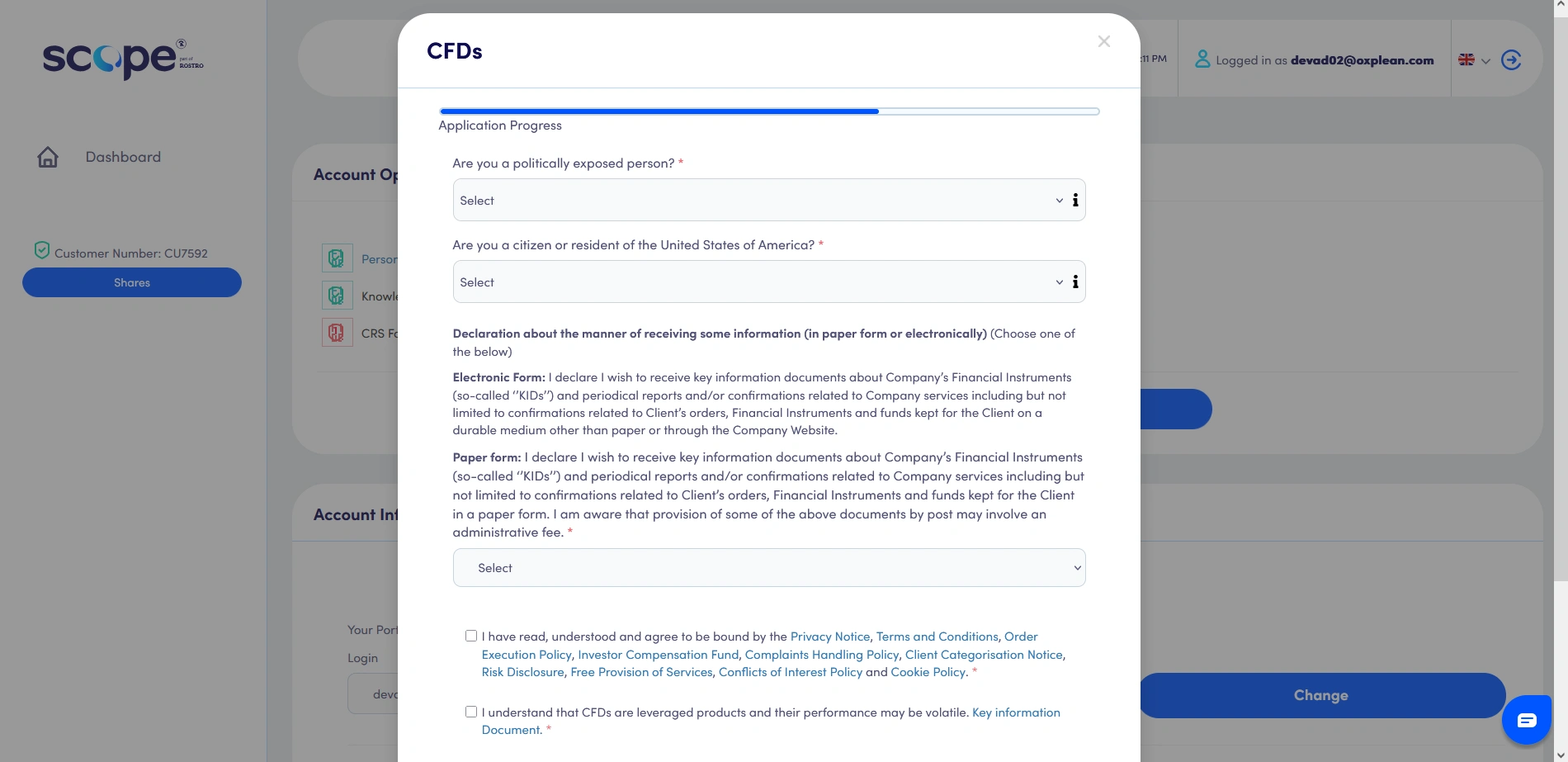

Clarify that you are not a politically exposed person and that you do not reside in the US. Then, choose whether you wish to receive crucial information documents electronically or in paper form. Agree to Scope Markets’ terms and confirm that you understand the risks tied to leveraged products like CFDs.

-

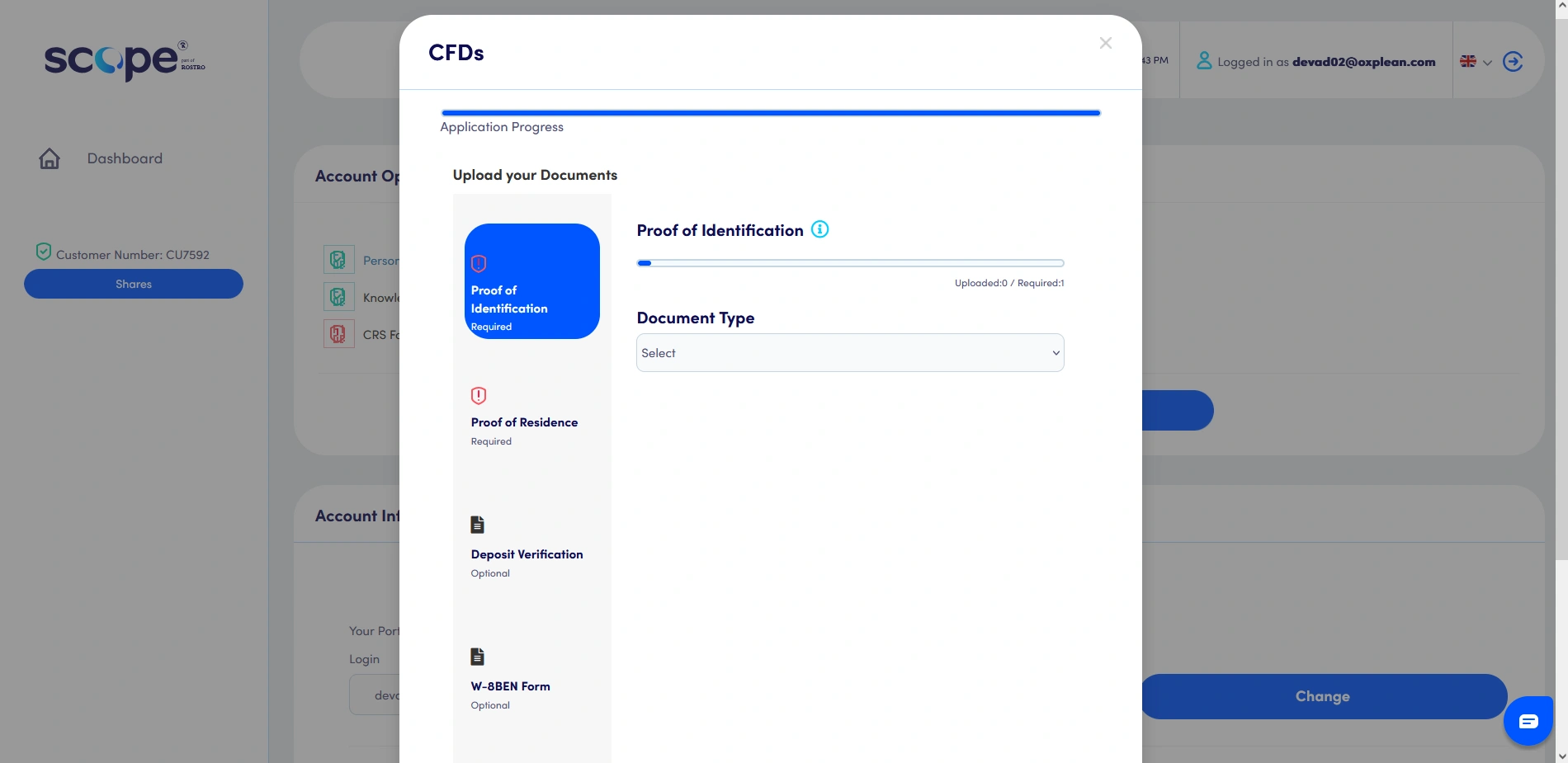

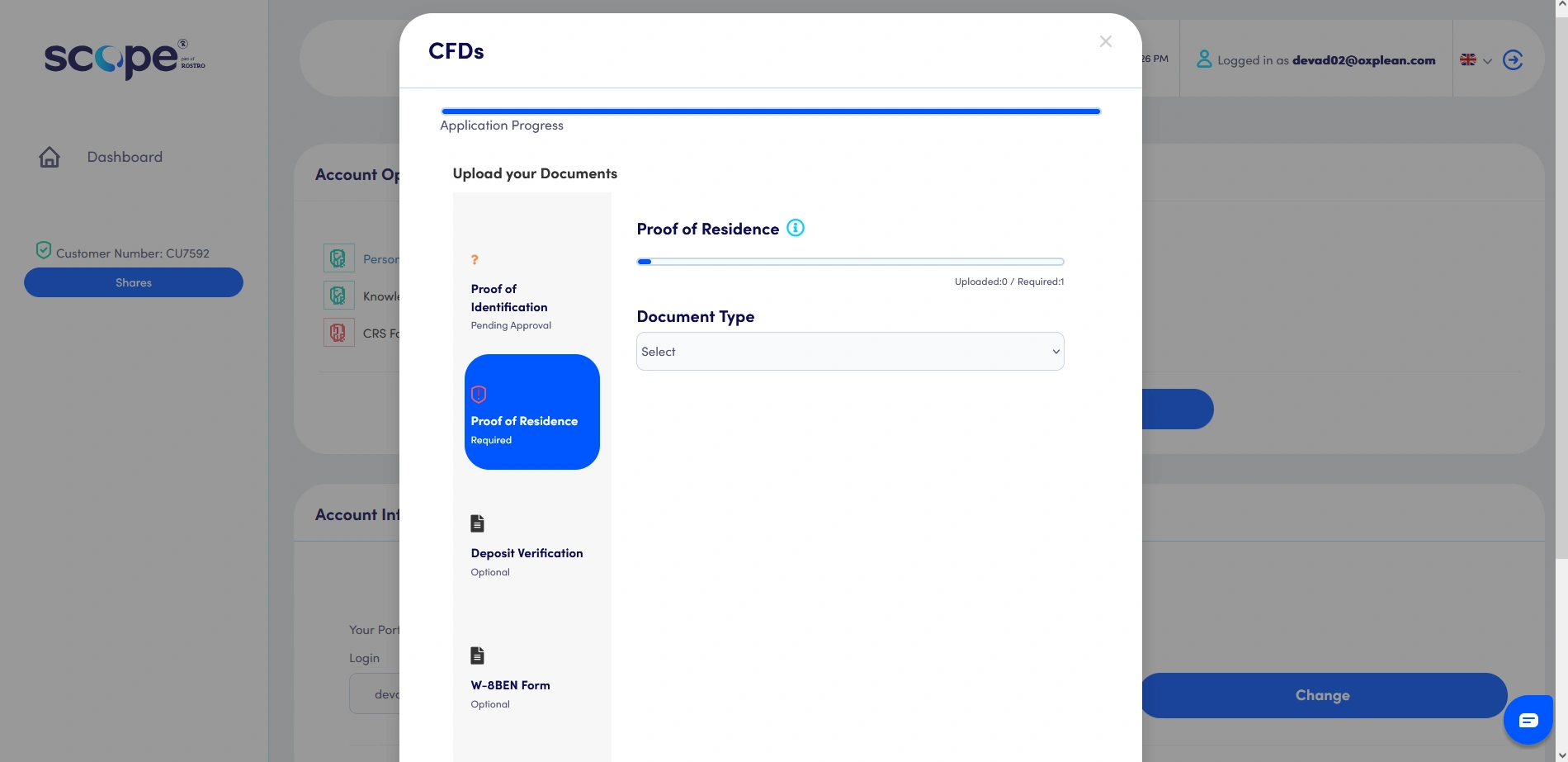

Provide proof of identification. The eligible options include your passport, residence permit, a selfie, a face portrait, NFC JSON, and your national identity card.

-

You will then need to submit proof of residence documentation such as a utility bill, local authority tax bill, bank residence letter on an official bank document form, or a credit card or bank statement.

-

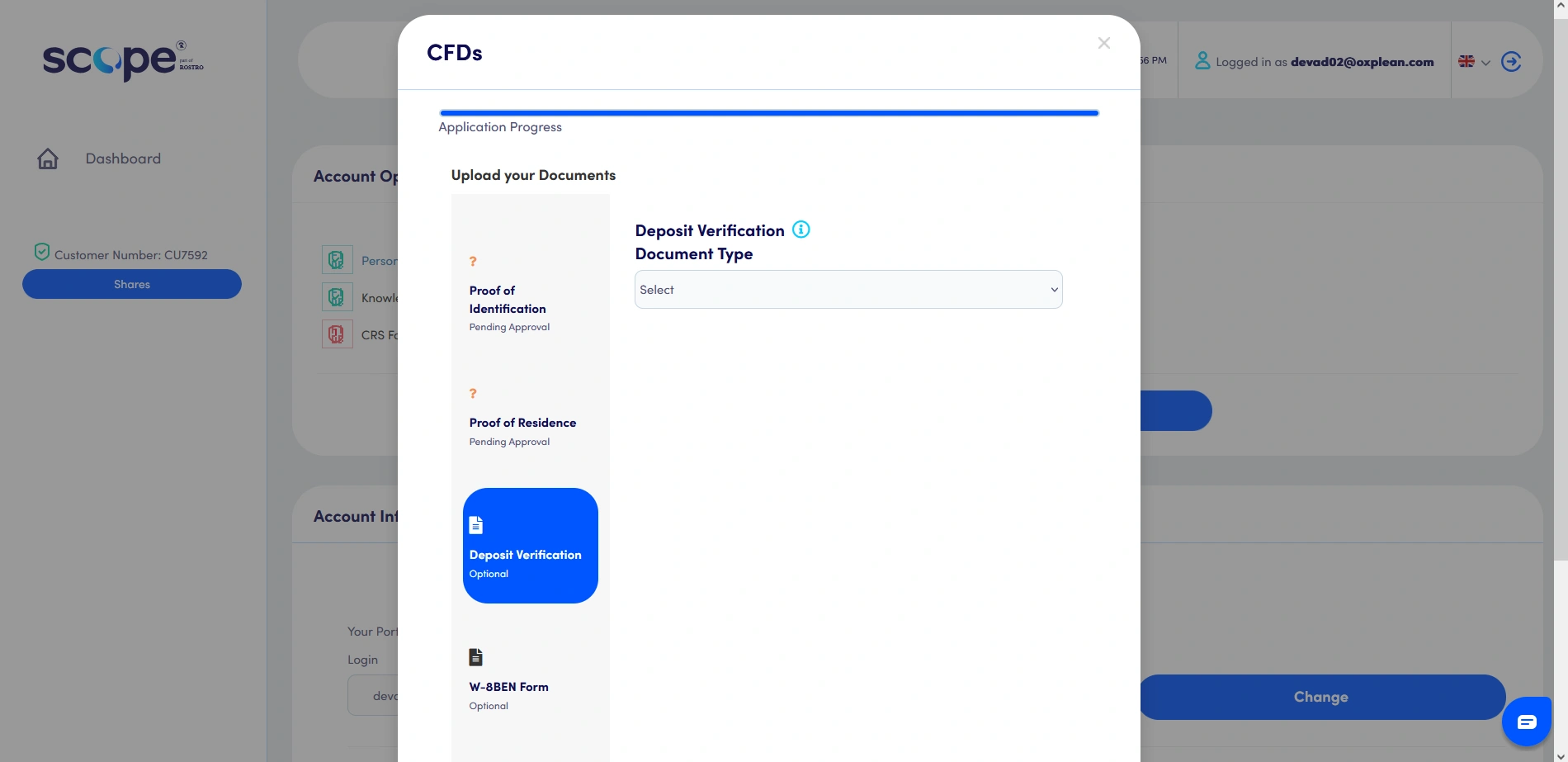

Deposit verification via card, wire transfer, or credit is optional.

-

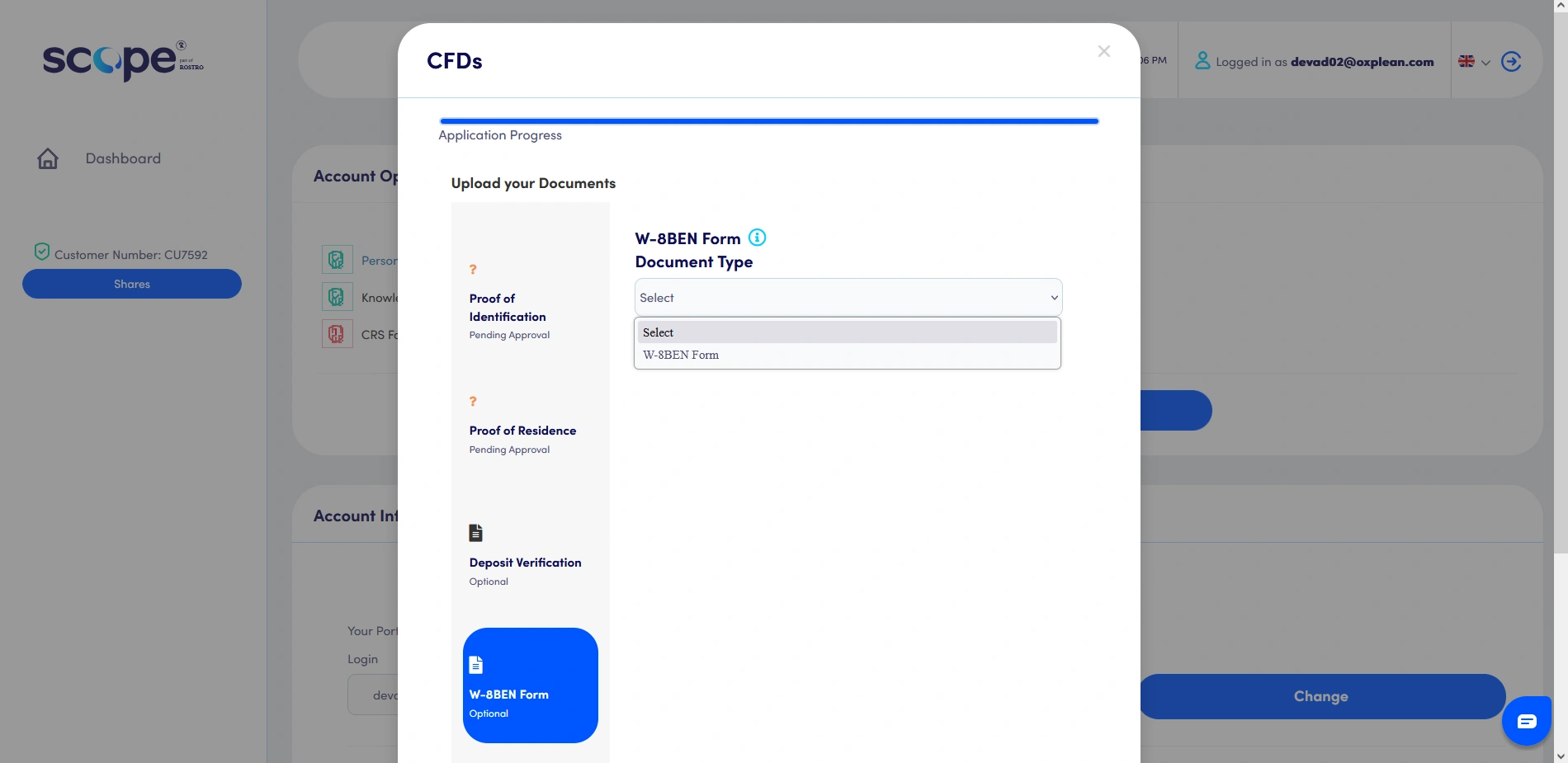

The last step involves submitting an IRS W-8BEN form, though this is only necessary if you plan on trading US shares. Known as a “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals),” this form will verify that you are not a US citizen and make you eligible for either exemption from or a reduction of taxes for earning US-sourced income.

Once you are done, you will be done with the registration and verification process. All that is left is waiting for Scope Markets to verify your documents, which can take up to 48 hours, though usually the verification time does not exceed one working day.

Overall Thoughts

All in all, the registration and verification steps may seem lengthy at a glance, but in practice, Scope Markets’ user interface ensures that the entire process will not take more than 15 minutes. If you have the required documentation at hand, it may take even less. As established, Scope Markets’ team can take up to 1 or 2 days to verify your details.