Account Types at Swissquote

Traders who wish to join Swissquote can pick from several account types, starting with the Demo account. Clients with such an account can practice trading without risking any real money, making it ideal for novices or those looking to test trading strategies.

As for live trading, Swissquote offers:

- Premium: Premium account holders enjoy zero-commission Forex trading, with the entire cost built into the spread. Traders who have activated a Premium account can trade major forex pairs with spreads starting from 1.3 pips.

- Prime: Deemed the most popular account option among Swissquote members, this account type charges zero commissions and offers even tighter spreads from 0.6 pips.

- Elite: Lastly, the Elite version reduces the spreads to a minimum of 0.0 pips, with a small commission of €2.50 charged per side of a single-lot trade.

All three account types come with negative balance protection, a stop-out level of 50%, and deposit protection of up to €20,000. Since retail traders are limited when it comes to available leverage, Swissquote also offers the option to apply for a professional account and access higher leverage ratios. Traders, however, must meet certain criteria to be eligible to trade as professionals. Additionally, keep in mind that the account type selection may differ depending on where you reside.

| Demo Account | |

| Islamic Account | |

| ECN Account | |

| Pro Account | |

| MAM Account |

Minimum Account Deposit Requirements

As mentioned above, if you are looking to start trading with Swissquote, you can choose from three main account types. The broker has determined $1,000 to be the deposit requirement for activating your trading account. While this may seem a rather high minimum limit, especially compared to brokers who have no such requirements, we believe it is a rather decent amount. The reason is that the minimum trade size at Swissquote is 0.01 lots, which equals 1,000 units in the base currency of your account.

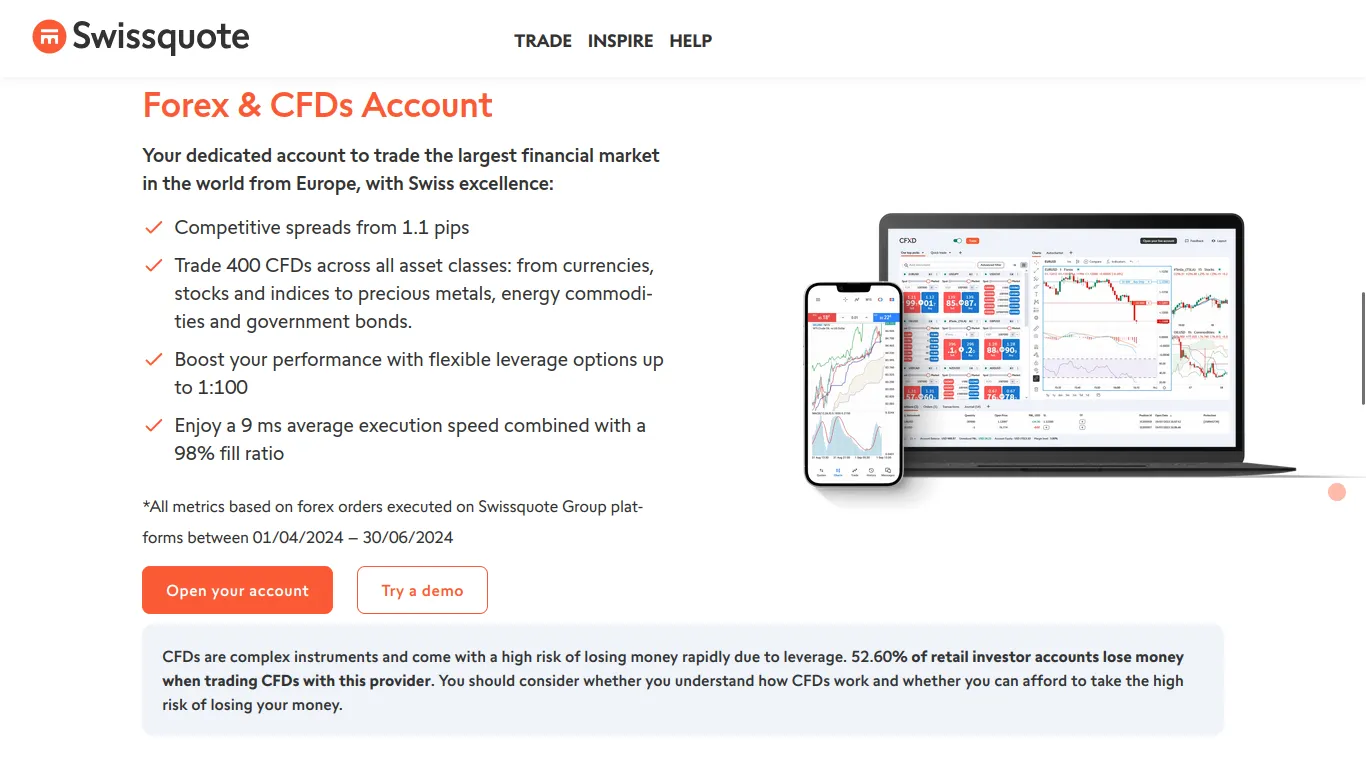

Tradable Instruments

To meet all of your preferences, Swissquote covers a wide range of markets, which include Forex pairs, metals, as well as CFDs on multiple instruments. Currency pairs include major, minor, and exotic tickers, with the total number of tradable Forex crosses exceeding 80. Meanwhile, there is also the opportunity to trade precious metals combined in pairs with popular fiat currencies.

CFD trading is also available at Swissquote, allowing traders to speculate on the price of numerous assets, profiting either through short or long positions. CFD instruments cover markets like commodities, indices, stocks, bonds, and cryptocurrencies.

Account Registration at Swissquote – Takes About 10 minutes for Live Accounts

When you join Swissquote, you have the choice to open a demo account and directly start trading with virtual funds intended for practice purposes. Opening a demo account is quick, as you can complete the process in two simple steps. That said, if you wish to create a Live Account, the whole process may take between 5 and 10 minutes as you will be asked to provide quite a few details.

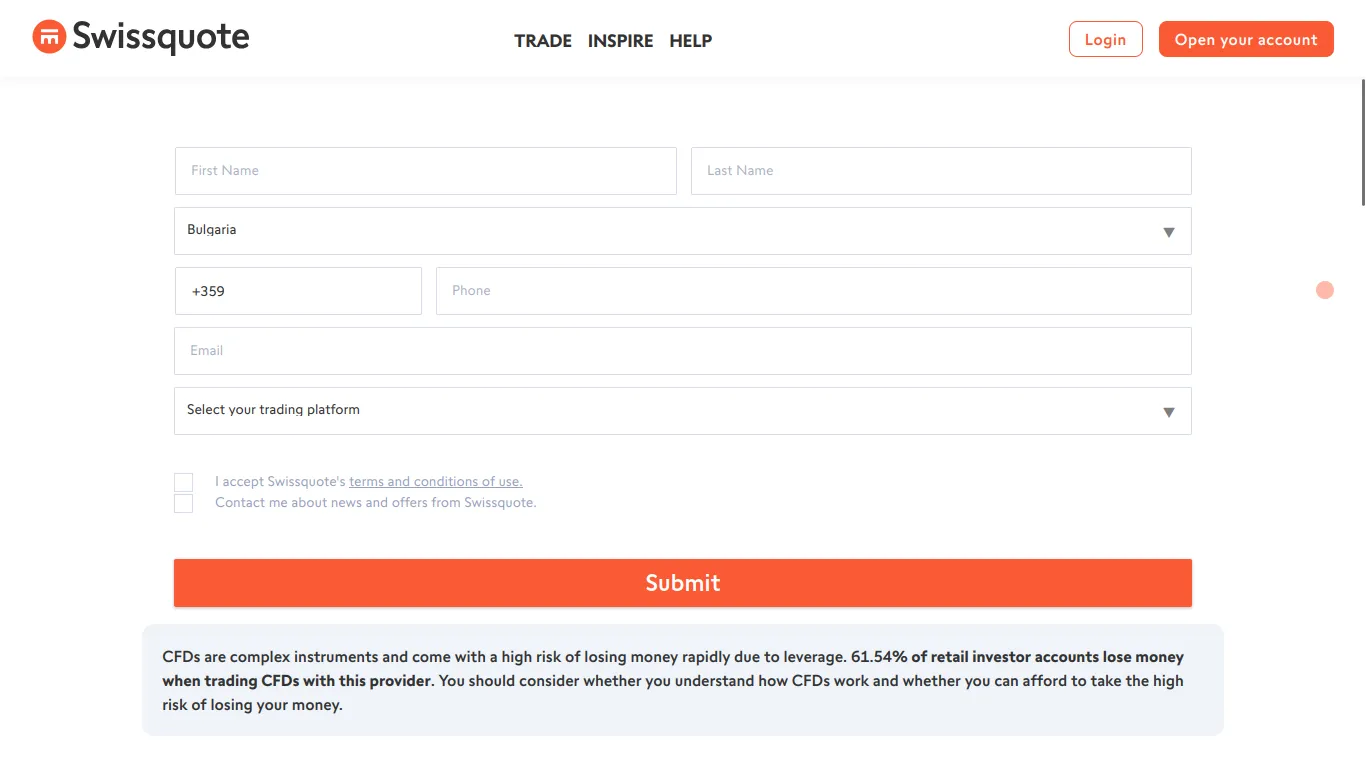

Start by launching the registration form through the ‘Sign up’ button and then selecting whether to proceed with a Demo account creation or with a Live trading account.

If you pick the ‘Try a demo’ option, you will be redirected to a page asking you to provide some basic personal information. Once you have done that, your demo account will be ready for your virtual money trades.

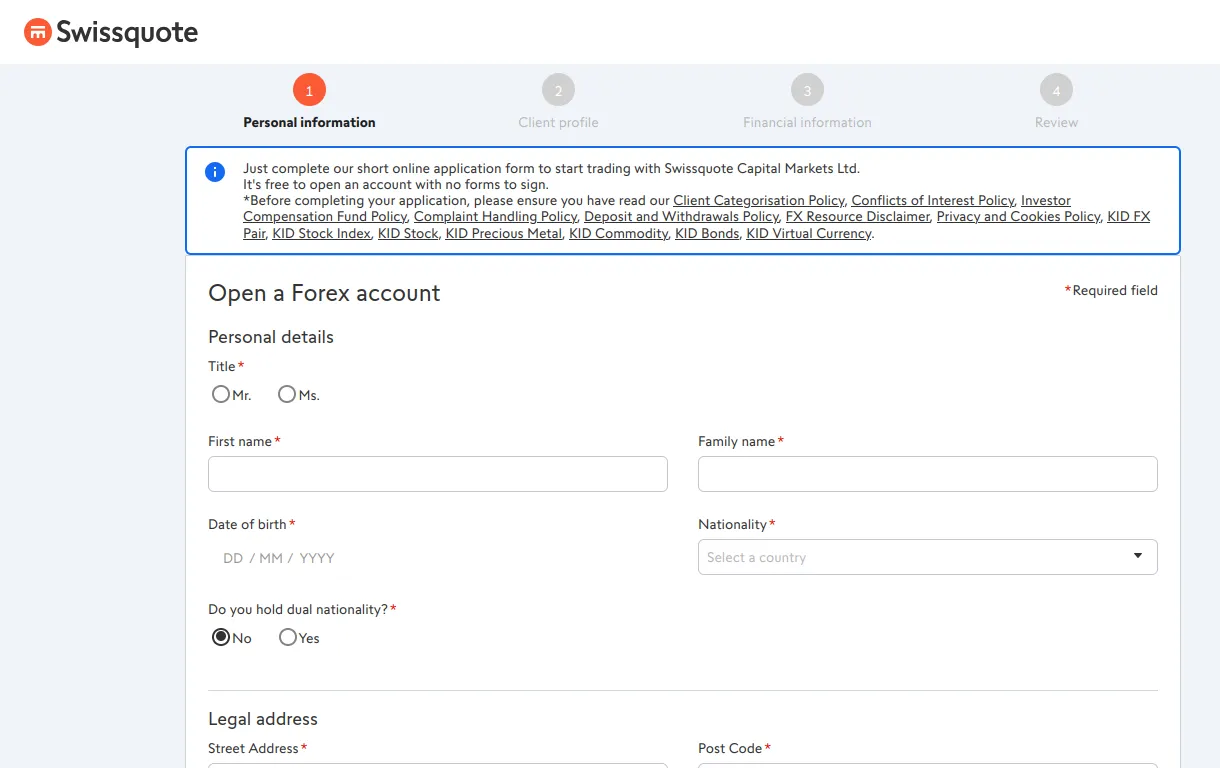

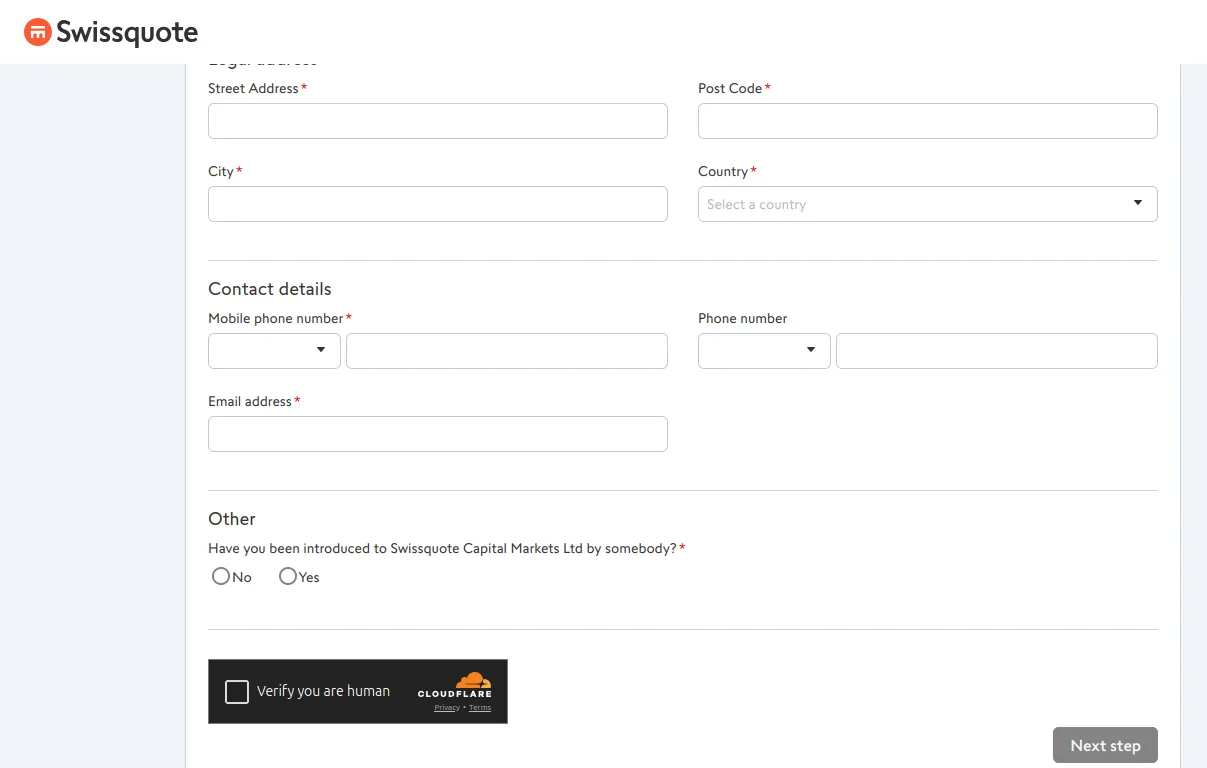

If you select to open a live trading account, you will be redirected to a different registration form, with the first step involving providing several personal details.

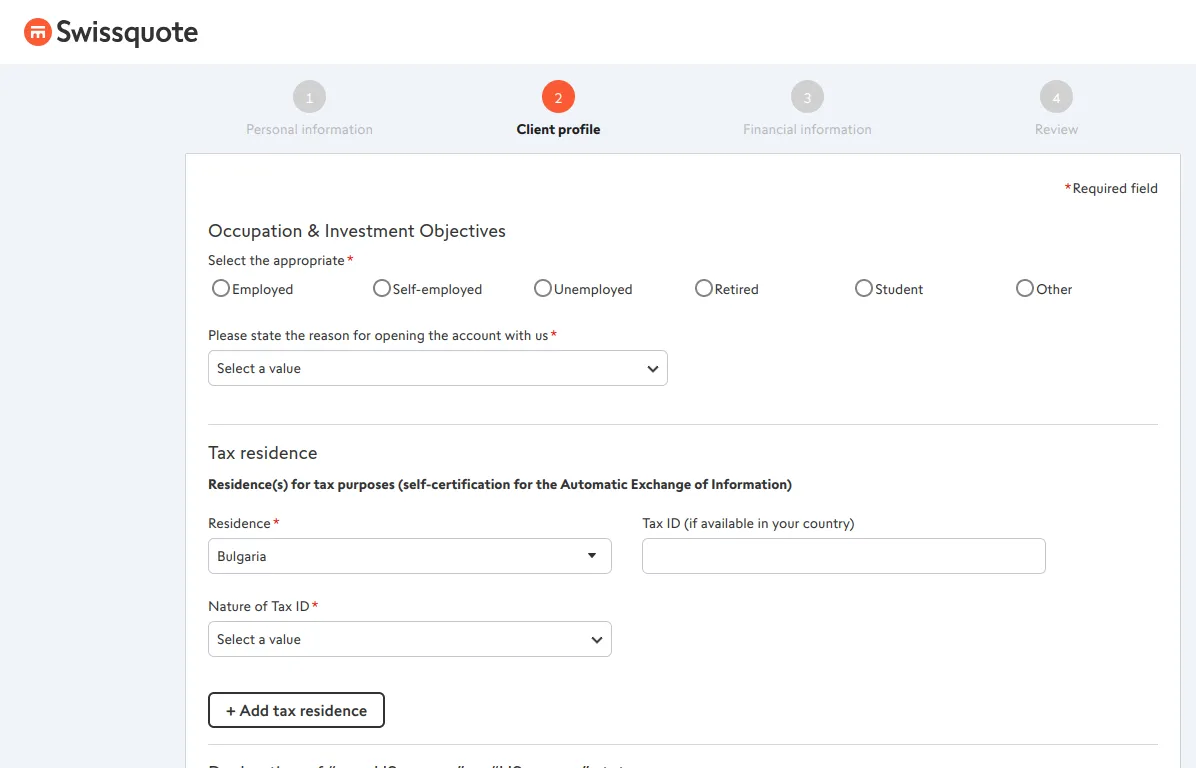

The next step of the account opening process is to disclose your occupation and your trading objectives. Select the appropriate option, depending on whether you are a US or non-US resident.

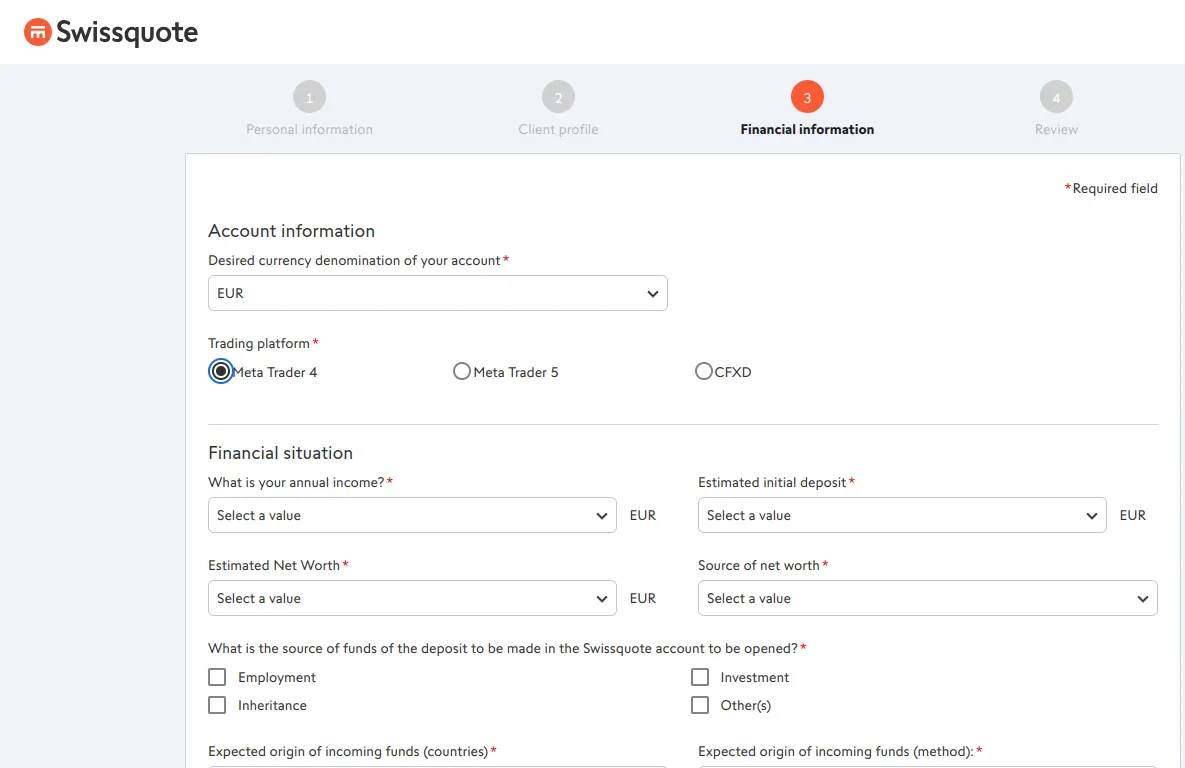

After setting up your Client profile, you will move to the Financial information section, where you must provide some account specifications as well as details about your financial situation.

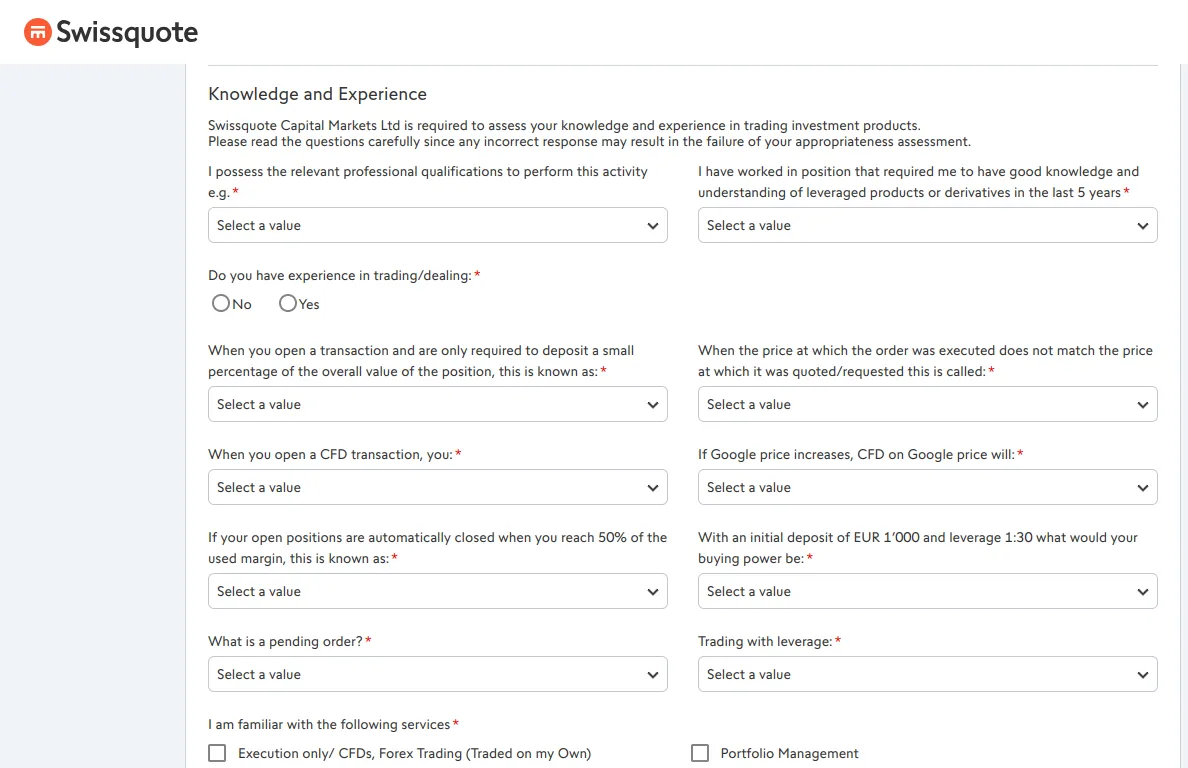

You will be asked to provide answers to several questions, which will help the broker assess your knowledge and experience in the field of trading.

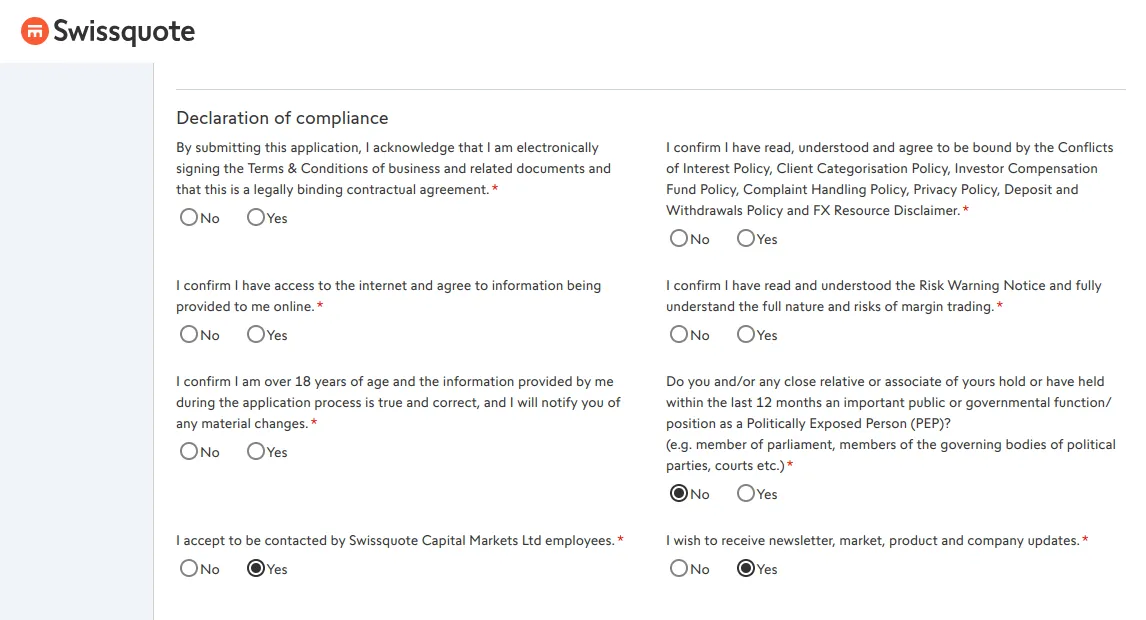

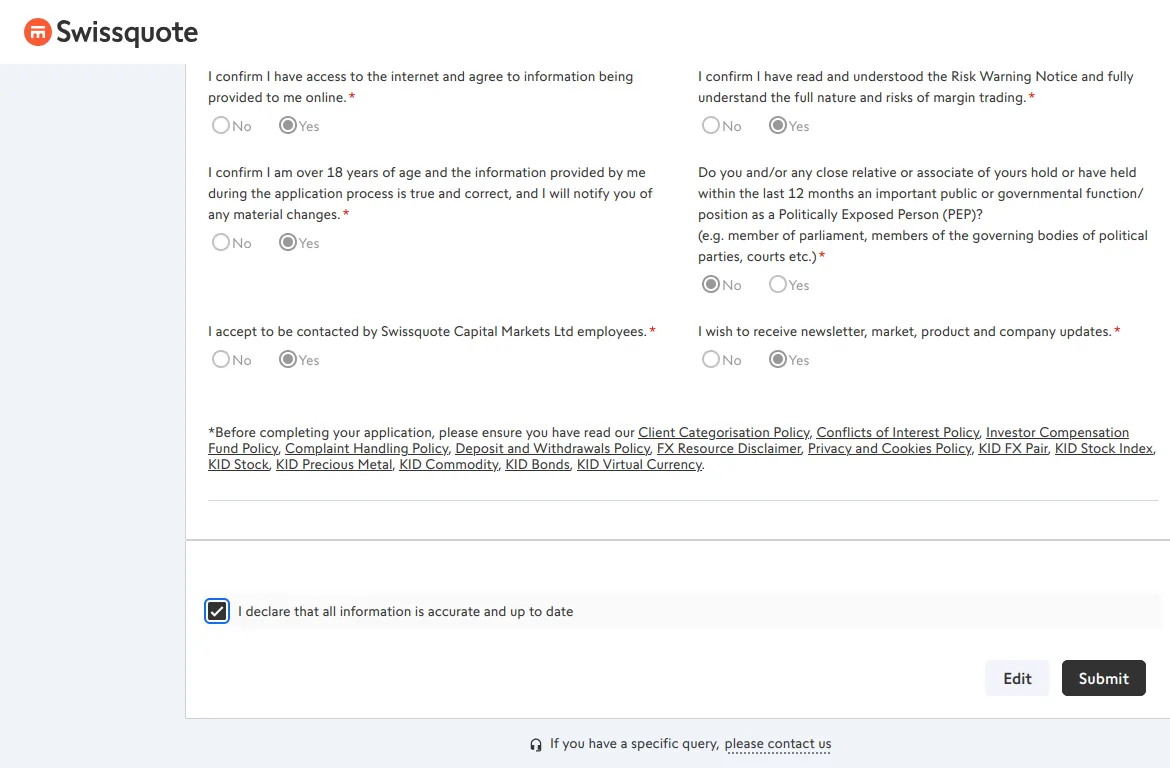

Make sure the details you have provided are correct and fill out the Declaration of Compliance form.

Account Verification – Takes about 5 minutes

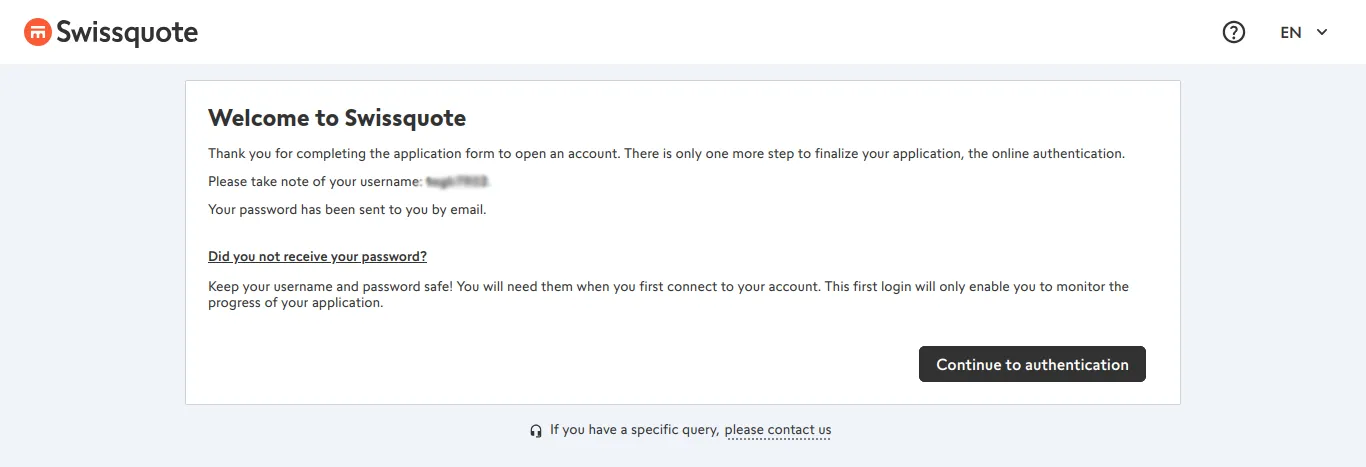

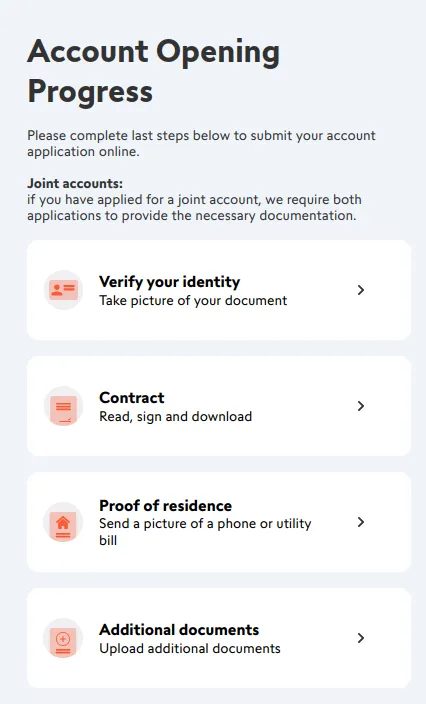

Once you have created your live trading account, you are required to complete Swissquote’s authentication process. This step is required by the broker as it follows strict regulatory guidelines, ensuring a safe and fair trading environment for its clients.

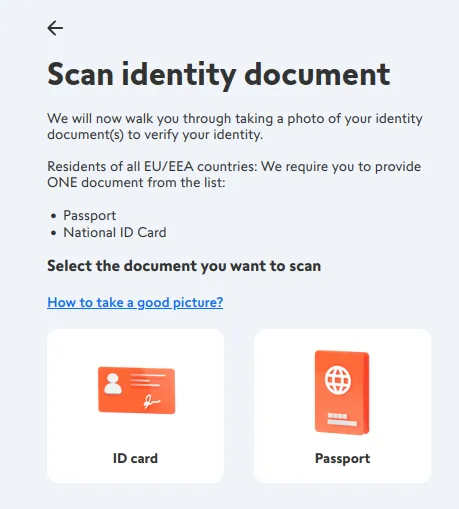

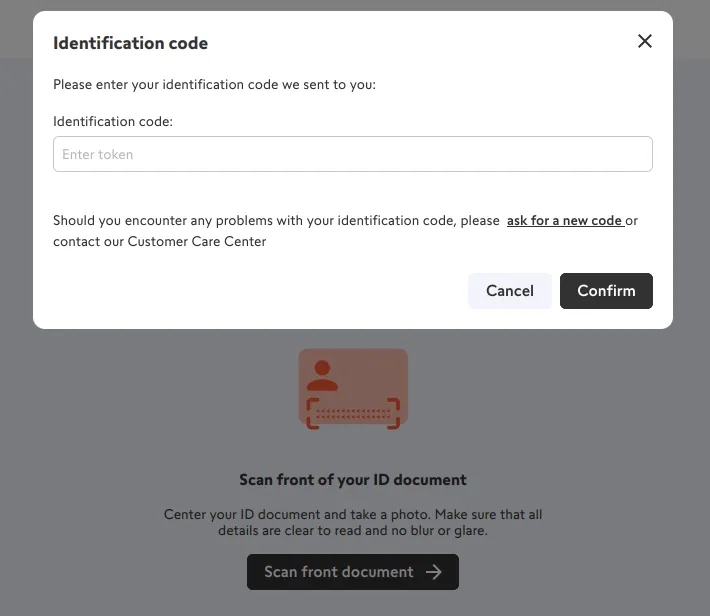

You can start by taking a picture of your ID card or passport, with the website asking for access to your preferred device’s camera. The broker will send you a verification code, either via SMS or by email, to ensure a safer connection when you are submitting copies of your official document.

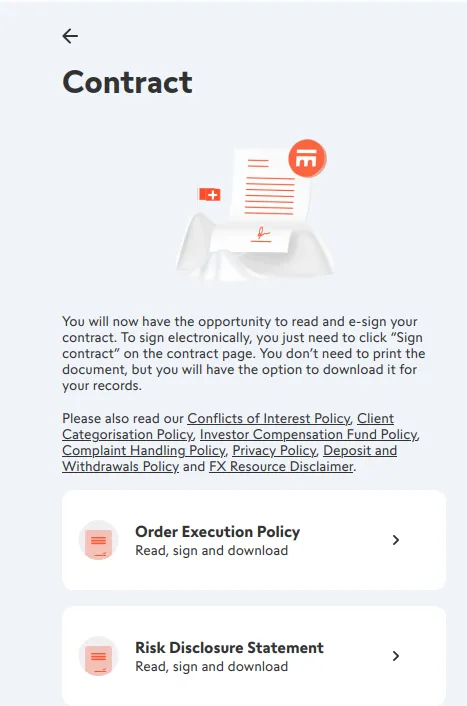

Next, you can proceed with reading, getting familiar with, and signing your contracts with Swissquote.

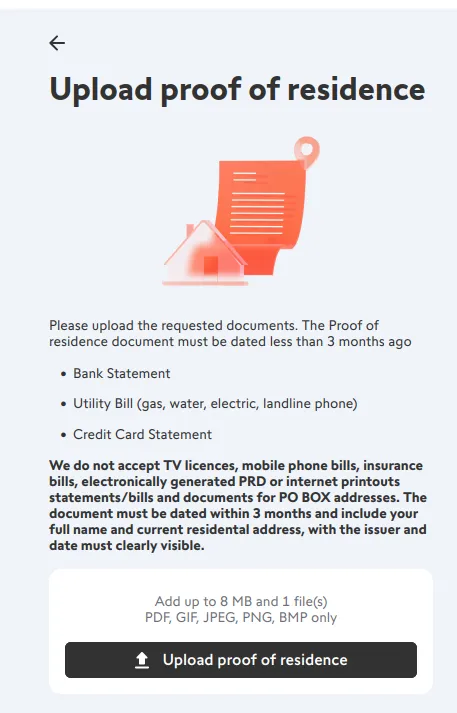

The broker also requires uploading a document to prove your residence.

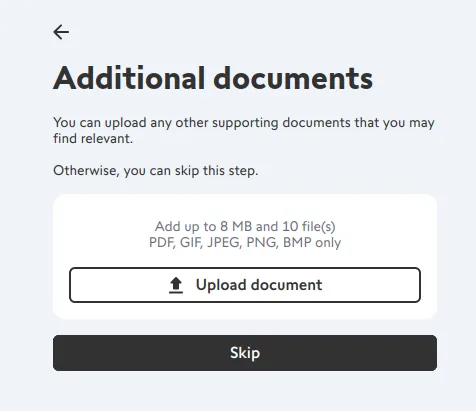

Traders may also provide any additional documents they believe can be useful for the verification process. However, if they have already uploaded the aforementioned documents, they can skip this step.

Once all required documents have been submitted, the broker’s team will review them. It will take up to a few hours to verify the respective Account Verification request.

Overall Thoughts

Creating a live trading account with Swissquote is most definitely more time-consuming than the Demo account opening process. To be able to create your profile with the broker, you will be asked to answer several financial and employment questions as well as provide information about your experience and knowledge of trading. Once you have set up your profile, you will also need to undergo the verification process. This is nothing out of the ordinary as Swissquote is following strict KYC guidelines imposed by tier-1 regulators like the Cyprus Securities and Exchange Commission (CySEC).