Current market uncertainty, provoked by a multitude of reasons including high inflation, energy crisis and fear of nuclear war, make investors very cautious. So far this year we saw a number of sell-offs. While some of the most stable assets like S&P 500 and Gold are down approximately 23% and 10%, crypto assets like Bitcoin and Ethereum crashed to -60% and -64% year-to-date.

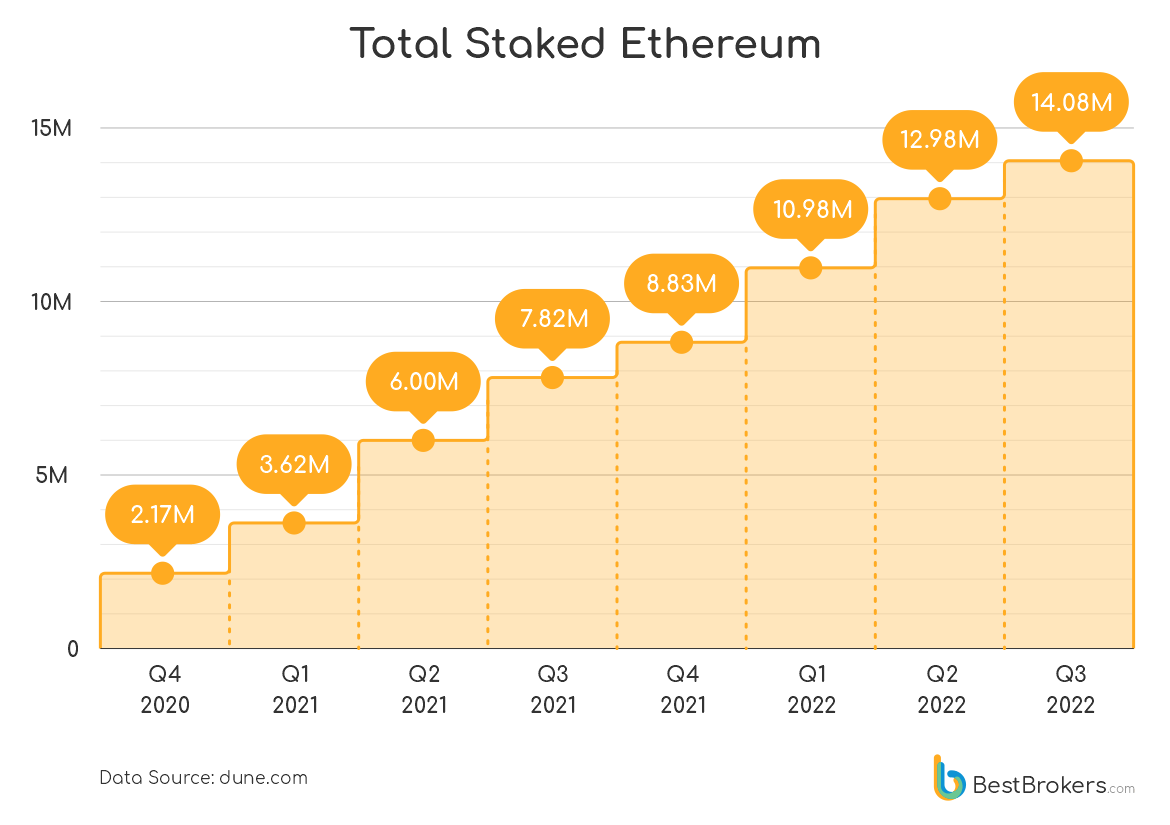

In such an undesirable climate, the BestBrokers team decided to analyze the effects of one of the positive events this year – the Ethereum 2.0 update, which turned Ethereum to proof-of-stake and reduced the electricity used by ETH crypto miners significantly. What is more important, the completion of the Merge paves the way for the long-awaited Shanghai update in H2 2023 when Ethereum stakeholders will be finally able to withdraw their staked amounts. To date, the total amount of staked ETH exceeds 14.44 million ($19.5 billion).

“Total Ethereum stake currently sits at approximately 14.44 million ($19.5 billion). Total staked ETH in Q3 2022 alone exceeds 1.096 million, which is a sign that traders find it a reliable alternative to the traditional markets”

– comments Alan Goldberg, market analyst at BestBrokers.

How traders benefit from staking

Staking is a process of participating in the transaction validation process and receiving rewards for that. While it requires 32 ETH to activate validation software, traders with lesser amounts can join a pool across multiple platforms and still receive rewards based on the amount staked.

Current annual percentage rate (APR) sits between 4% and 5% with a tendency to decrease as more ETH are staked.

What is vital is that currently traders cannot unstake nor withdraw the rewards. It will be possible with the next Ethereum “Shanghai” update, planned for H2 2022.

“Making a deposit for a year without access to your funds is a risky move, especially if the funds are in crypto. However, traders continue to stake. Currently over 11% of the total circulating supply (122.37 million ETH) are staked and the amount rises daily. It just proves that many traders feel secure with Ethereum.”

– adds Alan.