Buy Now, Pay Later (BNPL) schemes have become increasingly popular in the UK market. In a time of economic crisis, many are looking for interest-free ways to manage their cash flow. Studies estimated that in 2020, 10.1 million people in the UK had used BNPL, growing by 70-80% from the year before. To put that into context, by 2021, 1 in 3 people used BNPL schemes at checkout.

With 76% of merchants saying that BNPL will be part of their growth plan, BestBrokers‘ analyst team decided to look into how the rules of money movement have been rewritten. Crucially, to see why they have become so popular, not only for consumers but also for merchants themselves.

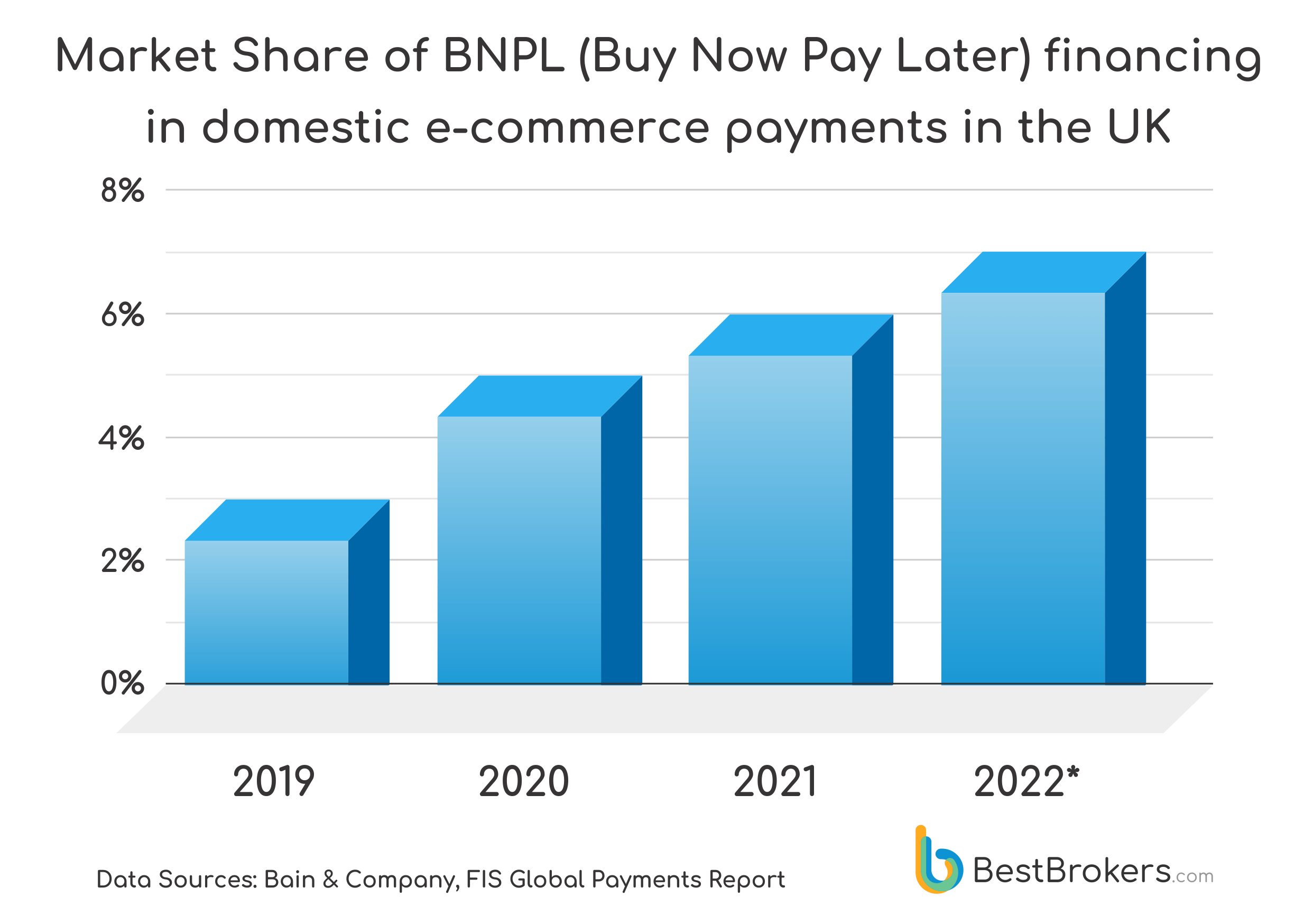

The Rise Of BNPL In The UK

The data acquired by Bain & Company found that £6.4 Billion was spent on BNPL in 2020, up 70% from the previous year. This trend is expected to continue to grow as BNPL appeals to the mass consumer, removing the barrier to entry for those with lower incomes by eliminating interest on large payments.

Not only that, there has been a generational shift in the younger generation as 54% of millennials and 50% of generation Z admitted using BNPL schemes in 2021. This can be seen due to a shift from traditional lending towards more low-cost, convenient services. In addition, studies found that younger consumers used BNPL for smaller purchases, whereas older consumers’ purchases were higher in value. Highlighting the shift from credit cards with high-interest rates, which often lead to debt, to using BNPL to avoid interest.

“2022 has seen the BNPL market rapidly grow as market leader Klarna increased the number of retailers it works with by 59% year-to-date. According to our analysis, BNPL payment schemes will exceed 7% of all E-Commerce Transactions in the UK in 2022.”

– commented Alan Goldberg, market analyst at BestBrokers

Merchants Are Benefitting Just As Much As The Consumer

BNPL appeals to both the mass consumer and merchants and has become a big part of companies’ growth plans. The convenience of BNPL encourages consumers to purchase more than they would normally. Data studies show that 46% of merchants are experiencing an increase in orders using BNPL versus credit card payments. BNPL spreads out payments over 3 or 4 months, giving consumers more confidence in paying it off compared to an upfront payment. Merchants are profiting off BNPL schemes and will continue to encourage consumers to use them at the checkout by making it easier than ever to complete and commit to a purchase.

On average, 200,000 merchants are currently offering BNPL at checkout, and in September 2022 alone Klarna had 194,388 downloads in the UK. By 2025 the global payment report predicts that BNPL will increase from 6% to 12% of e-commerce shares while credit cards are expected to decline. Therefore we can expect to see BNPL continue to grow in popularity as it benefits the consumer just as much as the merchant. In addition, BNPL is expanding from online shopping to in-store payments, solidifying the upward trajectory.

Regulation Needs To Be Considered With Rapid Growth And Users

As we advance, BNPL companies must stay one step ahead of regulation to ensure users don’t fall into debt. As the users grow, consumer protection needs to be a high priority. Especially with the current economic climate, BNPL needs to understand the risks involved if someone cannot make a payment. According to our data in 2021 almost ⅓ of BNPL users in the UK had missed at least one payment. It is unknown how this will affect the BNPL sector; however, it will significantly impact how BNPL solutions are offered.

“The appeal of interest-free instalments allows shoppers more flexibility, however it increases the risk of debt and overspending. Evidence proves that 30% of shoppers in the UK have admitted to using BNPL for purchases they cannot afford, highlighting the increased need for regulation to ensure consumers don’t miss pending payments.”

– added Alan