On Thursday, just a few hours after police stormed the Nexo offices, an email to Nexo’s management, allegedly written by one of the firm’s co-founders Georgi Shulev surfaced and BestBrokers got a hold of a copy of it. The email, originally written in 2020 in reply to a Zeus Capital email, explains why Shulev, the son of former Bulgarian vice-Prime Minister Lydia Shuleva, exited the crypto firm.

Nexo and its owners have engaged in illegal activities for years, Shulev claims in his email, explaining in detail some of the company’s alleged malpractices.

I consider it appropriate and necessary to inform you about the way the company is operating today. Unlawful activities are carried out on a day-to-day basis, both in Bulgaria and in numerous other jurisdictions, and the assets of the company’s clients are being misused without their knowledge.

In July 2020, Nexo announced a partnership with blockchain technology platform Chainlink for the integration of its proprietary token, LINK, on the Nexo platform. A week later, “asset management” firm Zeus Capital published and sent out slandering reports about Chainlink, claiming it was a Ponzi scheme. In an email, it advised investors to exit their long positions in LINK. According to Shulev, Nexo itself was behind Zeus Capital and the “analysis”, while its agenda was to benefit from the short positions on LINK.

His accusation of Nexo being behind Zeus Capital was also shared by the Twitter user @ChainLinkGod back in 2020, when they found identical typeform code on both Nexo’s and Zeus Capital’s websites. This code quickly disappeared from Zeus Capital’s website.

Below is a translated version from Bulgarian to English of the leaked letter from the former Nexo co-founder Georgi Shulev

Georgi Shulev

Hello,

I hope this email finds you well. As you know, on the evening of September 13, 2019, Kosta, Antoni, and Kalin cut off my access to the company without communicating the reason why, attempting to discuss the matter, and above all, without having the pluck to provide any explanation.

I suppose you know that I wanted to get in touch with you on numerous occasions, especially after some of you informed me about the version Kosta circulated. A version that defies any moral or ethical classification. Regardless, I want to say my actions until this moment have been driven solely by the best interests of the clients and their assets’ protection against fraud and other unlawful activities. The main reason for postponing this letter was that I wanted to try and reach a reasonable agreement with Kosta without disrupting the company’s operations and the work of its employees. Driven by my desire to reach a reasonable and above all, ethical resolution with Kosta, I decided against discussing the situation with anyone other than my attorneys. Unfortunately, we still failed to reach an agreement after almost a full year of unsuccessful negotiations. More importantly, there is no positive change in the ethics of the company’s management, which was the root cause of our conflict, to begin with. On the contrary, things are progressively getting worse without my interference.

Given these circumstances, I consider it appropriate and necessary to inform you about the way the company is operating today. Unlawful activities are carried out on a day-to-day basis, both in Bulgaria and in numerous other jurisdictions, and the assets of the company’s clients are being misused without their knowledge.

Kosta and I have repeatedly argued over the way the company was being managed. We have had multiple conversations, during which he always managed to prevail and exert his will to grossly violate the laws of various jurisdictions and misuse the clients’ funds. This is evident from the company’s actions to this day. The primary reason for Kosta always trying to have his way is that he was deliberately dragging on the actual distribution of the company’s shares for two years. We have repeatedly shared with you during job interviews, personal meetings, and last year’s first team building that Kosta and I founded and started working on Nexo in late August 2017. We initially agreed on a 50/50 partnership with equal shares and this arrangement remained unchanged. When the project kicked off in early September 2017, equity shares were promised to Credissimo (Sokol Iankov) as a legal entity, Antoni, and Kalin, as well as to some of you. These promises were never fulfilled despite me and all others addressing the issue on multiple occasions. On June 5, 2020, some of you who were promised shares received an email from Sokol where he reported he also had been defrauded by Kosta. It is important to point out that apart from having been promised shares, Antoni and Kalin have also committed to the company with substantial deposits of their private capital. As a result, they still depend on Kosta’s decisions and will despite any eventual dissent and disinclination on their behalf. Regardless, the company continues to be run with Kosta as the sole owner to this day.

On August 21, 2019, Costa and I arranged a meeting to discuss the allocation of the shares of all people who had started working for the company after us and whom we had promised shares. During the conversation, when we got to how these promised shares would change our original 50/50 allocation, Kosta reneged on our initial agreement and said it implied he should be on a yacht rather than in the office. He unequivocally indicated that maintaining our equal shares is no option for him. As for the distribution of the remaining shares, he evaded further discussions by deploying his usual contingencies and use of future tense. He ended the meeting and left the very next day to return after two weeks.

After he returned on Monday, September 9, the week passed as if the conversation had never taken place. On Friday (September 13) around 10 pm, my access to all emails, accounts, and funds was cut off without any warning or attempt at further discussions. On multiple occasions in the past, Kosta had considered and discussed firing Kalin in the same manner, painting a scenario where “we cut off all access at once and will deal with him later”. I made numerous attempts to contact Kosta, Kalin, and Antoni, but none of them had the pluck to answer my calls and explain why my access was cut off. I dropped by Antoni’s home, but he refused to open the door and merely hid behind the window curtains. Even after I messaged and emailed Kosta, Antoni, Kalin, and Vasko, none of them responded. Kosta had apparently decided to eliminate the person with whom he was supposed to split Nexo shares equally and had convinced Kalin and Antoni to join him in overthrowing me, a move he had been planning over the three weeks after our last conversation on August 21. He probably promised to redistribute my shares between Antoni and Kalin in return for their support. But even if this is not the case, Antoni and Kalin have still invested a significant amount of their personal funds into the company and this suffices to subordinate them to Kosta and his orders. If they refuse to follow suit or disagree with him, they run the risk of irrevocably losing the funds they invested in the company.

In this way, Kosta took hold of my share and, to this day, refuses to discuss the subject of bringing it back to me or providing compensation. I guess that, to this day, he is the only person who has shares in Nexo, a company that actually owns anything.

The ownership issues within the company and the ones with Kosta personally are indeed serious, but that is not what is really alarming. The real problem is the involvement of employees in operations and responsibilities for actions that are illegal. Perhaps, you might have already guessed about some of these activities, or have already heard about them. Yet, no mention is ever made of most of these activities and the investigations of a number of regulators from multiple jurisdictions.

It is no coincidence I decided to write a response to the email I received from Zeus Capital, especially after it became clear that Nexo is the company behind it. As it turns out, Kosta and Antoni’s idea to create a company that writes, publishes, and distributes advertisements that contain analysis designed to degrade projects like Chainlink in order to make a profit from short positions ultimately yields results.

If there are still people who do not know or doubt that Nexo is behind Zeus Capital, I wish to point out that the email address (below) to which Zeus sent me their degrading analysis about Chainlink was used solely to register with Nexo. This goes to prove that Nexo sends these reports on behalf of Zeus Capital using its own client database.

In addition to this, a considerable number of people who invested in Chainlink have found proof confirming that Nexo is behind Zeus Capital and that the analysis was written by their new colleague Simeon Rusanov. This is just one of the most recent examples of the abuse Kosta, Antoni, and Kalin are committing with cryptocurrencies and customer personal data. Say nothing of the apparent conflict of interest between Nexo and its customers who have deposited their LINK tokens to get credit and still believe they are not sold to Binance but are insured and in a safe place on BitGo. I leave it to you to decide if this is the truth.

I will also not comment on the fact that Antoni proudly announced Nexo’s partnership with Chainlink, the hidden and main purpose of which is to attract additional resources to open short positions with LINK. This example is enough to provide evidence for conflicts of interest, market manipulation, misuse of personal data, and abuse of client assets.

My ambition was to turn Nexo into a company that is a leader in its field. A company that will prove that Bulgarians also know how to create successful global companies, and not only come up with schemes for abuse, law violation, and siphoning off funds. Yet, this is exactly what Kosta turned the company into.

Unfortunately, a great number of highly intelligent people who give their best to constantly improve their skills still work at the company. These people are unwittingly involved in numerous illegal activities in many jurisdictions around the world on a daily basis. Although Kosta has referred to these people as rats on multiple occasions, they continue to contribute to Nexo’s development, and above all, the profits he amasses.

I can say for sure that Kosta does not and will never possess values like honor, dignity, integrity, and morality. What he puts first instead are greed, dishonesty, and his self-centeredness.

I am really sorry that I could not talk with all of you sooner. You all know that I highly value your talent and hard work and that it has been a pleasure working and meeting with you each week. No matter whether you continue working at Nexo or not, I believe you should all find out the truth about the company. If I am not the cause of the change in Kosta’s behavior, then you should be the one to bring about this transformation as Kosta can not do without the strong and efficient team.

I remain available for further questions and want to thank you all for your cooperation. It has been a pleasure for me.

Joro

********

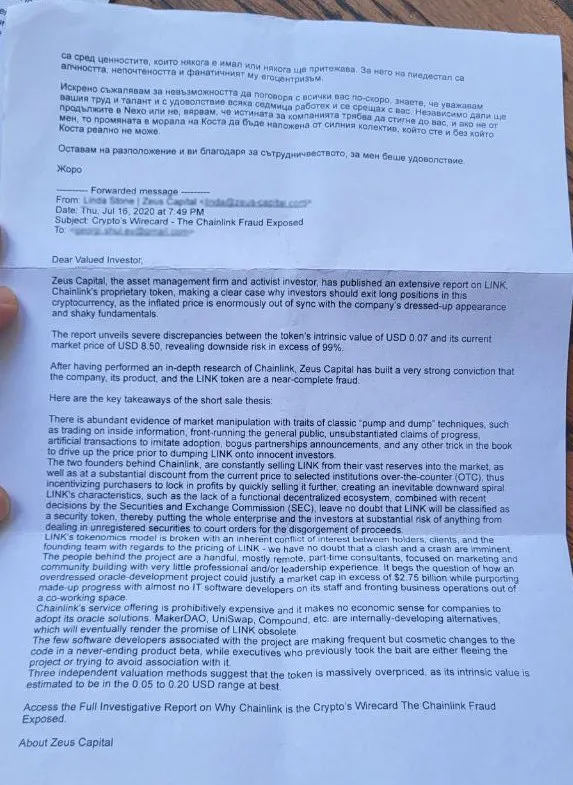

Zeus Capital, the asset management firm and activist investor, has published an extensive report on LINK. Chainlink’s proprietary token, making a clear case why investors should exit long positions in this cryptocurrency, as the inflated price is enormously out of sync with the company’s dressed-up appearance and shaky fundamentals.

The report unveils severe discrepancies between the token’s intrinsic value of USD 0.07 and its current market price of USD 8.50, revealing downside risk in excess of 99%.

After having performed an in-depth research of Chainlink, Zeus Capital has built a very strong conviction that the company, its product, and the LINK token are a near-complete fraud.

Here are the key takeaways of the short sale thesis:

There is abundant evidence of market manipulation with traits of classic “pump and dump” techniques, such as trading on inside information, front-running the general public, unsubstantiated claims of progress, artificial transactions to imitate adoption, bogus partnerships announcements, and any other trick in the book to drive up the price prior to dumping LINK onto innocent investors.

The two founders behind Chainlink, are constantly selling LINK from their vast reserves into the market, as well as at a substantial discount from the current price to selected institutions over-the-counter (OTC), thus incentivizing purchasers to lock in profits by quickly selling it further, creating an inevitable downward spiral LINK’s characteristics, such as the lack of a functional decentralized ecosystem, combined with recent decisions by the Securities and Exchange Commission (SEC), leave no doubt that LINK will be classified as a security token, thereby putting the whole enterprise and the investors at substantial risk of anything from dealing in unregistered securities to court orders for the disgorgement of proceeds.

LINK’s tokenomics model is broken with an inherent conflict of interest between holders, clients, and the founding team with regards to the pricing of LINK – we have no doubt that a clash and a crash are imminent. The people behind the project are a handful, mostly remote, part-time consultants, focused on marketing and community building with very little professional and/or leadership experience. It begs the question of how an overdressed oracle-development project could justify a market cap in excess of $2.75 billion while purporting made-up progress with almost no IT software developers on its staff and fronting business operations out of a co-working space.

Chainlink’s service offering is prohibitively expensive and it makes no economic sense for companies to adopt its oracle solutions. MakerDAO, UniSwap, Compound, etc. are internally-developing alternatives, which will eventually render the promise of LINK obsolete.

The few software developers associated with the project are making frequent but cosmetic changes to the code in a never-ending product beta, while executives who previously took the bait are either fleeing the project or trying to avoid association with it.

Access the Full Investigative Report on Why Chainlink is the Crypto’s Wirecard The Chainlink Fraud Exposed.

About Zeus Capital

Zeus Capital is an international asset management company focused on alternative investments, market inefficiencies, and event-driven opportunities. Zeus Capital deploys capital based on an unparalleled combination of deep fundamental research, predictive analytical tools, and cutting-edge technology to derive alpha-rich investment ideas.

Linda Stone